Julian itemba assignment.pdf

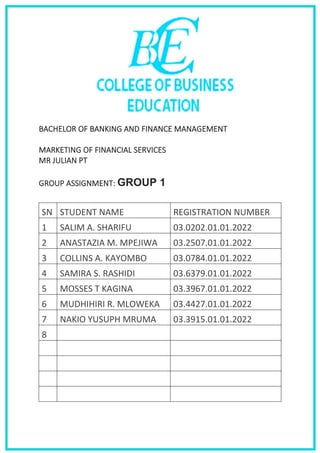

- 1. SN STUDENT NAME REGISTRATION NUMBER 1 SALIM A. SHARIFU 03.0202.01.01.2022 2 ANASTAZIA M. MPEJIWA 03.2507.01.01.2022 3 COLLINS A. KAYOMBO 03.0784.01.01.2022 4 SAMIRA S. RASHIDI 03.6379.01.01.2022 5 MOSSES T KAGINA 03.3967.01.01.2022 6 MUDHIHIRI R. MLOWEKA 03.4427.01.01.2022 7 NAKIO YUSUPH MRUMA 03.3915.01.01.2022 8 BACHELOR OF BANKING AND FINANCE MANAGEMENT MARKETING OF FINANCIAL SERVICES MR JULIAN PT GROUP ASSIGNMENT: GROUP 1

- 2. QN 1. Explain role of financial intermediation in global economy Financial intermediaries are sometimes known as investment managers or investment bankers. They act as middlemen and establish a link between investors and savers (where the excess money comes from) to the users of fund. These services include investment consultancy, market analysis and credit rating of financial institutions. financial intermediary includes share brokers, underwriters, investment company, banks and credit rating agencies. The following are roles of financial intermediation in global economy Obtaining fund from lenders, savers and investors hence accumulating capital that could be further provided to borrowers to whom invest it in various economic sectors to generate profit. This leads to positive global economic growth. Financial intermediaries like banks and cooperative societies mobilize fund from its clients and channel to the borrowers such as cooperates and even governments which fund various investment schemes around the global economy. Transferring excess fund from savers and lenders to where there is deficit (usually to borrowers). Apart from obtaining and mobilizing fund, financial intermediation also is tasked to transmit and ensuring those mobilized fund reach the target. Reliable transfer of fund enables the borrower to obtain the fund in accurate time for the purpose of economic investment which leads to economic development. Management of financial assets to customers in economy. Investors do not need to do hard work of overseeing each and every movement of their financial asset they have invested to. Instead, financial intermediaries take charge of it and which in return increases efficiency in management of those financial assets in the economy. Risk diversification to savers which eliminates risk of loss incase borrower default loan. Financial intermediaries like banks ensures savers incur no loss even if it is its fund that has been used to lend to the borrower who failed to settle the debt. This maintains financial and economic stability of savers and encourages more people to save which in return allows more mobilization of fund for investment in global economy. Expertise of financial intermediaries lowers economic risks and improves profitability of investment in global economy. Financial intermediaries offer advice, consultancy and detailed investment analysis to investors on which sector to invest and how much to invest so as not to incur loss. Borrowing gets easier which facilitate quick transfer of funds from investors to borrowers hence accelerating investment and global economic growth. Financial intermediary has many sources to rise fund and have relatively simplified mean (due to their expertise) on transferring of fund unlike if an investor or a borrower could have done each and every step by himself. However financial intermediaries, financial regulators and financial markets join together to make huge impact on the global economy

- 3. Qn2. Explain the risks associated with financial institutions and markets in discharging their responsibility Risk can be simply defined as uncertainties of future events. Financial institutions and markets face these uncertainties in their daily provision of financial services, these risks result into possibility of losing money to the financial sector. The risks associated with financial institutions are as follows; Liquidity Risk—the risk that a sudden and unexpected increase in liability withdrawals. Liquidity risk arises when a financial institution liability holder, such as depositors or insurance policyholders, demand immediate cash for the financial claims they hold with a financial institution or when holders of off-balance-sheet loan commitments suddenly exercise their right to borrow. Credit Risk—occurs when borrowers or counterparties fail to meet contractual obligations. An example is when borrowers default on a principal or interest payment of a loan. Defaults can occur on mortgages, credit cards, and fixed income securities. Failure to meet obligational contracts can also occur in areas such as derivatives and guarantees provided. Interest Rate Risk—the risk incurred by financial institution when the maturities of its assets and liabilities are mismatched and interest rates are volatile. Market Risk—the risk incurred in trading assets and liabilities due to changes in interest rates, exchange rates, and other asset prices. Market risk arises when financial institution actively trades assets and liabilities rather than holding them for longer term investment, funding, or hedging purposes. Market risk is closely related to interest rate and foreign exchange risk in that as these risks increase or decrease. Off-Balance-Sheet Risk—the risk incurred by financial institution as the result of its activities related to contingent assets and liabilities. Foreign Exchange Risk—the risk that exchange rate changes can affect the value of a financial institution assets and liabilities denominated in foreign currencies. Country or Sovereign Risk—the risk that repayments by foreign borrowers may be interrupted because of interference from foreign governments or other political entities. economy, its monetary policy, capital flows and foreign investment, inflation, and the structure of its financial system. Technology Risk—the risk incurred by a financial institution when its technological investments do not produce anticipated cost savings. Operational Risk—the risk that existing technology or support systems may malfunction, that fraud that impacts the financial institution activities may occur, and or that external shocks such as hurricanes and floods may occur. Insolvency Risk—the risk that financial institution may not have enough capital to offset a sudden decline in the value of its assets relative to its liabilities Financial institutions must take a closer look and consider how they can minimize or take calculated risk in their policy formulation. This is possible through good risk management system

- 4. Qn3. Challenges facing the financial services sectors Financial services sectors are sectors that provide economic services in finance industry, they include banking sector, insurance sector, pensions and fund investment sector to mention few. These sectors in finance industry faces a lot of difficulties and hardships in their daily activities of providing financial services. Those challenges include the following: Cyber security challenge. Due to advanced technology and high interconnection in digital world in where the financial sectors also exist, they find put themselves in the position to be attacked by hackers. The hackers usually send malwares and other viruses that may steal sensitive financial data, destroy them, encrypt them or even demand high amount of money to release them back. Example a cyber attack in the USA in 2020 where hacker posted personal details of banks customers online to attempt to extort money from the bank. Strict regulations and excessive interference of financial sectors by the government. The government imposes too much policies and regulations on financial sectors which sometimes are politically motivated. These strict regulations give difficult time for financial sectors to operate smoothly. High degree level of competition in the industry. Stiff and cut throat competition (both domestic and international competition) makes financial sectors always scratch their heads on how to maintain their customers or otherwise they will sink in the markets. Therefore, every now and then financial sectors must be creative and innovative to stand out competition in the market. High operational costs. Financial sectors face dramatic increase of day to day running costs of their institutions this is because of need to fund innovation, need to be updated in technology, various marketing strategy which needs to be funded such as advertisements and many other more to mention few. However, these costs reduce profitability of financial institution Challenge of error in dealing with massive data. There are hundreds of thousands of customers each day their transactions need to be processed. Basically, financial sectors deal with big data. Due to massive data the chances of inaccuracy and mistakes of handling the data is very high which results to inefficiency. Above all, there are some challenges which faces financial sectors but they are very beneficial for the health of economy, example due to stiff competition, the services provided by financial sectors improve and also encourages technological innovation in financial sector.