The document provides an analysis of online advertising expenditure (AdEx) in Europe in 2011. Some of the key findings include:

- Total online advertising spend in Europe reached €20.9 billion in 2011, up 14.5% from 2010, outpacing overall ad growth of 0.8%.

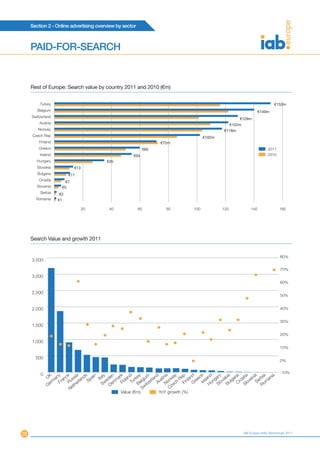

- The top 10 markets by spend were UK, Germany, France, Italy, Netherlands, Russia, Spain, Sweden, Norway, and Denmark. Russia saw the most significant change, surpassing Spain as the sixth largest market.

- Central and Eastern European markets grew faster than Western Europe, with Russia and Croatia seeing over 40% growth. Overall CEE markets increased their share of European online ad spend.