Industry report sugar

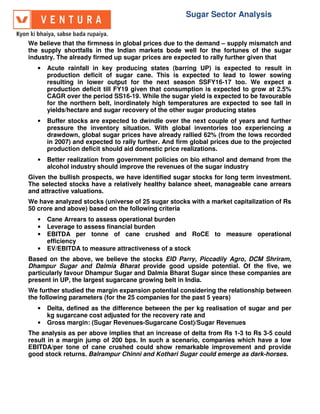

- 1. We believe that the firmness in global prices due to the demand the supply shortfalls in the Indian markets bode well for the fortunes of the sugar industry. The already firmed up sugar prices are expected to rally further given that • Acute rainfall in key producing sta production deficit of sugar cane resulting in lower output for the next season SSFY16 production deficit till FY19 g CAGR over the period SS16 for the northern belt, inordinately high yields/hectare and sugar recovery • Buffer stocks are expected to dwindle over the next couple of years pressure the inventory situation drawdown, global sugar prices have already rallied in 2007) and expected to rally further. And f production deficit should aid domestic price realizations • Better realization from government policies on bio ethanol and demand from the alcohol industry should improve the revenues of the sugar industry Given the bullish prospects, we The selected stocks have a relatively healthy balance sheet, manageable cane arrears and attractive valuations. We have analyzed stocks (universe of 50 crore and above) based on the following criteria • Cane Arrears to assess operational burden • Leverage to assess financial burden • EBITDA per tonne of cane crushed and RoCE to measure operational efficiency • EV/EBITDA to measure attractiveness of a stock Based on the above, we believe the stocks Dhampur Sugar and Dalmia Bharat particularly favour Dhampur Sugar and Dalmia present in UP, the largest sugarcane growing belt in India. We further studied the margin expansion potential considering the following parameters (for the 25 companies for the past 5 years • Delta, defined as the difference between the per kg realisation of sugar and per kg sugarcane cost adjusted for the recovery rate and • Gross margin: (Sugar Revenues The analysis as per above implies that a result in a margin jump of 200 bps. In such a scenario, companies which have a low EBITDA/per tone of cane crushed could show remarkable improvement and provide good stock returns. Balrampur Chinni Sugar Sector Analysis We believe that the firmness in global prices due to the demand – supply mismatch and the supply shortfalls in the Indian markets bode well for the fortunes of the sugar The already firmed up sugar prices are expected to rally further given that Acute rainfall in key producing states (barring UP) is expected to result in production deficit of sugar cane. This is expected to lead to lower sowing resulting in lower output for the next season SSFY16-17 too. We expect deficit till FY19 given that consumption is expected to grow at 2.5% CAGR over the period SS16-19. While the sugar yield is expected to be favourable hern belt, inordinately high temperatures are expected to see fall in and sugar recovery of the other sugar producing states Buffer stocks are expected to dwindle over the next couple of years pressure the inventory situation. With global inventories too experiencing a ar prices have already rallied 62% (from the lows recorded and expected to rally further. And firm global prices due to the projected production deficit should aid domestic price realizations. Better realization from government policies on bio ethanol and demand from the ndustry should improve the revenues of the sugar industry Given the bullish prospects, we have identified sugar stocks for long term investment. The selected stocks have a relatively healthy balance sheet, manageable cane arrears stocks (universe of 25 sugar stocks with a market capitalization of based on the following criteria Cane Arrears to assess operational burden Leverage to assess financial burden EBITDA per tonne of cane crushed and RoCE to measure operational EV/EBITDA to measure attractiveness of a stock Based on the above, we believe the stocks EID Parry, Piccadily Agro Dhampur Sugar and Dalmia Bharat provide good upside potential. Of the five Dhampur Sugar and Dalmia Bharat Sugar since these companies are present in UP, the largest sugarcane growing belt in India. We further studied the margin expansion potential considering the relationship between for the 25 companies for the past 5 years) Delta, defined as the difference between the per kg realisation of sugar and per kg sugarcane cost adjusted for the recovery rate and Gross margin: (Sugar Revenues-Sugarcane Cost)/Sugar Revenues The analysis as per above implies that an increase of delta from Rs 1- result in a margin jump of 200 bps. In such a scenario, companies which have a low EBITDA/per tone of cane crushed could show remarkable improvement and provide Balrampur Chinni and Kothari Sugar could emerge as dark Sugar Sector Analysis supply mismatch and the supply shortfalls in the Indian markets bode well for the fortunes of the sugar The already firmed up sugar prices are expected to rally further given that tes (barring UP) is expected to result in . This is expected to lead to lower sowing 17 too. We expect a is expected to grow at 2.5% While the sugar yield is expected to be favourable temperatures are expected to see fall in her sugar producing states Buffer stocks are expected to dwindle over the next couple of years and further . With global inventories too experiencing a (from the lows recorded irm global prices due to the projected Better realization from government policies on bio ethanol and demand from the ndustry should improve the revenues of the sugar industry have identified sugar stocks for long term investment. The selected stocks have a relatively healthy balance sheet, manageable cane arrears 25 sugar stocks with a market capitalization of Rs EBITDA per tonne of cane crushed and RoCE to measure operational EID Parry, Piccadily Agro, DCM Shriram, d upside potential. Of the five, we these companies are the relationship between Delta, defined as the difference between the per kg realisation of sugar and per Sugarcane Cost)/Sugar Revenues -3 to Rs 3-5 could result in a margin jump of 200 bps. In such a scenario, companies which have a low EBITDA/per tone of cane crushed could show remarkable improvement and provide emerge as dark-horses.

