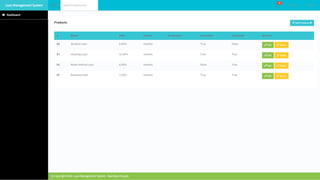

The Loan Management System (LMS) is a web-based application designed to manage the loan lifecycle, from application to repayment, streamlining processes for administrators, employees, and users. Key features include user roles for admins, employees, and users, a comprehensive dashboard, and functionalities like loan and borrower management. Installation involves cloning the repository, setting up a virtual environment, and applying migrations to start using the system.