This document discusses empirical research on the determinants of bank lending across countries. It proposes estimating equations to model domestic credit levels based on bank balance sheet and capital requirements approaches. The analysis will use data from 146 countries over 1990-2013 to examine how economic growth, banking system health, and external capital flows influence domestic credit after controlling for other factors. Key determinants expected to impact credit include deposits, interest rates, costs, capital levels, and macroeconomic conditions.

![21

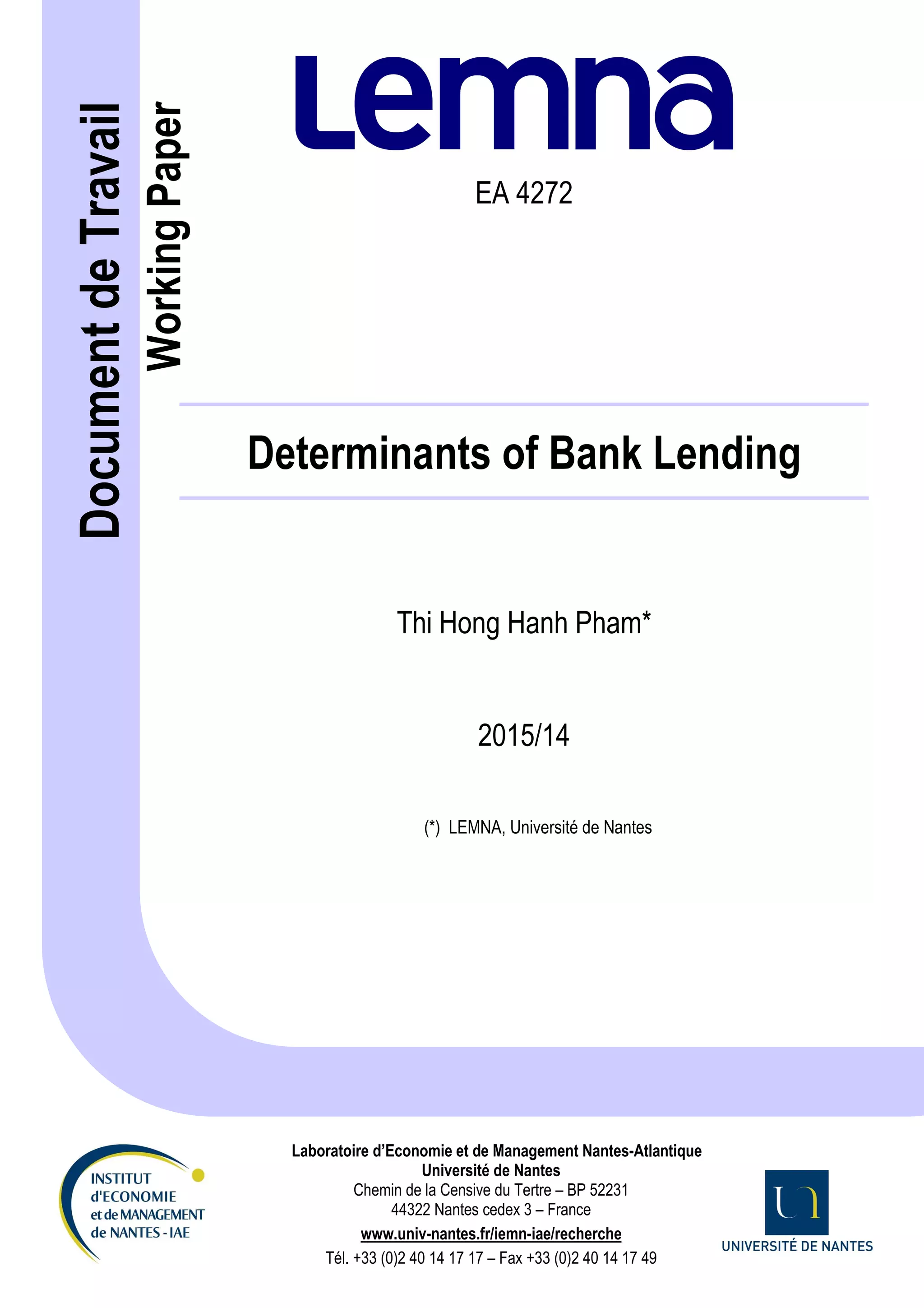

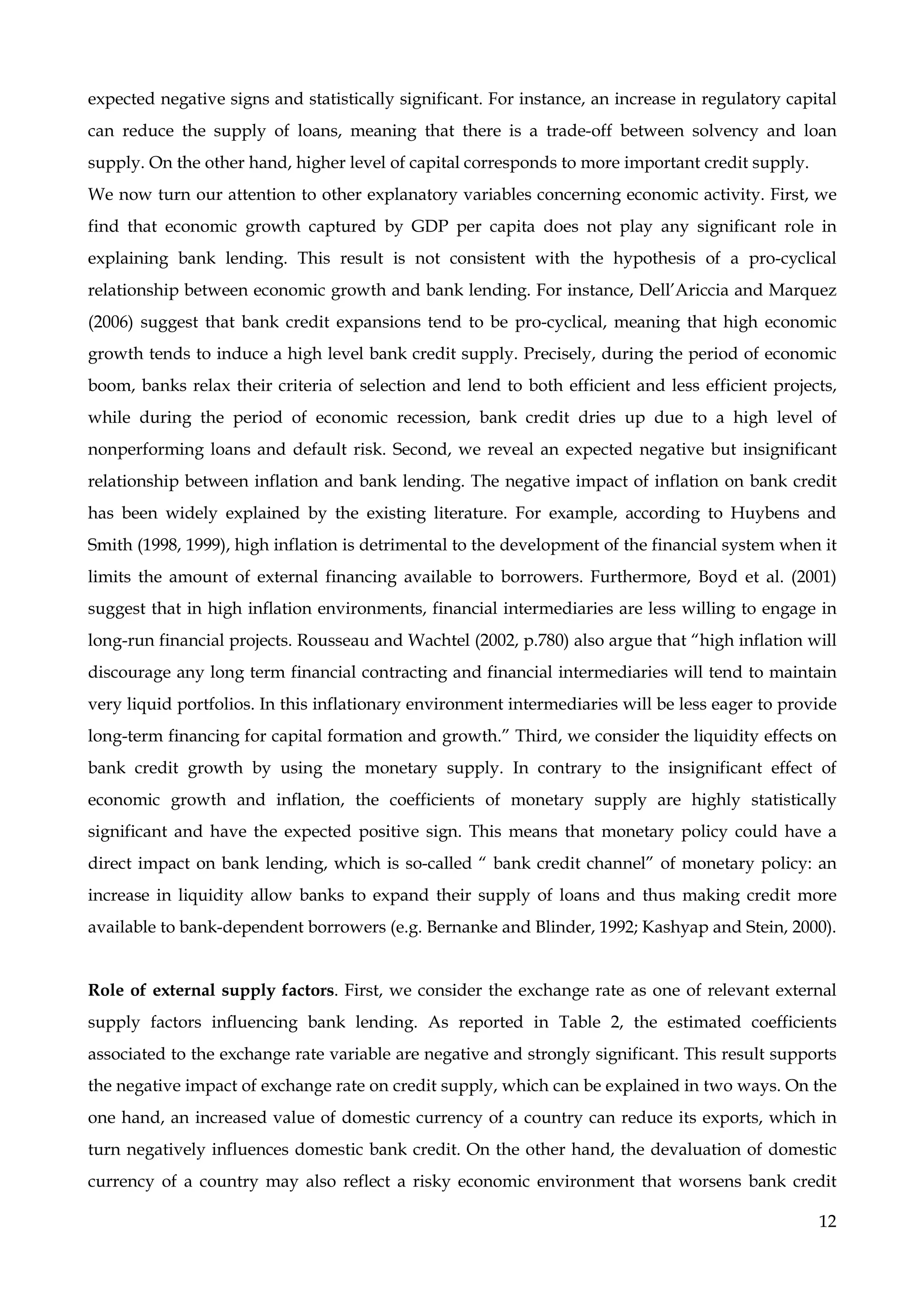

Table 2: GMM estimator’s results for Full sample

Independent

Variables

Model 1 Model 2 Model 3 Model 4

Lagged bank credit 0.698*** (0.054) 0.734*** (0.042) 0.685*** (0.053) 0.598*** (0.060)

Internal demand factors

Bank deposit -0.020 (0.115) -0.036 (0.083) -0.078 (0.107) -0.054 (0.074)

Real interest rate 0.707*** (0.090) 0.838*** (0.075) 0.754*** (0.084) 0.377*** (0.100)

Costs/Income -0.023 (0.032) - -0.003 (0.037) -

Bank capital/Assets 0.102** (0.040) - 0.099** (0.034) -

Regulatory capital -0.112** (0.046) - -0.134*** (0.037) -

GDP per capita -0.019 (0.106) -0.041 (0.118) 0.134 (0.122) 0.009 (0.087)

Inflation rate -0.091 (0.053) 0.087 (0.057) -0.119 (0.062) -0.007 (0.050)

Money supply 0.441*** (0.126) 0.450*** (0.100) 0.487*** (0.104) 0.562*** (0.090)

External supply factors

Exchange rate -0.170*** (0.057) -0.159*** (0.041) -0.117** (0.056) -0.073** (0.032)

FDI flows 0.050 (0.096) 0.028 (0.078) 0.110 (0.093) 0.048 (0.121)

KAOPEN -0.026** (0.011) -0.023** (0.011) -0.010 (0.011) 0.001 (0.018)

