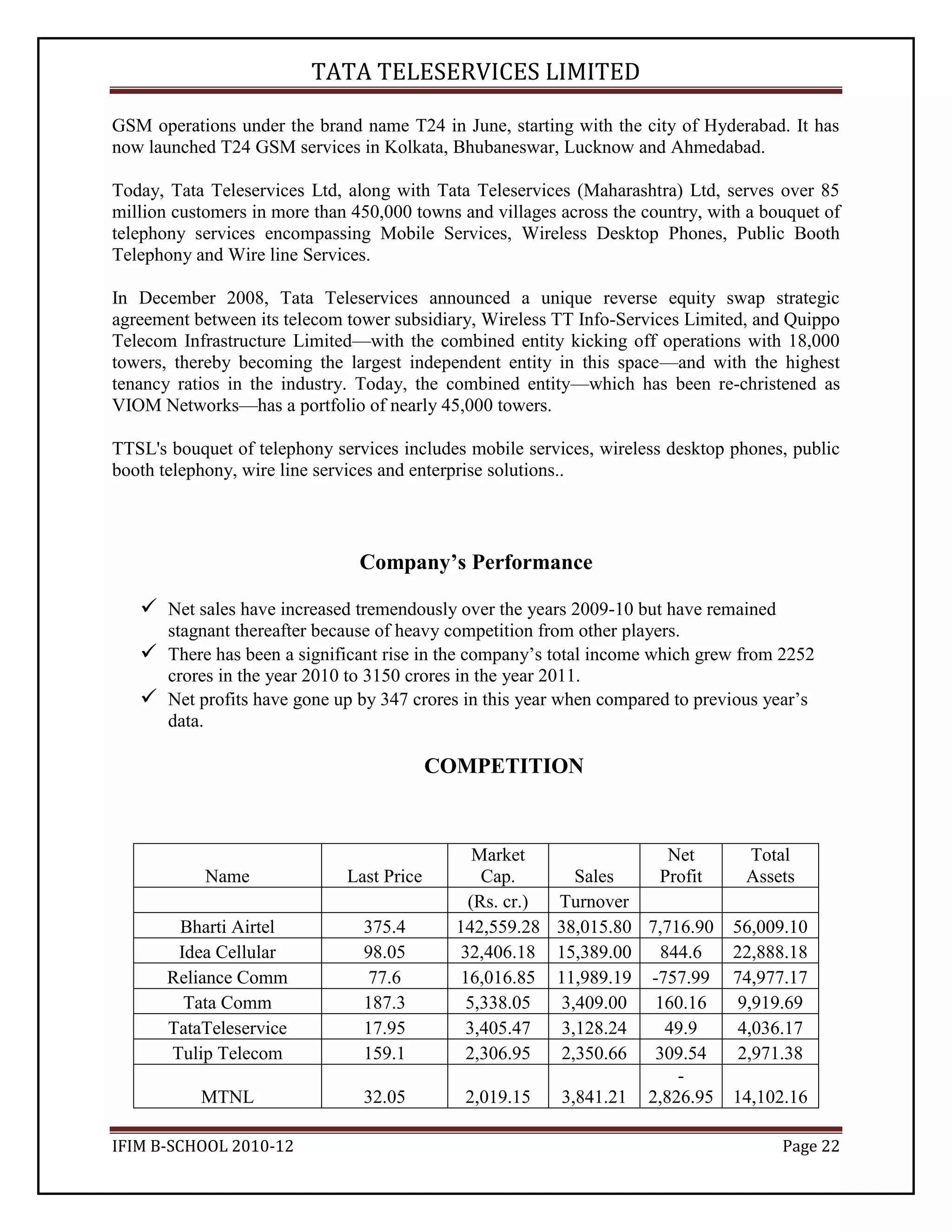

The document provides an overview of the Indian telecom industry including key statistics and economic analysis. It states that India has the second largest number of subscribers globally and is projected to become the largest mobile market by 2013. The telecom sector contributes around 3% to India's economy and is growing rapidly, though it has also faced scandals. The document then analyzes financial data and performance metrics of major telecom companies in India.