- 2. Key Investment Highlights Acute rainfall in key producing states (barring UP) is expected to result in production deficit of sugar cane Maharashtra (33%) & Karnataka (16%) which together contribute to over 49% of the total cane acreage has witnessed acute shortage of rainfall impacting yields and sugar recovery. According to initial estimates the area under sugarcane cultivation in Maharashtra would fall to 6.30 lakh hectares this year as against 9.27 lakh hectares in the same period last year. This should lead to a 30% fall in sugar production from these states Despite UP, the 2nd largest sugar producing state, has received poor rainfall, better quality crop and favourable climatic conditions production of sugar was down at 6.8 million tons (down 3.4% YoY). State wise sugar production in 2015-16 33% 27% 16% 4% 2% 16% Maharashtra Uttar Pradesh Karnataka Tamil Nadu Andhra Pradesh Other states Source: CMIE, Ventura Research Maharashtra the largest sugar producing state has been impacted adversely by drought.

- 3. State wise data of rainfall in India Source: IMD, Ventura Research

- 4. Overall we expect a drop in sugar production of 2 million tons to 23 million tons (as per ISMA) for the sugar season 2016-17 on the back of lower cane cultivation in key producing areas. This is far lower than the production of SS11 when prices were elevated. With poor rains persisting, the sowing for the next sugar season (SS 2016-17) is also below par and hence we expect a further drop in production next year. This should ensure that prices will remain elevated over the next couple of seasons. The strong consumption trend for sugar is expected to keep demand buoyant. India’s sugar demand has grown at 3% CAGR over the past few years. Going forward this growth is expected to further improve as per capita consumption is expected to grow in line with the improving disposable income. Cane acreage in India 5,100 5,279 5,341 5,307 5,284 4,950 5,000 5,050 5,100 5,150 5,200 5,250 5,300 5,350 5,400 SS12 SS13 SS14 SS15 SS16 Cane acreage '000 hectares Source: ISMA, Ventura Research Sugar production in India 26.3 25.1 24.4 28.3 25.1 15 20 25 30 SS12 SS13 SS14 SS15 SS16 India Production million MT Source: ISMA, Ventura Research Consumption trend expected to strengthen 21.9 22.9 21.3 20.8 22.6 22.8 24.2 25.1 25.0 25.5 26.1 26.9 15 18 21 24 27 30 SS08 SS09 SS10 SS11 SS12 SS13 SS14 SS15 SS16 SS17 SS18 SS19 Projected consumption million ton Source: CMIE, Ventura Research

