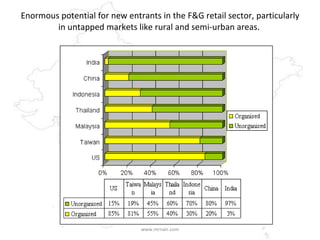

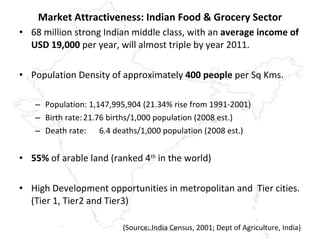

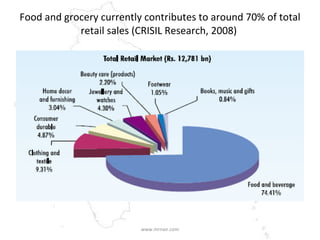

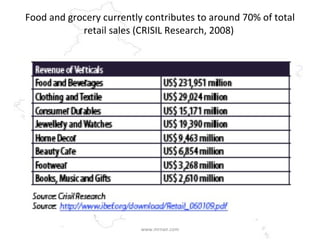

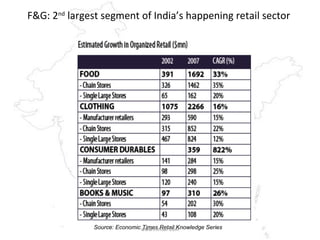

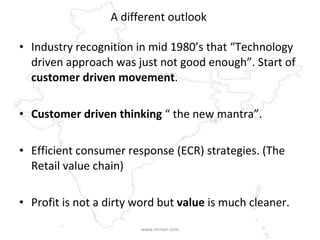

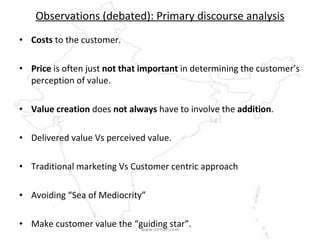

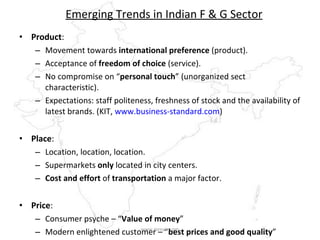

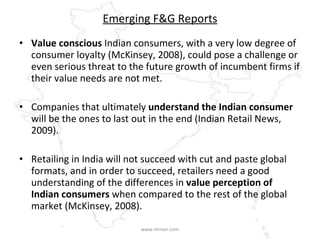

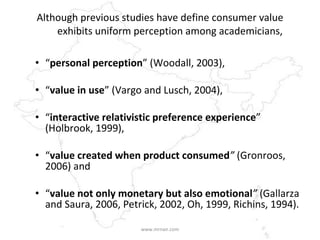

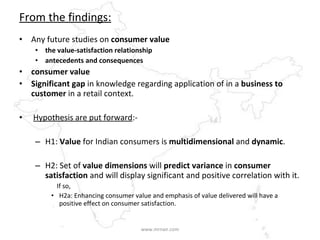

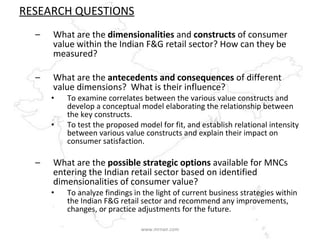

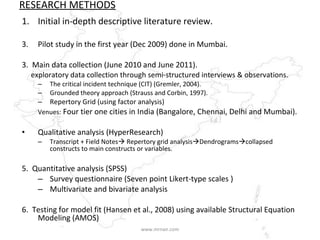

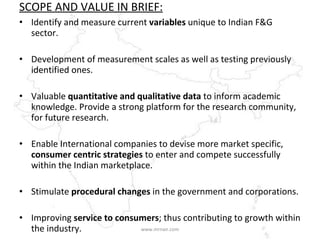

The document discusses research on consumer values in the Indian food and grocery retail sector. It provides background on the large and growing market in India. The research aims to identify and measure key dimensions of consumer value in the sector and examine their relationship to consumer satisfaction. A mixed methods approach is proposed involving interviews, observations and surveys to develop models of consumer values and how they influence satisfaction. The findings could help international retailers better understand Indian consumers as the market continues to develop.