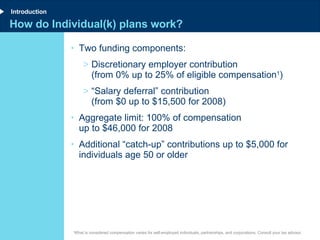

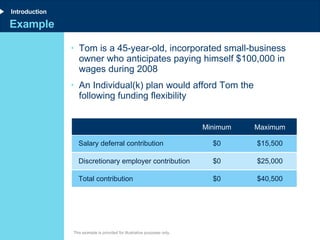

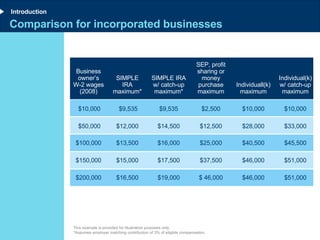

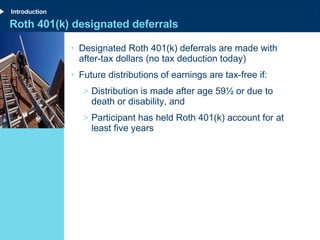

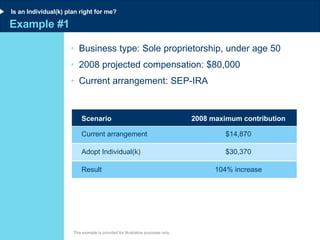

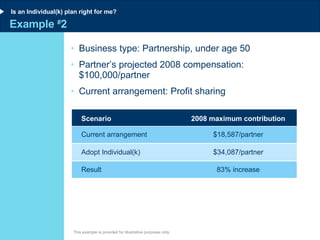

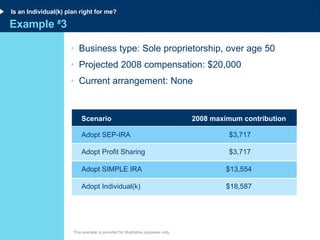

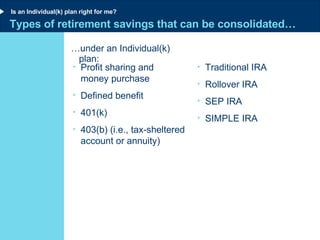

An Individual(k) plan can provide higher contribution limits, greater funding flexibility, and lower costs than other retirement plan options for self-employed individuals or small business owners. Key benefits include the ability to make discretionary employer contributions of up to 25% of compensation, employee contributions of up to $15,500 per year, and loans and distributions from the plan. Individual(k) plans also allow for consolidating other retirement accounts and designating some contributions as Roth 401(k) contributions, which provide tax-free future distributions. The plan may be a good fit for businesses with only owner-employees or those that can exclude common-law employees from participation.