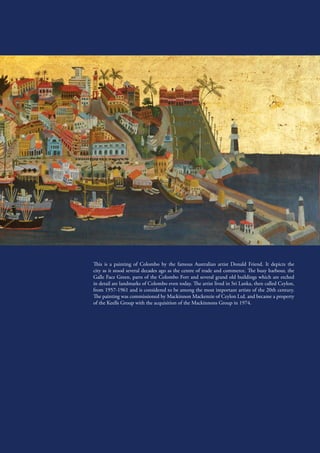

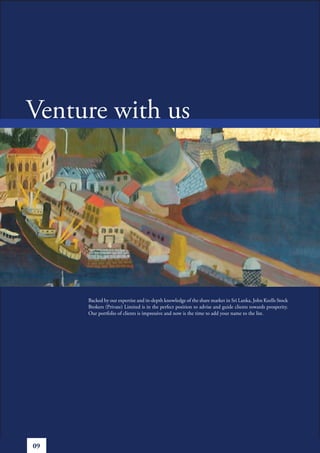

This painting by Australian artist Donald Friend depicts the city of Colombo as it stood several decades ago, showing landmarks like the busy harbour, Galle Face Green, parts of Colombo Fort, and several grand old buildings. The artist lived in Sri Lanka from 1957-1961 and is considered one of the most important 20th century artists. The painting was commissioned by Mackinnon Mackenzie of Ceylon Ltd. and became a property of the Keells Group with their acquisition of the Mackinnons Group in 1974.