- 5. This will result in demand outstripping supply and imports would become imperative. The highest ever production of sugar in India is 28.3 million tons (SS 14-15) and unless the yield per hectare of cane and sugar recoveries improve drastically, India would become a net importer of sugar leading to higher sugar prices as India is a swing consumer ( being the largest in the world). However global sugar deficit forecast for CY17 cut by 29% on bumper Brazil crop World production will fall short of demand by 5.48 million metric tons ( as per Kingsman forecast http://goo.gl/OC1oSI ) in the season started last October, down from an earlier estimate of 7.67 million tons on the back of a record sugar crop in Brazil’s center south, the main growing region of the world’s largest sugar producer Drawdown in inventories expected in India and globally We expect India buffer stocks to deplete going forward given the shortfall in production which should boost prices not only in the domestic market, but globally too (as India is a swing consumer).. Buffer stocks in India to fall sharply 5.4 5.2 6.1 7.2 9.4 8.2 9.9 7.0 4.3 3.0 2.3 0 500 1000 1500 2000 2500 3000 3500 - 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 SS09 SS10 SS11 SS12 SS13 SS14 SS15 SS16 SS17 SS18 SS19 Buffer stock Sugar Prices million ton Rs / quintal Source: ISMA, Ventura Research Global sugar production – consumption in delicate balance 140.0 145.0 150.0 155.0 160.0 165.0 170.0 175.0 180.0 07-08 08-09 09-10 10-11 11-12 12-13 13-14 14-15 15-16 Production Consumption million MT Source: USDA, ISMA, Ventura Research Projected shortages of buffer stock would necessitate imports, which should pressure global sugar price upwards.

- 6. Contracted sugar export commitments to pressure domestic inventories To incentivize the ailing industry, exports to the extent of 1.5 million ton was permitted in sugar year 2014-15, for which a subsidy of Rs 4000/ ton was given. In 2014-15 exports were to the extent of 1.1 million ton and contracted for sugar season 2015-16 is 1.15 million ton. However with sugar export prices hovering around ~$475/ ton FOB (equivalent to Rs 31,500/ ton) - very close the average ex- mill prices (INR 32,000-34,000/ ton) has rendered exports less viable. India sugar industry dynamics suggest demand outstripping supply Particulars SS09 SS10 SS11 SS12 SS13 SS14 SS15 SS16 SS17 SS18 SS19 Opening stock 11.3 5.4 5.2 6.1 7.2 9.4 8.2 9.9 8.4 5.7 4.4 Production 14.5 18.9 24.4 26.3 25.1 24.4 28.3 25.0 23.0 25.0 26.5 Consumption 22.9 21.3 20.8 22.6 22.8 24.2 25.1 25.0 25.5 26.1 26.9 Exports 0.2 0.2 2.6 3.0 0.4 2.2 1.1 1.5* 0.2 0.2 0.3 Imports 2.7 2.5 - - 0.7 0.1 - - - - - Closing stock 5.4 5.2 6.1 7.2 9.4 8.2 9.9 8.4 5.7 4.4 3.7 Source: ISMA,USDA, Ventura Research *contracted quantity Global Sugar Industry Particulars SS09 SS10 SS11 SS12 SS13 SS14 SS15 SS16 (E) Opening stock 42.7 31.2 29.3 29.5 35.2 42.5 43.8 43.6 Production 144.1 153.7 161.4 172.4 177.6 175.6 175.1 173.4 Consumption 153.7 154.7 156.1 159.6 166.6 167.5 171.8 173.4 Exports 47.8 51.6 56.1 55.0 55.5 57.7 54.1 55.8 Imports 46.7 51.4 51.7 48.6 51.9 51.1 50.4 52.8 Closing stock 31.2 29.3 29.5 35.2 42.5 43.8 43.6 40.5 Source: USDA, Ventura Research Falling sugar inventories expected to result in a surge in sugar prices Source: USDA, ISMA, Ventura Research 42.7 31.2 29.3 29.5 35.2 42.5 43.8 43.6 40.5 200 300 400 500 600 700 800 900 20.0 25.0 30.0 35.0 40.0 45.0 50.0 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16(E) Closing stock ICE Prices USc/lbmillion MT