Trade openness level 0.040 (0.059) 0.002 (0.049) 0.002 (0.060) 0.022 (0.064)

Global factors

U.S money supply 0.131 (0.080) 0.112 (0.093) 0.009 (0.102) 0.023 (0.121)

U.S. FED rate 0.005 (0.005) 0.007 (0.005) 0.001 (0.004) 0.006 (0.005)

Lending rates’ gap -0.231*** (0.062) -0.199** (0.048) -0.281*** (0.055) -0.244*** (0.072)

External debt -0.021 (0.033) -0.027 (0.031) -0.024 (0.030) -0.008 (0.026)

Crisis -0.035 (0.034) -0.018 (0.027) -0.029 (0.029) -0.009 (0.025)

Characteristics of domestic banking system

ROE -0.105 (0.127) 0.013 (0.011) - -

ROA -0.095 (0.301) -0.680 (0.419) - -

Bank concentration -0.150*** (0.041) -0.119*** (0.039) - -

Non-performing loans -0.037*** (0.011) -0.048*** (0.011) - -

Constant -1.955 (2.006) -0.572 (2.172) -4.490*** (0.911) -1.480 (1.034)

Serial Corr. (m1) -4.672 [0.000] -5.279 [0.000] -3.782 [0.000] -4.656 [0.000]

Serial Corr. (m2) -1.540 [0.123] -2.607 [0.009] -0.814 [0.416] 0.858 [0.391]

Note: Values in parentheses are robust standard errors. Values in brackets are P-values. *** (**; *): Significant at 1%,

5% and 10% level respectively.](https://image.slidesharecdn.com/lemnawp2015-14-211021112557/75/Lemna-wp-2015-14-23-2048.jpg)

