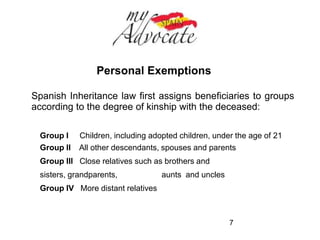

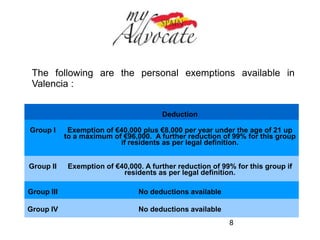

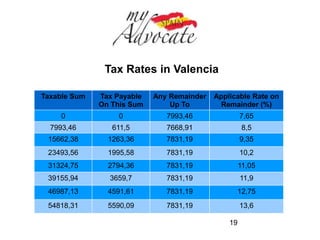

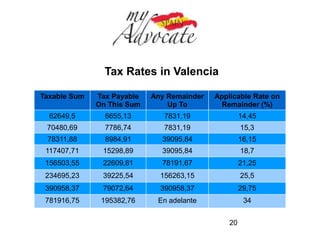

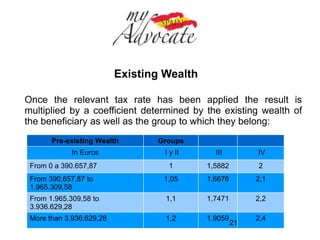

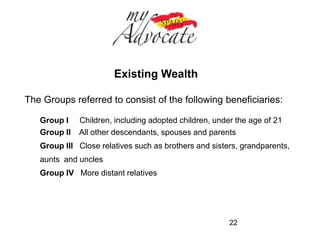

The document discusses inheritance tax deductions and exemptions in Alicante Province, Spain in 2014. Key changes include an increased personal exemption of €100,000 for Group I beneficiaries (children under 21), and €100,000 exemption for Group II beneficiaries (other descendants and spouses). There is also a 95% deduction on the value of a family home up to €150,000 for specified beneficiaries. The deductions available in Alicante are more generous than those approved by the central Spanish government for non-residents.