- 7. Sugar prices expected to rise To ensure sustainability of the farmers and farm produce, the Central Govt fixes the FRP (Fair and Remunerative Price) below which no sugar mill can purchase cane from farmers. In place to the FRP, certain states provide higher incentive to farmer through the SAP (State Advised Price). FRP directly impacts the cost of production and since 2009; FRP has jumped 283% (CAGR of 16%) from Rs 81/quintal to Rs 230/ quintal. In contrast to this the sugar prices have fallen 2.3% over the same period. Farmers have always sold sugar cane at market determined prices (with sharing in the surplus in case of higher sugar prices). However in down cycles the FRP / SAP has acted as a floor- price. This has led to a catch 22 situation where the sugar mills have been subjected to significant losses leading to mounting cane arrears and debt. Sharp escalation of FRP to reflect market pricing 1000 1500 2000 2500 3000 3500 75 100 125 150 175 200 225 250 SS09 SS10 SS11 SS12 SS13 SS14 SS15 SS16 Cane prices Sugar Prices Rs/quintal Source: ISMA, Ventura Research FRP has grown at a CAGR of 14% while sugar prices have remained flat with negative bias. International sugar price for last year 340 360 380 400 420 440 460 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Price USD / ton Source: ISMA, Ventura Research Historical International sugar price 150 225 300 375 450 525 600 675 750 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Last Price USD / ton Source: ISMA, Ventura Research

- 8. However in our optimism the prices are expected to surge given our bullish stance as stated elsewhere in the report. 5. Higher demand for bio ethanol The current blending limit on ethanol is set at 5% which the government wants to double to 10%. This move by the Government is a shot in the arm for sugar industry since this would increase the demand for ethanol. To improve supplies of ethanol and keep prices down, the government has extended soft loans of up to 40 percent to encourage sugar mills to set up ethanol plants, fixed "remunerative ex- depot price of ethanol" and waived some taxes on its supplies to oil marketing companies. The current realization for ethanol is in the range of INR 43-45 / litre which has risen substantially from Rs 33-35 levels. Higher realization for ethanol would lead to further improvement in the ethanol margins for sugar industry. Ex mill prices inching above costs after a hiatus - 500 1,000 1,500 2,000 2,500 3,000 3,500 - 500 1,000 1,500 2,000 2,500 3,000 3,500 SS12 SS13 SS14 SS15 SS16 Production cost Ex-mill price NCDEX price Rs/quintal Source: ISMA, Ventura Research Mounting cane arrears 8,577 12,702 18,648 20,099 0 5,000 10,000 15,000 20,000 25,000 SS12 SS13 SS14 SS15 Cane Arrears Rs in crore Source: ISMA, Ventura Research Mounting debt of corporate entities 11,472 15,284 17,945 19,220 41,248 40,066 39,432 40,903 - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 SS12 SS13 SS14 SS15 Debt of Listed Co Debt of Unlisted Co 52,720 55,350 57,377 60,123 Source: ISMA, Ventura Research

