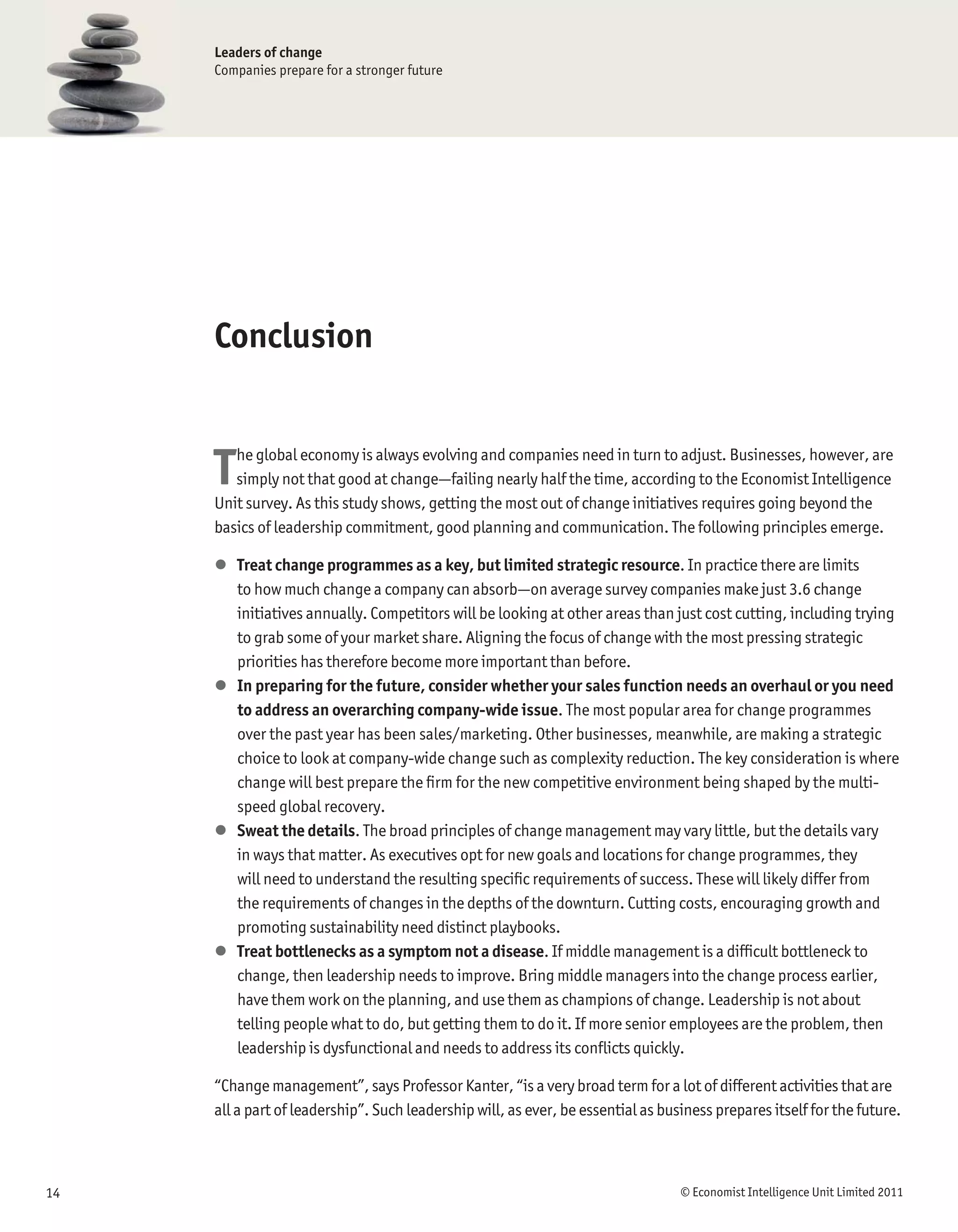

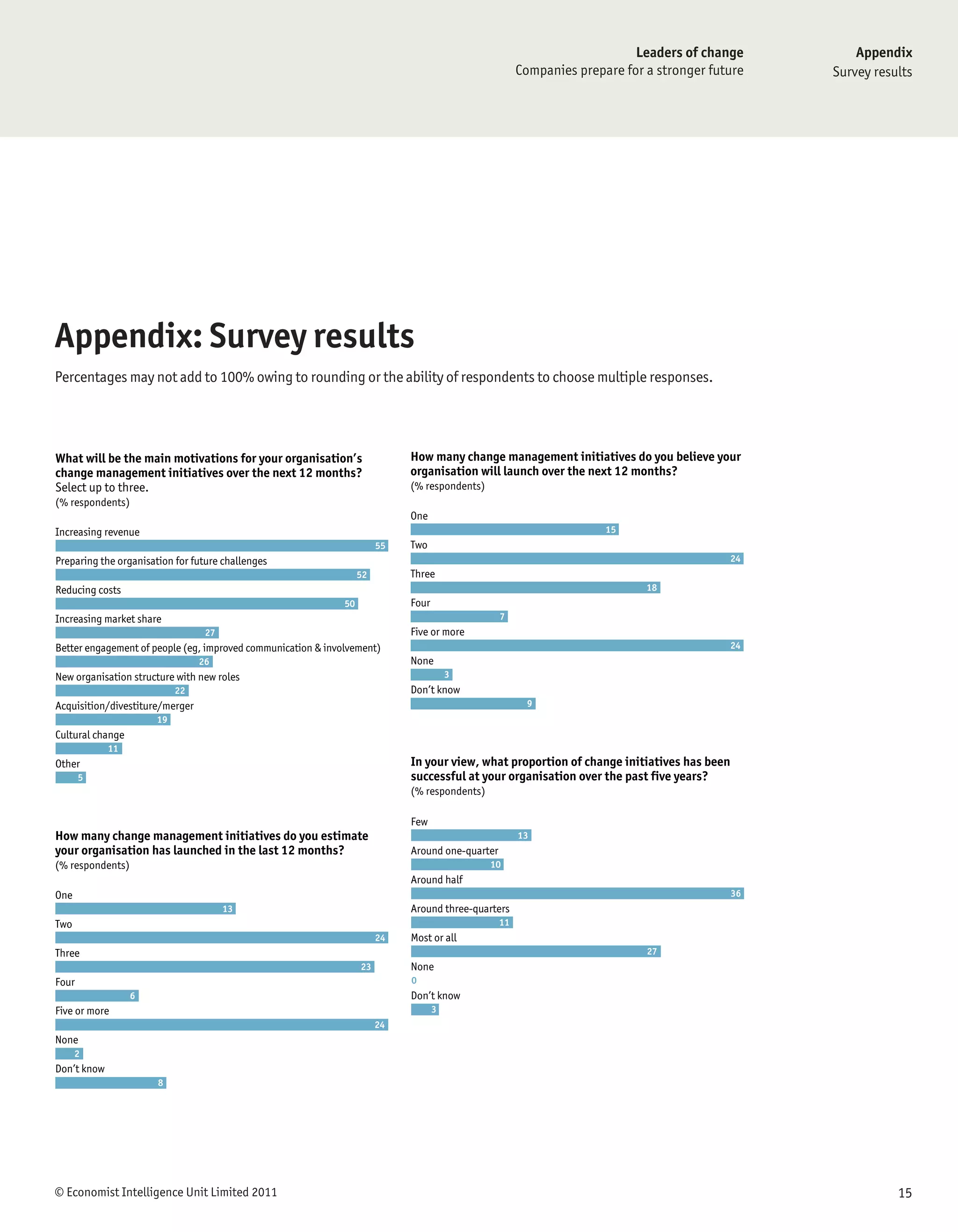

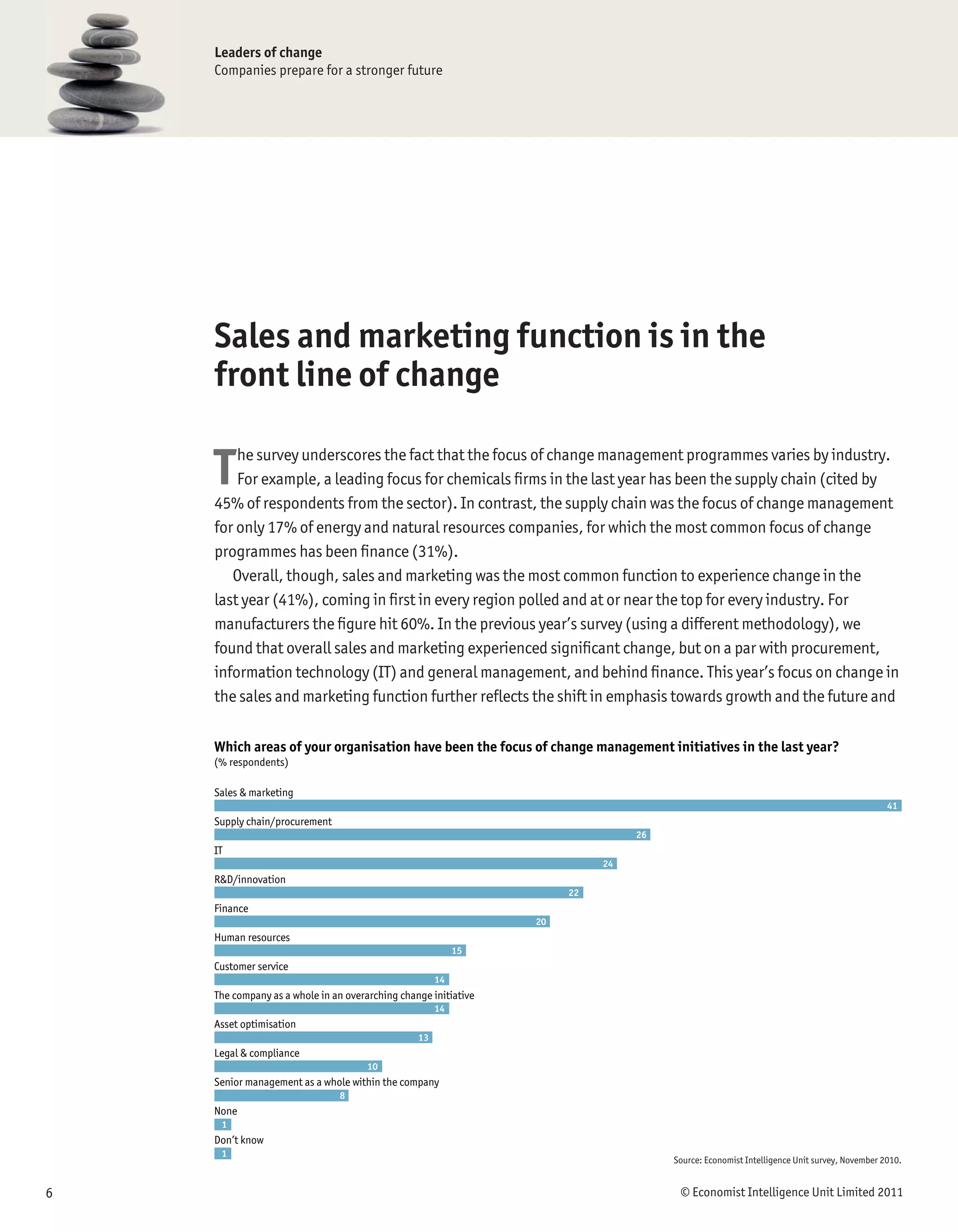

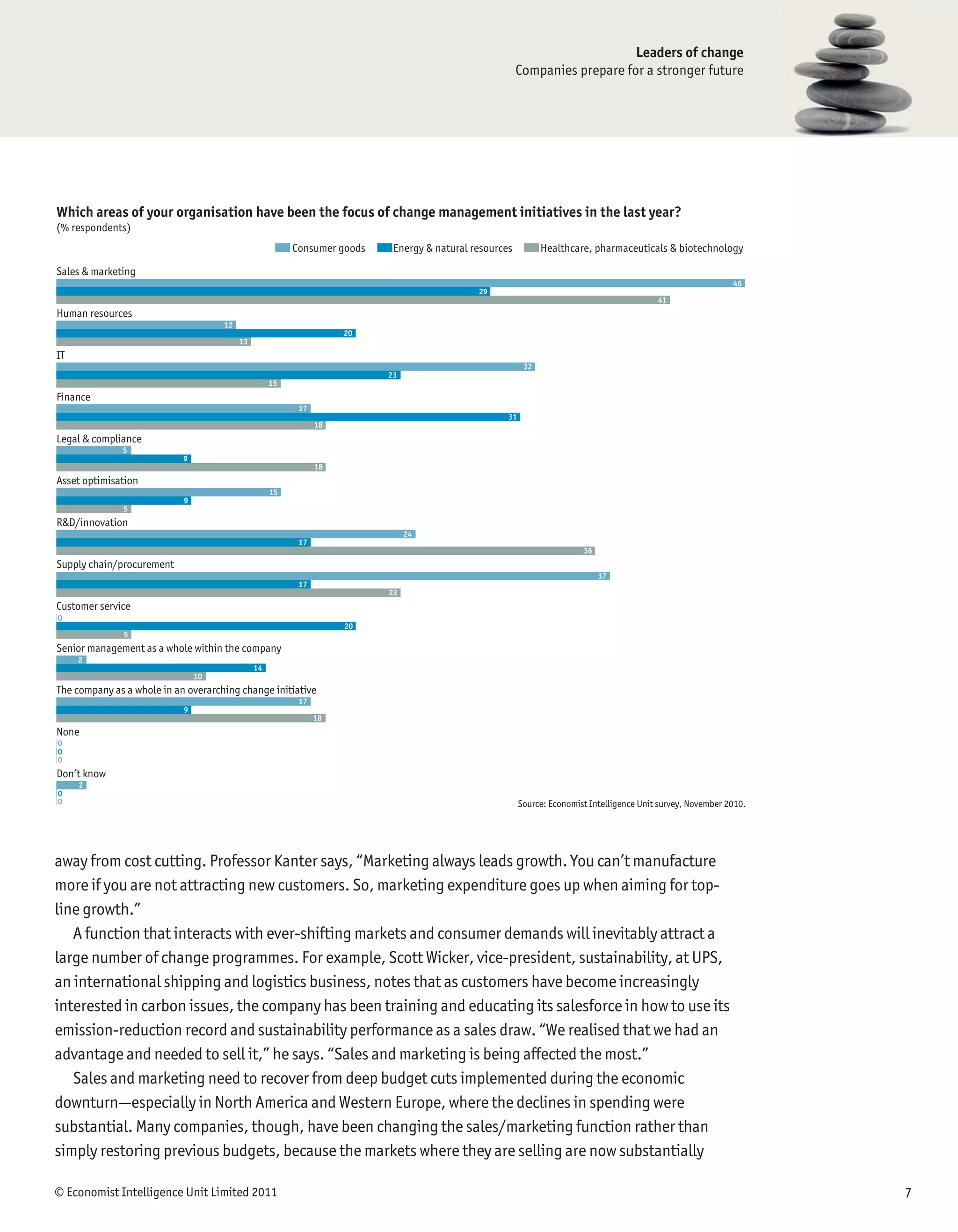

The Economist Intelligence Unit report, sponsored by Celerant Consulting, highlights a shift in corporate change management priorities towards growth and preparing for the future, with a survey of 288 senior executives revealing that increasing revenue and market share are now key goals. Despite an increased focus on these goals, many companies continue to struggle with change implementation, with only 56% of initiatives deemed successful. The report emphasizes the evolving landscape, particularly the need for businesses to adapt their sales and marketing strategies to increasingly competitive and changing market conditions.

