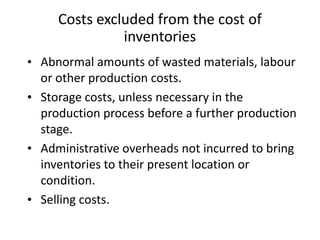

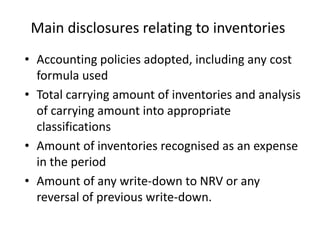

This document provides an overview of the accounting standard IAS2 on inventories. It defines inventories as assets held for sale, in production, or in the form of materials used in production. Inventories must be measured at the lower of cost or net realizable value, where cost includes all purchase, conversion, and costs to bring the inventory to its present condition and location. It outlines what costs should be included and excluded from inventory valuation and acceptable costing techniques including standard costing and retail method. [/SUMMARY]