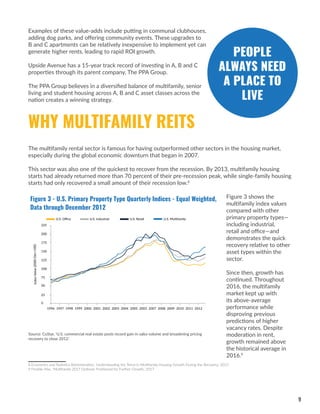

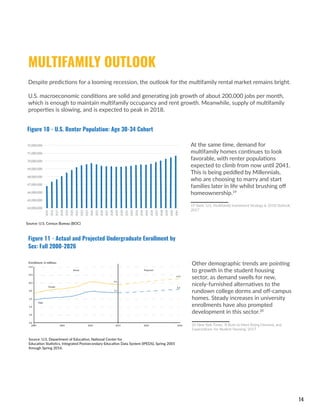

The document outlines the advantages of real estate investing, particularly in multifamily properties, as a response to the decline in stock market participation post-2008. It highlights the tangible nature of real estate investments, their potential for cash flow and appreciation, and the demand for diverse investment strategies, especially as concerns about economic downturns grow. Additionally, it points out the resilience of multifamily and senior housing markets amidst economic challenges, suggesting these sectors as favorable for future investment.