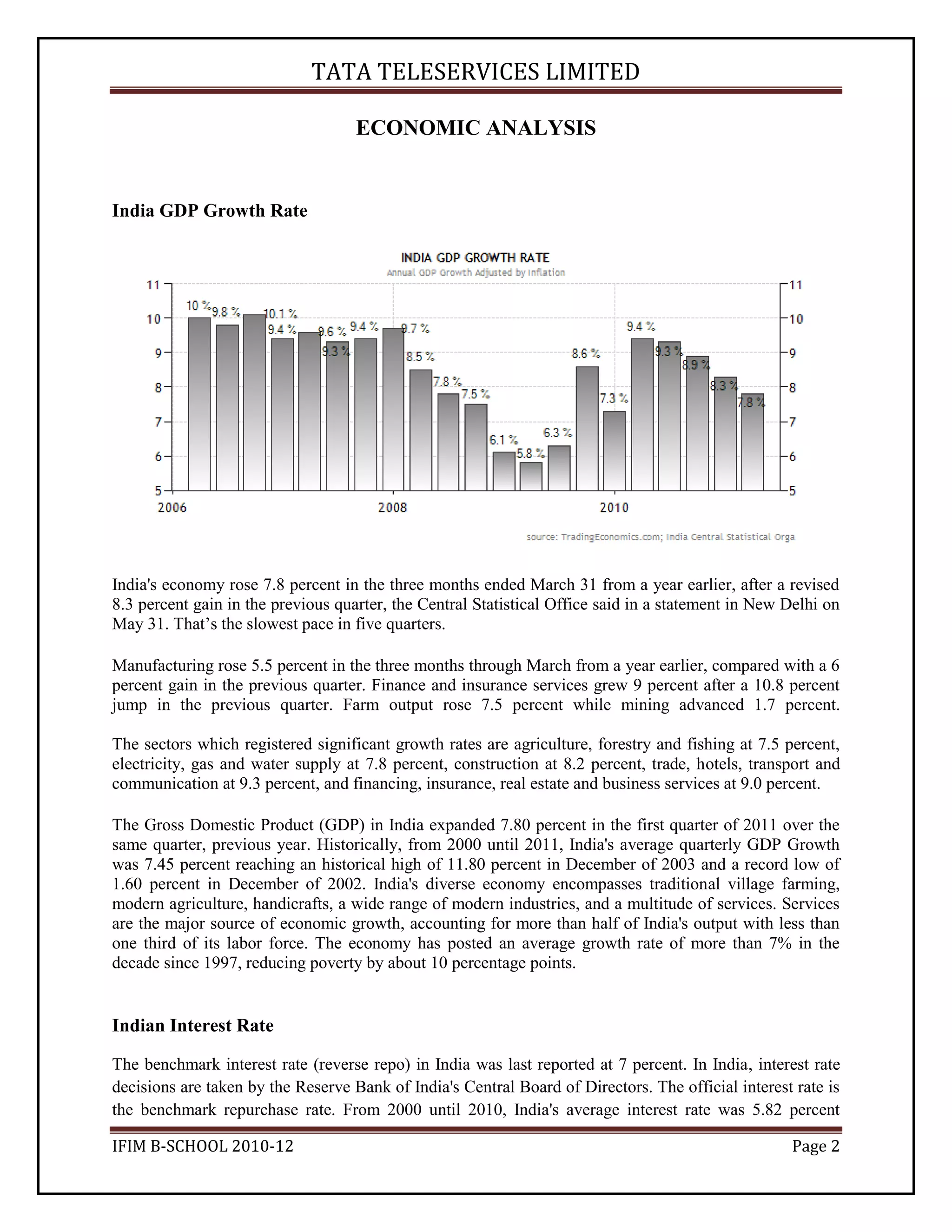

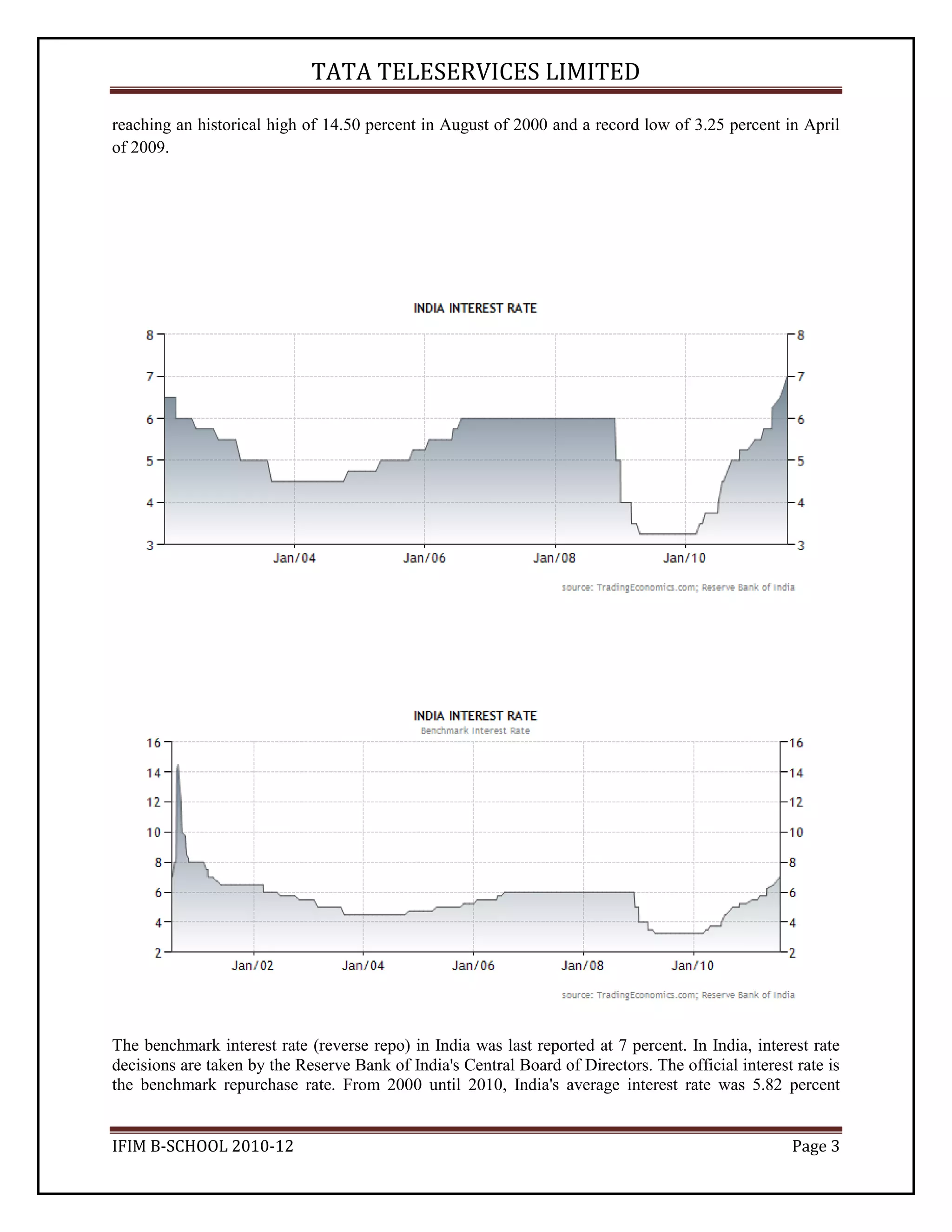

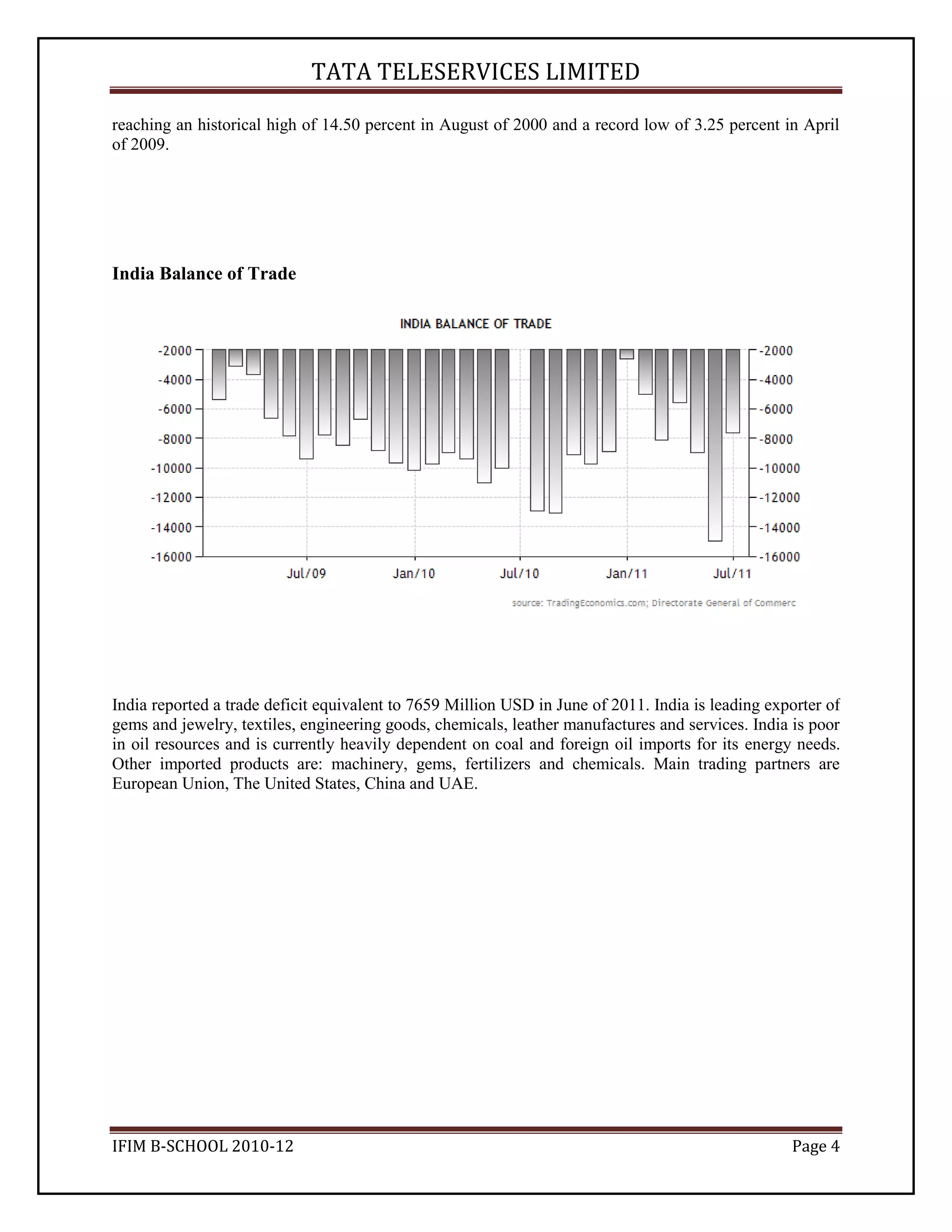

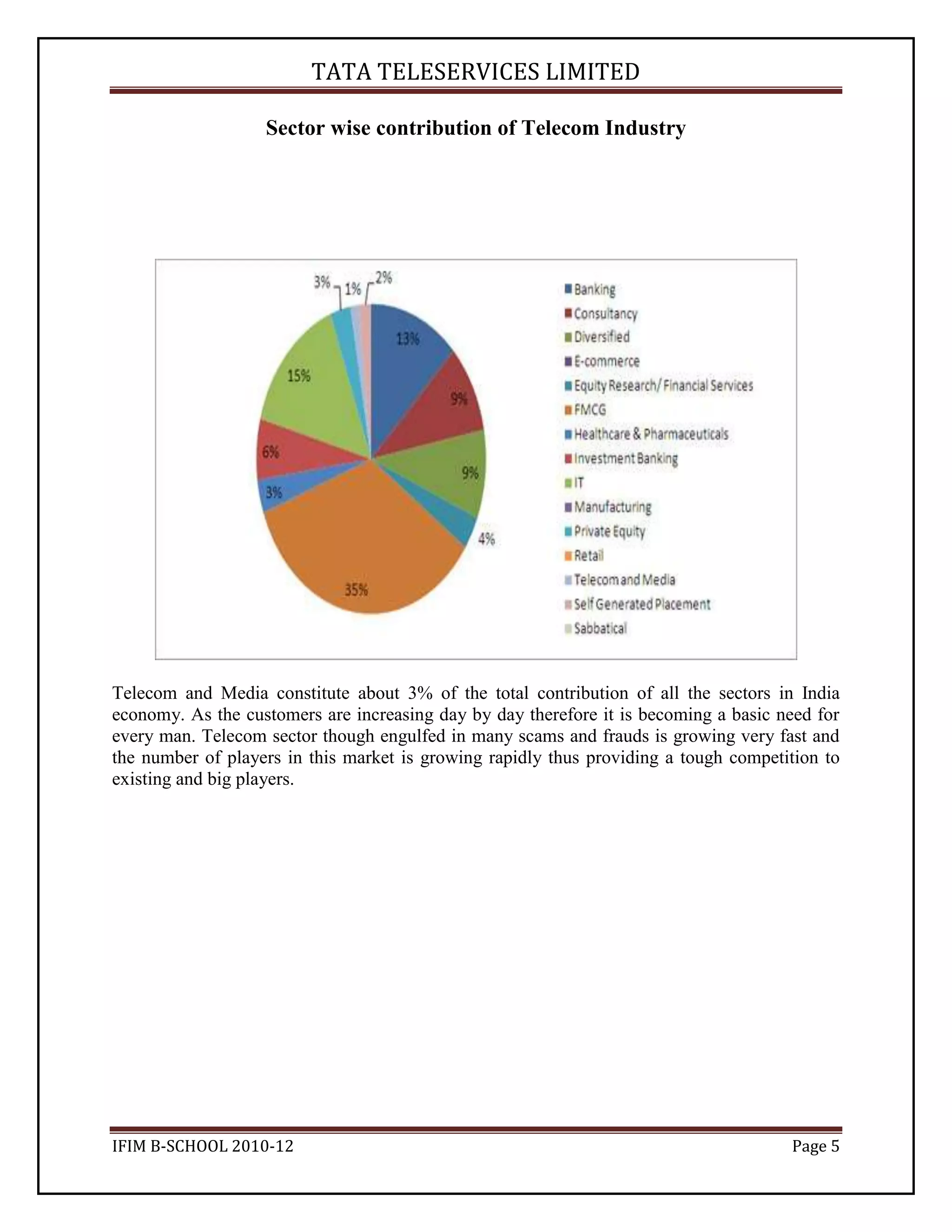

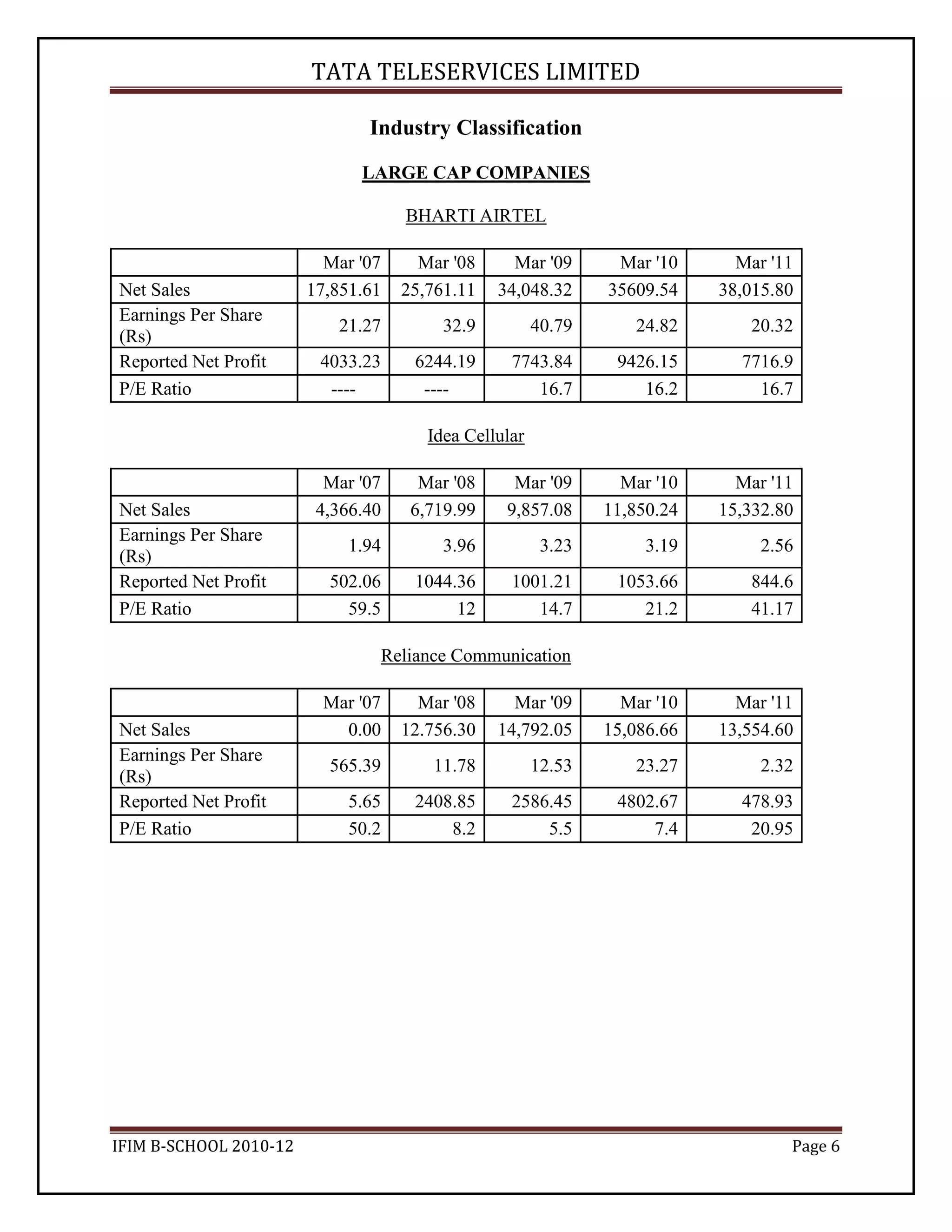

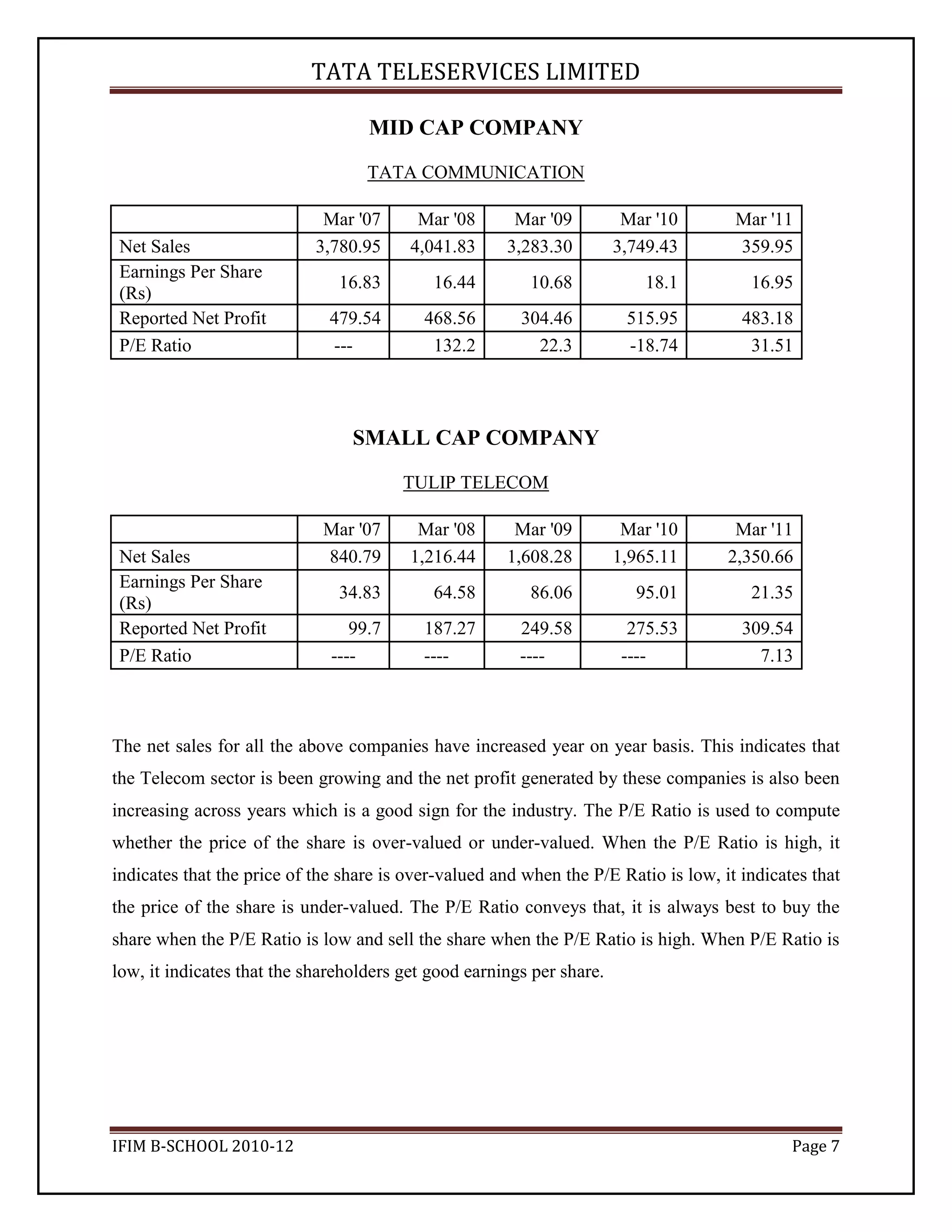

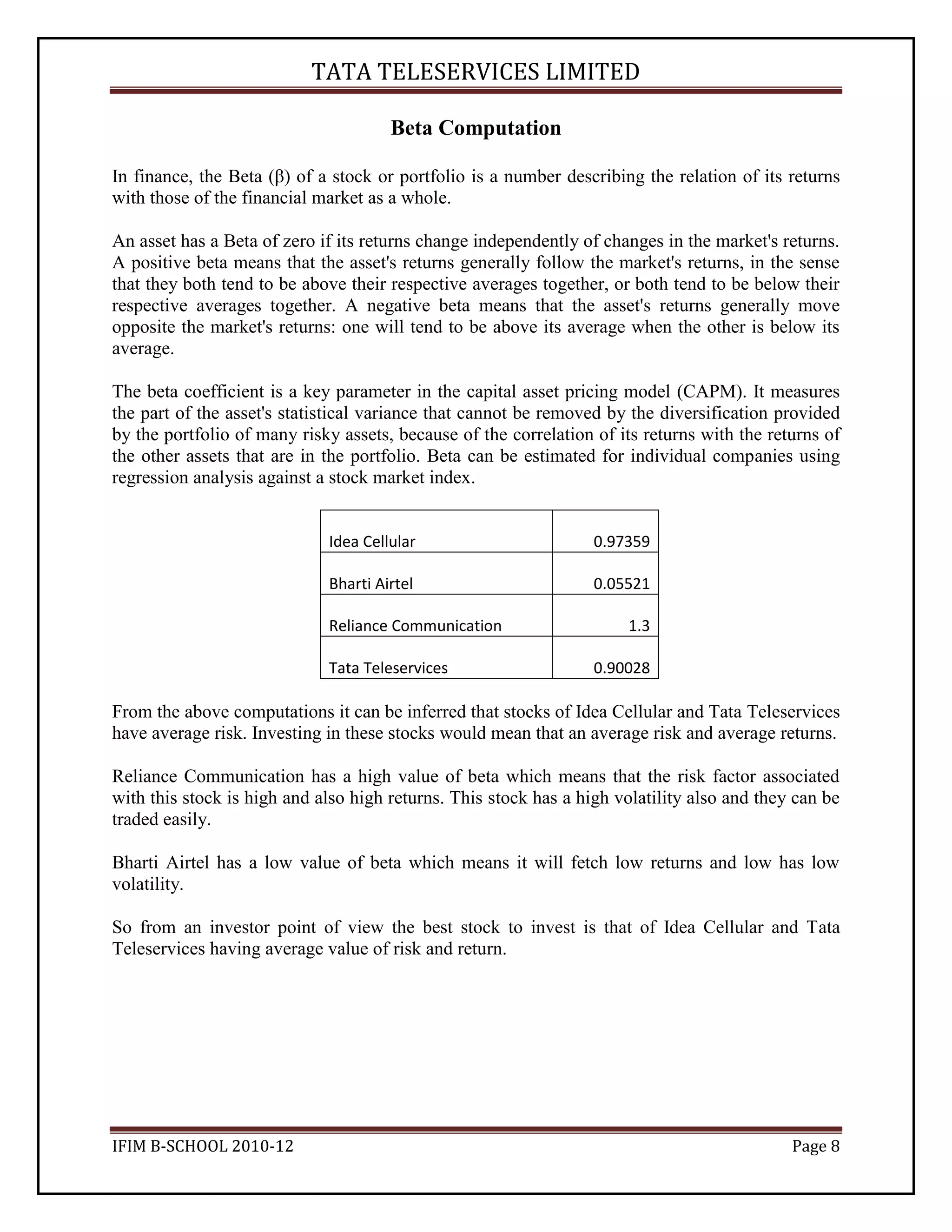

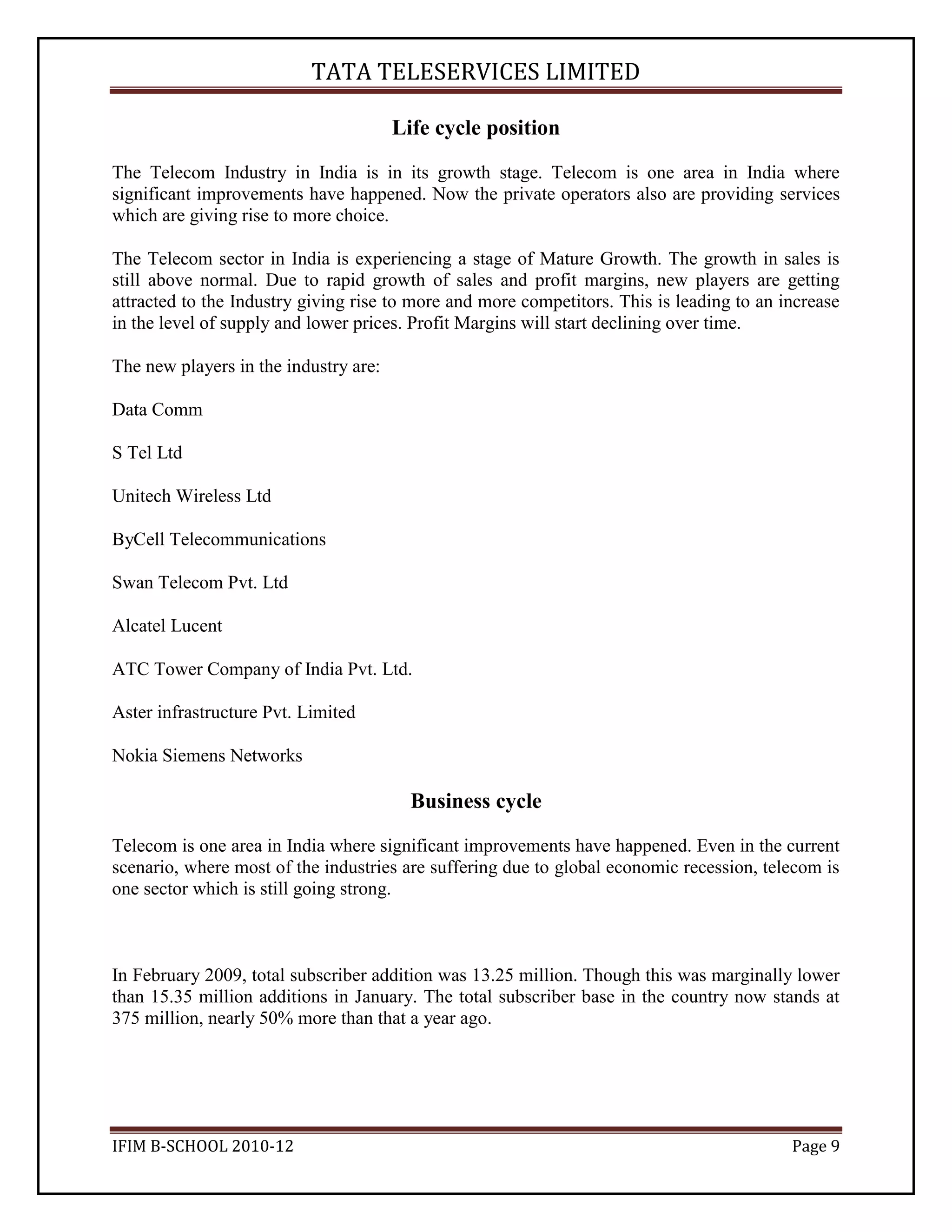

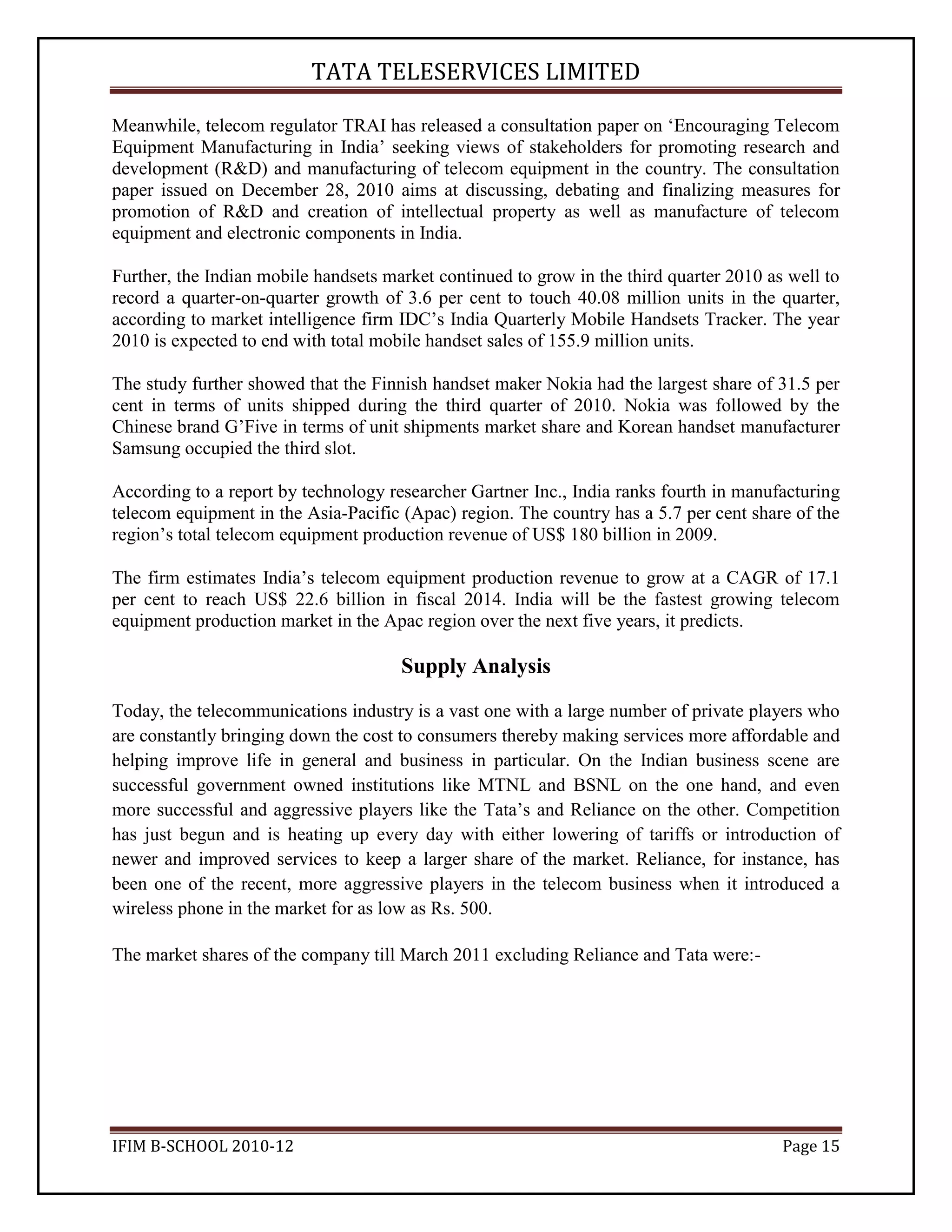

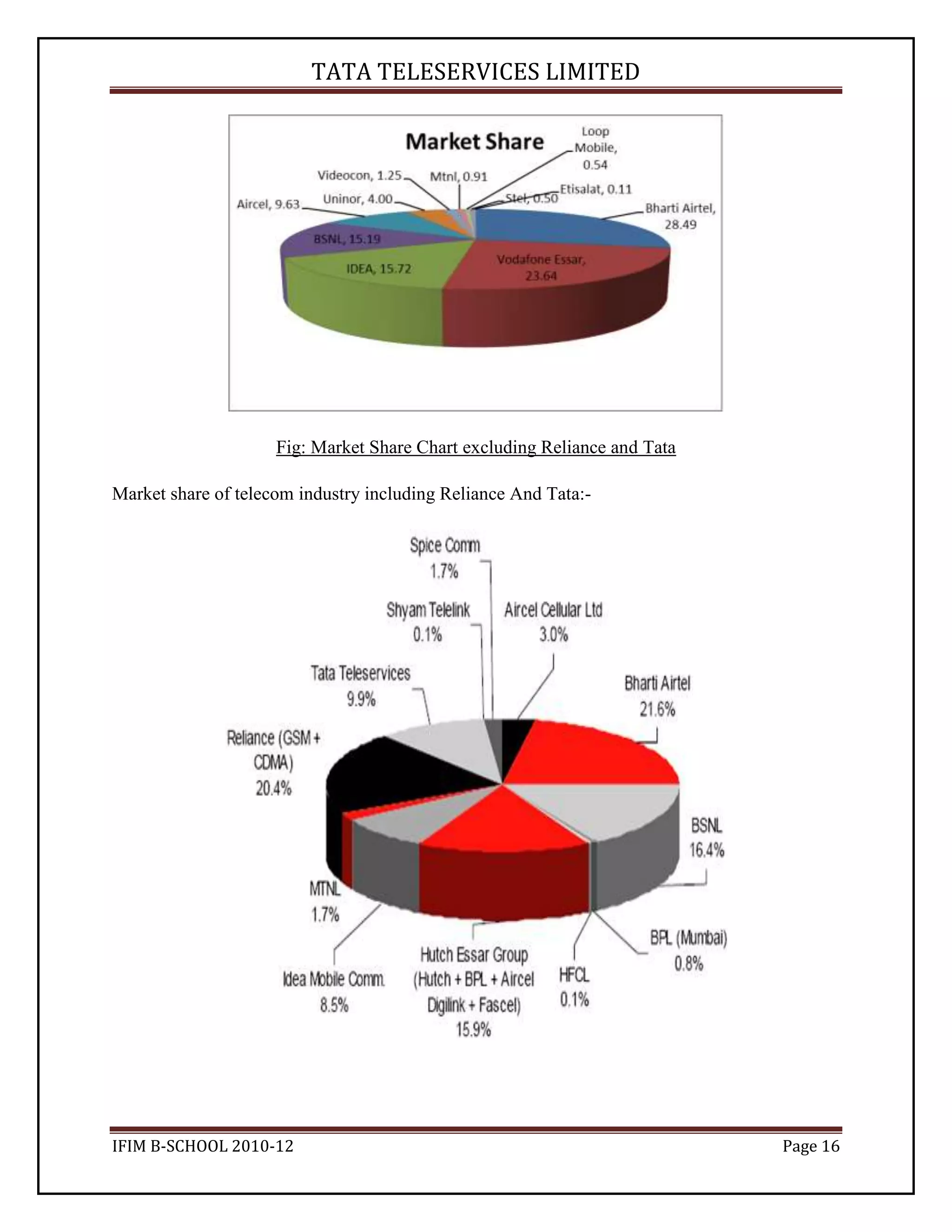

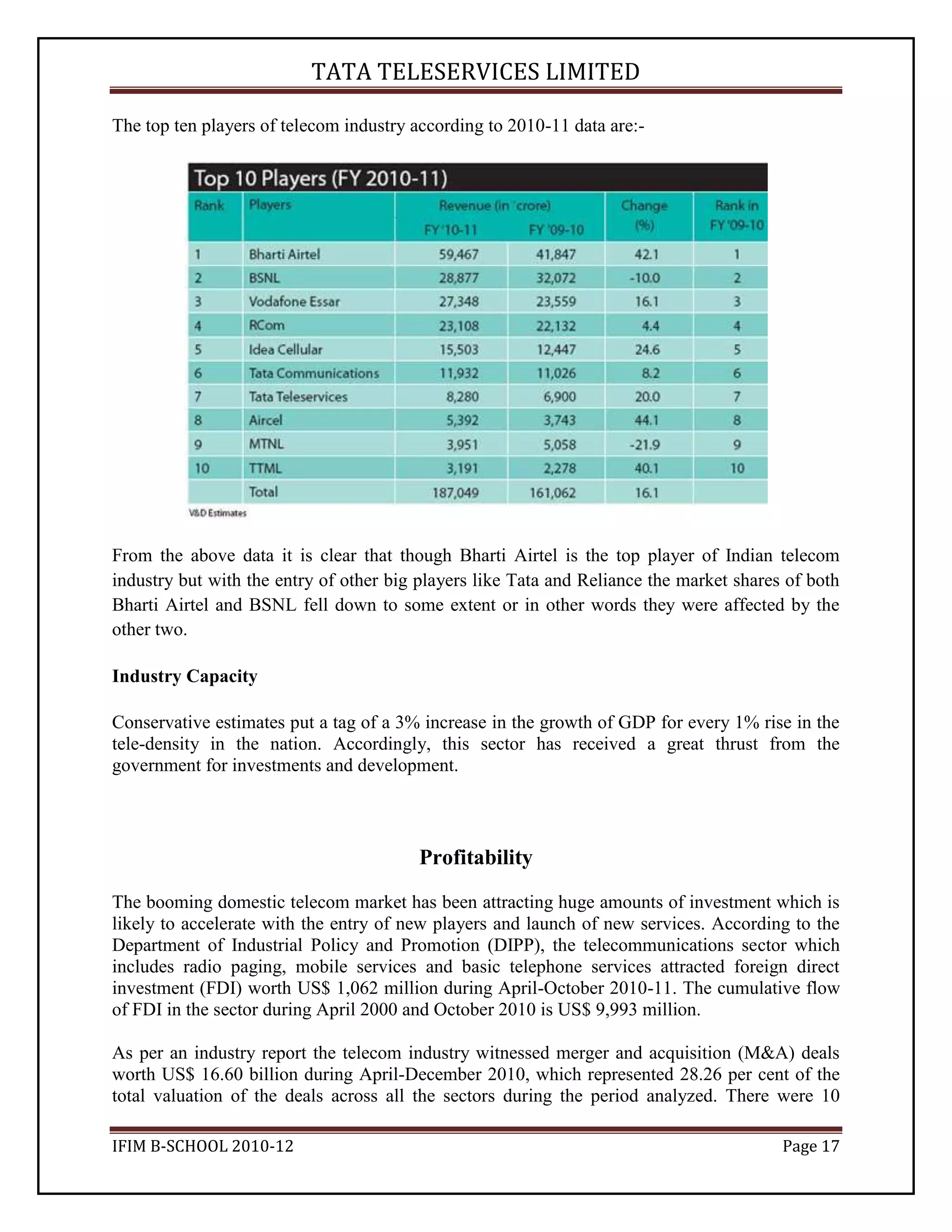

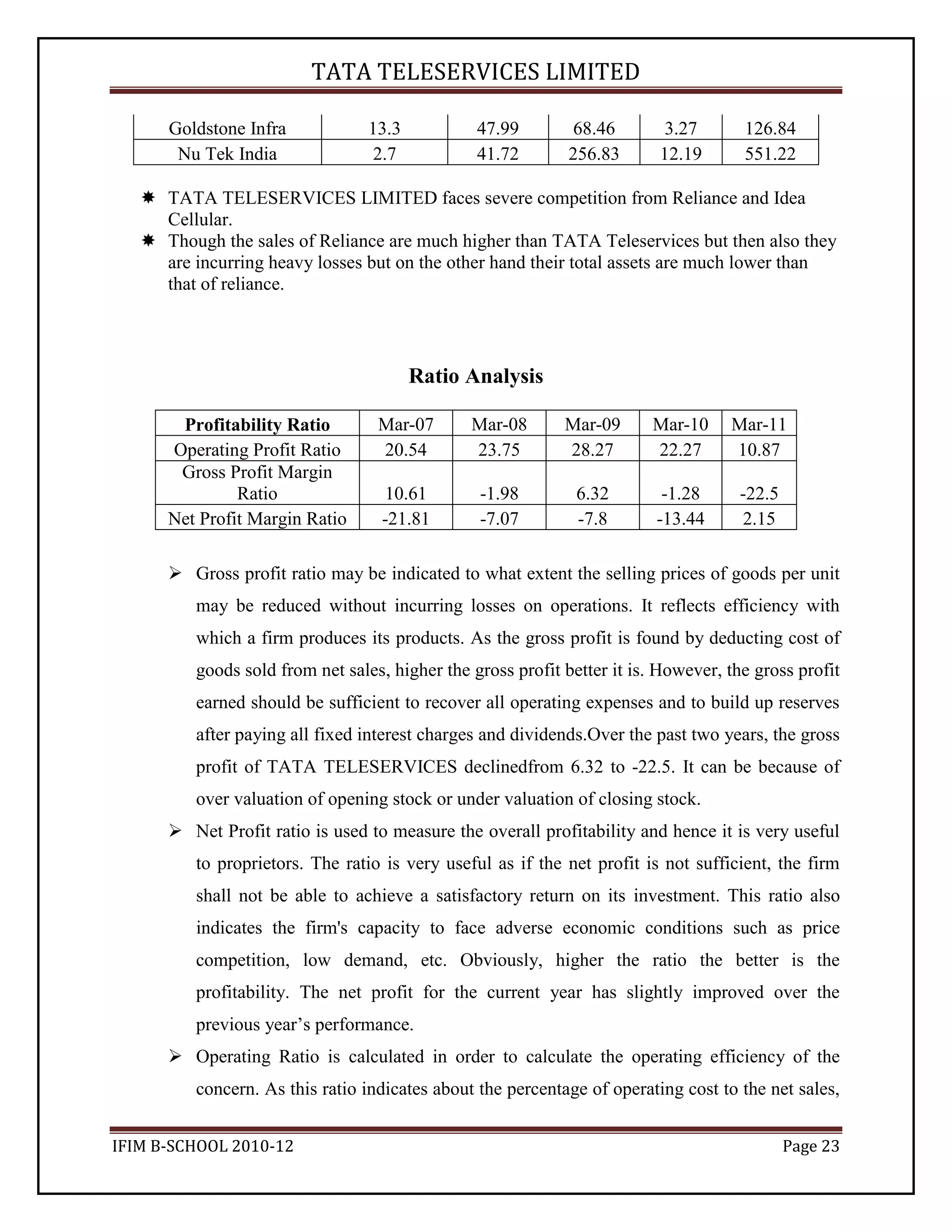

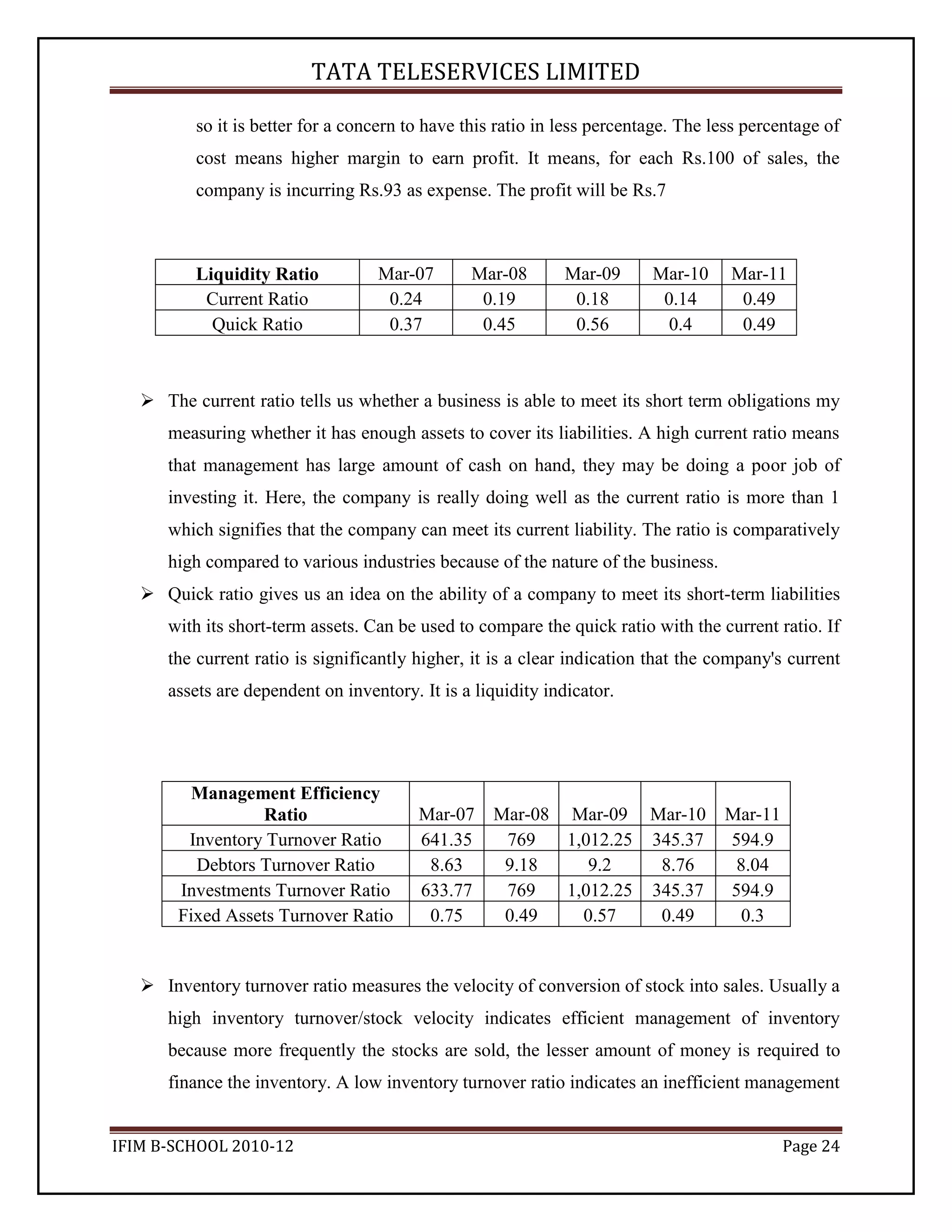

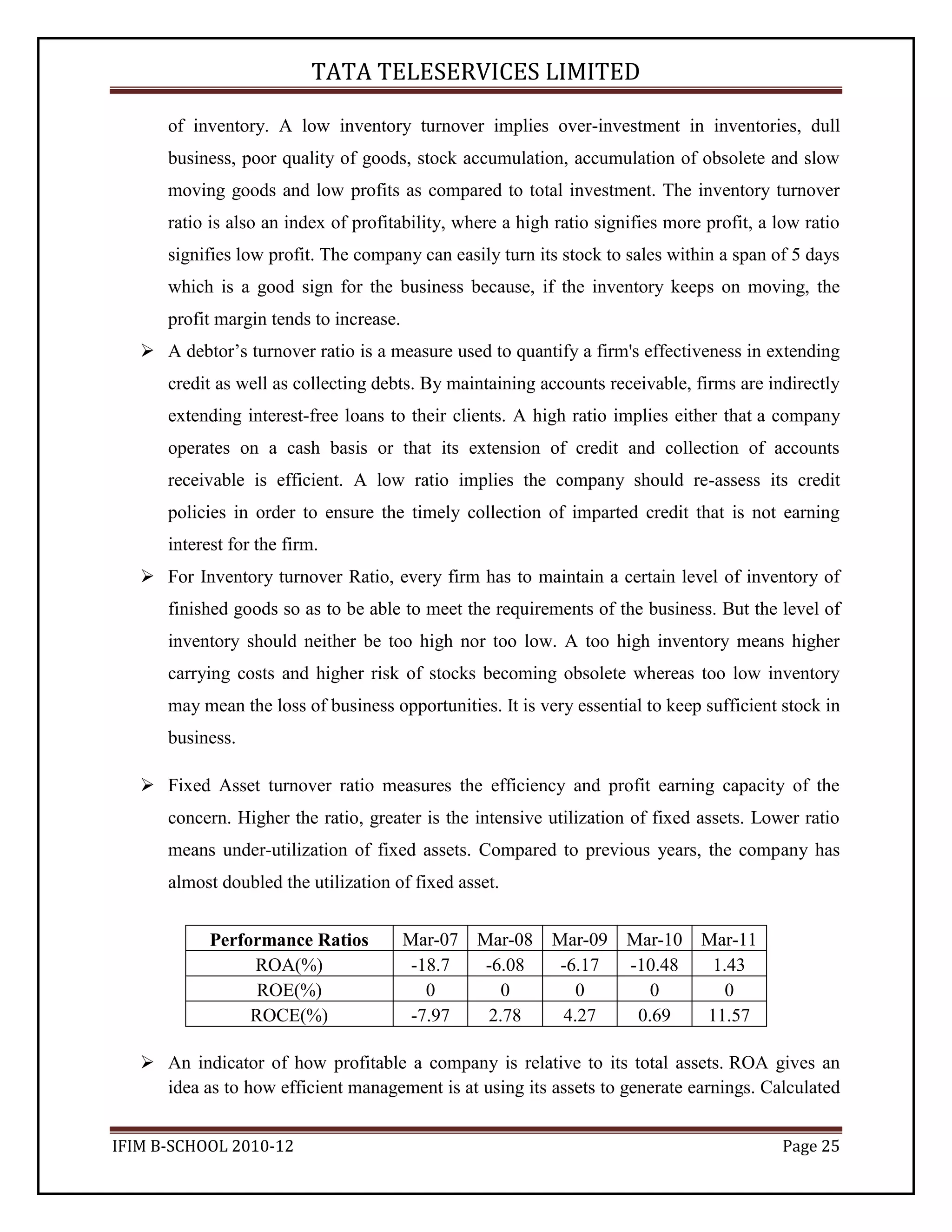

![Introduction to Indian telecom Industry<br />The Republic of India possesses a diversified communications system that links all parts of the country by Internet, telephone, telegraph, radio, and television. None of the telecommunications forms are as prevalent or as advanced as those in modern Western countries, but the system includes some of the most sophisticated technology in the world and constitutes a foundation for further development of a modern network. Indian telecommunication industry is the world's second-largest in terms of number of subscribers, and the world's fastest growing market in terms of number of new subscriber. India had 851.70 million mobile phone subscribers at the end of June 2011. The country has third highest number of Internet users as of December 2010. The primary regulator of communications in India is the Telecom Regulatory Authority of India. It closely regulates all of the industries mentioned below with the exception of newspapers and the Internet service provider industry.<br />As the fastest growing telecommunications market in the world, India is projected to have 1.159 billion mobile subscribers by 2013. Several leading global consultancies estimate that India will become the world's largest mobile phone market by subscriptions by 2013. The industry is expected to reach a size of 344,921 crore (US$76.92 billion) by 2012 at a growth rate of over 26 per cent, and generate employment opportunities for about 10 million people during the same period.[11] According to analysts, the sector would create direct employment for 2.8 million people and for 7 million indirectly.[11] In 2008-09 the overall telecom equipment revenue in India stood at 136,833 crore (US$30.51 billion) during the fiscal, as against 115,382 crore (US$25.73 billion) a year before.<br />ECONOMIC ANALYSIS<br />India GDP Growth Rate<br />India's economy rose 7.8 percent in the three months ended March 31 from a year earlier, after a revised 8.3 percent gain in the previous quarter, the Central Statistical Office said in a statement in New Delhi on May 31. That’s the slowest pace in five quarters. Manufacturing rose 5.5 percent in the three months through March from a year earlier, compared with a 6 percent gain in the previous quarter. Finance and insurance services grew 9 percent after a 10.8 percent jump in the previous quarter. Farm output rose 7.5 percent while mining advanced 1.7 percent. The sectors which registered significant growth rates are agriculture, forestry and fishing at 7.5 percent, electricity, gas and water supply at 7.8 percent, construction at 8.2 percent, trade, hotels, transport and communication at 9.3 percent, and financing, insurance, real estate and business services at 9.0 percent.The Gross Domestic Product (GDP) in India expanded 7.80 percent in the first quarter of 2011 over the same quarter, previous year. Historically, from 2000 until 2011, India's average quarterly GDP Growth was 7.45 percent reaching an historical high of 11.80 percent in December of 2003 and a record low of 1.60 percent in December of 2002. India's diverse economy encompasses traditional village farming, modern agriculture, handicrafts, a wide range of modern industries, and a multitude of services. Services are the major source of economic growth, accounting for more than half of India's output with less than one third of its labor force. The economy has posted an average growth rate of more than 7% in the decade since 1997, reducing poverty by about 10 percentage points. <br />Indian Interest Rate<br />The benchmark interest rate (reverse repo) in India was last reported at 7 percent. In India, interest rate decisions are taken by the Reserve Bank of India's Central Board of Directors. The official interest rate is the benchmark repurchase rate. From 2000 until 2010, India's average interest rate was 5.82 percent reaching an historical high of 14.50 percent in August of 2000 and a record low of 3.25 percent in April of 2009. <br />The benchmark interest rate (reverse repo) in India was last reported at 7 percent. In India, interest rate decisions are taken by the Reserve Bank of India's Central Board of Directors. The official interest rate is the benchmark repurchase rate. From 2000 until 2010, India's average interest rate was 5.82 percent reaching an historical high of 14.50 percent in August of 2000 and a record low of 3.25 percent in April of 2009. <br />India Balance of Trade<br />India reported a trade deficit equivalent to 7659 Million USD in June of 2011. India is leading exporter of gems and jewelry, textiles, engineering goods, chemicals, leather manufactures and services. India is poor in oil resources and is currently heavily dependent on coal and foreign oil imports for its energy needs. Other imported products are: machinery, gems, fertilizers and chemicals. Main trading partners are European Union, The United States, China and UAE. <br />Sector wise contribution of Telecom Industry<br />Telecom and Media constitute about 3% of the total contribution of all the sectors in India economy. As the customers are increasing day by day therefore it is becoming a basic need for every man. Telecom sector though engulfed in many scams and frauds is growing very fast and the number of players in this market is growing rapidly thus providing a tough competition to existing and big players.