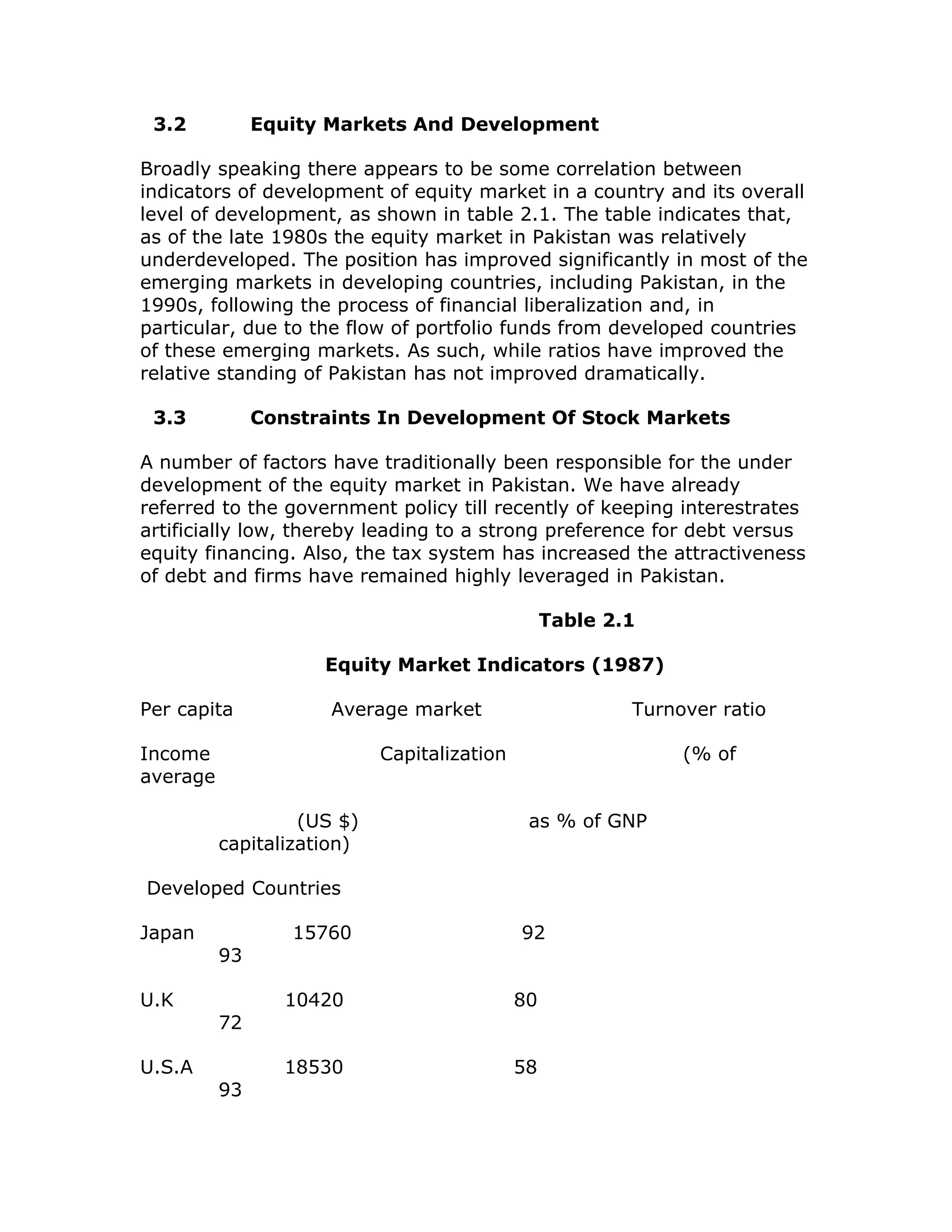

The document discusses the role of financial systems and stock markets in economic development. It provides an overview of Pakistan's financial system, including the historical dominance of informal finance. While financial reforms in recent decades improved access to formal institutions, stock markets remain underdeveloped in Pakistan. The document analyzes constraints like low interest rates, weak regulation, and political instability that have limited stock market growth. It recommends further reforms like reducing corporate leverage, encouraging bond markets, and improving disclosure to strengthen Pakistan's financial system.

