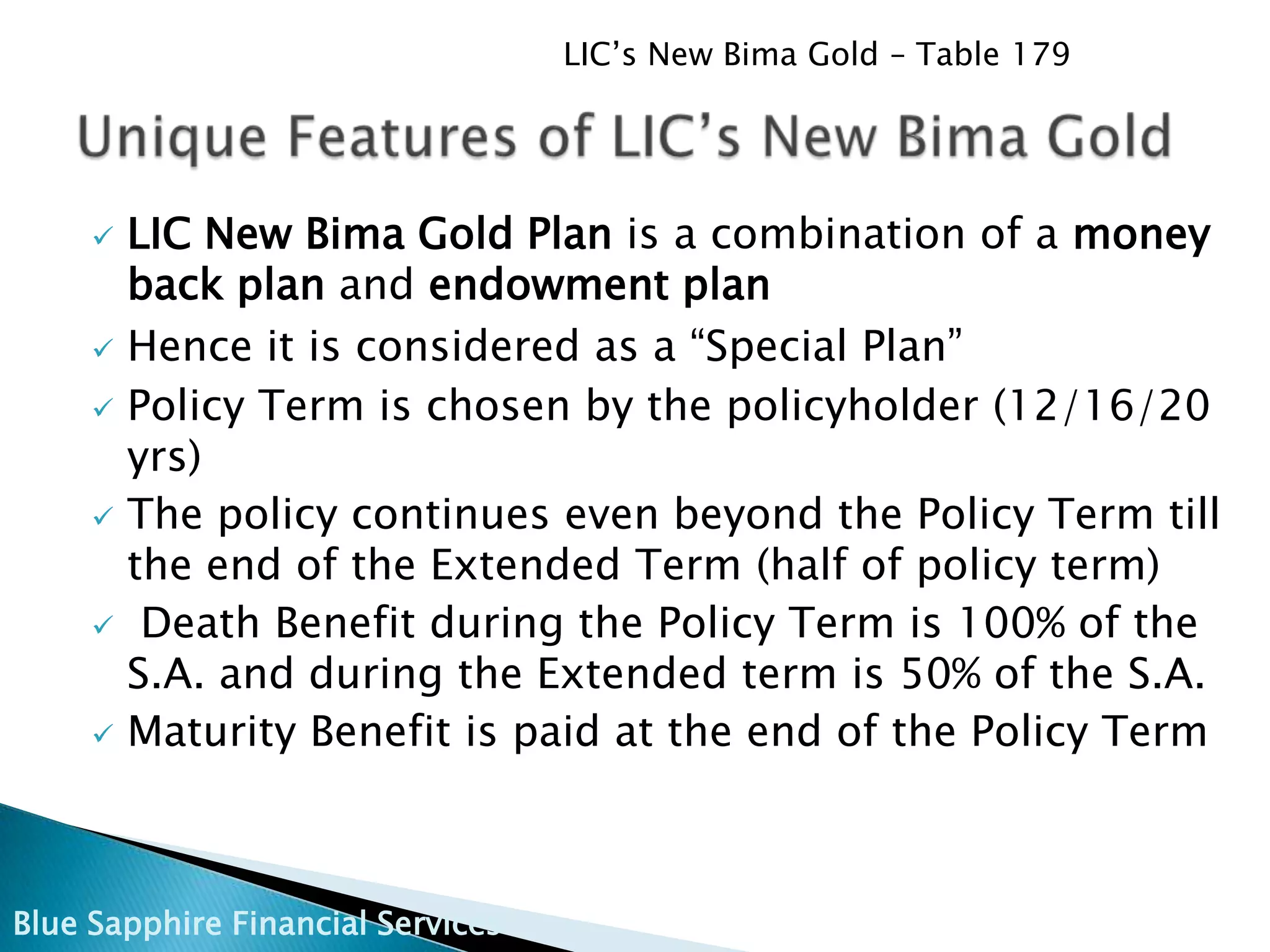

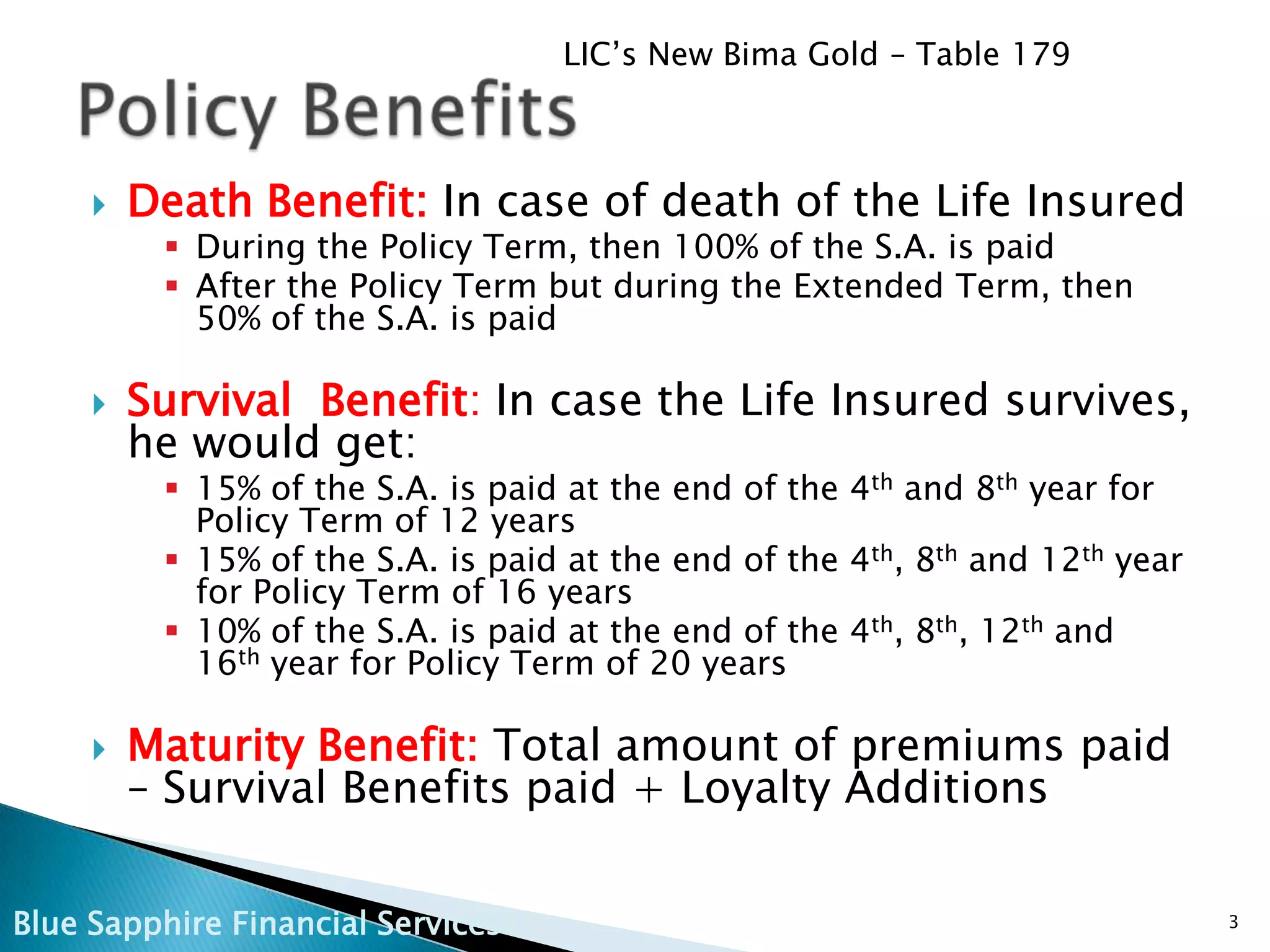

LIC's New Bima Gold - Table 179 is a special plan combining a money back and endowment plan, with policy terms of 12, 16, or 20 years. It offers benefits like 100% of the sum assured during the policy term and 50% during the extended term, along with maturity benefits based on premiums paid and survival benefits at specific intervals. This plan is managed by LIC, India's oldest insurance company, with a strong customer base and substantial assets.