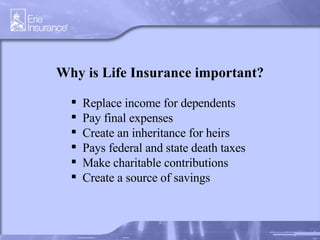

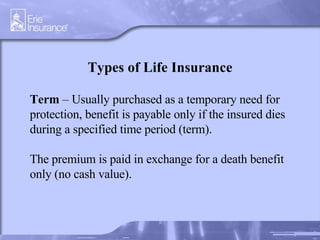

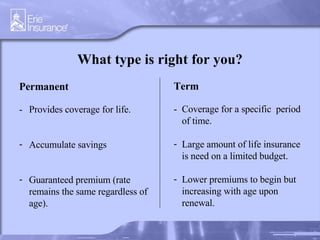

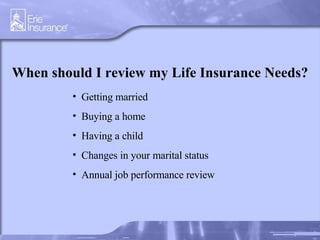

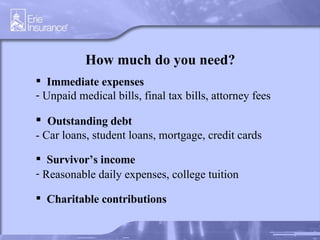

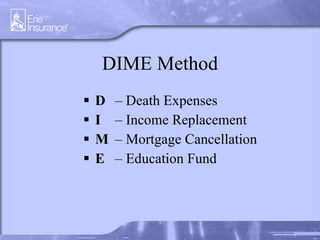

Life insurance protects a family's financial future in the event of a breadwinner's death. There are two main types of life insurance: term insurance, which provides affordable coverage for a set period of time, and permanent insurance, which provides lifelong coverage and allows savings to accumulate. An insurance professional can help determine the right amount and type of coverage needed based on factors like income needs, debts, and future expenses like education.

![Lisa Fuller Fuller & Associates Insurance 410-914-5467 www.InsureWithFuller.com www.InsureWithFuller.com [email_address] We’ve got you covered. It’s our true blue promise. Contact Information](https://image.slidesharecdn.com/life-12404358209-phpapp01/85/Life-12-320.jpg)