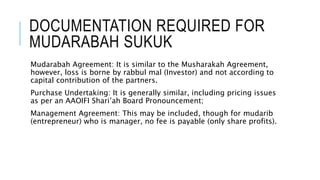

This document outlines the key legal documentation required for different sukuk structures. It discusses the rights represented by different types of sukuk, including rights to underlying assets, cash flows, and undivided interests. It then summarizes the common terms and purpose of key agreements like subscription agreements, trust deeds, and sale/purchase undertakings. Specific sukuk types like ijarah, musharakah and mudaraba are discussed in terms of their required agreements. The document provides a high-level overview of the legal frameworks for structuring different kinds of sharia-compliant sukuk instruments.