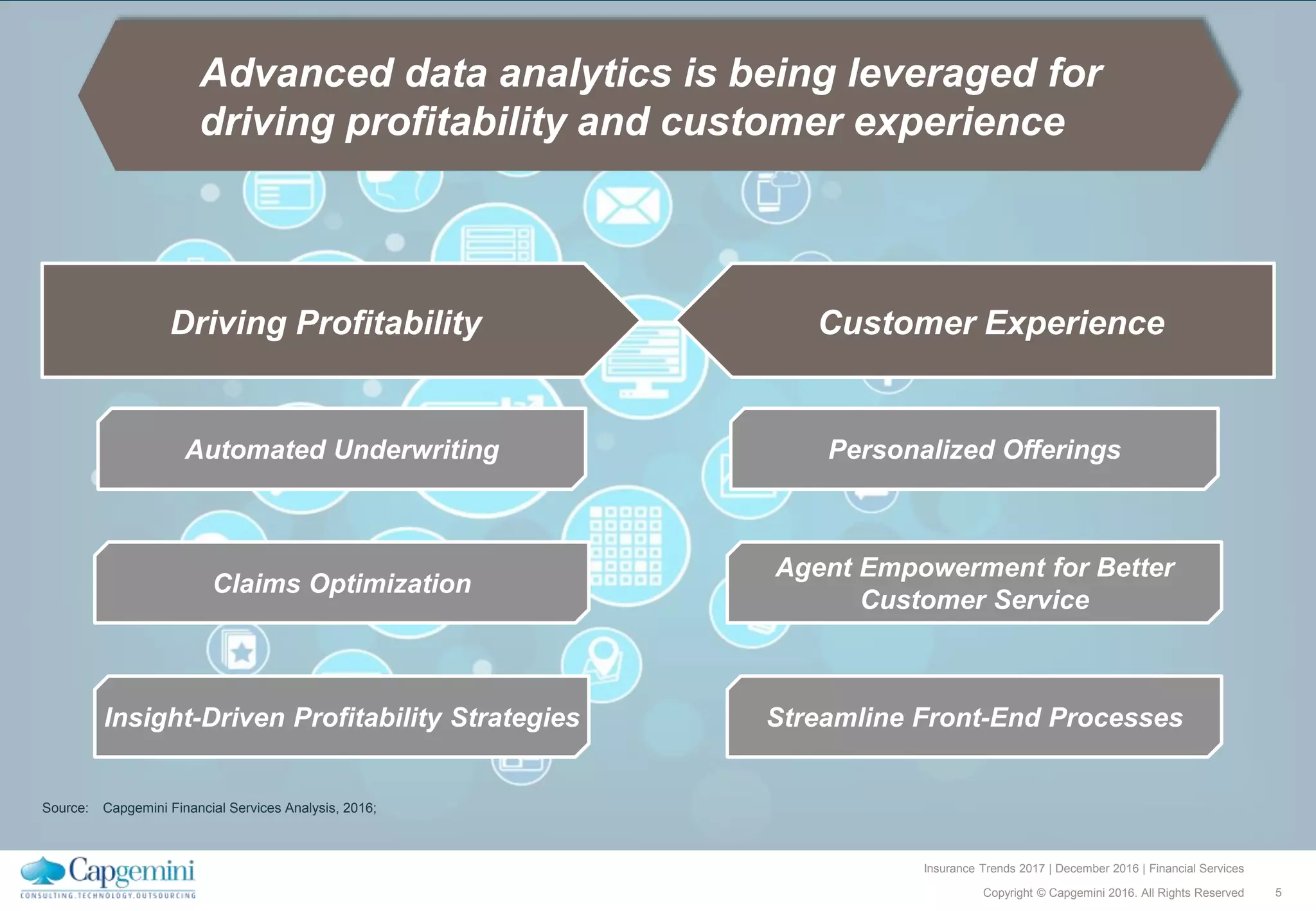

The document discusses several emerging technology trends in the insurance industry for 2017. It notes that insurers are leveraging digital tools and mobile applications for risk management and improving customer experience. New products are being developed for the sharing economy. Advanced data analytics is being used to drive profitability and enhance the customer experience. Emerging technologies like blockchain, artificial intelligence, augmented reality, and the internet of things are also being explored for applications across the insurance value chain.