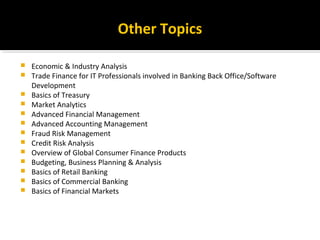

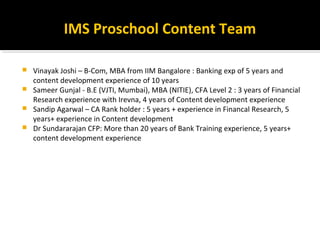

IMS Proschool was launched in 2006 to provide certification programs and skills training to graduates and professionals. It is owned by IMS, India's largest test preparation organization with a 30-year history and presence in 120 cities. IMS Proschool uses tools like multimedia, self-study modules, and interactive exercises to train over 10,000 banking and finance professionals annually. It offers various financial certification programs both online and in-person on topics such as financial planning, risk management, and financial markets.