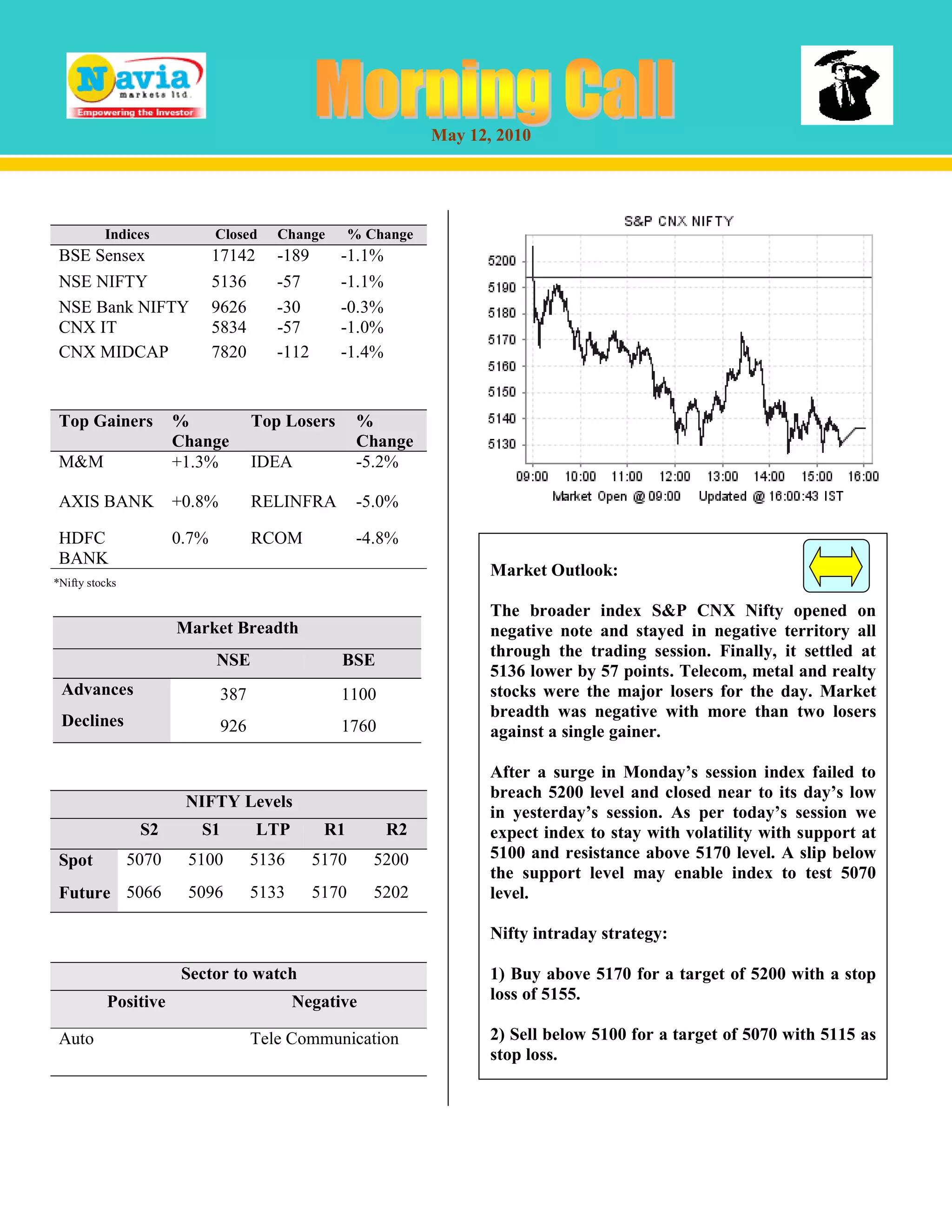

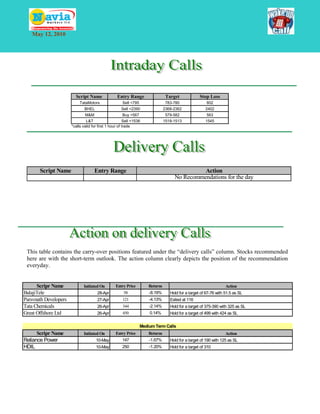

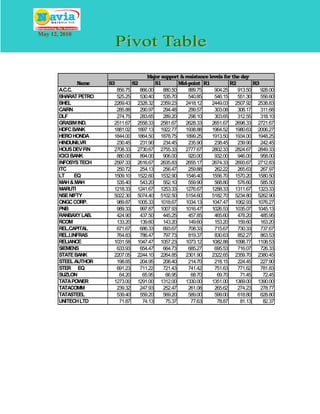

The document provides a market summary for May 12, 2010. It reports that key indices like the BSE Sensex and NSE Nifty closed lower by around 1%. It identifies top gainers and losers. It recommends intraday trading strategies and provides technical analysis on various stocks, including support and resistance levels. It also includes updates on two companies, IVRCL Infra securing new orders and Glenmark settling a patent dispute over a cholesterol drug.