1. JPMorgan announced that it will include Indian government bonds in its emerging markets bond index starting June 2024. This inclusion will attract an estimated $25-40 billion in passive inflows to India over the next 1-2 years as index funds purchase the required bonds.

2. The inclusion recognizes India's growing economy and appeal as an investment destination for international investors. It will widen India's investor base and ease financing of its current account deficit.

3. However, it may also increase sensitivity to global factors and volatility. India will need to balance monetary and fiscal policies to account for foreign investor perceptions and manage any currency appreciation or bond yield movements.

![15

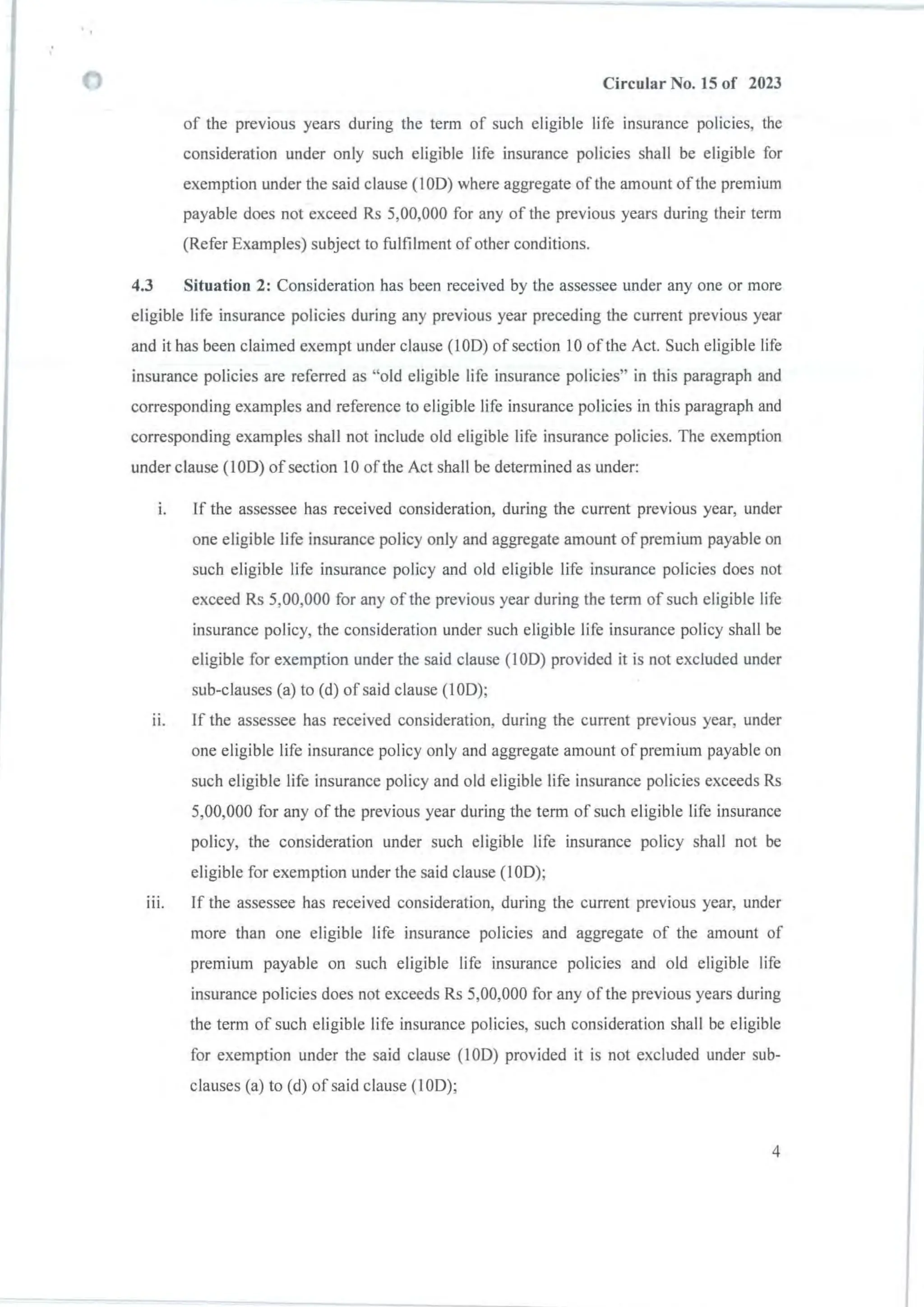

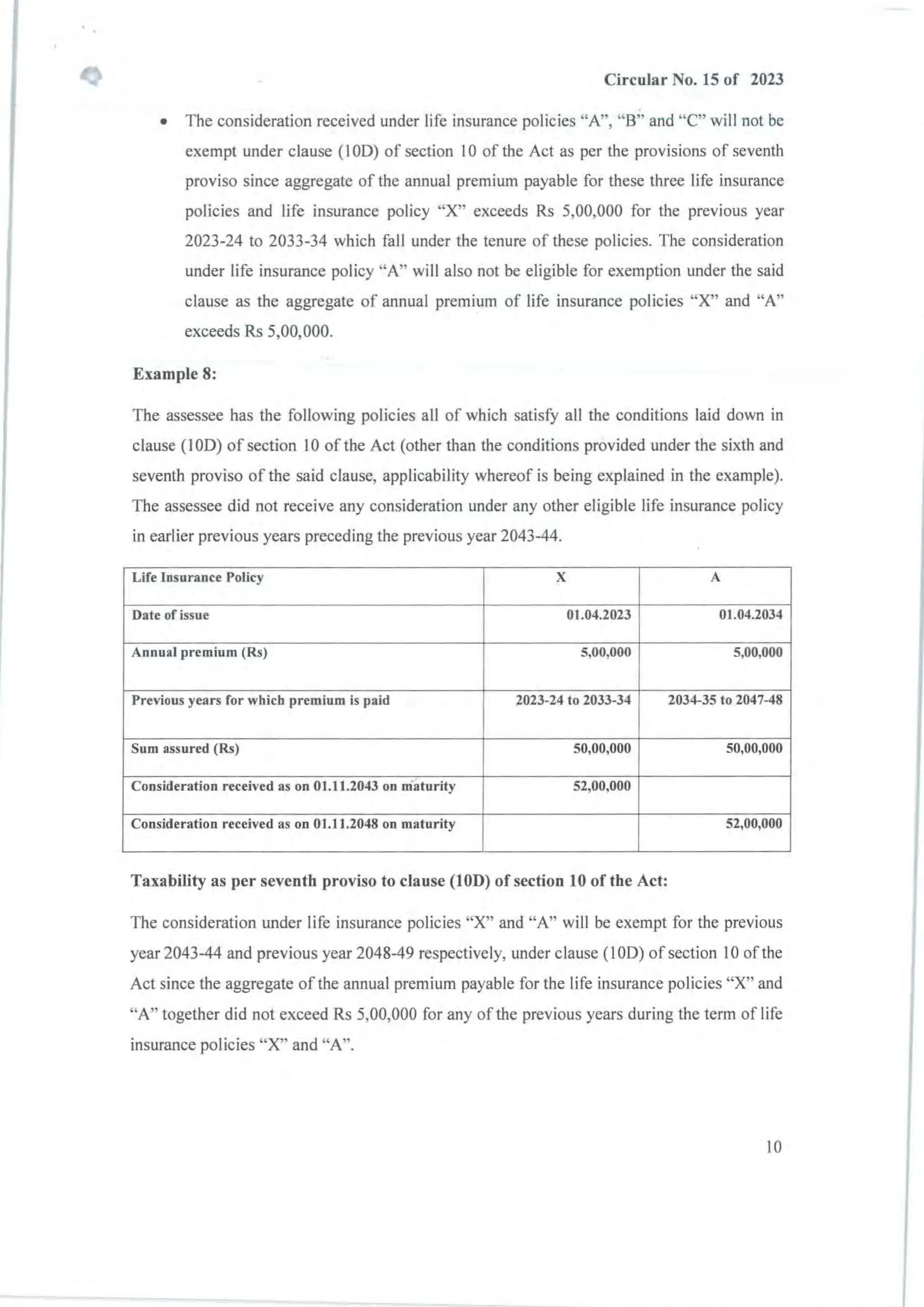

