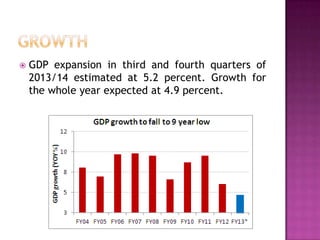

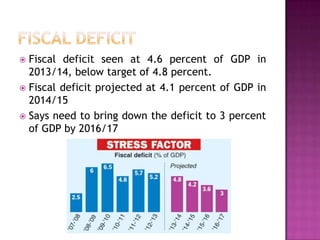

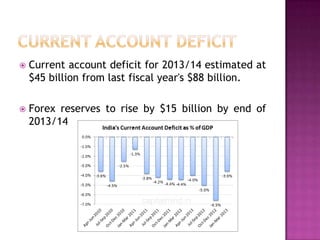

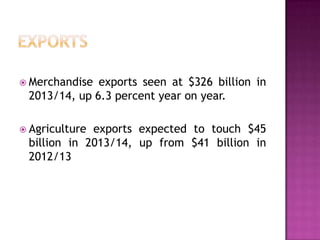

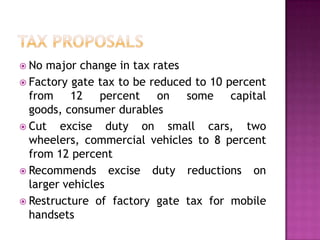

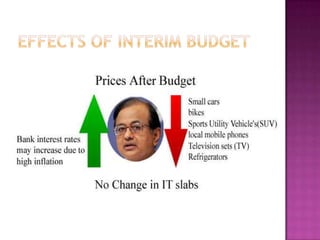

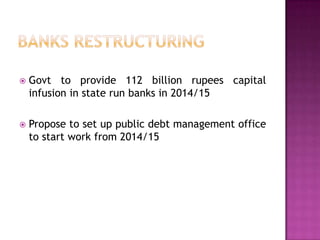

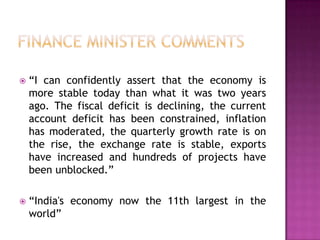

The document summarizes key points from India's budget for 2014-15. It reports that GDP growth for 2013-14 is estimated at 4.9% with fiscal deficit below target at 4.6% of GDP. The fiscal deficit is projected to decline further to 4.1% in 2014-15. The current account deficit for 2013-14 is estimated at $45 billion, down from $88 billion the previous year. Several measures are outlined including planned expenditures, subsidies, tax changes, and capital infusions to support continued economic stability and growth.