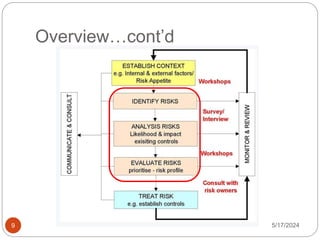

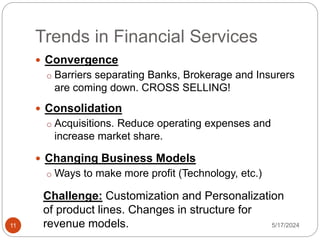

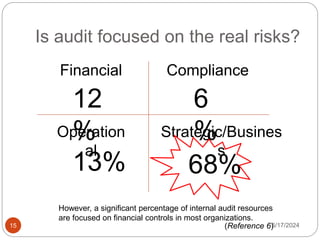

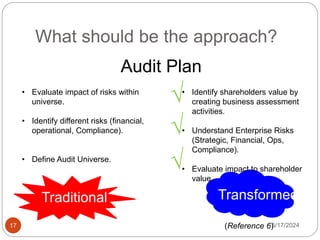

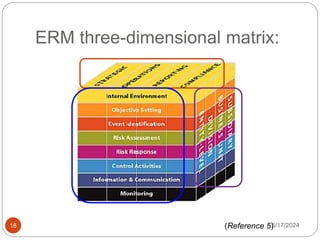

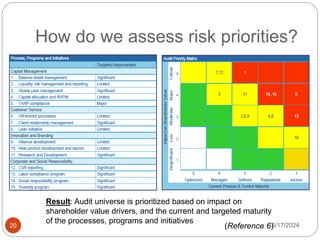

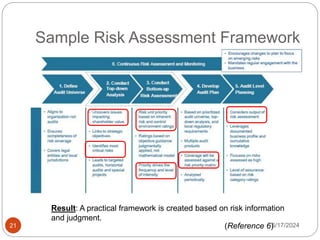

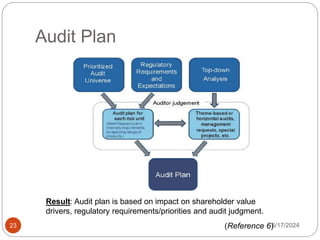

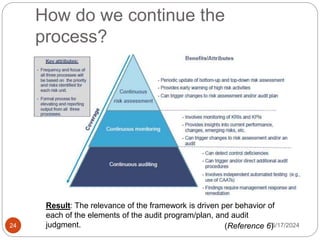

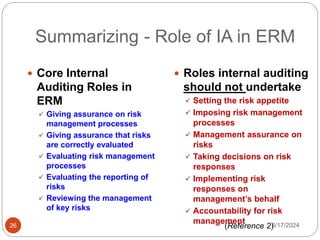

The document discusses the collaboration between risk management and internal audit functions, emphasizing how this partnership can enhance organizational efficiency and decision-making. It reviews trends in financial services, the challenges faced by internal auditors, and the importance of focusing on real risks rather than just financial compliance. Additionally, it outlines the core roles of internal auditing in enterprise risk management (ERM) and provides a framework for assessing risk priorities and developing an effective audit plan.