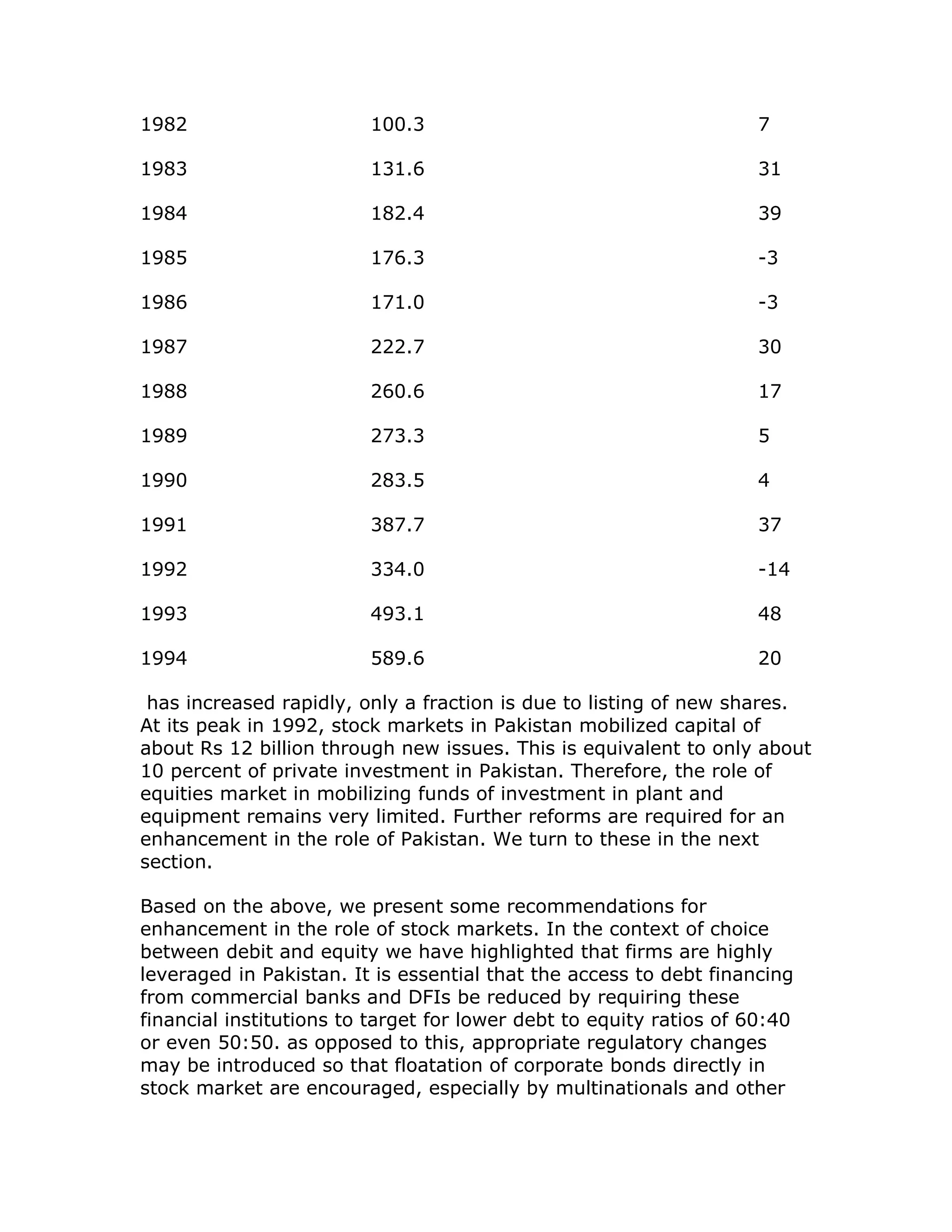

![3.3 Recent Stock Market Development

The boom witnessed during the 90’s in the stock market of Pakistan

can be attributed to a large number of factors, including, first, the

process of financial liberalization resulting in a rise and inflow of

foreign portfolio investment; second, the process of privatization and

the offering of new attractive shares; third, a greater measure of

political stability and investor confidence; fourth, improvements in the

operational efficiency of stock markets. It is of significance to note that

the two major measures of the share price index coincided with the

induction of popularly elected governments in 1990 and 1993

respectively. More recently, prices have plummeted in response to

weakening in the underlying macro economic fundamentals,

deteriorating law and order situation and exodus of foreign portfolio

capital.

The experience of the last years demonstrates that while the process

of financial liberalization and deregulation has conferred large capital

gains in terms of the increase in market capitalization (of over ten

times between 1989 and 1995), the result remain fixed. First, there

has apparently been an increase in the volatility of the stock market,

with large increase being followed by big decrease. For example, share

prices rose by as much as 48% in 1993, but have fallen since by 40%

(see table 2.2). This volatility is not only the consequence of

underlying law and order and political factors but also a reflection of

relatively short term nature of inflows of foreign portfolio funds. These

fluctuations in share prices have increased perceptions of risks and run

the danger of driving out risk averse investors from the market,

resulting in a degree of disintermediation. Second, while market

capitalization.

Table 2.2

Index Of Share Prices In Pakistan

Year SBP general index percent

Of share prices Annual change

[1980-91=100]

1981 93.5 -](https://image.slidesharecdn.com/introduction-120513144959-phpapp02/75/Introduction-7-2048.jpg)