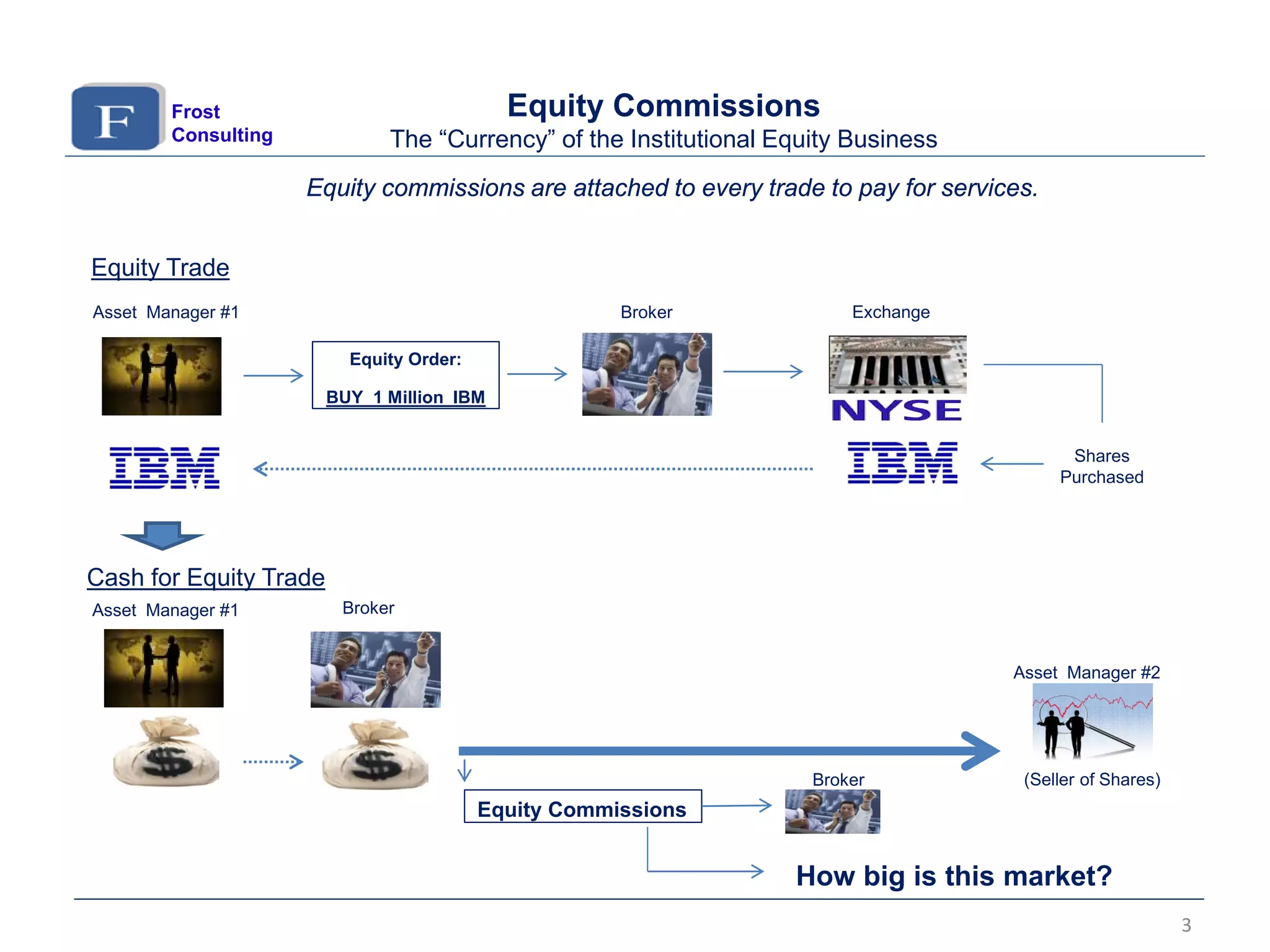

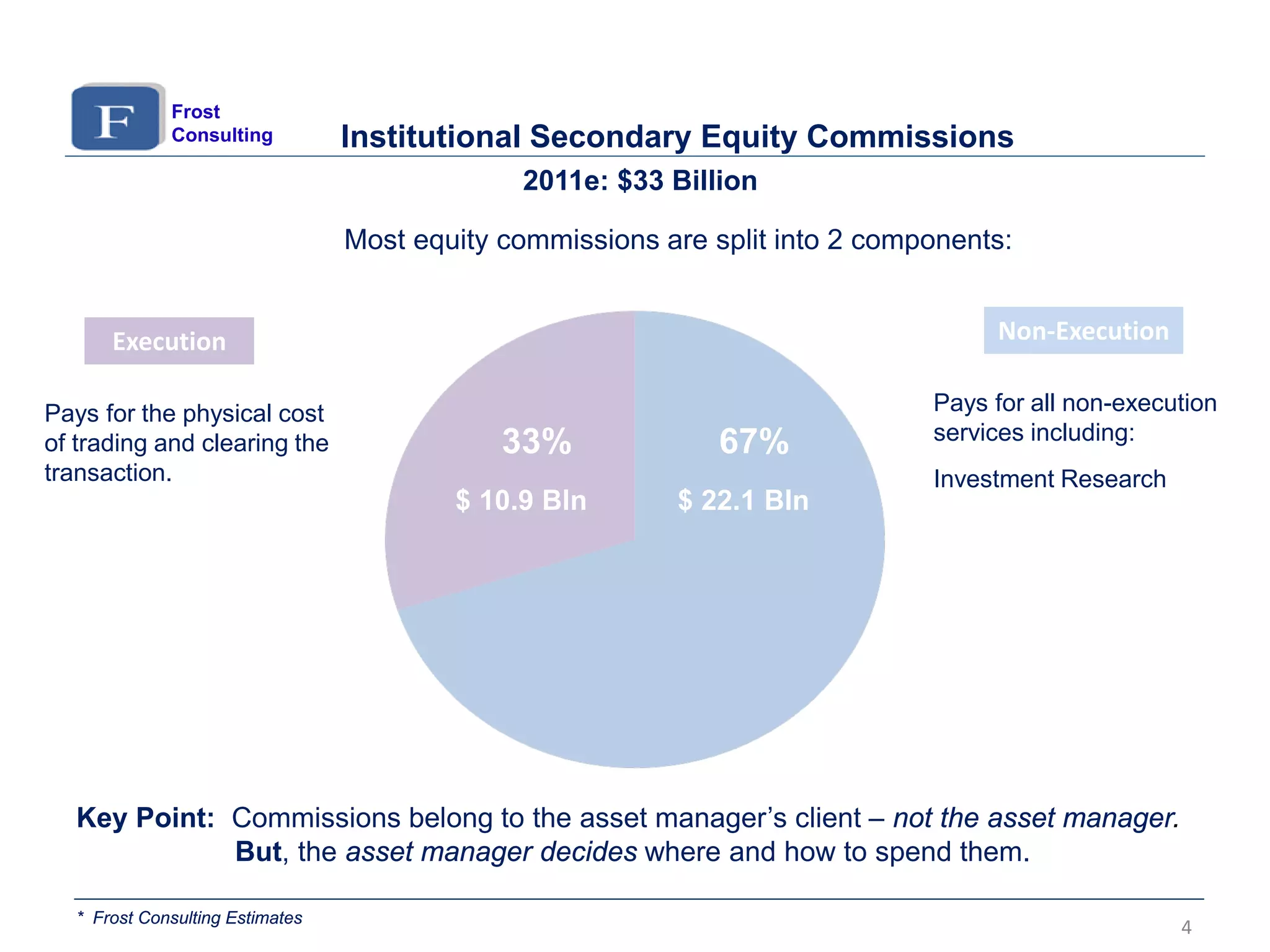

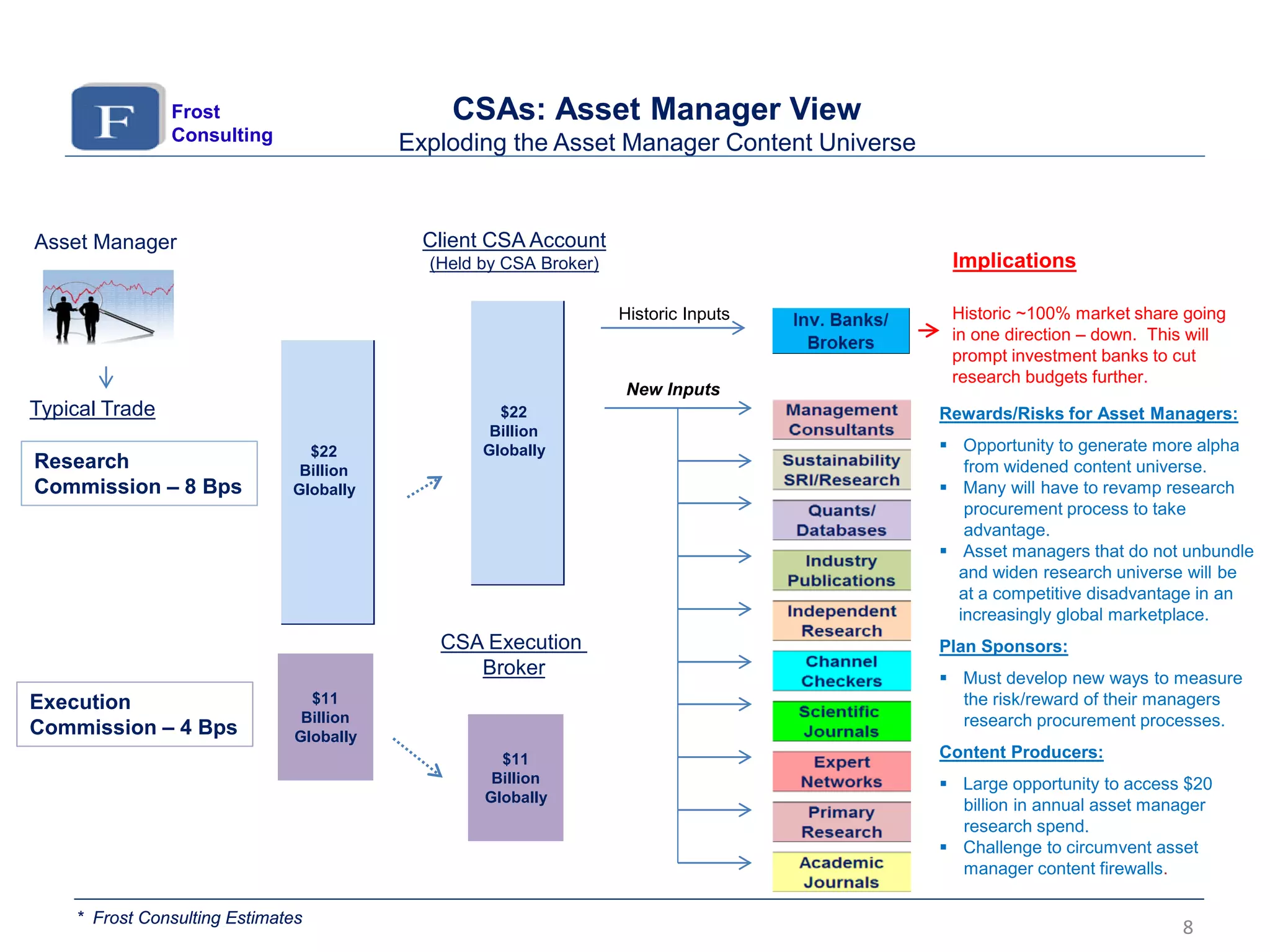

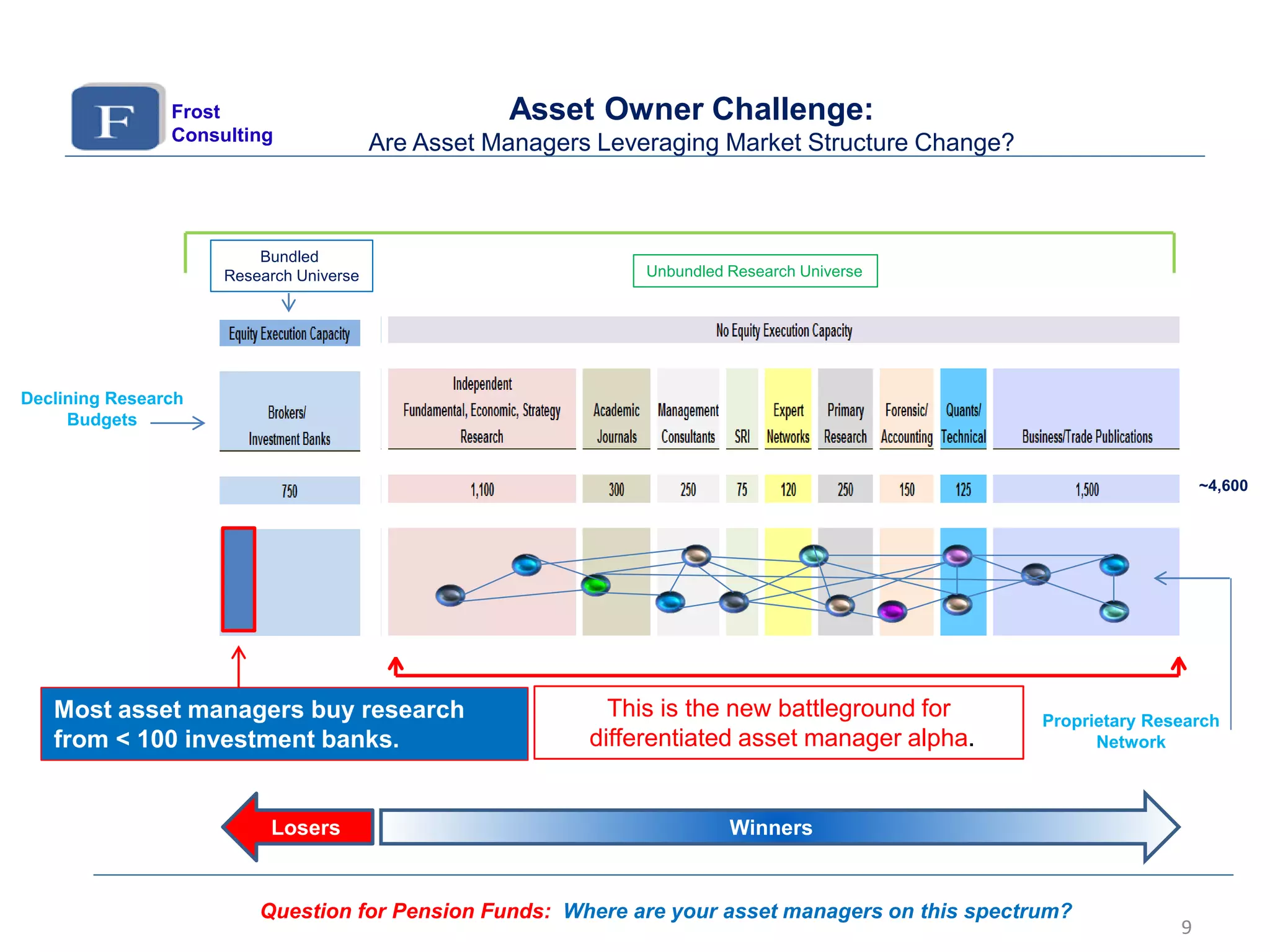

