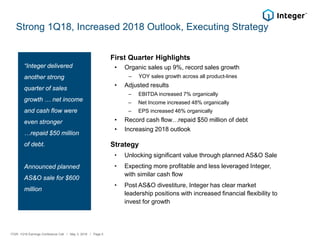

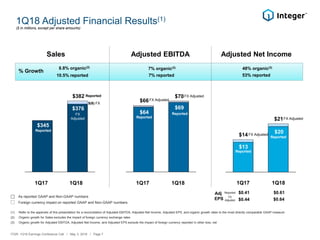

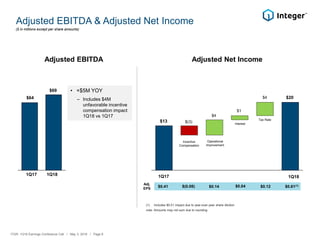

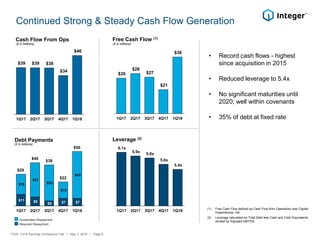

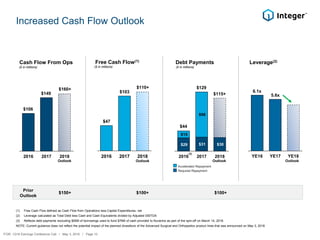

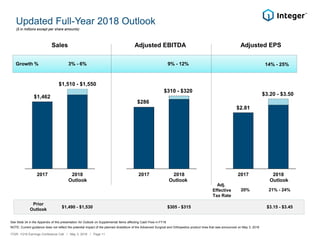

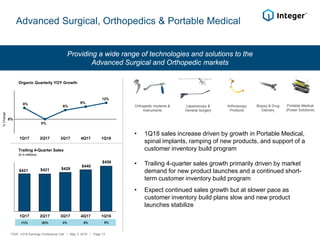

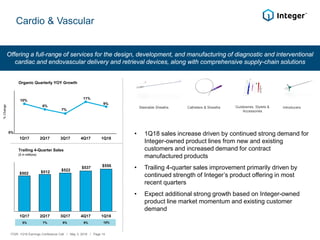

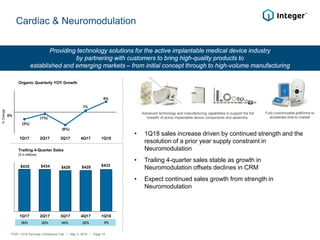

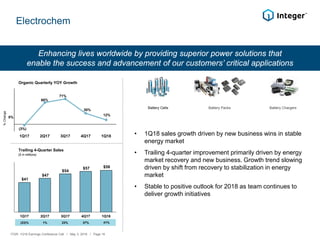

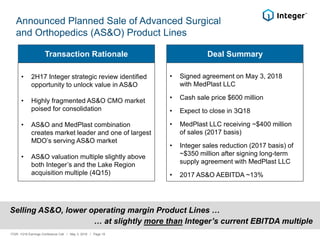

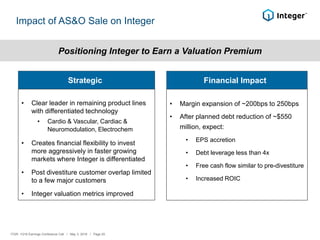

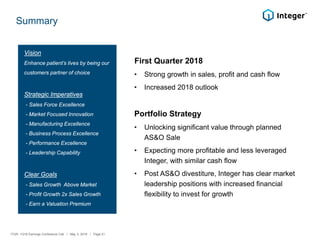

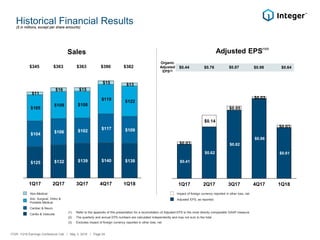

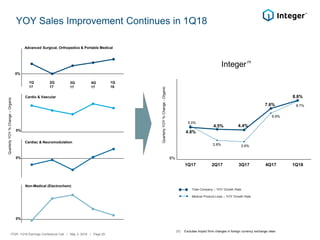

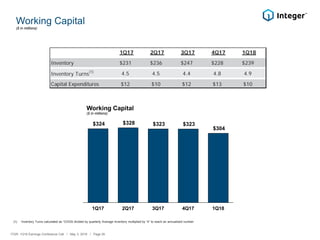

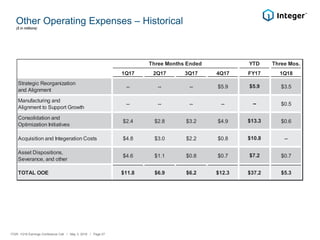

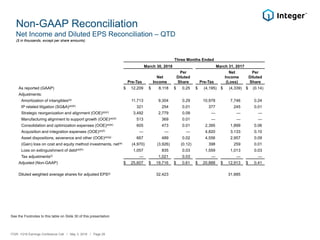

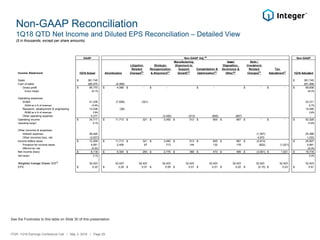

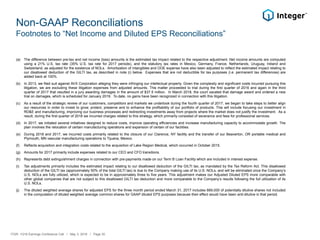

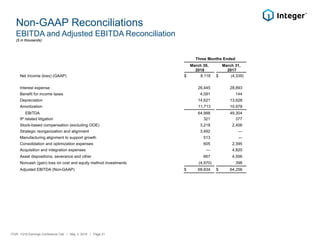

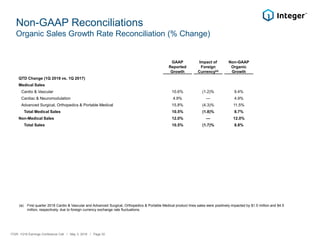

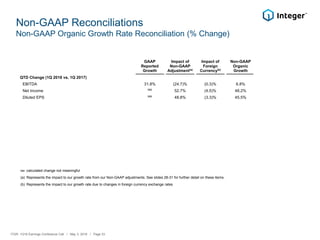

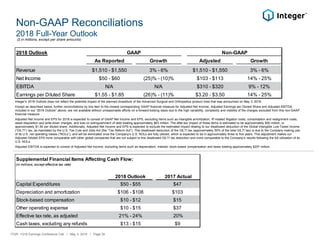

Integer reported strong financial results for the first quarter of 2018. Sales grew 9% organically compared to the first quarter of 2017, driven by growth across all product lines. Adjusted EBITDA increased 7% organically and adjusted net income increased 48% organically. Integer also generated record cash flow in the quarter and used $50 million to repay debt, lowering leverage. For full-year 2018, Integer increased its outlook for sales growth to 3-6% and adjusted EPS growth to 14-25%, driven by continued momentum. The company also announced a planned sale of its Advanced Surgical and Orthopedics product lines for $600 million.