- 9. Given that the sugar industry is on the verge of an up-trend with prices expected to remain firm and demand expected to improve, we have identified sugar stocks for long term investment. The selected stocks have a relatively healthy balance sheet, manageable cane arrears and attractive valuations. Selection Methodology We selected 25 sugar stocks with a market capitalization of Rs 50 crore and above for our analysis. The stocks were analysed on the following parameters: i) Cane Arrears to assess operational burden ii) Leverage to assess financial burden iii) EBITDA per tonne of cane crushed and RoCE to measure operational efficiency iv) EV/EBITDA to measure attractiveness of a stock Operational parameters Operational parameters of the sugar stocks are as follows: Operational Parameters Company Name Area of Operations TCD capacity Distillery capacity (kl/day) Cogen capacity (MW) Total Cane crushed (MMT) Sugar Produced (MMT) Recovery FY15 E.I.D. Parry Andhra Pradesh, Pondicherry, Karnataka, Tamil Nadu 39000 230 160 4.96 0.51 10.1% Balrampur Chini Uttar Pradesh 79000 320 251.55 7.72 0.76 9.8% Bajaj Hindusthan Uttar Pradesh 136000 800 449 12.11 1.14 9.4% Bannari Amman Tamil Nadu, Karnataka 20100 127.5 104.8 2.42 0.24 9.8% Shree Renuka 4 in Centre-South Brazil, 7 in India ( Karnataka, Maharashtra, Gujarat) 101520 4160 584 4.97 0.58 11.6% Triveni 3 in West UP, 3 in Central UP and 1 unit in East UP 61000 160 103 4.69 0.43 9.2% Dalmia Bharat Sugar 3 in UP, 1 in Maharashtra 27500 90 102 3.10 0.34 10.9% Dhampur Sugar Uttar Pradesh 45500 300 205 4.58 0.44 9.5% Dwarikesh Sugar Uttar Pradesh 21500 30 86 2.09 0.22 10.8% Sakthi Sugars Tamil Nadu and Orrisa 19000 50 92 1.48 0.13 8.9% KCP Sugar Andhra Pradesh 11500 50 20 1.10 0.10 9.3% DCM Shriram 2 in UP 1 in Rajasthan 33000 125 94.5 1.68 0.16 9.6% Ponni Sugars Tamil Nadu 3500 60 19 0.45 0.04 9.7% Ugar Sugar Andhra Pradesh, Orissa 17000 75 59 2.01 0.23 11.5% Oudh Sugar Uttar Pradesh and Bihar 28700 160 55 0.32 0.03 10.0% Uttam Sugar 3 in UP 1 in Uttarakhand 23750 75 103 2.34 0.23 9.7% Mawana Sugars Uttar Pradesh, Punjab 29500 120 116 2.56 0.23 9.1% Upper Ganges Sugar Uttar Pradesh 20000 100 52 2.34 0.23 9.9% Kothari Sugars Tamil Nadu 10000 60 11 0.89 0.08 9.0% Rajshree Sugars Tamil Nadu 14000 45 54.5 1.58 0.14 9.1% Rana Sugars 2 in UP, 1 in Punjab 15000 60 87.5 1.63 0.14 8.8% Piccadily Agro Haryana 5000 90 0 0.38 0.04 10.2% Parrys Sugar Karnataka 4000 0 13 0.67 0.08 12.1% KM Sugar Uttar Pradesh 9000 45 25 1.83 0.17 9.3% Source: Ventura Research

- 10. A] Cane Arrears and Debt Cane Arrears as a % of RM cost v/s DE(x) High Debt& Low Cane Arrears High Debt& High Cane Arrears Low Debt& Low Cane Arrears Low Debt & High Cane Arrears Source: Ventura Research

- 11. B] Debt & Interest Coverage Ratio D/E v/s Interest Coverage Ratio High D/E and Low Interest Coverage High D/E but High Interest Coverage Low D/E and Low InterestCoverage Low D/E and High Interest Coverage Source: Ventura Research

- 12. C] RoCE & EV/EBITDA multiple RoCE v/s EV/EBITDA multiple High RoCE and High EV/EBITDA multiple High RoCE and Low EV/EBITDA multiple Low RoCE and High EV/EBITDA multiple Low RoCE and Low EV/EBITDA multiple Source: Ventura Research

- 13. D] EBITDA/Per tone of cane crushed and EV/EBITDA multiple To arrive at stocks suitable for long term investment, we have plotted EBITDA/Tonne of cane crushed which measures operational efficiency across the entire value chain – sugar, alcohol and co-generation power. EBITDA/Per ton of cane crushed v/s EV/EBITDA multiple High EBITDA/cane crushed & Low EV/EBITDA multiple High EBITDA/cane crushed & High EV/EBITDA multiple Low EBITDA/canecrushed & low EV/EBITDA multiple Low EBITDA/canecrushed & high EV/EBITDA multiple Source: Ventura Research