<br />Industry Classification<br />LARGE CAP COMPANIES<br />BHARTI AIRTEL<br /> Mar '07Mar '08Mar '09Mar '10Mar '11Net Sales17,851.6125,761.1134,048.3235609.5438,015.80Earnings Per Share (Rs)21.2732.940.7924.8220.32Reported Net Profit4033.236244.197743.849426.157716.9P/E Ratio--------16.716.216.7<br />Idea Cellular<br /> Mar '07Mar '08Mar '09Mar '10Mar '11Net Sales4,366.406,719.999,857.0811,850.2415,332.80Earnings Per Share (Rs)1.943.963.233.192.56Reported Net Profit502.061044.361001.211053.66844.6P/E Ratio59.51214.721.241.17<br />Reliance Communication<br /> Mar '07Mar '08Mar '09Mar '10Mar '11Net Sales0.0012.756.3014,792.0515,086.6613,554.60Earnings Per Share (Rs)565.3911.7812.5323.272.32Reported Net Profit5.652408.852586.454802.67478.93P/E Ratio50.28.25.57.420.95<br />MID CAP COMPANY<br />TATA COMMUNICATION<br /> Mar '07Mar '08Mar '09Mar '10Mar '11Net Sales3,780.954,041.833,283.303,749.43359.95Earnings Per Share (Rs)16.8316.4410.6818.116.95Reported Net Profit479.54468.56304.46515.95483.18P/E Ratio---132.222.3-18.7431.51<br />SMALL CAP COMPANY<br />TULIP TELECOM<br /> Mar '07Mar '08Mar '09Mar '10Mar '11Net Sales840.791,216.441,608.281,965.112,350.66Earnings Per Share (Rs)34.8364.5886.0695.0121.35Reported Net Profit99.7187.27249.58275.53309.54P/E Ratio----------------7.13<br />The net sales for all the above companies have increased year on year basis. This indicates that the Telecom sector is been growing and the net profit generated by these companies is also been increasing across years which is a good sign for the industry. The P/E Ratio is used to compute whether the price of the share is over-valued or under-valued. When the P/E Ratio is high, it indicates that the price of the share is over-valued and when the P/E Ratio is low, it indicates that the price of the share is under-valued. The P/E Ratio conveys that, it is always best to buy the share when the P/E Ratio is low and sell the share when the P/E Ratio is high. When P/E Ratio is low, it indicates that the shareholders get good earnings per share. <br />Beta Computation<br />In finance, the Beta (β) of a stock or portfolio is a number describing the relation of its returns with those of the financial market as a whole.<br />An asset has a Beta of zero if its returns change independently of changes in the market's returns. A positive beta means that the asset's returns generally follow the market's returns, in the sense that they both tend to be above their respective averages together, or both tend to be below their respective averages together. A negative beta means that the asset's returns generally move opposite the market's returns: one will tend to be above its average when the other is below its average.<br />The beta coefficient is a key parameter in the capital asset pricing model (CAPM). It measures the part of the asset's statistical variance that cannot be removed by the diversification provided by the portfolio of many risky assets, because of the correlation of its returns with the returns of the other assets that are in the portfolio. Beta can be estimated for individual companies using regression analysis against a stock market index.<br />Idea Cellular0.97359Bharti Airtel0.05521Reliance Communication1.3Tata Teleservices0.90028<br />From the above computations it can be inferred that stocks of Idea Cellular and Tata Teleservices have average risk. Investing in these stocks would mean that an average risk and average returns.<br />Reliance Communication has a high value of beta which means that the risk factor associated with this stock is high and also high returns. This stock has a high volatility also and they can be traded easily.<br />Bharti Airtel has a low value of beta which means it will fetch low returns and low has low volatility.<br />So from an investor point of view the best stock to invest is that of Idea Cellular and Tata Teleservices having average value of risk and return.<br />Life cycle position<br />The Telecom Industry in India is in its growth stage. Telecom is one area in India where significant improvements have happened. Now the private operators also are providing services which are giving rise to more choice.<br />The Telecom sector in India is experiencing a stage of Mature Growth. The growth in sales is still above normal. Due to rapid growth of sales and profit margins, new players are getting attracted to the Industry giving rise to more and more competitors. This is leading to an increase in the level of supply and lower prices. Profit Margins will start declining over time.<br />The new players in the industry are:<br />Data Comm<br />S Tel Ltd<br />Unitech Wireless Ltd<br />ByCell Telecommunications<br />Swan Telecom Pvt. Ltd<br />Alcatel Lucent<br />ATC Tower Company of India Pvt. Ltd.