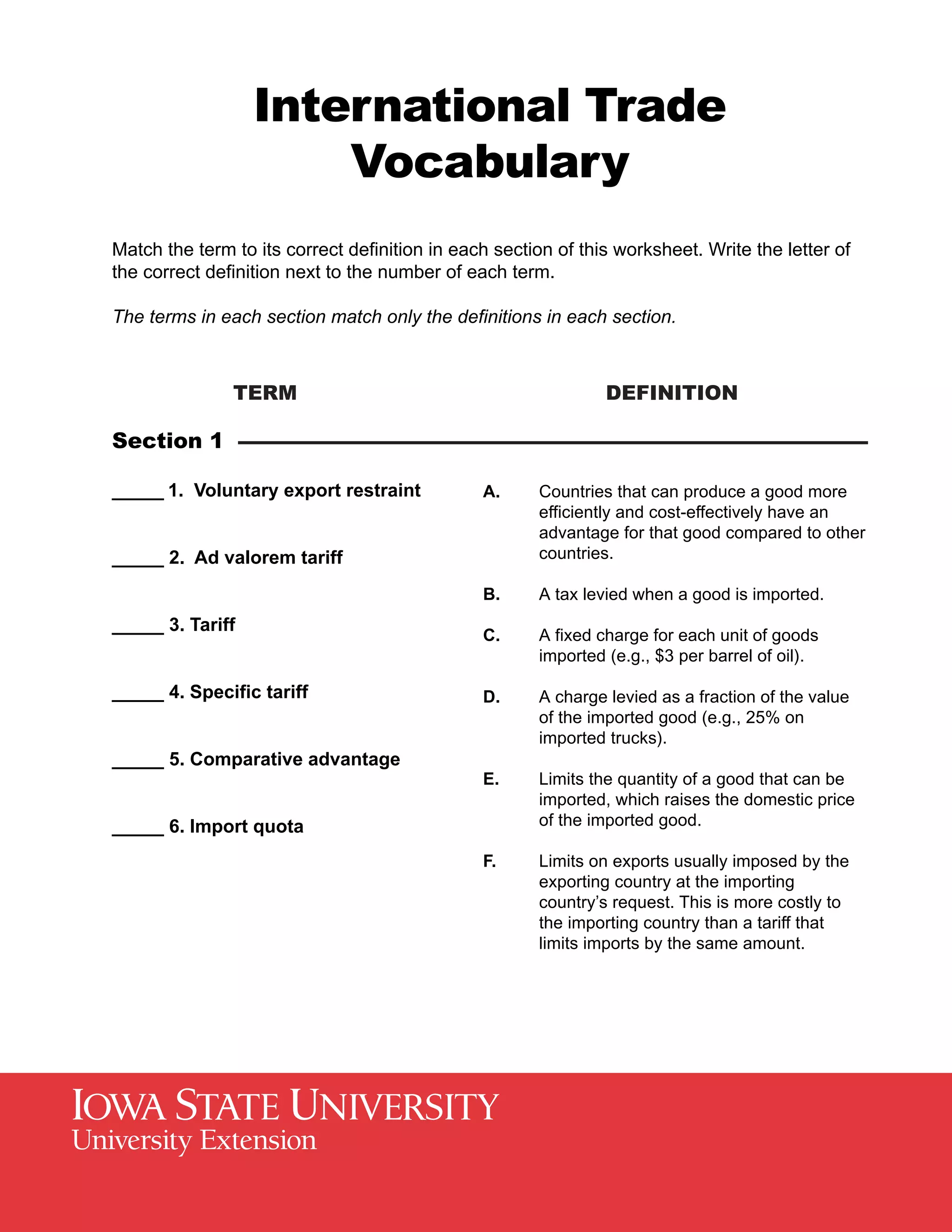

This document provides definitions for key terms related to international trade. It defines 17 terms across 3 sections: Section 1 defines terms related to tariffs and quotas; Section 2 defines terms related to subsidies and exchange rates; Section 3 defines major international trade agreements and organizations. The terms are matched to their corresponding definitions.