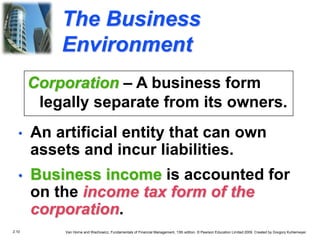

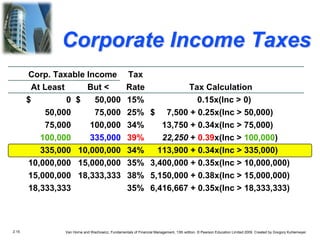

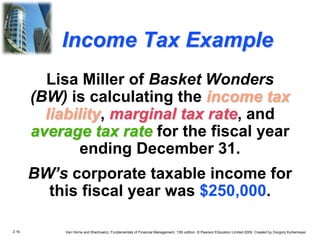

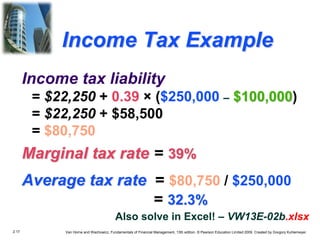

This document summarizes key concepts from Chapter 2 of the 13th edition of the textbook "Fundamentals of Financial Management" by Van Horne and Wachowicz. It discusses the four main forms of business organization in the US (sole proprietorships, partnerships, corporations, LLCs), how to calculate corporate taxable income and rates, methods of depreciation including straight-line and MACRS, and how debt financing provides a tax advantage over equity financing through interest tax deductibility.

![2.20 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

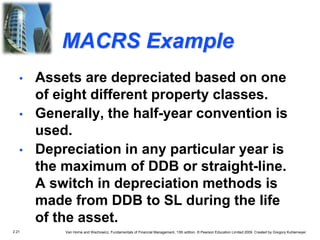

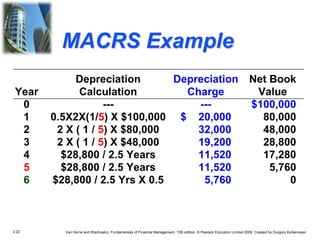

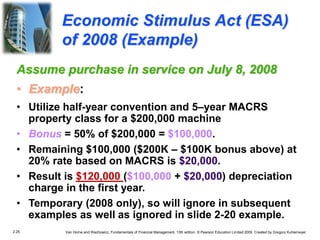

Depreciation Example

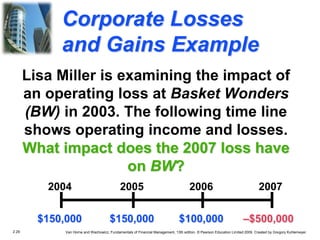

Lisa Miller of Basket Wonders (BW) is

calculating the depreciation on a machine

with a depreciable basis of $100,000, a 6-

year useful life, and a 5-year property

class life.

She calculates the annual depreciation

charges using MACRS. [Note – ignore

“bonus” depreciation discussed in 2–25]](https://image.slidesharecdn.com/pp02-230319084034-6ce72cff/85/pp02-ppt-20-320.jpg)