<br />Aster infrastructure Pvt. Limited<br />Nokia Siemens Networks<br />Business cycle<br />Telecom is one area in India where significant improvements have happened. Even in the current scenario, where most of the industries are suffering due to global economic recession, telecom is one sector which is still going strong.<br />In February 2009, total subscriber addition was 13.25 million. Though this was marginally lower than 15.35 million additions in January. The total subscriber base in the country now stands at 375 million, nearly 50% more than that a year ago.<br />External Factors<br />Government Policy Initiatives<br />The government plans to formulate a comprehensive ‘National Telecom Policy 2011’ including the recognition of Telecom as infrastructure and as an essential service, encouraging Green Telecom, steps to accelerate migration from IPv4 to IPv6 at the earliest, release of IPv6 standards by Telecom Engineering Centre for implementation in the country, etc., as per a press release by the Ministry of Communications & Information Technology.<br />Further, the government plans to take concrete steps towards finalization of ‘National Broadband Plan’ including strategy for implementation and initiation of steps for roll out of optical fiber.<br />The government has taken many proactive initiatives to facilitate the rapid growth of the Indian telecom industry.<br />In the area of telecom equipment manufacturing and provision of IT-enabled services, 100 per cent FDI is permitted<br />No cap on the number of access providers in any service area. In 2008, 122 new Unified Access Service (UAS) licenses were granted to 17 companies in 22 services areas of the country<br />Revised subscriber based criteria for allocation of Global System of Mobile Communication (GSM) and Code Division Multiple Access (CDMA) spectra were issued in January 2008<br />To provide infrastructure support for mobile services a scheme has been launched to provide support for setting up and managing 7,436 infrastructure sites spread over 500 districts in 27 states. As on December 31, 2009, about 6,956 towers had been set up under the scheme<br />According to the Consolidated Foreign Direct Investment (FDI) Policy document, the FDI limit in telecom services is 74 per cent subject to the following conditions:<br />This is applicable in case of Basic, Cellular, Unified Access Services, National/ International Long Distance, V-Sat, Public Mobile Radio Trunked Services (PMRTS), Global Mobile Personal Communications Services (GMPCS) and other value added Services<br />Both direct and indirect foreign investment in the licensee company shall be counted for the purpose of FDI ceiling. Foreign Investment shall include investment by Foreign Institutional Investors (FIIs), Non-resident Indians (NRIs), Foreign Currency Convertible Bonds (FCCBs), American Depository Receipts (ADRs), Global Depository Receipts (GDRs) and convertible preference shares held by foreign entity. In any case, the ‘Indian’ shareholding will not be less than 26 per cent<br />FDI up to 49 per cent is on the automatic route and beyond that on the government route. FDI in the licensee company/Indian promoters/investment companies including their holding companies shall require approval of the Foreign Investment Promotion Board (FIPB) if it has a bearing on the overall ceiling of 74 per cent. While approving the investment proposals, FIPB shall take note that investment is not coming from countries of concern and/or unfriendly entities<br />The investment approval by FIPB shall envisage the conditionality that the Company would adhere to license agreement<br />FDI shall be subject to laws of India and not the laws of the foreign country/countries<br />Technological Changes<br />Value-Added Services (VAS) Market<br />Mobile value added services (VAS) include text or SMS, menu-based services, downloading of music or ring tones, mobile TV, videos and sophisticated m-commerce applications. As per a report, ‘India Telecom 2010’ released by KPMG in December 2010, currently, the VAS market is worth US$ 2.45 billion-US$ 2.67 billion, which is around 10 per cent of the total revenue of the wireless industry. The share of VAS in wireless revenue is likely to increase to 12-13 per cent by 2011, on the back of increased operator focus on VAS due to continuous fall in voice tariffs, increasing penetration of feature rich handsets, availability of vernacular content and increased user adoption of VAS applications.<br />Tele-medicine<br />With increase in cell phone users to around 700 million and introduction of 3G services soon in the country, remote treatment and diagnosis of patients through mobile phones would become a reality in the near future. In fact, a few telecom operators and value-added service developers are planning to use mobile phones for diagnostic and treatment support, remote disease monitoring, health awareness and communication.<br />The Gujarat health department plans to connect all villages through its telemedicine network. The state government has so far expanded the reach of telemedicine services from 53 villages in 2008 to 453, and hopes to cross 500 villages soon. Jay Narayan Vyas, state health minister, said “First thing we plan to do is to start the 104 service over the phone. People can call up and talk to paramedics in call centers who can suggest the primary action to be taken in case of any health emergency. Also, they would be able to suggest generic and over the counter drugs.”