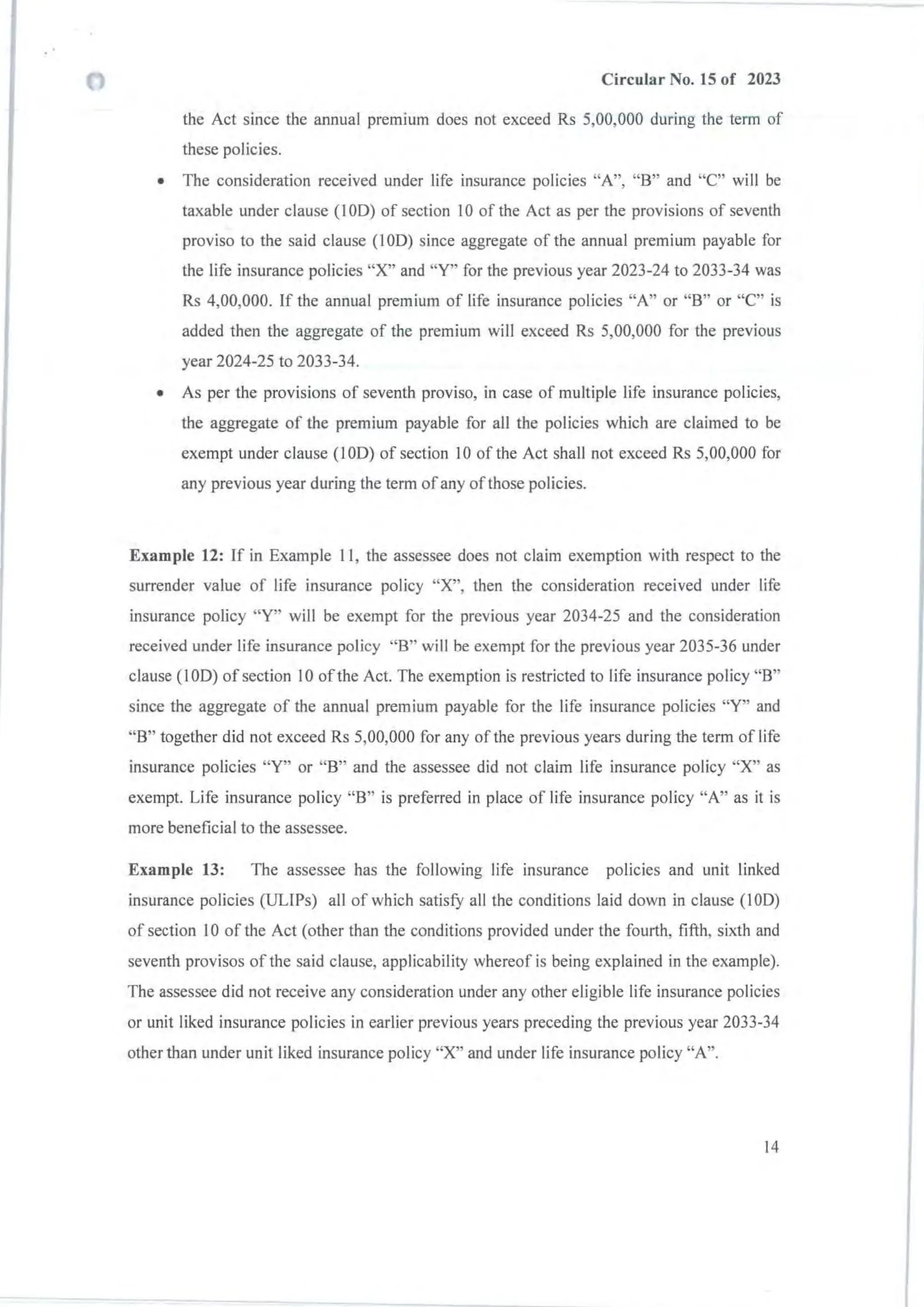

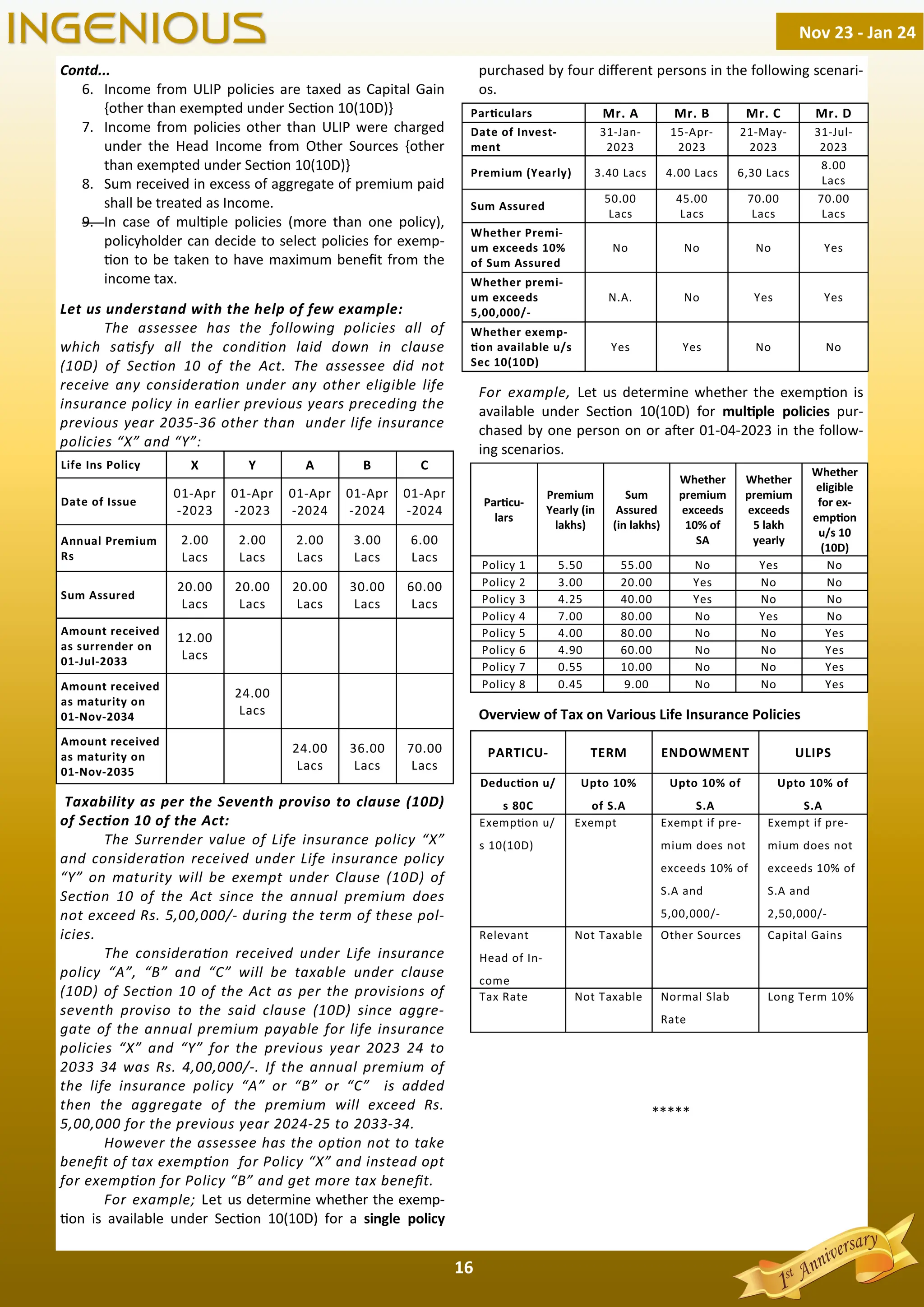

Sec on 10 (10D) of the Income Tax Act 1961 is an im-

portant provision that deals with the taxa on of life

insurance policies. This sec on was introduced in the Fi-

nance Act 2003 and has undergone several amendments

since then.

The main objec ve of Sec on 10 (10D) is to provide

tax benefits to policyholders who purchase life insurance

policies. According to this sec on, the proceeds of a life in-

surance policy are exempt from tax if certain condi ons are

met.

Let us look at the exis ng provisions for be er under-

standing of the changes made in Finance Act,2023

a) The Finance Act, 2003 introduced a limit on the pre-

mium payable for any year during the term of the

policy. Where the premium exceeds 20% of the Sum

Insured in any year, no exemp on will be granted for

the sum received under such insurance policy.

b) The Finance Act, 2012 further reduced the threshold

limit on the premium payable to 10% of Sum Insured

for policies issued on or a er 01-04-2012.

c) The Finance Act, 2021 introduced a monetary cap on

the premium payable in respect of unit-linked insur-

ance policies (ULIPs), disallowing exemp on if the

premium payable for any year during the term policy

exceeds Rs.2,50,000 (on policies issued on or a er

01.02.2021).

A er the Finance Act, 2021, both the monetary and

percentage caps apply to ULIPs. Further, in the Finance Act,

2021, ULIPs were included in the defini on of a Capital As-

set, clarifying that income from ULIPs shall be taxable under

the head Capital Gains.

