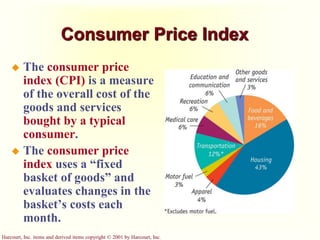

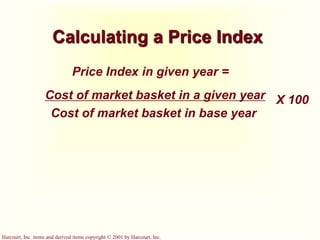

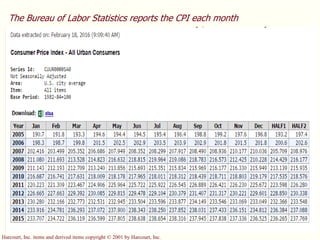

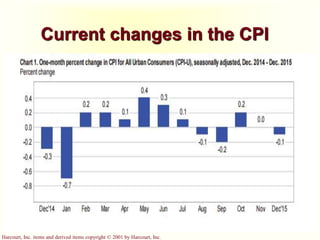

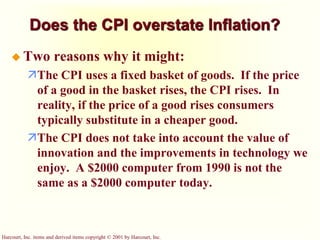

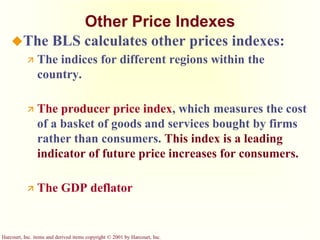

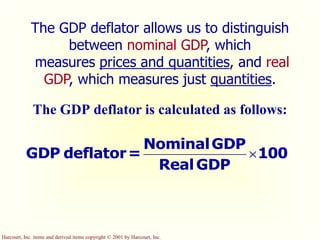

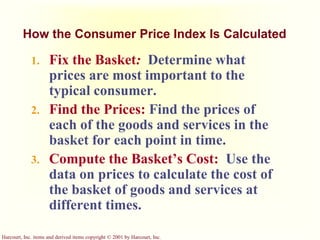

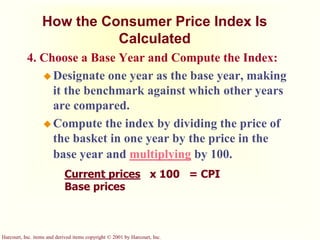

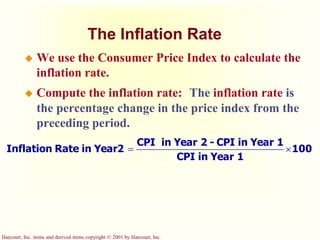

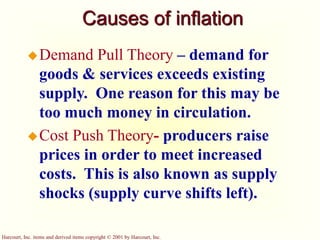

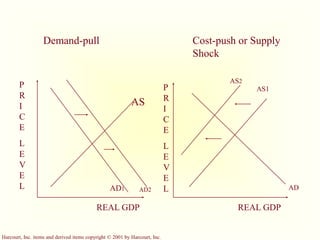

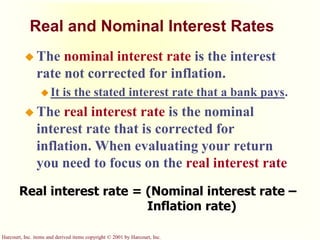

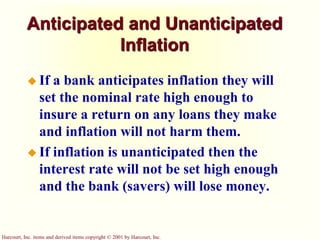

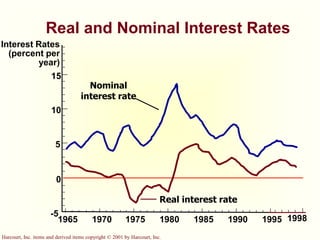

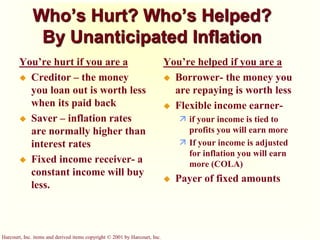

The document discusses measuring inflation and cost of living using price indexes. It explains that price indexes like the Consumer Price Index (CPI) measure changes in the average prices of goods and services over time to calculate inflation. The CPI uses a fixed basket of consumer goods and services to track price changes monthly. It also discusses how the CPI is calculated, real vs nominal GDP, effects of inflation like on interest rates, and who is helped and hurt by anticipated vs unanticipated inflation.