<br />3G Services<br />The Department of Telecom has taken the pioneering decision of launching of 3G services by BSNL and MTNL and initiation of process for auction of spectrum for 3G services to private operators. Allocation of spectrum for 3G and BWA services was done through a controlled simultaneous, ascending e-auction process.<br />All the 71 blocks that were put up for auction across the 22 service areas in the country were sold, leaving no unsold lots. Auction for 3G spectrum ended on May 19, 2010 after 183 rounds of intense bidding over a span of 34 days. The Government is expected to morph revenue worth US$ 14.6 billion. All the available slots across 22 circles have been sold to seven different operators.<br />A pan-India bid for third generation spectrum stood at US$ 3.6 billion. The Anil Ambani-led Reliance Communication bagged the highest number of 13 circles at a cost of US$ 1.9 billion, followed by Bharti Airtel in 12, Idea in 11 and Vodafone and the Tata’s in nine circles each, according to the Department of Telecommunications. MTNL and BSNL will have to pay US$ 1.42 billion and US$ 2.2 billion respectively.<br />3G spectra have already been allotted to successful bidders for commercial use on September 1, 2010 as per the timelines indicated in the Notice Inviting Application (NIA) and in the Letter of Intent issued after the bid amounts were deposited. The 3G spectrum has been allotted to AirTel, Aircel, Vodafone, S Tel, Reliance, Idea Cellular and Tata Cellular Services who won the bids through the electronic auction spread over a period of 34 days in respect of 3G and 16 days in respect of BWA. The BWA spectra have also been assigned to the successful bidders which are Aircel, Augere, Tikona, Qualcomm, Infotel and Bharti. 3G & BWA spectrum would enable users to have value added services like video streaming, mobile internet access, higher & faster data downloads.<br />Rural Telephony<br />The rural Telephone connections have gone up from 3.6 million in 1999 to 12.3 million in March 2004 and further to 200.77 million in March 2010. Their share in the total telephones has constantly increased from around 14 per cent in 2005 to 32.75 per cent at the end of October 2010. The rural subscribers have grown to 243.04 million at the end of October 2010. The wireless connections have contributed substantially to total rural telephone connections; it stands at 233.95 million in October 2010. During 2010-11, the growth rate of rural telephones was 21.05 per cent as against 18.69 per cent of urban telephones.<br />The private sector has contributed to the growth of rural telephones as it provided about 84.27 per cent of rural telephones during October 2010.<br />The government plans to connect all revenue villages in India either through landline, mobile or WLL by February 2011. “We have already connected about 96 per cent of the revenue villages. The remaining 25,000 villages will have connectivity by February 2011,” stated Mr. Sachin Pilot, Minister of State for Communications and IT.<br />Further, the Government, under Bharat Nirman II Programme, has envisaged providing broadband coverage to all 250,000 Gram Panchayats by 2012.<br />Demographics<br />The following demographic statistics are from the CIA World Fact book:-<br />Total Population<br />1,147.996 million (July 2008 est. CIA)<br />Rural Population<br />72.2%, male: 381,668,992, female: 360,948,755 <br />Age structure%In this age groupMaleFemale 0 to 14 years30.80%188,208,196171,356,02415 to 64 years64.30%386,432,921364,215,75965 and above4.90%27,258,25930,031,289<br />The median age of Indians is 25.1 years.<br />The majority of the Indian population is in the age group of 15-64 years. Mostly users of mobile phones belong to this category of age. Hence, Indian holds a great potential market for telecom service providers. Even young generation of India is attracted more and more towards cell phones and this has become a trend and need of even small children in India. This assures a high growth in this industry in future.<br />Most of the service providers have covered majority of the urban population of India. But many far fledged villages of India still need to be connected through mobile phones. The untapped rural population of India is a huge proportion of the 72.2% total rural population of India. Also, the demand for telecom service in rural people is increasing day by day. This further ensures growth in the industry. <br />Demand Analysis<br />The Indian telecom industry has continued with its strong subscriber additions during the current year. At the end of December 2010, the total subscriber base stood at nearly 747 m, of which wireless subscribers contributed to nearly 94%. During March 2010, this figure had stood at about 578 m. The key reason for such a growth in subscriber base has been the affordability factor. With almost 15 operators competing for subscriber share, tariffs have been declining. Therefore while companies have added subscribers to their base, the benefits of the same have not really reflected in their financial performances. Added to this has been the burden of the interest costs related to the huge amounts of debt that most companies have taken on to fund the 3G spectrum fee. This has led most companies to operate on very thin margins.