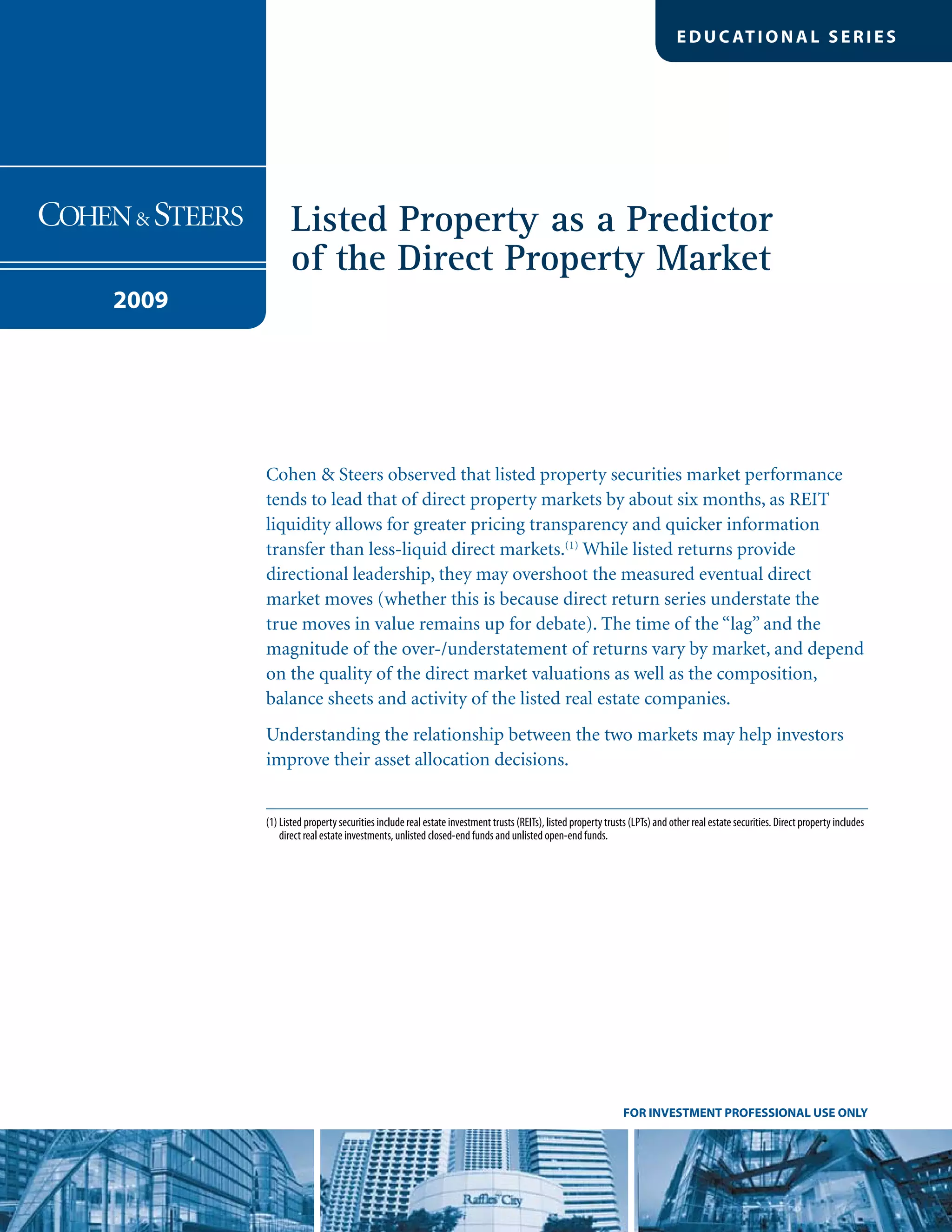

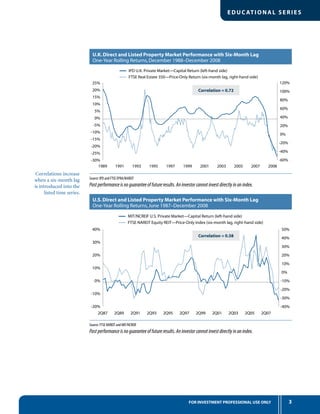

Listed property securities markets tend to lead direct property markets by about six months, as REIT liquidity allows for quicker pricing of new information. While listed returns provide a directional signal, they may overstate eventual direct market moves. Understanding the relationship between listed and direct markets can help investors with asset allocation. Introducing a six-month lag to listed returns increases their correlation with direct returns across most markets. Listed returns often accurately predict accelerations and decelerations in direct returns several months in advance.