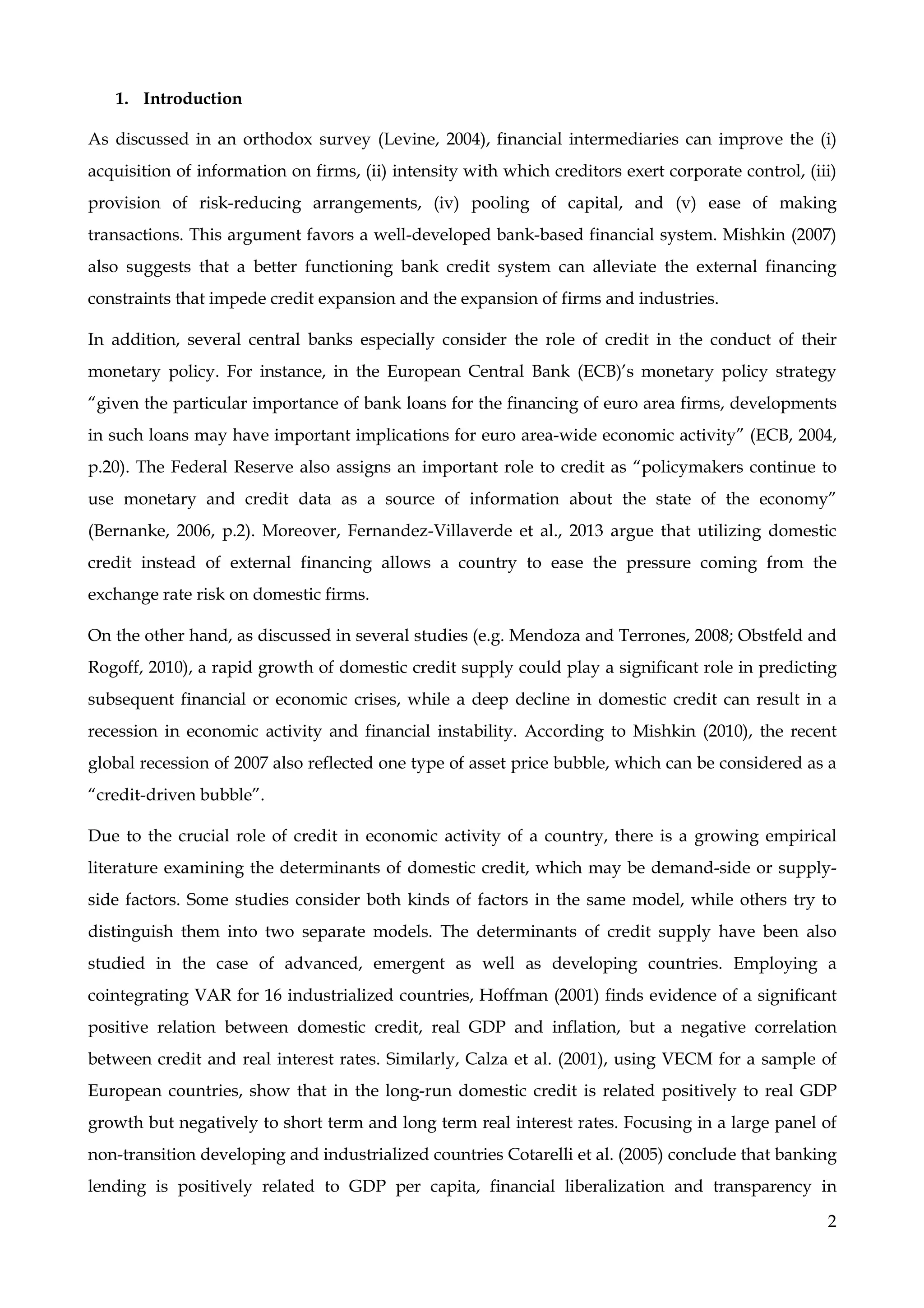

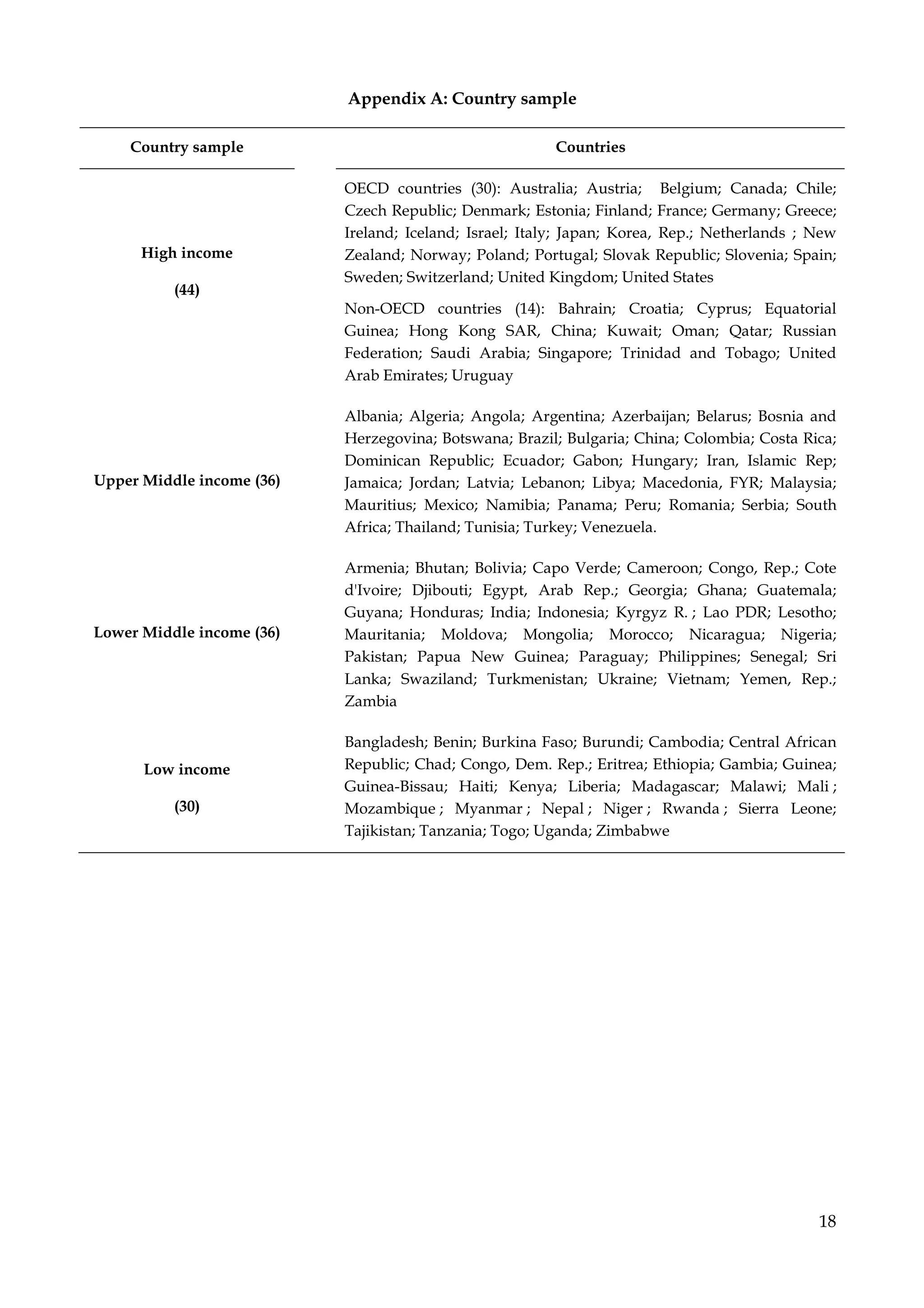

![22

Table 3: GMM estimator’s results for Low income sample

Independent

Variables

Model 1 Model 2 Model 3 Model 4

Lagged bank credit 0.015 (0.060) 0.482***(0.067) 0.200** (0.089) 0.575** (0.066)

