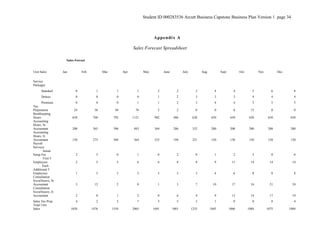

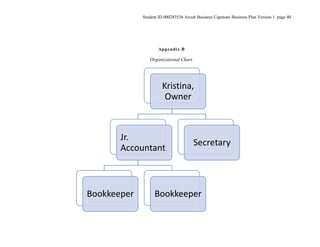

Horizon Accounting Services is a new accounting firm located in Memphis, TN that will provide tax, management accounting, bookkeeping, and investment services primarily to small businesses and individuals. The business plan outlines the company's mission to offer top quality, affordable accounting services through a team of trusted CPAs. Financial projections include a sales forecast, profit and loss statement, balance sheet, and estimates for capital needs to launch the business.