- 14. Based on the above, we believe the following stocks in the sugar sector provide good upside potential: • EID Parry • Piccadily Agro • DCM Shriram • Dhampur Sugar and, • Dalmia Bharat Sugar Of the five, we particularly favour Dhampur Sugar and Dalmia Bharat Sugar since these companies have a sizeable presence in UP, the largest sugarcane growing belt in India. Also, to estimate the margin expansion potential, we studied the relationship between the following parameters for the 25 companies for the past 5 years: i) Delta, defined as the difference between the per kg realisation of sugar and per kg sugarcane cost adjusted for the recovery rate and ii) Gross margin: (Sugar Revenues-Sugarcane Cost)/Sugar Revenues Our research reveals that sugar companies need to earn delta in the range of Rs 1-3 to make positive EBITDA margin. Sensitivity Table Movement of Delta and Gross Margins Delta Average Gross Margin Rs 10+ 34.3% Rs 5-10 19.8% Rs 3-5 10.3% Rs 1-3 7.9% Rs 0-1 0.3% Less than Rs 1 -10.9% -100% -80% -60% -40% -20% 0% 20% 40% 60% 80% -80.0 -70.0 -60.0 -50.0 -40.0 -30.0 -20.0 -10.0 0.0 10.0 20.0 30.0 Rs per kg Delta GM (RHS) Source: Ventura Research Source: Ventura Research Given that sugar prices are expected to firm up due to demand-supply imbalance and sugarcane prices are expected to remain stable, an increase of delta from Rs 1-3 to Rs 3-5 could result in a margin jump of 200 bps. In such a scenario, companies which have a low EBITDA/per tone of cane crushed could show remarkable improvement and provide good stock returns. Balrampur Chinni and and Kothari Sugar, (as indicated in the previous scatter plot), with currently low EBITDA/Cane crushed could be the dark- horses. The following companies, trading at a high EV/EBITDA multiple have limited upside: • Triveni and • Bannari Aman