The Finance Act, 2023

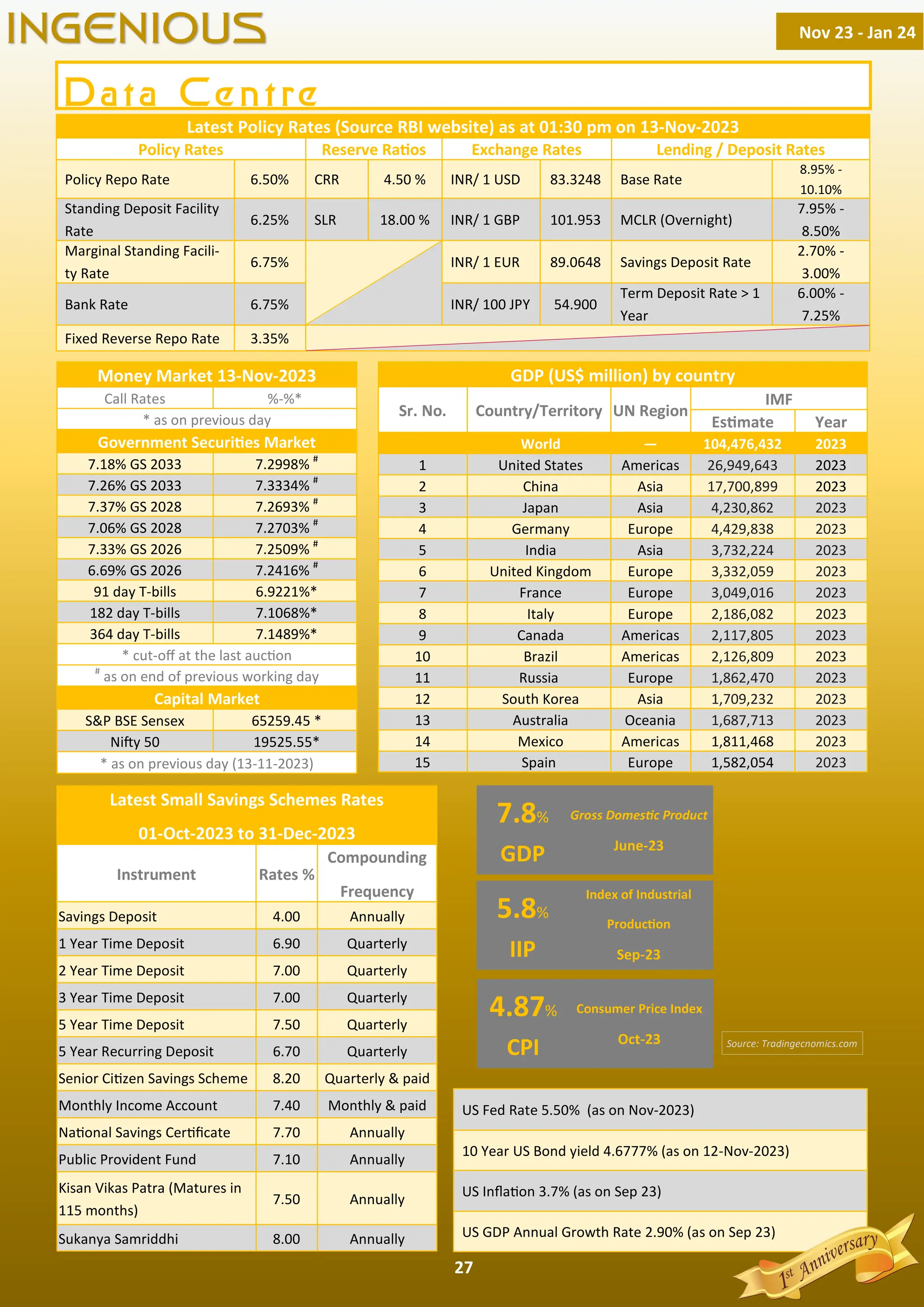

The Central Board of Direct Taxes (CBDT) via a circular

issued on August 16 no fied new guidelines under clause

(10D) of sec on 10 of the Income-Tax Act, 1961.

It said that clause (10D) of sec on 10 of the IT Act

provides for income-tax exemp on on any sum received

under a life insurance policy, including the sum allocated by

way of bonus on such policy subject to certain exclusions.

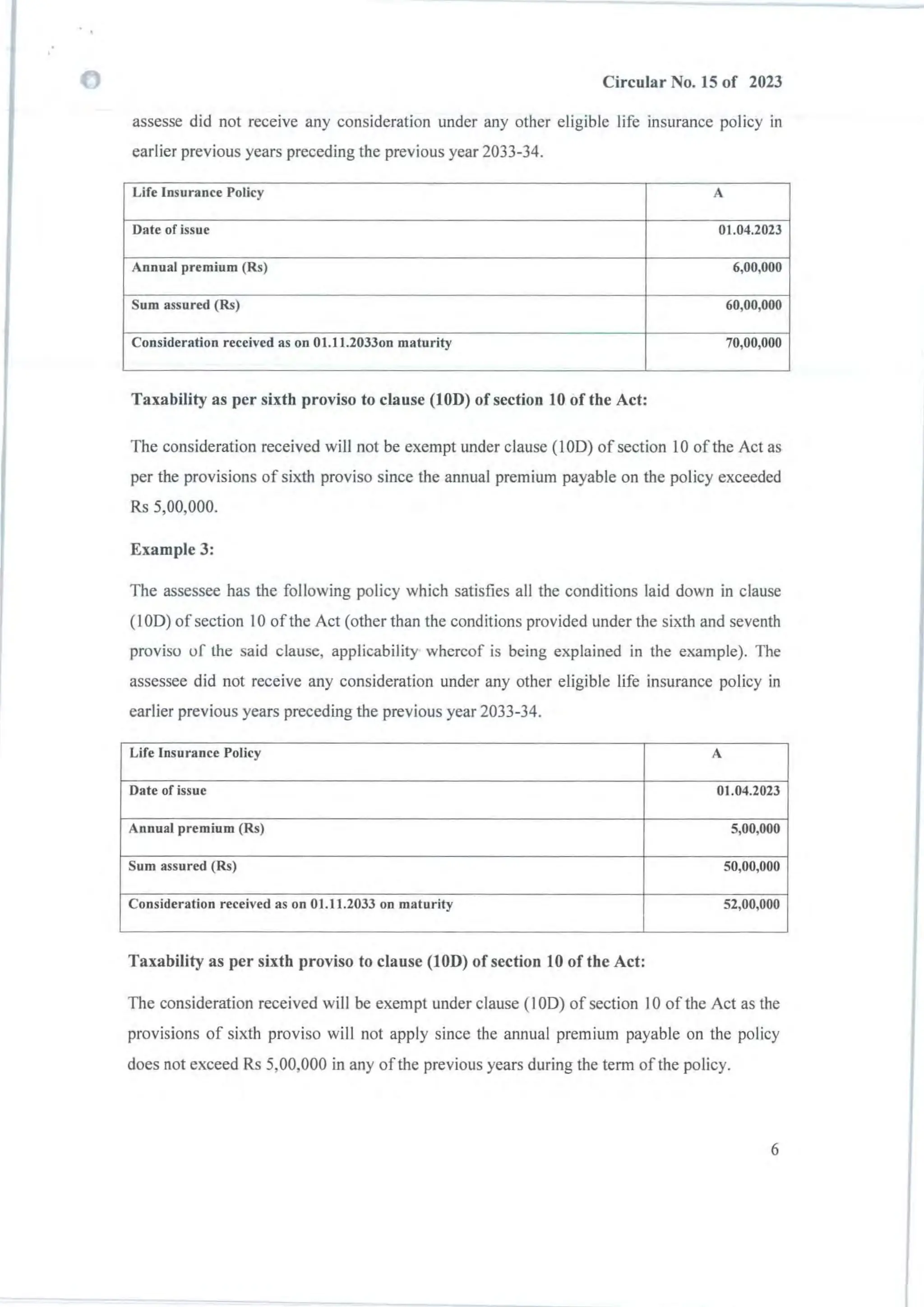

i) with effect from the assessment year 2024-25, the

sum received under a life insurance policy, other than

a unit-linked insurance policy, issued on or a er the

first day of April 2023, shall not be exempt under the

said clause if the amount of premium payable for any

of the previous years during the term of such policy

exceeds Rs 5,00,000 [sixth proviso];

ii) if a premium is payable for more than one life insur-

ance policy, other than a unit-linked insurance policy,

issued on or a er 01.04.2023, the exemp on under

the said clause shall be available only with respect to

such policies where the aggregate premium does not

exceed Rs 5,00,000 for any of the previous years dur-

ing the term of any of those policies [seventh provi-

so];

iii) the sixth and seventh provisos shall not apply in case

of any sum received on the death of a person [eighth

proviso]

Further, it is provided that any amount received un-

der life insurance policies (other than ULIPs) shall be taxable

under the head of other sources if not exempt under Sec on

10(10D). The following provisions have been inserted in this

respect:

a) Sum received under life insurance policies shall be

treated as income [sub-clause (xviid) of Sec on 2

(24)].

b) The income from life insurance policies (other than

ULIPs) shall be taxable under the head of other

sources if not exempt under sec on 10(10D) [clause

(xiii) of Sec on 56(2)].

c) Sum received under life insurance policies, in excess

of the aggregate of premium paid during the term of

policy, shall be treated as income under the head of

Other Sources. The rules shall also be prescribed for

the computa on of such income [clause (xiii) of Sec-

on 56(2)].

