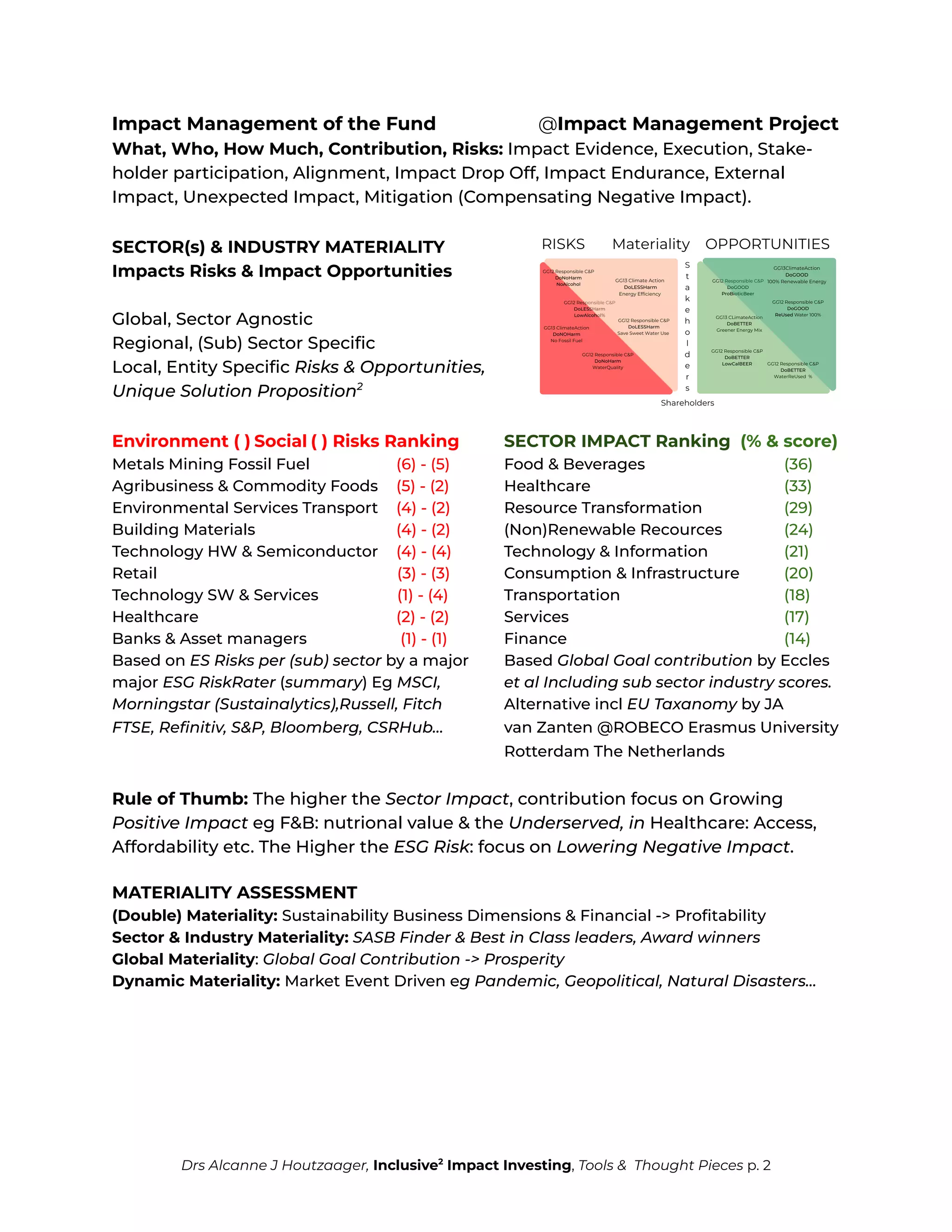

The document provides a comprehensive overview of a 2023 impact investment fund, detailing its objectives, investment strategies, and frameworks aimed at achieving positive social and environmental outcomes. It emphasizes the importance of minimizing negative impacts and maximizing contributions to global goals through careful impact management and assessment of risks. Additionally, it outlines the specific sectors and themes the fund focuses on, along with metrics and standards for measuring impact.