Internal demand factors

Bank deposit -0.069 (0.165) 0.022(0.195) 0.131 (0.267) -0.034 (0.121)

Real interest rate 0.576***(0.142) 0.427***(0.206) 0.692** (0.268) 0.303*** (0.074)

Costs/Income 0.100 (0.097) - 0.114 (0.097) -

Bank capital/Assets 0.384***(0.075) - 0.272*** (0.069) -

Regulatory capital -0.304***(0.050) - -0.249*** (0.068) -

GDP per capita 0.601 (0.332) -0.379 (0.350) -0.260 (0.177) -0.079 (0.223)

Inflation rate -0.205 (0.120) -0.025 (0.029) -0.065 (0.092) -0.093 (0.081)

Money supply 0.819***(0.133) 0.530***(0.170) 0.689*** (0.208) 0.529*** (0.118)

External supply factors

Exchange rate -0.490**(0.215) 0.032(0.156) 0.023(0.278) -0.046 (0.038)

FDI flows 0.252 (0.158) -0.326*** (0.095) -0.145 (0.227) -0.052 (0.214)

KAOPEN -0.067**(0.027) -0.001(0.025) 0.034(0.021) -0.009 (0.030)

Trade openness level 0.338**(0.153) 0.020(0.058) -0.060 (0.129) 0.073 (0.111)

Global factors

U.S money supply 0.187***(0.087) 1.362**(0.536) 0.944**(0.353) 0.306*** (0.090)

U.S. FED rate -0.115**(0.032) -0.005 (0.012) -0.061(0.045) -0.015 (0.011)

Lending rates’ gap -1.145*** (0.159) -0.597***(0.184) -0.828**(0.392) -0.420*** (0.136)

External debt 0.071(0.076) 0.031(0.078) -0.045 (0.035) 0.021 (0.032)

Crisis - - - -0.064 (0.054)

Characteristics of domestic banking system

ROE -0.122 (0.118) -0.189 (0.286) - -

ROA -1.567 (1.407) -1.096 (1.099) - -

Bank concentration 0.143 (0.230) -0.298** (0.131) - -

Nonperforming loans -0.164*** (0.030) -0.031 (0.038) - -

Constant -49.646*** (7.488) 3.864 (4.309) -4.513 (4.973) -0.906 (1.494)

Serial Corr. (m1) -1.748 [0.080] -1.624 [0.100] -1.736 [0.082] -2.777 [0.006]

Serial Corr. (m2) 1.634 [0.102] 0.185 [0.853] 1.552 [0.121] 1.220 [0.222]

Note: Values in parentheses are robust standard errors. Values in brackets are P-values. *** (**; *): Significant at 1%,

5% and 10% level respectively.](https://image.slidesharecdn.com/lemnawp2015-14-211021112557/75/Lemna-wp-2015-14-24-2048.jpg)

