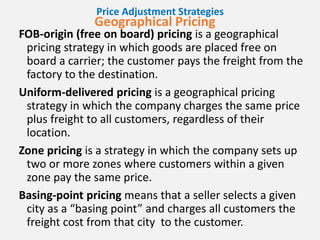

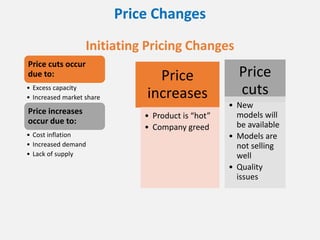

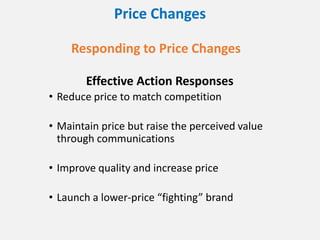

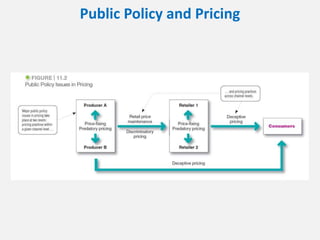

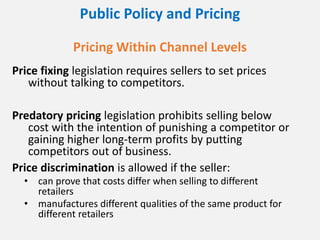

This document summarizes different pricing strategies and considerations discussed in Chapter 11 of the textbook "Principles of Marketing" by Kotler and Armstrong. It outlines new product pricing strategies like market-skimming and market-penetration pricing. It also discusses product mix pricing strategies, price adjustment strategies, factors that influence price changes, and public policy considerations related to pricing.