![Leaders of change

Companies prepare for a stronger future

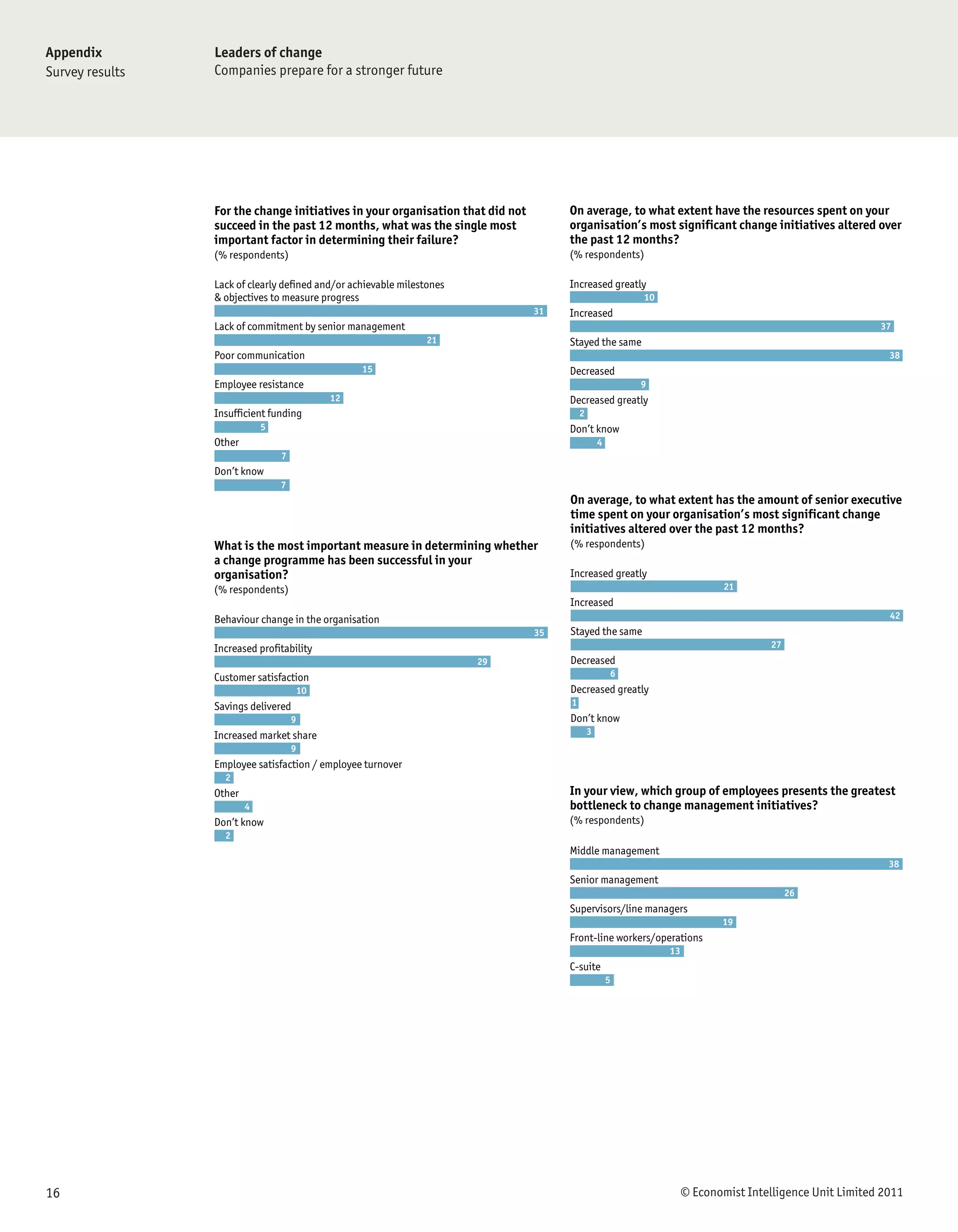

‘A’ for effort, but ‘E’ for execution?

