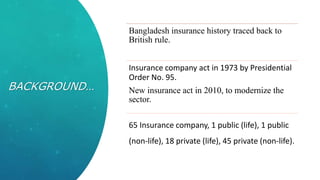

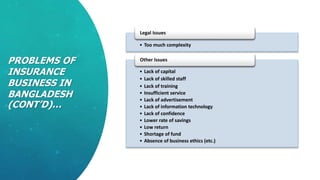

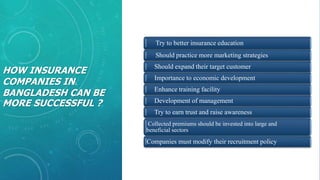

This document provides an overview of the insurance sector in Bangladesh. It discusses the history and types of insurance, including life, property, fire, marine, and motor insurance. It outlines the economic role of insurance and analyzes the scenario and problems facing the insurance industry in Bangladesh, such as a lack of public awareness, political instability, and insufficient training. Finally, it offers recommendations on how insurance companies can improve, including better education, marketing strategies, and addressing economic and management issues.