<br />Telecom industry in India has undergone a major revolution in the recent years and no doubt we all know that looking at the latest technologies that are being introduced to customers every day. India is ranked second worldwide in terms of having the largest telecommunication network only after China.<br />Tele-density in India has improved significantly over the recent years. The tele-density in India currently stands at 51%. All this has been possible owing to improving network infrastructure as a result of the ongoing investments. The launch of advanced telecom services like 3G and IPTV will also drive the growth in Indian telecom subscriber base over the forecast period. Furthermore, mobile handset market is also expected to register a robust growth in near future.<br />With a strong population of over 1.1 Billion, India has become one of the most dynamic and promising telecom markets of the world and has emerged as one of the fastest growing telecom markets in the world. During 2003-2007, the country witnessed the number of phones increasing more than triple and total tele-density rising from 5.1% to 18.2%.<br />Some major achievements of the Indian Telecom Industry:<br />The total telecom subscription in India surged at a CAGR of over 38% from fiscal 2003 to fiscal 2007, making the country the third largest telecom market in the world.<br />Mobile phones accounted for 80.2% of the total telephone subscriber base at the end of March 2007.<br />The Internet subscriber base in the country, as on March 31, 2007, stood at 9.3 Million as compared to 6.9 Million on March 31, 2006 registering a growth of 34.8%.<br /> By fiscal 2010, Indian will require around 330,000 telecom network towers. To meet this enormous need, the telecom operators are resorting to network infrastructure sharing.<br />Manufacturing<br />The Indian telecom industry manufactures a vast range of telecom equipment using state-of-the-art technology.<br />As per a press release by the Ministry of Communications & Information Technology, the production of telecom equipment in value terms is expected to increase from US$ 10.87 billion during 2008-09 to US$ 11.87 billion in 2010-2011. Favorable factors such as policy moves taken by the Government, incentives offered, large talent pool in R&D and low labor cost can provide an impetus to the industry. Exports increased from US$ 89.24 million in 2002-03 to US$ 3 billion in 2009-10 accounting for 26 per cent of the total equipment produced in the country and it is expected to increase to US$ 3.33 billion in 2010-11.<br />Meanwhile, telecom regulator TRAI has released a consultation paper on ‘Encouraging Telecom Equipment Manufacturing in India’ seeking views of stakeholders for promoting research and development (R&D) and manufacturing of telecom equipment in the country. The consultation paper issued on December 28, 2010 aims at discussing, debating and finalizing measures for promotion of R&D and creation of intellectual property as well as manufacture of telecom equipment and electronic components in India.<br />Further, the Indian mobile handsets market continued to grow in the third quarter 2010 as well to record a quarter-on-quarter growth of 3.6 per cent to touch 40.08 million units in the quarter, according to market intelligence firm IDC’s India Quarterly Mobile Handsets Tracker. The year 2010 is expected to end with total mobile handset sales of 155.9 million units.<br />The study further showed that the Finnish handset maker Nokia had the largest share of 31.5 per cent in terms of units shipped during the third quarter of 2010. Nokia was followed by the Chinese brand G’Five in terms of unit shipments market share and Korean handset manufacturer Samsung occupied the third slot.<br />According to a report by technology researcher Gartner Inc., India ranks fourth in manufacturing telecom equipment in the Asia-Pacific (Apac) region. The country has a 5.7 per cent share of the region’s total telecom equipment production revenue of US$ 180 billion in 2009.<br />The firm estimates India’s telecom equipment production revenue to grow at a CAGR of 17.1 per cent to reach US$ 22.6 billion in fiscal 2014. India will be the fastest growing telecom equipment production market in the Apac region over the next five years, it predicts.<br />Supply Analysis<br />Today, the telecommunications industry is a vast one with a large number of private players who are constantly bringing down the cost to consumers thereby making services more affordable and helping improve life in general and business in particular. On the Indian business scene are successful government owned institutions like MTNL and BSNL on the one hand, and even more successful and aggressive players like the Tata’s and Reliance on the other. Competition has just begun and is heating up every day with either lowering of tariffs or introduction of newer and improved services to keep a larger share of the market. Reliance, for instance, has been one of the recent, more aggressive players in the telecom business when it introduced a wireless phone in the market for as low as Rs. 500. <br />The market shares of the company till March 2011 excluding Reliance and Tata were:-<br />Fig: Market Share Chart excluding Reliance and Tata<br />Market share of telecom industry including Reliance And Tata:-<br />The top ten players of telecom industry according to 2010-11 data are:-<br />From the above data it is clear that though Bharti Airtel is the top player of Indian telecom industry but with the entry of other big players like Tata and Reliance the market shares of both Bharti Airtel and BSNL fell down to some extent or in other words they were affected by the other two.