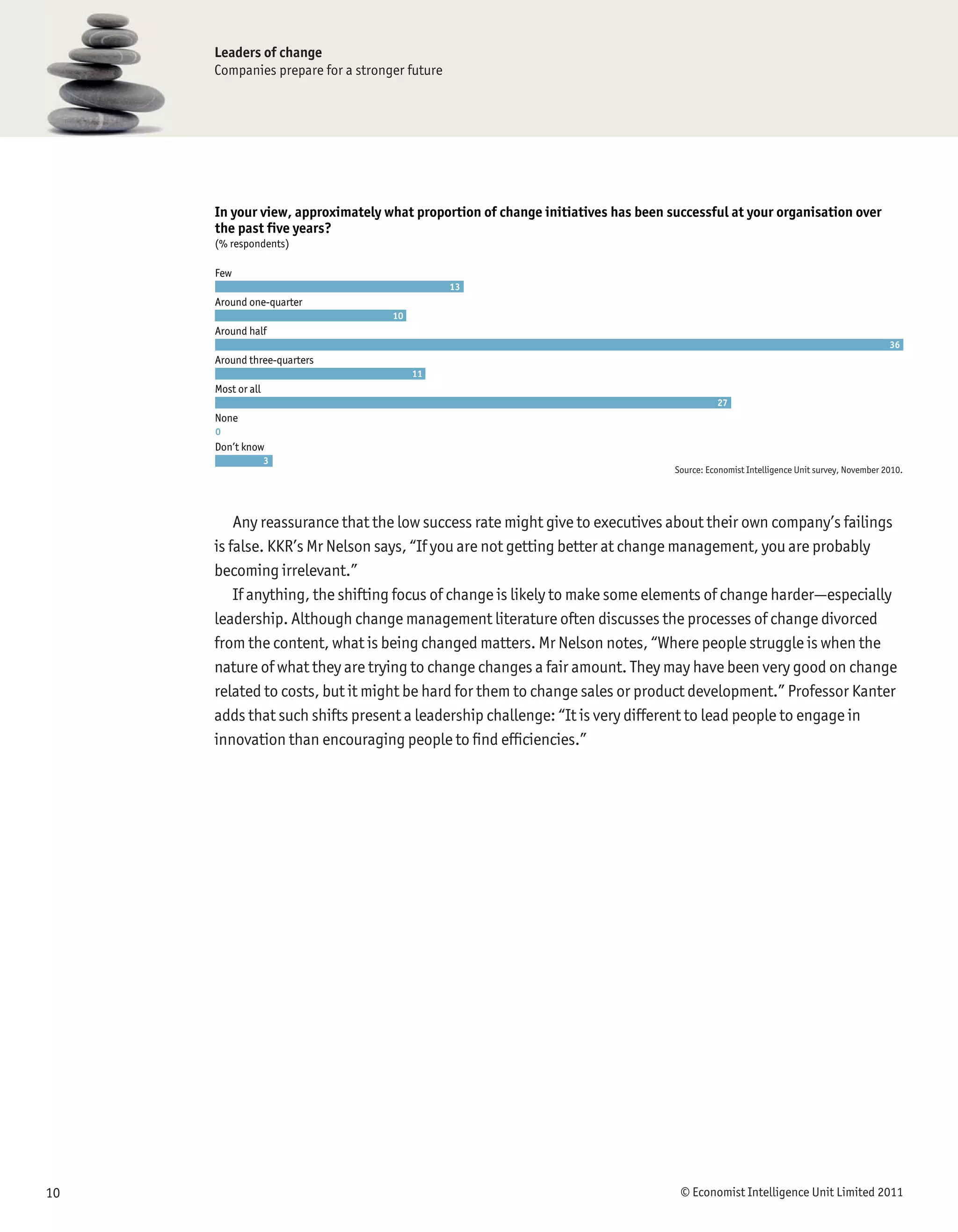

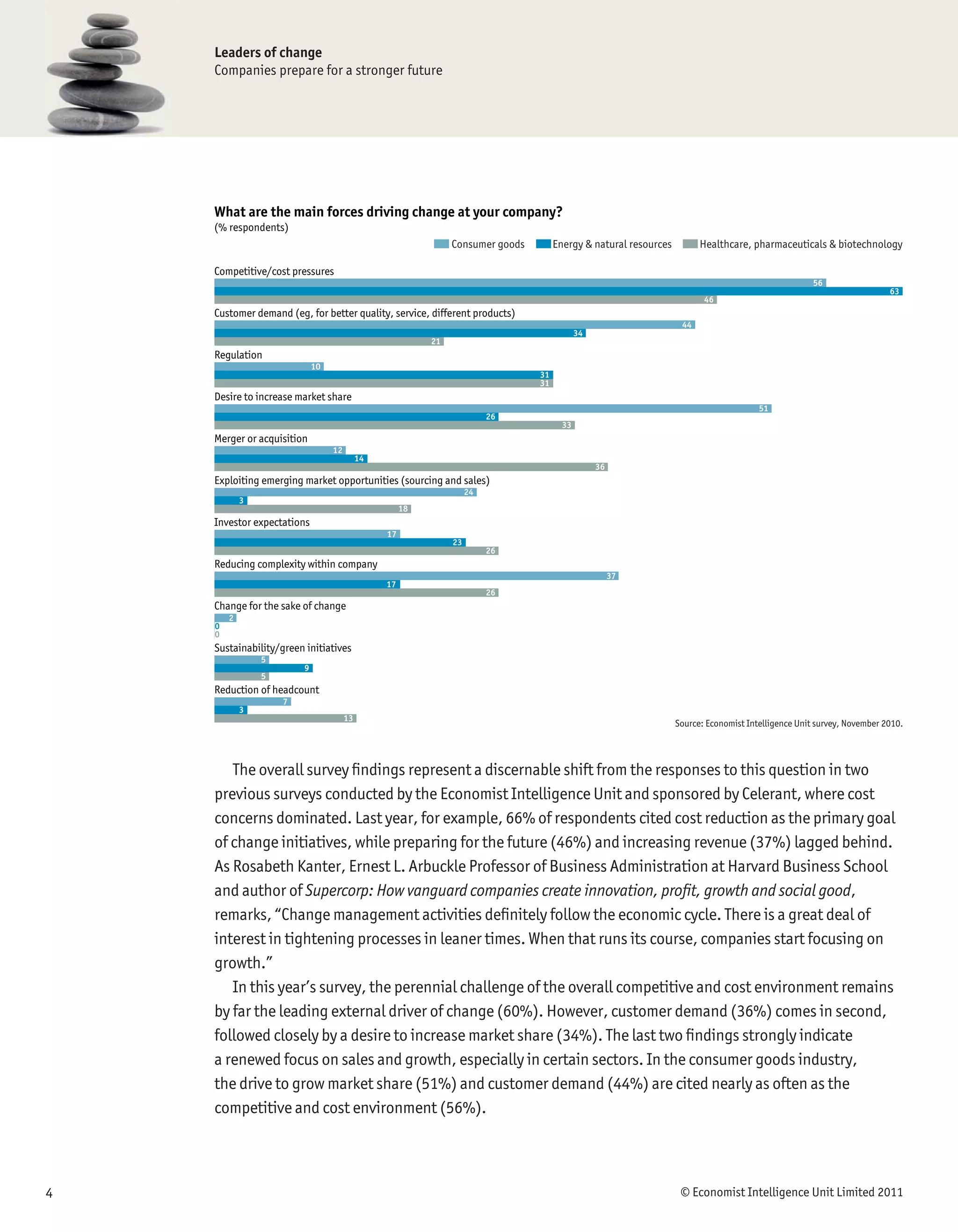

A s companies make their strategic choices about how best to change in order to face current and future

challenges, change programmes are consuming ever more corporate resources. Sixty-three percent

of survey respondents report that more senior executive time was devoted to change management

initiatives over the past year, against just 7% noting a decline. The equivalent figures for increased

spending are 47% and 11%.