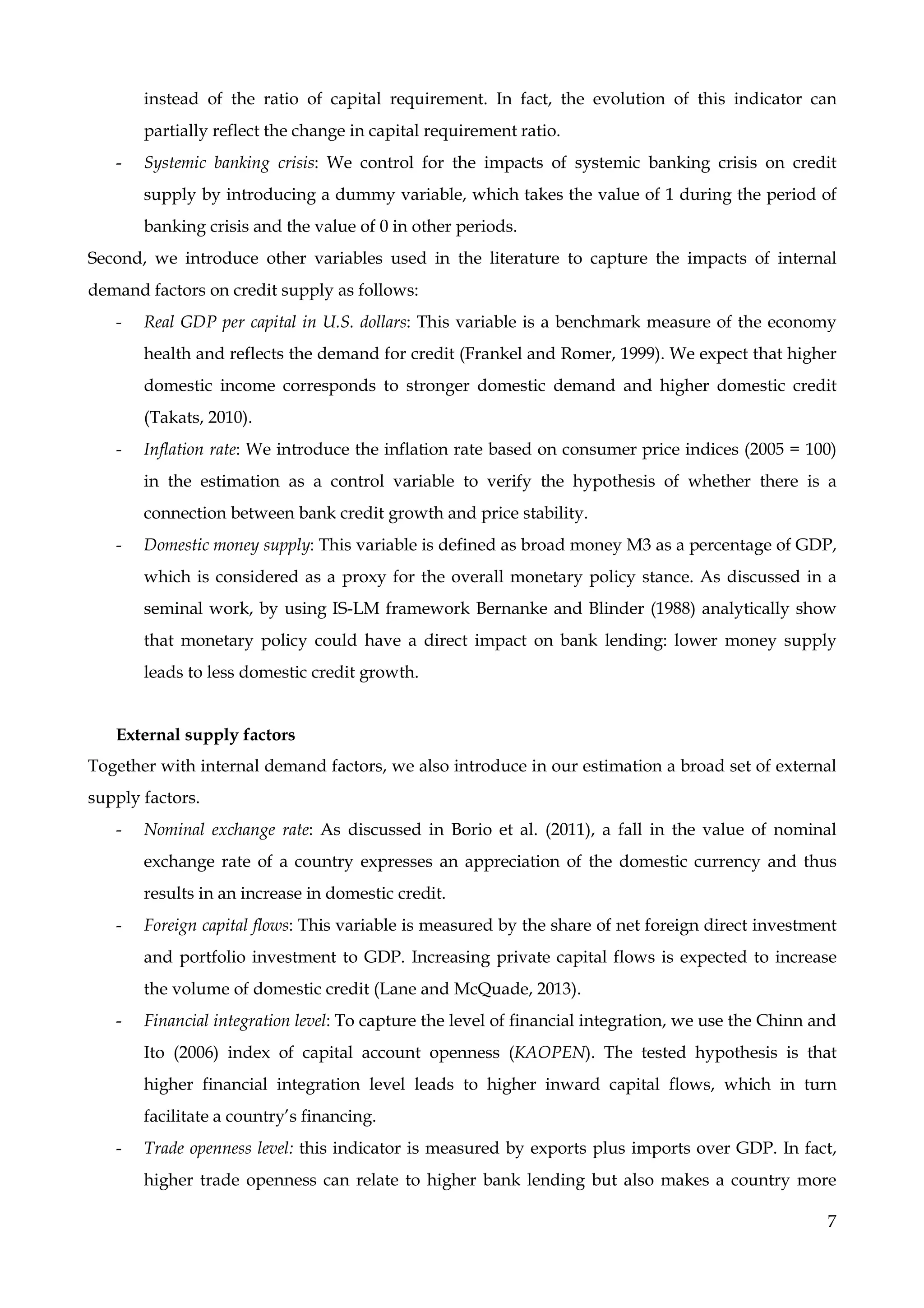

![23

Table 4: GMM estimator’s results for Lower middle income sample

Independent

Variables

Model 1 Model 2 Model 3 Model 4

Lagged bank credit 0.752*** (0.053) 0.831*** (0.029) 0.791*** (0.048) 0.598*** (0.064)

Internal demand factors

Bank deposit -0.303 (0.176) -0.293** (0.111) -0.188 (0.131) -0.147 (0.133)

Real interest rate 0.506 (0.300) 0.782*** (0.126) 0.629*** (0.160) 0.314* (0.181)

Costs/Income -0.020 (0.102) - 0.074 (0.081) -

Bank capital/Assets 0.185 (0.133) - 0.200** (0.073) -

Regulatory capital -0.176 (0.102) - -0.146** (0.057) -

GDP per capita 0.176 (0.114) 0.063 (0.126) 0.093 (0.134) 0.027 (0.149)

Inflation rate -0.147 (0.109) -0.141 (0.099) -0.105 (0.087) -0.006 (0.082)

Money supply 0.842*** (0.117) 0.657*** (0.110) 0.716*** (0.095) 0.618*** (0.134)

External supply factors

Exchange rate -0.218** (0.096) -0.275*** (0.085) -0.295** (0.098) -0.183*** (0.060)

FDI flows 0.106 (0.329) 0.067 (0.324) 0.203 (0.347) -0.029 (0.264)

KAOPEN -0.024* (0.012) -0.028* (0.016) 0.023 (0.022) 0.035 (0.026)

Trade openness level -0.085 (0.060) -0.063 (0.057) -0.001 (0.082) -0.022 (0.093)

Global factors

U.S money supply -0.357* (0.176) -0.389** (0.164) -0.415** (0.153) 0.188 (0.264)

U.S. FED rate 0.005 (0.008) -0.009 (0.008) 0.001 (0.007) 0.002 (0.008)

Lending rates’ gap -0.133 (0.115) -0.215*** (0.059) -0.060 (0.087) -0.378*** (0.093)

External debt -0.059 (0.051) 0.014 (0.070) -0.110** (0.049) 0.040 (0.048)

Crisis -0.060 (0.058) -0.079** (0.025) -0.021 (0.039) -0.001 (0.045)

Characteristics of domestic banking system

ROE -0.583 (0.582) 0.155*** (0.018) - -

ROA -0.965 (1.461) -0.432 (0.709) - -

Bank concentration -0.093 (0.057) -0.037 (0.059) - -

Non-performing loans -0.013 (0.015) -0.054*** (0.016) - -

Constant 5.563 (5.896) -1.076 (4.081) -3.359* (1.891) -0.838 (1.228)

Serial Corr. (m1) -2.945 [0.003] -3.215 [0.001] -3.275 [0.001] -2.958 [0.003]

Serial Corr. (m2) 0.399 [0.689] -1.382 [0.167] 0.305 [0.760] 0.949 [0.342]

Note: Values in parentheses are robust standard errors. Values in brackets are P-values. *** (**; *): Significant at 1%,