- 15. Snapshot of Sugar Stocks ( Recommendations Highlighted) Company Name CMP Mcap EV / TTM EBIDTA (x) 52 wk H 52 wk L Net Sales FY15 Net Sales FY16 EBITDA FY15 EBITDA FY16 PAT FY15 PAT FY16 D/E (Latest) Interest Coverage (Latest) ROE (%) ROCE (%) Cane Arreas as a % of RM E.I.D. Parry 235.40 4138.68 8.92 255 123 13,953 15,398 1008 846 276 155 1.9 1.4 7.0 9.2 39% Balrampur Chini 106.65 2612.39 9.07 120 33 2,987 2,757 126 419.25 -58 99.3 1.2 4.1 8.1 11.3 21% Bajaj Hindusthan 18.55 2102.75 49.59 23 11 4,535 -169 -1192 4.4 -0.3 -61.5 -3.5 81% Bannari Amman 1770.95 2025.91 17.81 1912 575 930 1,396 128 181.73 1 25.24 1.0 1.0 2.6 4.8 9% Shree Renuka 13.06 1213.03 220.01 18 7 10,088 421 -1814 3.1 -1.3 0.0 -14.9 72% Triveni 48.75 1257.48 19.71 58 14 2,079 1,915 1 125 -152 -9.8 2.4 0.6 -1.5 3.0 31% Dalmia Bharat Sugar 92.15 745.86 6.62 118 19 1,150 1,166 113 227 1 58 2.0 1.3 11.4 7.7 34% Dhampur Sugar 85.25 513.33 8.96 100 27 1,790 2,233 143 210 -13 26 2.0 1.0 3.6 7.1 31% Dwarikesh Sugar 192.90 314.71 8.03 225 20 1,136 799 93 116.83 -17 38.97 5.1 1.7 33.3 12.2 75% Sakthi Sugars 32.80 315.58 12.13 44 13 837 113 -35 2.1 0.6 -95.0 6.9 74% KCP Sugar 28.80 326.55 -18.32 33 12 426 -20 -14 0.3 -4.5 -5.8 -6.0 35% DCM Shriram 130.25 226.61 9.34 155 56 1,299 64 5 1.2 1.3 2.3 9.2 50% Ponni Sugars 195.00 167.67 -22.06 250 113 159 -5 -4 0.7 -0.1 -3.0 -0.2 25% Ugar Sugar 29.30 329.63 8.64 36 7 652 21 -3 16.2 0.6 -3.8 3.0 54% Oudh Sugar 80.35 208.25 8.40 103 14 1,382 1,166 44 139 -71 10 -14.9 1.0 -14.5 11.8 35% Uttam Sugar 49.55 188.97 9.68 67 9 760 810 -15 83 -88 15 5.4 1.3 15.6 10.4 59% Mawana Sugars 41.45 162.14 3.66 49 6 1,401 1,485 -53 106 -181 1 -92.6 0.9 -0.2 -0.9 65% Upper Ganges Sugar 175.20 202.48 9.33 207 28 853 837 -6 76 -53 15 7.9 1.1 20.8 9.8 41% Kothari Sugars 13.15 109.00 12.56 0 0 340 9 -4 1.5 1.0 -3.4 1.7 15% Rajshree Sugars 47.00 132.38 -36.59 56 14 711 3 -66 31.9 -0.3 -135.6 -2.9 46% Rana Sugars 7.01 107.65 17.68 8 2 698 24 -55 3.6 0.1 -32.5 0.5 50% Piccadily Agro 17.00 80.19 7.83 20 10 344 28 9 1.2 2.7 6.9 11.0 69% Parrys Sugar 40.35 80.55 -62.92 59 14 198 291 7 -4 -16 -26 4.3 0.1 -168.3 0.6 68% KM Sugar 7.14 65.69 11.41 8 2 550 30 7 3.6 1.6 54.7 16.2 25% Source: Ventura Research

