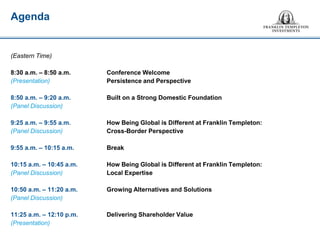

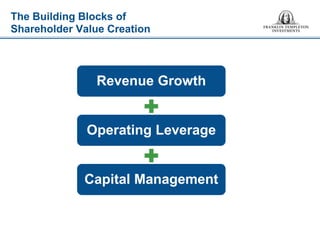

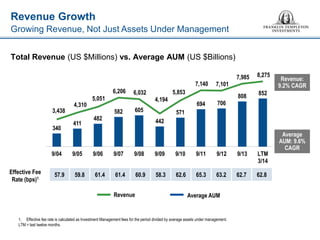

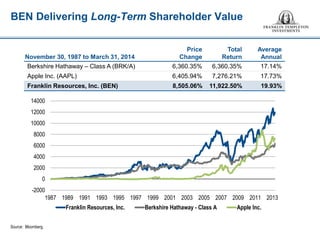

The document contains an agenda for a Franklin Templeton Investments conference. The agenda lists the scheduled presentations and panel discussions throughout the day-long conference, including topics like "Persistence and Perspective", "Built on a Strong Domestic Foundation", and "Delivering Shareholder Value". It also includes forward-looking statements and information about Franklin Templeton.