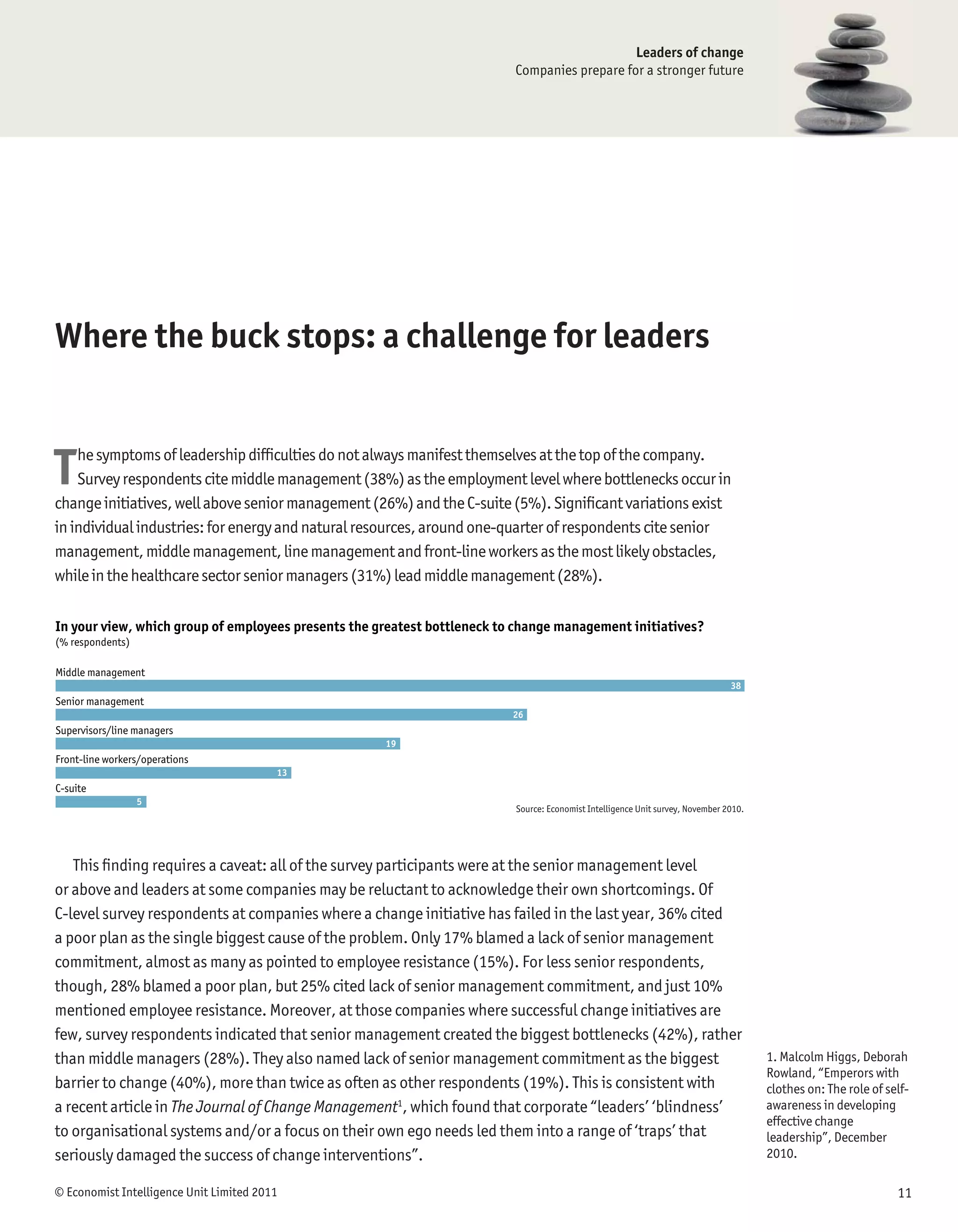

Nevertheless, most companies are still remarkably unsuccessful at implementing change. Respondents

say that on average only 56% of change initiatives are successful. This is no surprise to Allianz’s Mr

Tartaglia. Surveying the corporate world as a whole, he sees “a lot more experienced people out there and

a better understanding of best practice, but I can’t say I have seen any empirical evidence that companies

are doing better [at change management]”.

On average, to what extent…

(% respondents)

…have the resources spent on your …has the amount of senior executive time spent

organisation’s most significant change on your organisation’s most significant change

initiatives altered over the past 12 months? initiatives altered over the past 12 months?

Increased greatly

10

21

Increased

37

42

Stayed the same

38

27

Decreased

9

6

Decreased greatly

2

1

Don’t know

4

3 Source: Economist Intelligence Unit survey, November 2010.

© Economist Intelligence Unit Limited 2011 9](https://image.slidesharecdn.com/leadersofchangeeiureportjan11-110119100641-phpapp01/75/Leaders-of-change-EIU-report-Jan_11-10-2048.jpg)