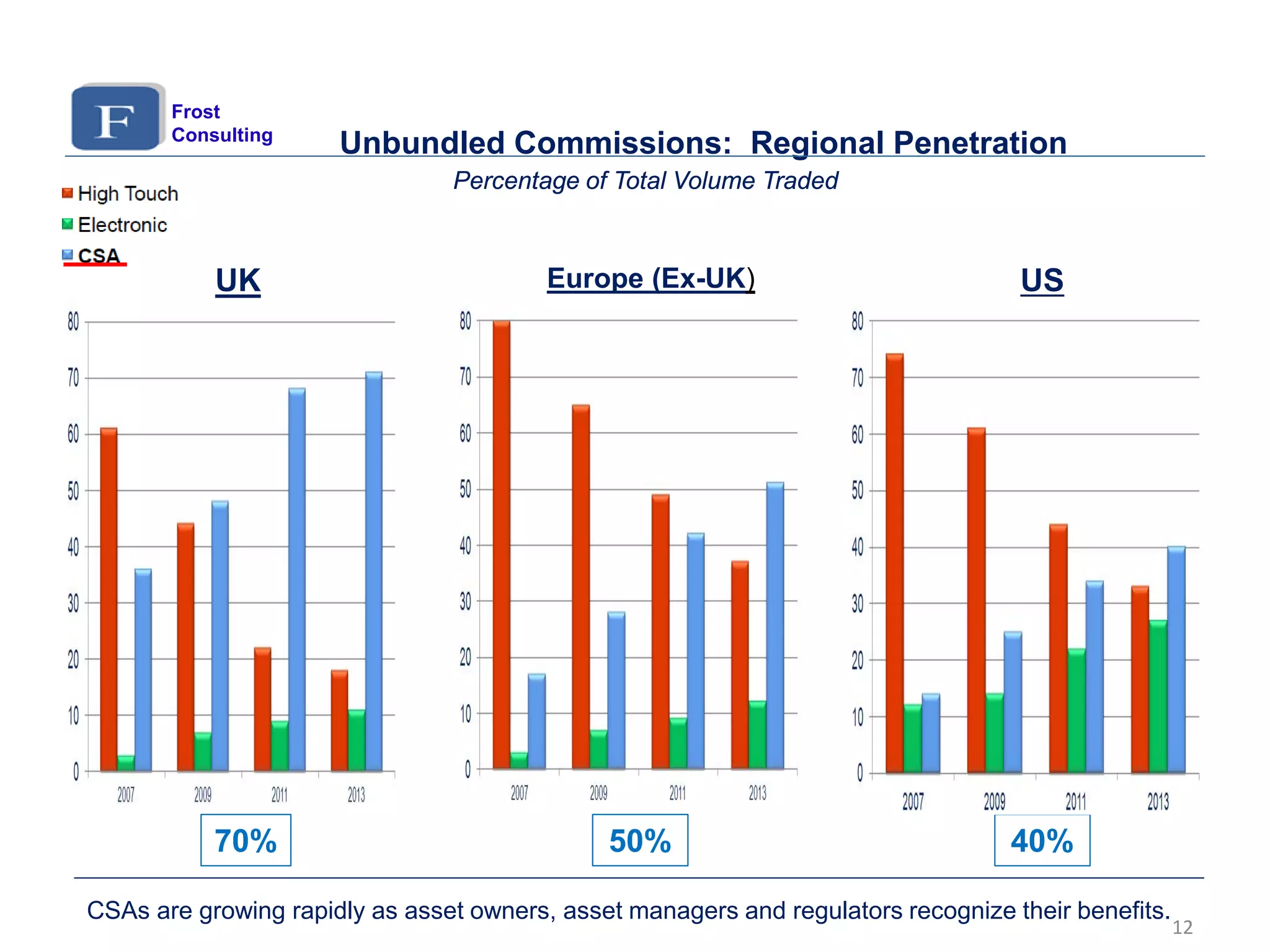

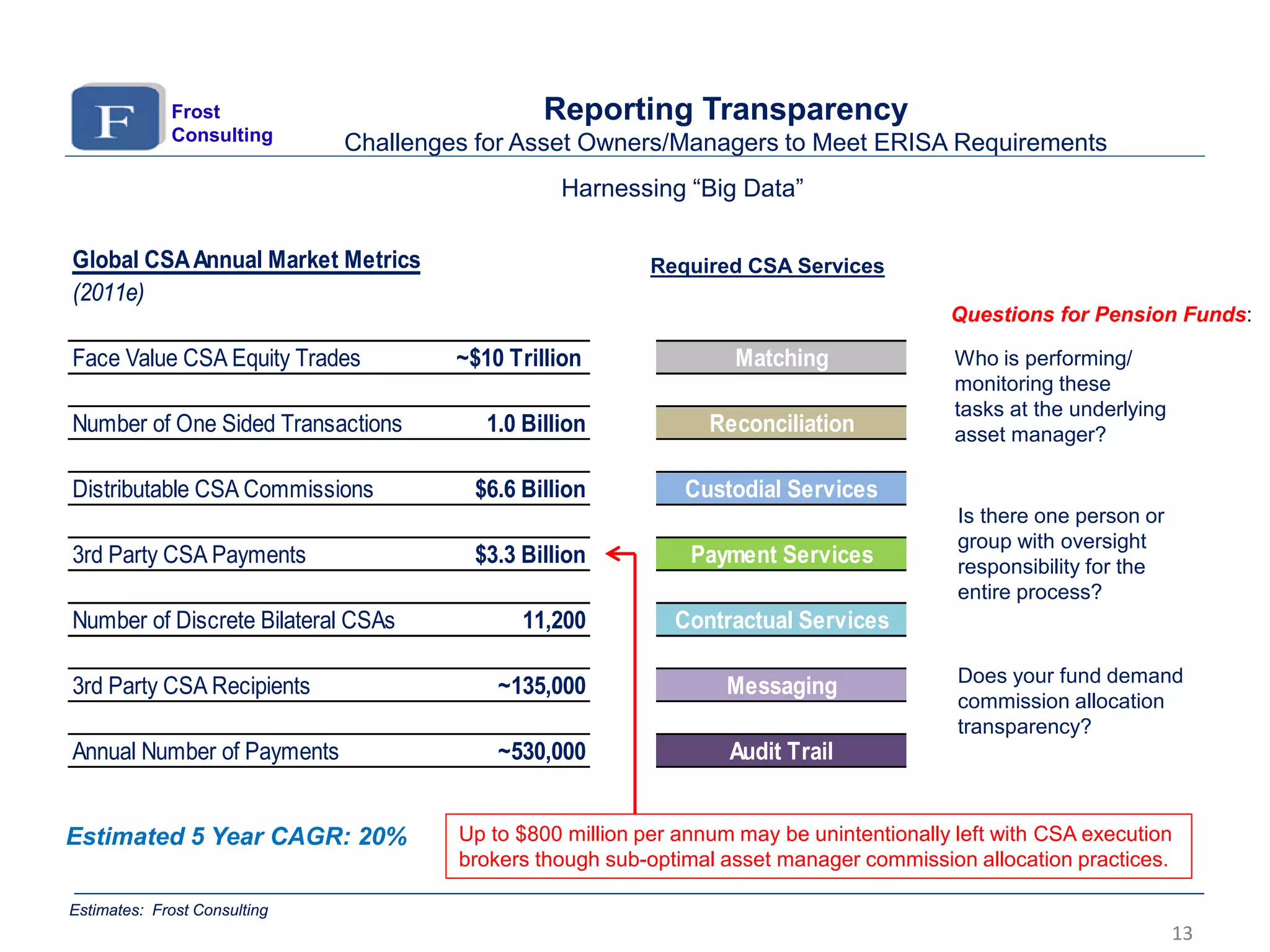

This document provides an overview of the institutional equity market and the impact of commission unbundling. It discusses how equity commissions have traditionally been used to pay for various services through bundled commissions. Recent regulatory changes now allow for the unbundling of commissions, separating execution payments from research payments. This provides asset managers greater flexibility in purchasing research from a wider range of providers rather than just brokers. It also ends the oligopoly investment banks previously had over research spending. Commission unbundling presents both opportunities and risks for all market participants to maximize returns in the new regulatory environment.