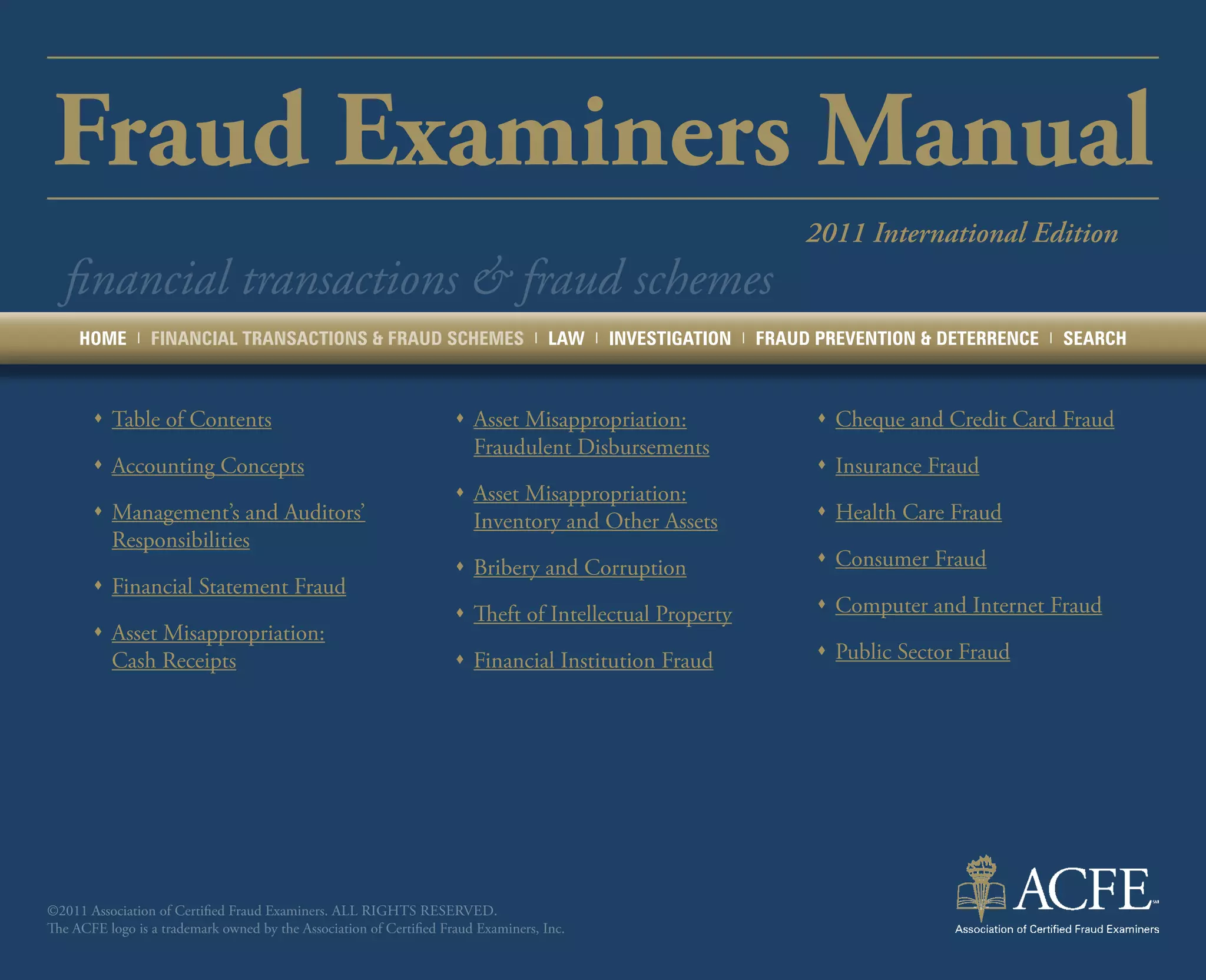

The 2011 International Edition of the Fraud Examiners Manual provides comprehensive guidance on various aspects of fraud detection, prevention, and investigation, covering financial transactions, legal frameworks, and ethics for fraud examiners. It includes detailed sections on asset misappropriation, financial statement fraud, and specific schemes like cheque tampering and billing schemes. The manual aims to equip fraud examiners with the necessary tools and knowledge to effectively address and mitigate fraud risks.