KEY POINTS TO REMEMBER

1. Premium payable shall be exclusive of the amount of

GST payable on such premium.

2. ULIP policies sold on or a er 01.02.2021, whose pre-

mium are above 2,50,000/- or 10% of Sum Insured

were not eligible for exemp on u/s 10(10D)

3. Policies (other than ULIP) policies, issued on or a er

01.04.2023, with annual premium above Rs.

5,00,000/- in any previous year were not eligible for

exemp on u/s 10(10D)

4. Policies (other than ULIP) policies, issued on or a er

01.04.2023, with annual premium of more than 10%

of Sum Insured in any previous year were also not

eligible for exemp on u/s 10(10D)

5. Any amount received as Death claim is exempt from

Income Tax under Sec 10(10D)

Contd...

Nov 23 - Jan 24

INGENIOUS

Hemant Agarwala

Assam](https://image.slidesharecdn.com/ingeniousnov2023tojan2024-231122175950-6994ee2a/75/Ingenious-Nov-2023-to-Jan-2024-pdf-15-2048.jpg)

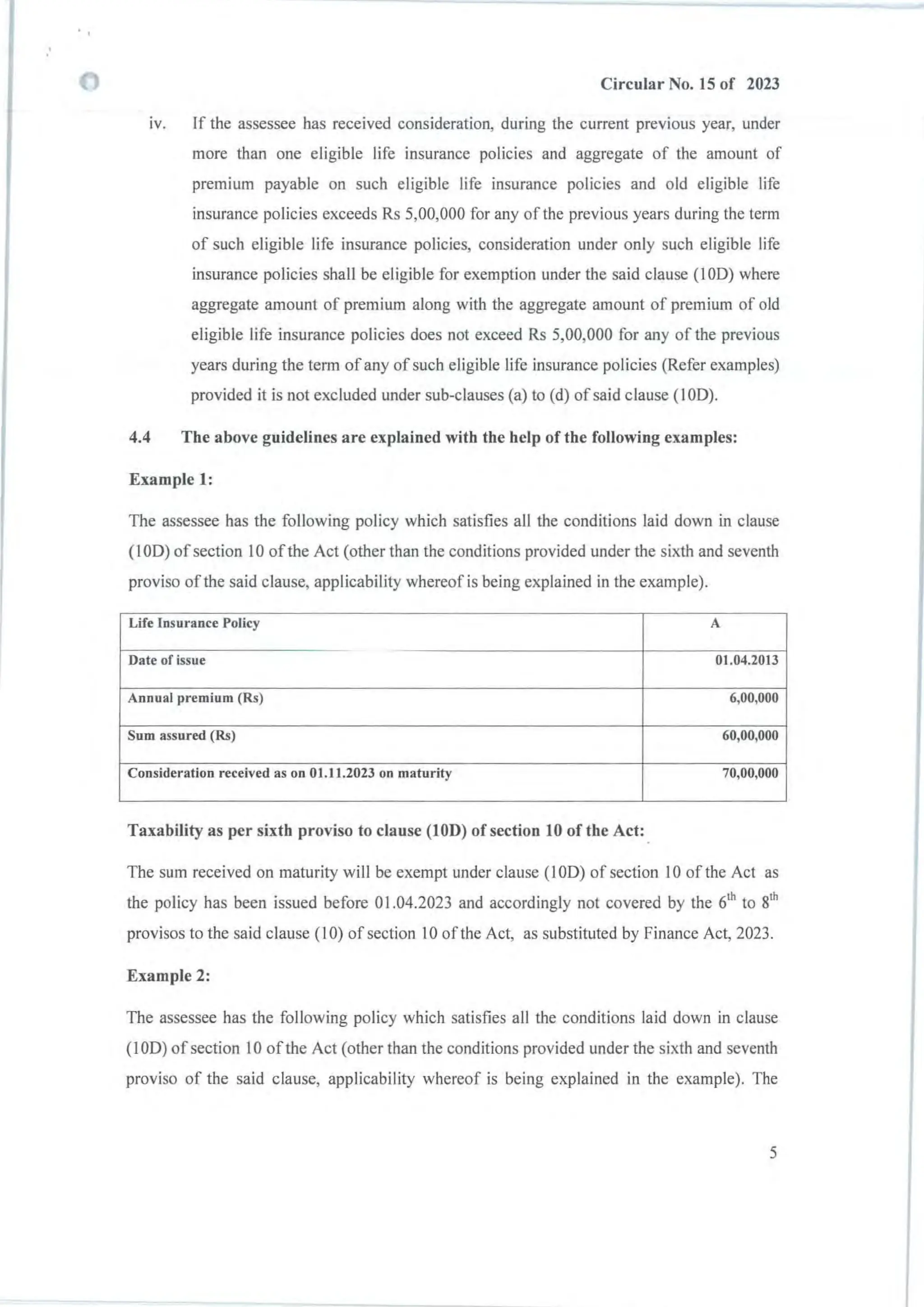

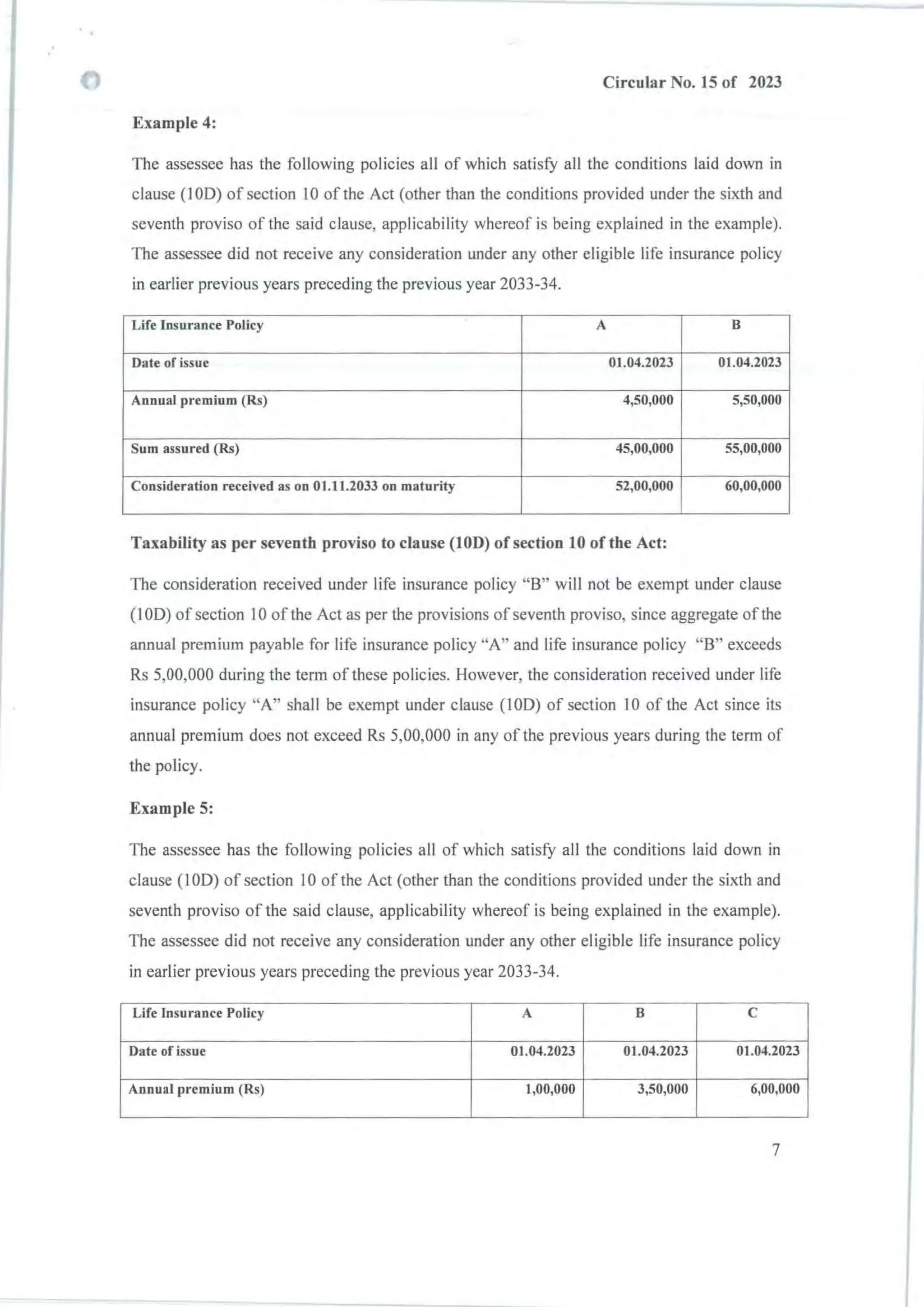

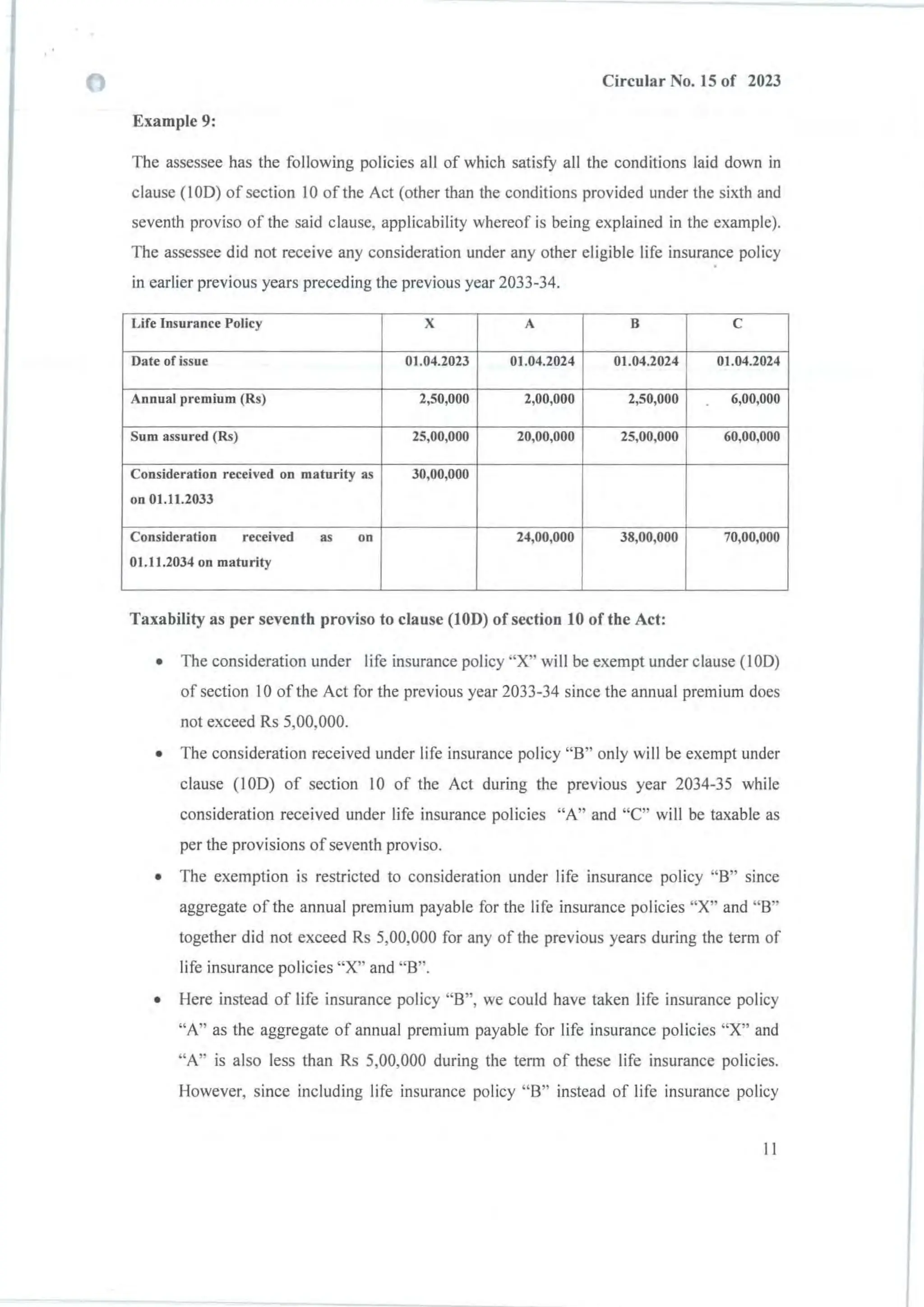

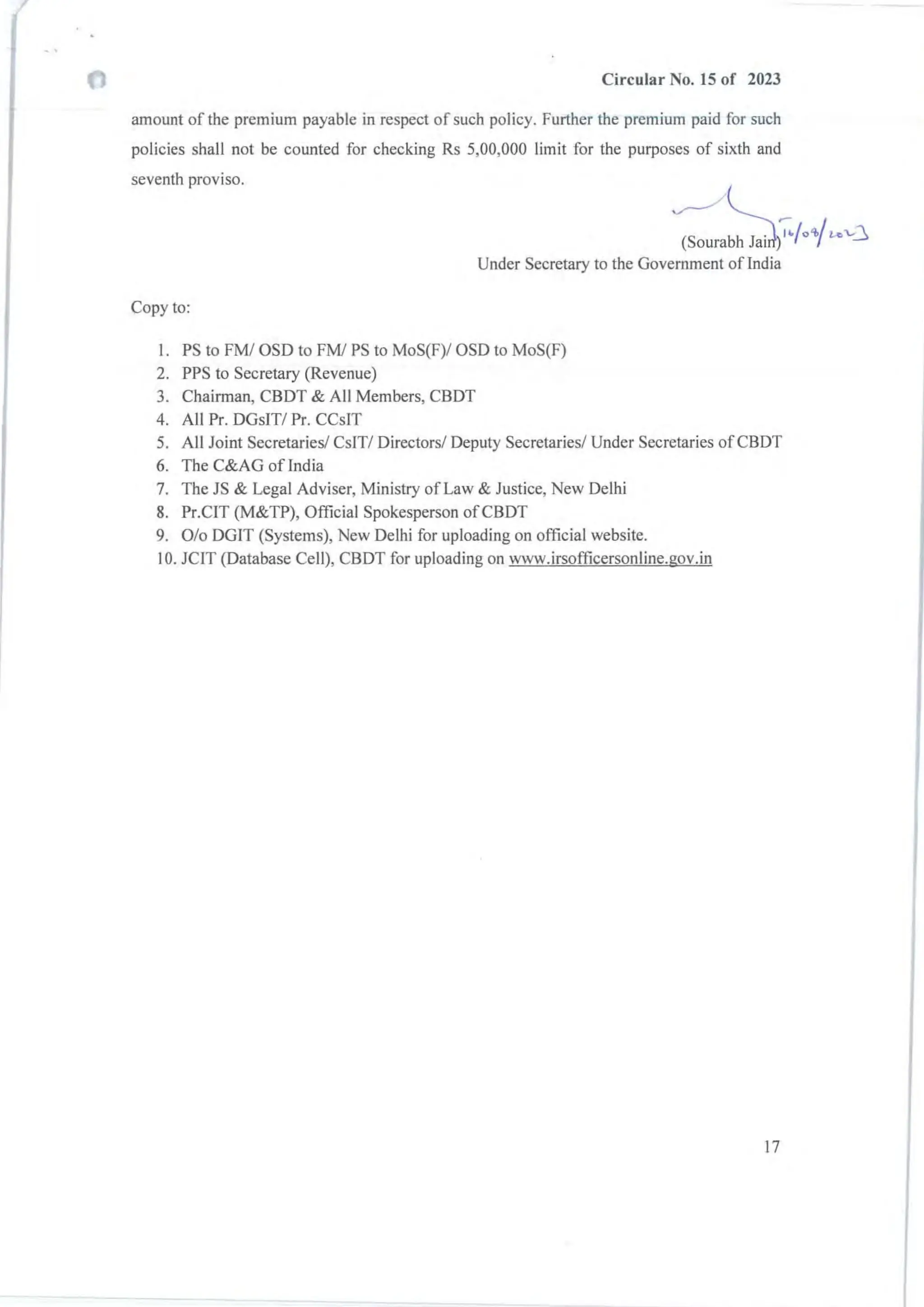

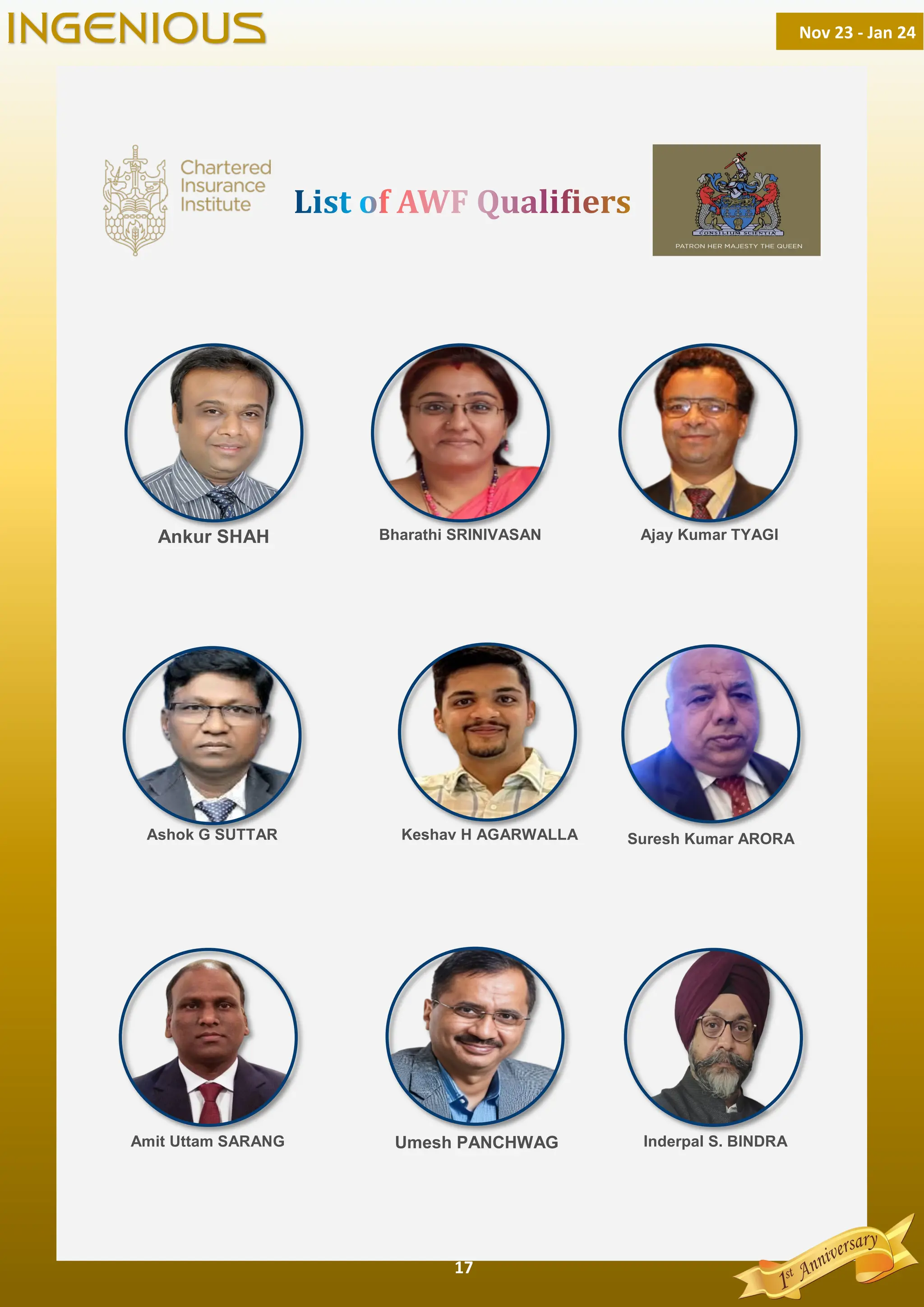

![..

