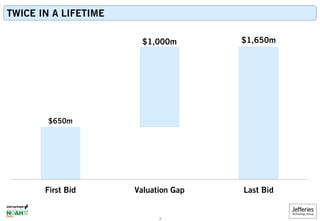

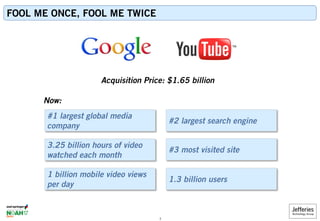

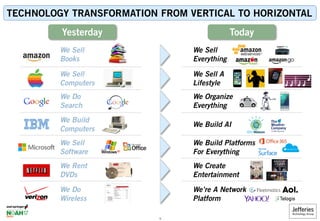

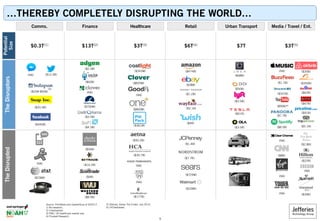

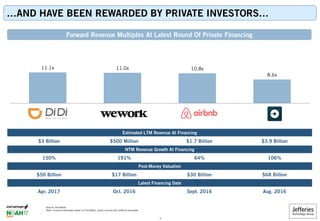

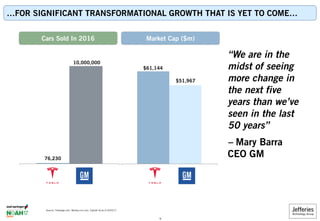

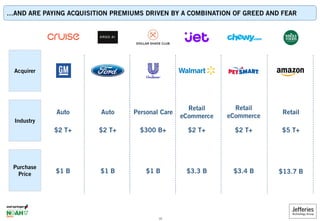

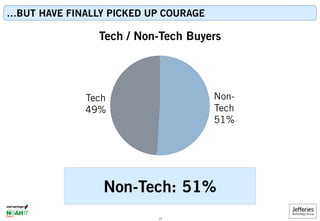

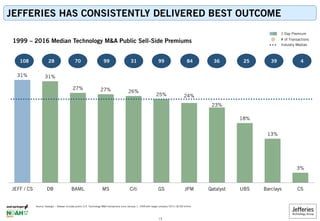

The document discusses the evolving landscape of technology mergers and acquisitions (M&A), emphasizing aggressive acquisitions and the disruption in various industries due to new technologies. It presents data on valuations, acquisition premiums, and market transformations, showing how significant growth opportunities are emerging. The importance of strategic advice in navigating this landscape is also highlighted, particularly through the role of Noah Advisors in facilitating transactions.