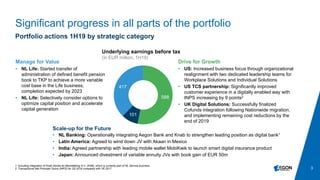

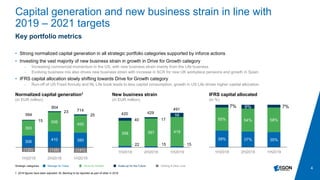

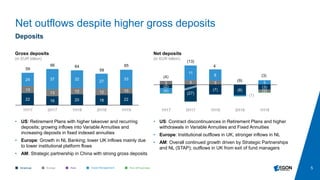

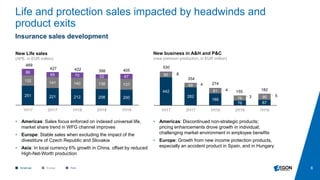

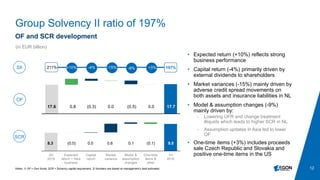

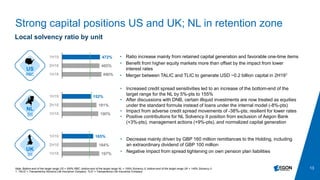

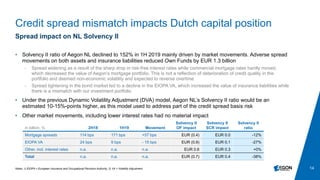

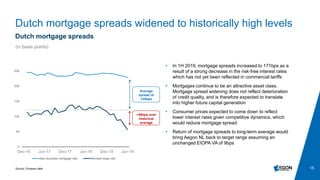

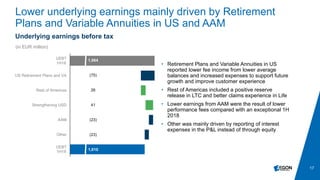

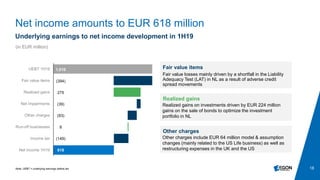

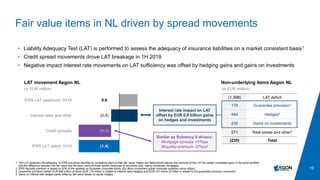

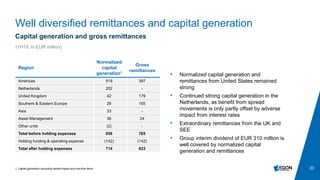

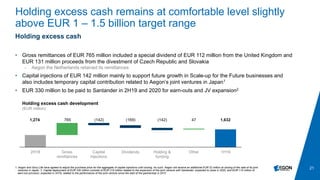

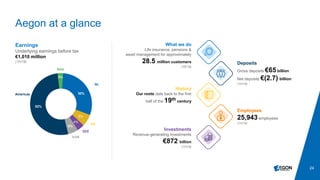

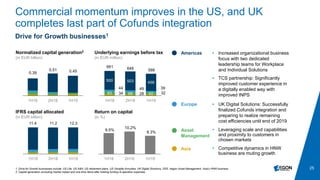

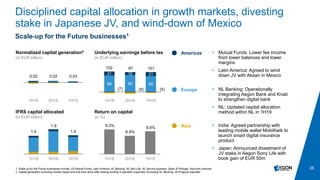

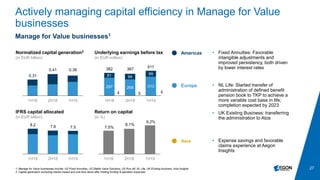

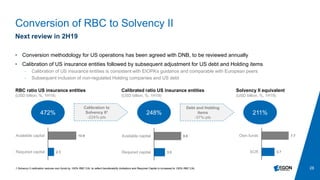

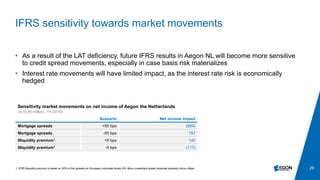

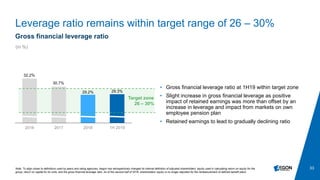

Aegon reported its financial results for the first half of 2019, showing a 5% decline in underlying earnings compared to the previous year, but a significant increase in net income of 26%. The company is focused on capital generation and optimizing its portfolio amid challenging market conditions, including low interest rates and competitive pressures in various regions. Strategic initiatives and organizational realignments are underway to improve customer service and enhance growth prospects in key markets.