<br />Industry Capacity<br />Conservative estimates put a tag of a 3% increase in the growth of GDP for every 1% rise in the tele-density in the nation. Accordingly, this sector has received a great thrust from the government for investments and development.<br />Profitability<br />The booming domestic telecom market has been attracting huge amounts of investment which is likely to accelerate with the entry of new players and launch of new services. According to the Department of Industrial Policy and Promotion (DIPP), the telecommunications sector which includes radio paging, mobile services and basic telephone services attracted foreign direct investment (FDI) worth US$ 1,062 million during April-October 2010-11. The cumulative flow of FDI in the sector during April 2000 and October 2010 is US$ 9,993 million.<br />As per an industry report the telecom industry witnessed merger and acquisition (M&A) deals worth US$ 16.60 billion during April-December 2010, which represented 28.26 per cent of the total valuation of the deals across all the sectors during the period analyzed. There were 10 inbound, outbound and domestic M&A deals in the telecom sector during the first nine months of the current fiscal. The biggest M&A deal in the sector was made by telecommunications service provider Bharti Airtel through the acquisition of Zain’s African mobile services operations in 15 countries. The deal involved a transaction of US$ 10.7 billion. In another deal, Bharti Airtel acquired 100 per cent stake of Telecom Seychelles Ltd for US$ 62 million.<br />Other major M&A deals included the acquisition of 95 per cent stake in Infotel Broadband for US$ 1,032.26 million by Reliance Industries and 26 per cent stake of US-based mobile chipmaker Qualcomm’s Indian arm for US$ 57.72 million by India’s Tulip Telecom and Global Holding. Further, India-based GTL Infrastructure Ltd has bought 17,500 telecom towers of Aircel Ltd. for US$ 1,702.95 million.<br />Employment Generation<br />As the number of licensees goes up and they start their operations with 77 networks on air, the employment opportunities in this sector will be huge. <br />Going Global<br />In March 2010, Bharti Airtel bought the African operations of Kuwait-based Zain Telecom for US$ 10.7 billion, driving the Indian player into the league of top ten telecom players globally.<br />The Reserve Bank of India (RBI) has liberalized the investment norms for Indian telecom companies by allowing them to invest in international submarine cable consortia through the automatic route. In April 2010, RBI issued a notification stating “As a measure of further liberalization, it has now been decided… to allow Indian companies to participate in a consortium with other international operators to construct and maintain submarine cable systems on co-ownership basis under the automatic route.” The notification further added, “Accordingly, banks may allow remittances by Indian companies for overseas direct investment.”<br />SWOT ANALYSIS OF INDIAN TELECOM INDUSTRY<br />Indian Telecom market is one of the fastest growing markets in the world. Indian telecom network has about 562.21 million connections as on 31 December 2010. With 525.15 million wireless connections, Indian telecom has become the second largest wireless network in the world after China. About 15 million connections are being added every month. Wireless telephones are increasing at faster rate. The share of wireless telephones as on December 31, 2010 is above 93% of the total phones. The share of private sector in total telephone is about 82.33%. <br />Strengths <br />Huge Customer potential <br />High Growth Rate <br />Allowed FDI limit ranging from 74% to 100% <br />High return on Investment <br />Liberalization efforts by Govt. <br />Lower capital expenditure <br />Weakness <br />Poor Telecommunication Infrastructure <br />Late adopters of New Technology <br />Most competitive market <br />A market strongly regulated by Government. <br />Difficult to enter because of requirement of huge financial resources. <br />Opportunities <br />3G Telecom services and 4G services <br />More Quality Service <br />Value added Services (VAS) <br />Boost to Telecom Manufacturing Companies <br />Telecom Equipment Exports <br />Threats <br />Telecommunication Policies <br />Declining ARPU (average Revenue per user) <br />Partiality on the part of the Govt. <br />Content Piracy <br />ConfrontIndian Average ARPU is very low.Low contribution from rural India.Infrastructure and clearing issue.Lack of skilled labour.AvoidIndulgence in scams.Unskilled managers and engineers.Old technologyExploitUntapped markets like rural India.Technical skills of employees.Foreign markets.SearchNew marketing strategies.New untapped markets.Ecofriendly measures.Porter’s Five Forces Model<br />Company Analysis<br />TATA TELESERVICES LIMITED<br />Tata Teleservices Limited spearheads the Tata Group's presence in the telecom sector. The Tata Group includes over 90 companies, over 395,000 employees worldwide and more than 3.5 million shareholders.