5% and 10% level respectively.](https://image.slidesharecdn.com/lemnawp2015-14-211021112557/75/Lemna-wp-2015-14-25-2048.jpg)

![24

Table 5: GMM estimator’s results for Upper middle income sample

Independent

Variables

Model 1 Model 2 Model 3 Model 4

Lagged bank credit 0.763*** (0.045) 0.764*** (0.050) 0.734*** (0.044) 0.720*** (0.054)

Internal demand factors

Bank deposit 0.042 (0.067) -0.035 (0.055) 0.152 (0.098) -0.247* (0.109)

Real interest rate 0.501*** (0.117) 0.639*** (0.108 0.538*** (0.089) 0.396*** (0.128)

Costs/Income 0.017 (0.068) - 0.094 (0.061) -

Bank capital/Assets 0.103** (0.049) - 0.127** (0.058) -

Regulatory capital -0.104** (0.044) - -0.087** (0.037) -

GDP per capita 0.075 (0.088) -0.036 (0.115) 0.191 (0.143) 0.237** (0.109)

Inflation rate -0.017 (0.056) -0.074 (0.052) -0.062 (0.066) -0.036 (0.096)

Money supply 0.195* (0.099) 0.260** (0.113) 0.151* (0.095) 0.520*** (0.145)

External supply factors

Exchange rate -0.151*** (0.047) -0.148*** (0.040) -0.074 (0.053) -0.060 (0.042)

FDI flows -0.027 (0.076) -0.091 (0.076) 0.053 (0.087) -0.086 (0.119)

KAOPEN -0.019** (0.009) -0.003** (0.001) -0.007 (0.011) 0.007 (0.021)

Trade openness level 0.082** (0.040) 0.073** (0.033) 0.033* (0.017) 0.057 (0.128)

Global factors

U.S money supply 0.046 (0.101) 0.174 (0.109) -0.063 (0.103) -0.184 (0.117)

U.S. FED rate 0.001 (0.006) 0.002 (0.007) 0.000 (0.008) 0.006 (0.009)

Lending rates’ gap -0.229*** (0.071) -0.228*** (0.062) -0.330*** (0.060) -0.216** (0.100)

External debt 0.048 (0.038) 0.081** (0.032) -0.003 (0.031) 0.073 (0.052)

Crisis -0.049** (0.019) -0.091** (0.037) -0.070** (0.034) -0.074** (0.031)

Characteristics of domestic banking system

ROE 0.256 (0.225) 0.184 (0.229) - -

ROA 0.503 (0.430) 0.154 (0.400) - -

Bank concentration -0.090** (0.042) -0.058* (0.030) - -

Nonperforming loans -0.060*** (0.008) -0.068*** (0.011) - -

Constant 3.548 (2.808) 2.094 (1.695) -3.390** (1.269) -1.705 (1.660)

Serial Corr. (m1) -3.350 [0.001] -3.396 [0.001] -2.935 [0.003] -3.250 [0.001]

Serial Corr. (m2) -0.696 [0.486] -0.969 [0.332] -0.420 [0.674] 0.192 [0.847]

Note: Values in parentheses are robust standard errors. Values in brackets are P-values. *** (**; *): Significant at 1%,

5% and 10% level respectively.](https://image.slidesharecdn.com/lemnawp2015-14-211021112557/75/Lemna-wp-2015-14-26-2048.jpg)

![25

Table 6: GMM estimator’s results for High-income sample

Independent

Variables

Model 1 Model 2 Model 3 Model 4

Lagged bank credit 0.452*** (0.075) 0.435*** (0.067) 0.515*** (0.048) 0.714*** (0.048)

Internal demand factors

Bank deposit 0.012 (0.177) -0.052 (0.132) -0.182 (0.117) -0.528***(0.170)

Real interest rate 1.579*** (0.476) 1.202** (0.404) 1.299*** (0.285) 0.899* (0.489)

Costs/Income -0.090 (0.072) - -0.059 (0.036) -

Bank capital/Assets 0.072** (0.033) - 0.077** (0.035) -

Regulatory capital -0.160* (0.083) - -0.074** (0.034) -

GDP per capita 0.559***(0.162) 0.493** (0.234) 0.278* (0.147) 0.303*** (0.132)

Inflation rate -0.126 (0.172) -0.018 (0.214) -0.053 (0.177) -0.097 (0.225)

Money supply 0.413** (0.175) 0.444** (0.159) 0.527*** (0.158) 0.437** (0.200)

External supply factors

Exchange rate -0.053** (0.023) -0.090** (0.033) -0.063* (0.033) -0.023** (0.011)

FDI flows -0.256 (0.191) -0.368** (0.151) -0.242* (0.131) 1.020 (0.754)

KAOPEN -0.119***(0.028) -0.091*** (0.022) -0.013 (0.014) 0.001 (0.031)