.'

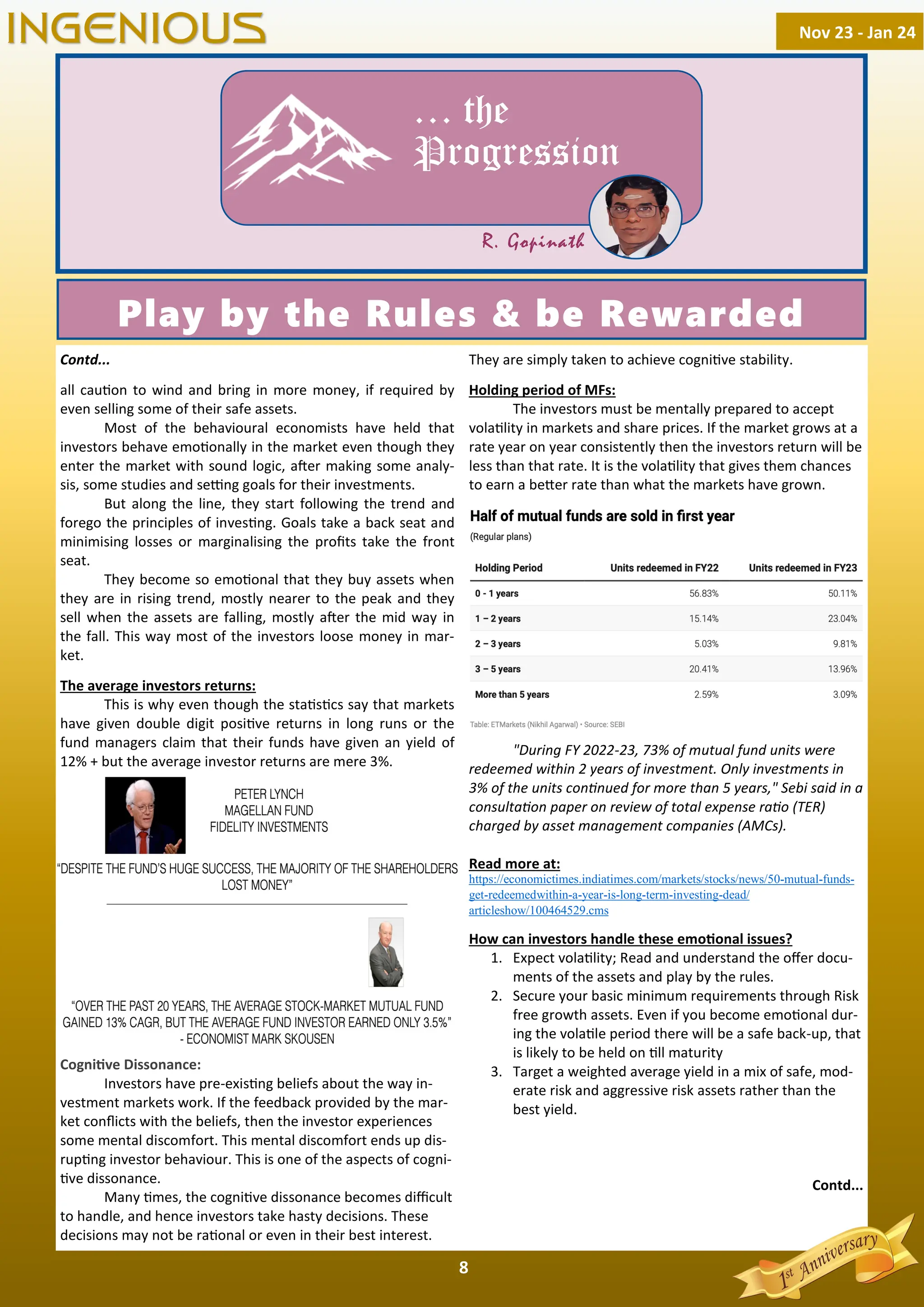

F. NO.370142/28/2023-TPL

Government of India

Ministry of Finance

Department of Revenue

(Central Board of Direct Taxes)

***********

Circular No. 15 of 2023

Dated tbe 16th

August, 2023

Sub: Guidelines under clause (lOD) of section 10 oftbe Income-tax Act. 1961- reg.

Clause (100) of section IO of the Income-tax Act, 1961 (the Act) provides for

income-tax exemption on any sum received under a life insurance policy, including the sum

allocated by way of bonus on such policy subject to certain exclusions.

2. The Finance Act, 2023 (Finance Act), inter-alia,-

l. amended clause (100) of section 10 of the Act by substituting the existing sixth

proviso with the new sixth, seventh and eighth provisos to, inter-alia, provide that:

(i) with effect from assessment year 2024-25, the sum received under a life

insurance policy, other than a unit linked insurance policy, issued on or after

the 151 day of April, 2023, shall not be exempt under the said clause if the

amount of premium payable for any of the previous years during the term of

such policy exceeds Rs 5,00,000 [sixth proviso];

(ii) if premium is payable for more than one life insurance policy, other than a

unit linked insurance policy, issued on or after 01.04.2023, the exemption

under the said clause shall be available only with respect to such policies

where the aggregate premium does not exceed Rs 5,00,000 for any of the

previous years during the term ofany of those policies [seventh proviso];

(iii) the sixth and seventh provisos shall not apply in case of any sum received on

the death ofa person [eighth proviso]

I!. inserted a new clause (xiii) in sub-section (2) of section 56 to provide that where any

sum is received, including the amount allocated by way of bonus, at any time during

a previous year, under a life insurance policy, other than the sum,-](https://image.slidesharecdn.com/ingeniousnov2023tojan2024-231122175950-6994ee2a/75/Ingenious-Nov-2023-to-Jan-2024-pdf-28-2048.jpg)