Embed presentation

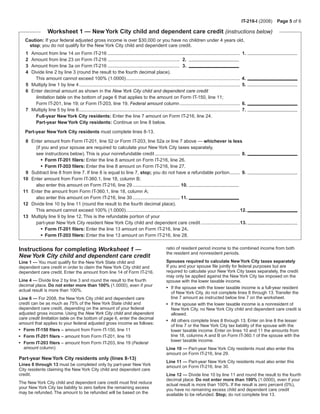

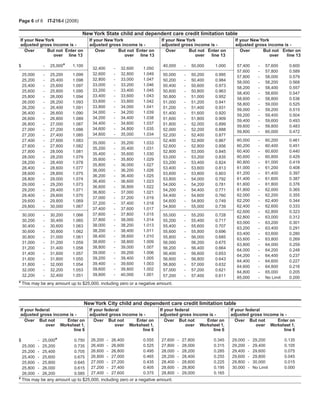

Download to read offline

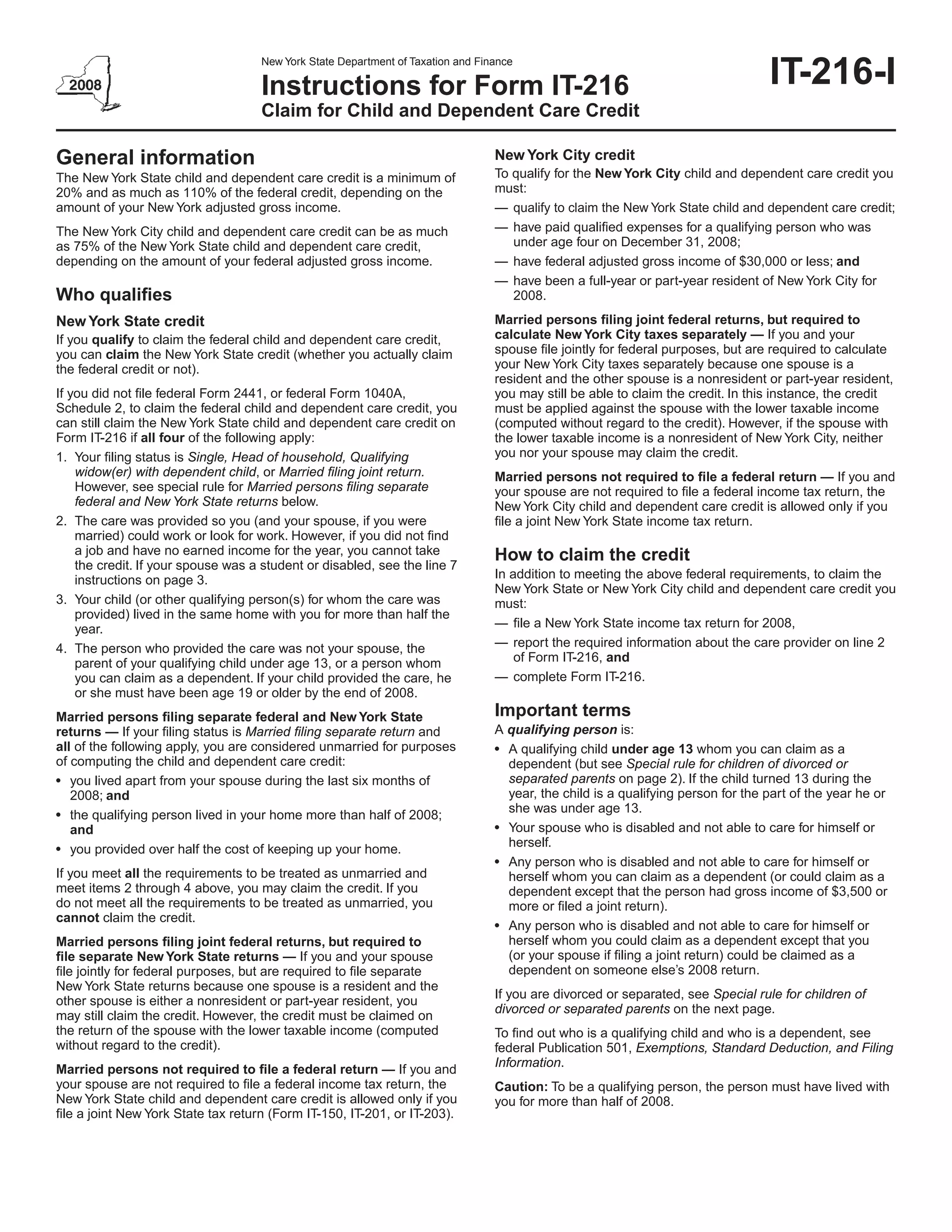

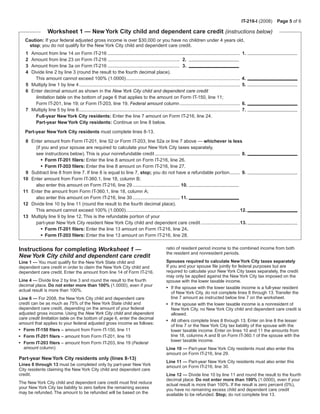

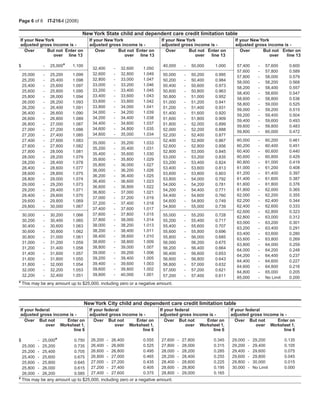

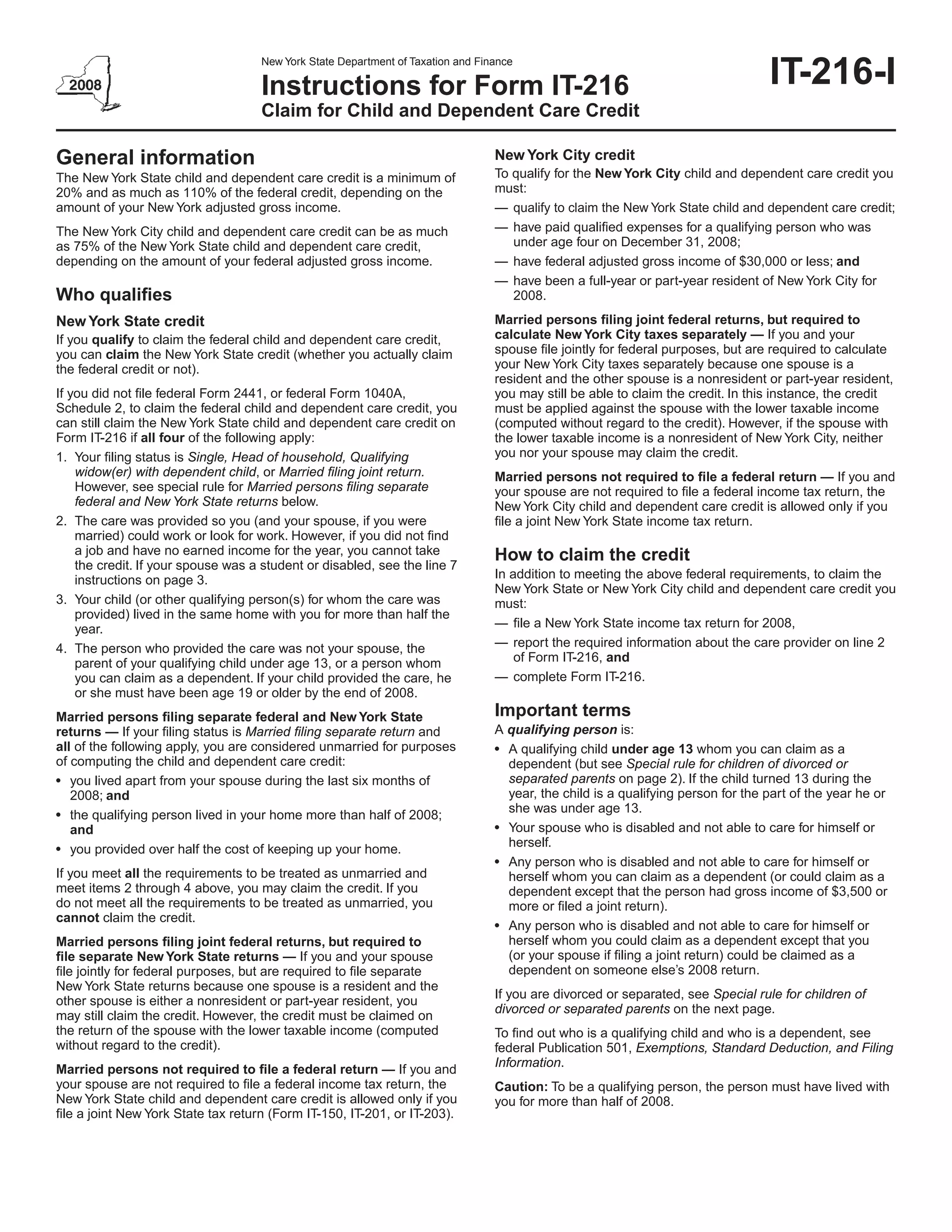

This document provides instructions for claiming the New York State and New York City child and dependent care credits. To qualify for the New York State credit, you must qualify for the federal child and dependent care credit. The New York State credit is a minimum of 20% and maximum of 110% of the federal credit. To qualify for the New York City credit, you must qualify for the New York State credit, have income under $30,000, have a qualifying person under age 4, and be a NYC resident. The credit is claimed on Form IT-216 which is filed with the New York State income tax return.