Trade openness level 0.311***(0.088) 0.260*** (0.061) 0.206*** (0.055) 0.210* (0.116)

Global factors

U.S money supply 0.308 (0.170) 0.250 (0.158) 0.046 (0.169) 0.206 (0.248)

U.S. FED rate 0.018** (0.009) 0.026** (0.010) 0.017* (0.010) -0.005 (0.023)

Lending rates’ gap -0.191** (0.094) -0.167* (0.091) -0.249** (0.111) -0.135 (0.136)

External debt -0.082*** (0.019) -0.074*** (0.021) -0.073*** (0.020) 0.008 (0.024)

Crisis -0.024 (0.015) -0.004 (0.015) 0.034 (0.028) -0.015 (0.015)

Characteristics of domestic banking system

ROE 0.503 (0.430) 0.251 (0.189) - -

ROA 0.569 (0.521) 0.333 (0.200) - -

Bank concentration -0.151* (0.076) -0.166** (0.078) - -

Non-performing loans -0.014** (0.006) 0.018** (0.007) - -

Constant -16.336*** (4.026) -9.923*** (3.082) -5.630*** (1.976) -10.132** (4.978)

Serial Corr. (m1) -1.904 [0.056] -1.949 [0.051] -1.981 [0.047] -1.487 [0.136]

Serial Corr. (m2) -0.371 [0.710] -0.722 [0.470] -1.854 [0.063] -0.636 [0.524]

Note: Values in parentheses are robust standard errors. Values in brackets are P-values. *** (**; *): Significant at 1%,

5% and 10% level respectively.](https://image.slidesharecdn.com/lemnawp2015-14-211021112557/75/Lemna-wp-2015-14-27-2048.jpg)

![26

Table 7: System-GMM estimator’s results for Full sample

Independent

Variables

Model 1 Model 2 Model 3 Model 4

Lagged bank credit 0.796*** (0.056) 0.857*** (0.043) 0.787*** (0.052) 0.697*** (0.051)

Internal demand factors

Bank deposit -0.143 (0.115) -0.113 (0.101) -0.118 (0.105) -0.080 (0.071)

Real interest rate 0.674*** (0.123) 0.808*** (0.094) 0.759*** (0.094) 0.297** (0.107)

Costs/Income -0.036 (0.044) - -0.071 (0.042) -

Bank capital/Assets 0.114** (0.049) - 0.120** (0.041) -

Regulatory capital -0.083* (0.049) - -0.129*** (0.042) -

GDP per capita -0.052 (0.061) -0.034 (0.056) 0.026 (0.039) -0.103 (0.055)

Inflation rate -0.074 (0.064) -0.093 (0.057) -0.044 (0.061) -0.096 (0.060)

Money supply 0.424*** (0.112) 0.438*** (0.095) 0.457*** (0.091) 0.531*** (0.082)

External supply factors

Exchange rate -0.056** (0.026) -0.052** (0.024) -0.017** (0.018) -0.054** (0.021)

FDI flows 0.077 (0.126) 0.001 (0.104) 0.359** (0.147) 0.198 (0.139)

KAOPEN -0.026* (0.014) -0.034** (0.013) -0.017 (0.013) 0.001 (0.013)

Trade openness level 0.150** (0.064) 0.092* (0.047) 0.161** (0.066) 0.120** (0.060)

Global factors

U.S money supply 0.357*** (0.102) 0.376*** (0.104) 0.365*** (0.109) 0.198 (0.113)

U.S. FED rate 0.011 (0.007) 0.015** (0.006) 0.006 (0.007) 0.009 (0.006)

Lending rates’ gap -0.201** (0.069) -0.158** (0.054) -0.242*** (0.070) -0.253*** (0.072)

External debt -0.023 (0.033) -0.032 (0.034) -0.044 (0.026) -0.038 (0.021)

Crisis -0.061 (0.040) -0.030 (0.024) -0.049 (0.029) -0.016 (0.030)

Characteristics of domestic banking system

ROE 0.221 (0.161) 0.128*** (0.013) - -

ROA 0.008 (0.286) 0.721 (0.465) - -

Bank concentration -0.170*** (0.043) -0.145** (0.051) - -

Non-performing loans -0.055*** (0.016) -0.061*** (0.015) - -

Constant -2.531 (2.044) -1.770 (2.679) -6.190*** (0.959) -1.708 (1.088)

Serial Corr. (m1) -4.545 [0.000] -5.172 [0.000] -3.668 [0.000] -4.953 [0.000]

Serial Corr. (m2) -1.495 [0.134] -2.095 [0.036] -1.126 [0.260] 1.003 [0.315]

Note: Values in parentheses are robust standard errors. Values in brackets are P-values. *** (**; *): Significant at 1%,

5% and 10% level respectively.](https://image.slidesharecdn.com/lemnawp2015-14-211021112557/75/Lemna-wp-2015-14-28-2048.jpg)