- 16. Disclosures and Disclaimer Ventura Securities Limited (VSL) is a SEBI registered intermediary offering broking, depository and portfolio management services to clients. VSL is member of BSE, NSE and MCX-SX. VSL is a depository participant of NSDL. VSL states that no disciplinary action whatsoever has been taken by SEBI against it in last five years except administrative warning issued in connection with technical and venial lapses observed while inspection of books of accounts and records. Ventura Commodities Limited, Ventura Guaranty Limited, Ventura Insurance Brokers Limited and Ventura Allied Services Private Limited are associates of VSL. Research Analyst (RA) involved in the preparation of this research report and VSL disclose that neither RA nor VSL nor its associates (i) have any financial interest in the company which is the subject matter of this research report (ii) holds ownership of one percent or more in the securities of subject company (iii) have any material conflict of interest at the time of publication of this research report (iv) have received any compensation from the subject company in the past twelve months (v) have managed or co-managed public offering of securities for the subject company in past twelve months (vi) have received any compensation for investment banking merchant banking or brokerage services from the subject company in the past twelve months (vii) have received any compensation for product or services from the subject company in the past twelve months (viii) have received any compensation or other benefits from the subject company or third party in connection with the research report. RA involved in the preparation of this research report discloses that he / she has not served as an officer, director or employee of the subject company. RA involved in the preparation of this research report and VSL discloses that they have not been engaged in the market making activity for the subject company. Our sales people, dealers, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein. We may have earlier issued or may issue in future reports on the companies covered herein with recommendations/ information inconsistent or different those made in this report. In reviewing this document, you should be aware that any or all of the foregoing, among other things, may give rise to or potential conflicts of interest. We may rely on information barriers, such as "Chinese Walls" to control the flow of information contained in one or more areas within us, or other areas, units, groups or affiliates of VSL. This report is for information purposes only and this document/material should not be construed as an offer to sell or the solicitation of an offer to buy, purchase or subscribe to any securities, and neither this document nor anything contained herein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. This document does not solicit any action based on the material contained herein. It is for the general information of the clients / prospective clients of VSL. VSL will not treat recipients as clients by virtue of their receiving this report. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of clients / prospective clients. Similarly, this document does not have regard to the specific investment objectives, financial situation/circumstances and the particular needs of any specific person who may receive this document. The securities discussed in this report may not be suitable for all investors. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Persons who may receive this document should consider and independently evaluate whether it is suitable for his/ her/their particular circumstances and, if necessary, seek professional/financial advice. And such person shall be responsible for conducting his/her/their own investigation and analysis of the information contained or referred to in this document and of evaluating the merits and risks involved in the securities forming the subject matter of this document. The projections and forecasts described in this report were based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections and forecasts were based will not materialize or will vary significantly from actual results, and such variances will likely increase over time. All projections and forecasts described in this report have been prepared solely by the authors of this report independently of the Company. These projections and forecasts were not prepared with a view toward compliance with published guidelines or generally accepted accounting principles. No independent accountants have expressed an opinion or any other form of assurance on these projections or forecasts. You should not regard the inclusion of the projections and forecasts described herein as a representation or warranty by VSL, its associates, the authors of this report or any other person that these projections or forecasts or their underlying assumptions will be achieved. For these reasons, you should only consider the projections and forecasts described in this report after carefully evaluating all of the information in this report, including the assumptions underlying such projections and forecasts. The price and value of the investments referred to in this document/material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance. Future returns are not guaranteed and a loss of original capital may occur. Actual results may differ materially from those set forth in projections. Forward- looking statements are not predictions and may be subject to change without notice. We do not provide tax advice to our clients, and all investors are strongly advised to consult regarding any potential investment. VSL, the RA involved in the preparation of this research report and its associates accept no liabilities for any loss or damage of any kind arising out of the use of this report. This report/document has been prepared by VSL, based upon information available to the public and sources, believed to be reliable. No representation or warranty, express or implied is made that it is accurate or complete. VSL has reviewed the report and, in so far as it includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed. The opinions expressed in this document/material are subject to change without notice and have no obligation to tell you when opinions or information in this report change. This report or recommendations or information contained herein do/does not constitute or purport to constitute investment advice in publicly accessible media and should not be reproduced, transmitted or published by the recipient. The report is for the use and consumption of the recipient only. This publication may not be distributed to the public used by the public media without the express written consent of VSL. This report or any portion hereof may not be printed, sold or distributed without the written consent of VSL. This document does not constitute an offer or invitation to subscribe for or purchase or deal in any securities and neither this document nor anything contained herein shall form the basis of any contract or commitment whatsoever. This document is strictly confidential and is being furnished to you solely for your information, may not be distributed to the press or other media and may not be reproduced or redistributed to any other person. The opinions and projections expressed herein are entirely those of the author and are given as part of the normal research activity of VSL and are given as of this date and are subject to change without notice. Any opinion estimate or projection herein constitutes a view as of the date of this report and there can be no assurance that future results or events will be consistent with any such opinions, estimate or projection. This document has not been prepared by or in conjunction with or on behalf of or at the instigation of, or by arrangement with the company or any of its directors or any other person. Information in this document must not be relied upon as having been authorized or approved by the company or its directors or any other person. Any opinions and projections contained herein are entirely those of the authors. None of the company or its directors or any other person accepts any liability whatsoever for any loss arising from any use of this document or its contents or otherwise arising in connection therewith. The information contained herein is not intended for publication or distribution or circulation in any manner whatsoever and any unauthorized reading, dissemination, distribution or copying of this communication is prohibited unless otherwise expressly authorized. Please ensure that you have read “Risk Disclosure Document for Capital Market and Derivatives Segments” as prescribed by Securities and Exchange Board of India before investing in Securities Market. Ventura Securities Limited Corporate Office: C-112/116, Bldg No. 1, Kailash Industrial Complex, Park Site, Vikhroli (W), Mumbai – 400079