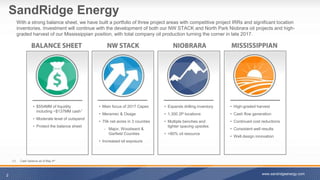

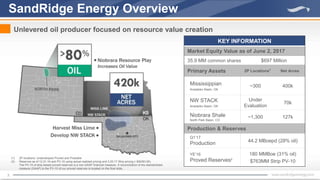

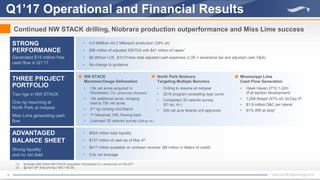

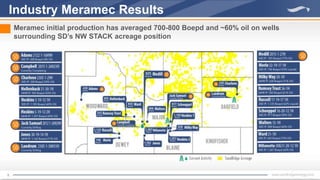

SandRidge Energy has built a portfolio focused on oil production growth from three key project areas: NW STACK, North Park Niobrara, and Mississippian. For 2017, the company plans to run two rigs in NW STACK to further delineate the Meramec and Osage formations, resume drilling at North Park Niobrara targeting multiple benches, and continue high-grading its Mississippian acreage. SandRidge has a strong balance sheet with $554 million in liquidity and no debt, positioning it to execute its development plans while generating free cash flow.