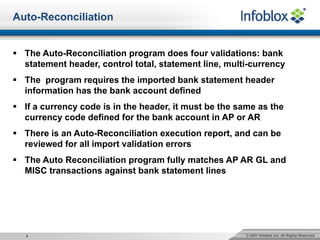

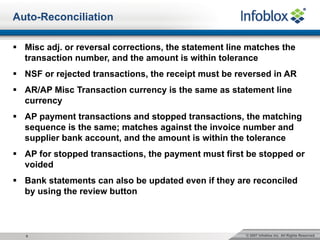

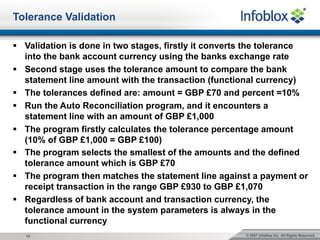

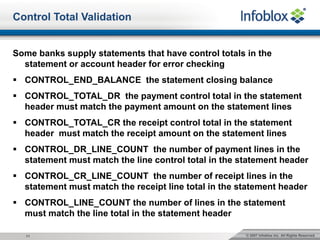

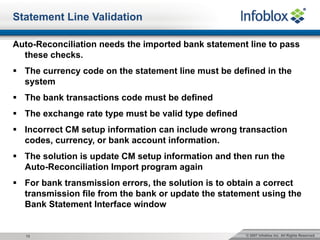

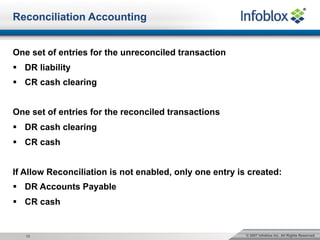

Cash Management is a system for managing bank statements and reconciling transactions in accounts payable and accounts receivable. It allows importing bank statements, matching transactions, and reconciling differences. There are parameters to set up accounts, transaction codes, tolerances, and controls. The auto-reconciliation program validates statements and matches transactions within tolerances, creating accounting entries for reconciled and unmatched amounts.