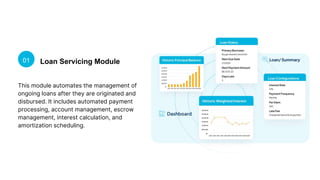

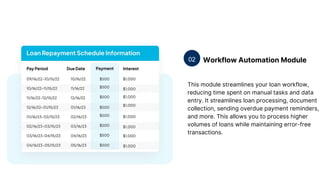

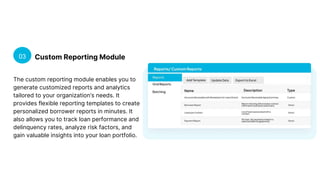

Loan management software simplifies the loan lifecycle for lenders by automating tasks such as onboarding, repayments, and compliance. Key modules include loan servicing, workflow automation, custom reporting, escrow management, document management, relationship management, asset tracking, ACH processing, and a borrower portal, each designed to enhance efficiency and service delivery. This solution allows lenders to manage loans effectively while ensuring accuracy and regulatory adherence.