<br />Incorporated in 1996, Tata Teleservices is the pioneer of the CDMA 1x technology platform in India. It has embarked on a growth path since the acquisition of Hughes Tele.com (India) Ltd [renamed Tata Teleservices (Maharashtra) Limited] by the Tata Group in 2002. It launched mobile operations in January 2005 under the brand name Tata Indicom and today enjoys a pan-India presence through existing operations in all of India's 22 telecom Circles. The company is also the market leader in the fixed wireless telephony market. The company's network has been rated as the 'Least Congested' in India for six consecutive quarters by the Telecom Regulatory Authority of India through independent surveys.<br />Tata Teleservices Limited has also become the first Indian private telecom operator to launch 3G services in India under the brand name Tata DOCOMO, with its recent launch in all the nine telecom Circles where it bagged the 3G license. In association with its partner NTT DOCOMO, the Company finds itself favorably positioned to leverage this first-mover advantage. With 3G, Tata DOCOMO stands to redefine the very face of telecoms in India. Tokyo-based NTT DOCOMO is one of the world's leading mobile operators—in Japan, the company is the clear market leader, used by nearly 55 per cent of the country's mobile phone users.<br />Tata Teleservices Limited also has a significant presence in the GSM space, through its joint venture with NTT DOCOMO of Japan, and offers differentiated products and services under the Tata DOCOMO brand name. Tata DOCOMO arises out of the Tata Group's strategic alliance with Japanese telecom major NTT DOCOMO in November 2008. Tata DOCOMO has received a pan-India license to operate GSM telecom services—and has also been allotted spectrum in 18 telecom Circles. The company has rolled out GSM services in all of these 18 telecom Circles in the quick span of just over a year.<br />Tata DOCOMO marks a significant milestone in the Indian telecom landscape, and has already redefined the very face of telecoms in India, being the first to pioneer the per-second tariff option—part of its 'Pay for What You Use' pricing paradigm. Tokyo-based NTT DOCOMO is one of the world's leading mobile operators—in the Japanese market, the company is the clear market leader, used by over 50 per cent of the country's mobile phone users.<br />The Tata Teleservices Limited bouquet comprises four other brands as well—Virgin Mobile, Walky (which is the brand for fixed wireless phones), the Photon family (the company's brand that provides a variety of options for wireless mobile broadband access, and T24. TTSL recently entered into a strategic partnership agreement with Indian retail giant Future Group to offer mobile telephony services under a new brand name—T24—on the GSM platform. The exciting new brand was unveiled in February and the company announced the commercial launch of GSM operations under the brand name T24 in June, starting with the city of Hyderabad. It has now launched T24 GSM services in Kolkata, Bhubaneswar, Lucknow and Ahmedabad.<br />Today, Tata Teleservices Ltd, along with Tata Teleservices (Maharashtra) Ltd, serves over 85 million customers in more than 450,000 towns and villages across the country, with a bouquet of telephony services encompassing Mobile Services, Wireless Desktop Phones, Public Booth Telephony and Wire line Services.<br />In December 2008, Tata Teleservices announced a unique reverse equity swap strategic agreement between its telecom tower subsidiary, Wireless TT Info-Services Limited, and Quippo Telecom Infrastructure Limited—with the combined entity kicking off operations with 18,000 towers, thereby becoming the largest independent entity in this space—and with the highest tenancy ratios in the industry. Today, the combined entity—which has been re-christened as VIOM Networks—has a portfolio of nearly 45,000 towers.<br />TTSL's bouquet of telephony services includes mobile services, wireless desktop phones, public booth telephony, wire line services and enterprise solutions..<br />Company’s Performance<br />Net sales have increased tremendously over the years 2009-10 but have remained stagnant thereafter because of heavy competition from other players.<br />There has been a significant rise in the company’s total income which grew from 2252 crores in the year 2010 to 3150 crores in the year 2011.<br />Net profits have gone up by 347 crores in this year when compared to previous year’s data.<br />COMPETITION<br />NameLast PriceMarket Cap.SalesNet ProfitTotal Assets (Rs. cr.)Turnover Bharti Airtel375.4142,559.2838,015.807,716.9056,009.10Idea Cellular98.0532,406.1815,389.00844.622,888.18Reliance Comm77.616,016.8511,989.19-757.9974,977.17Tata Comm187.35,338.053,409.00160.169,919.69TataTeleservice17.953,405.473,128.2449.94,036.17Tulip Telecom159.12,306.952,350.66309.542,971.38MTNL32.052,019.153,841.21-2,826.9514,102.16Goldstone Infra13.347.9968.463.27126.84Nu Tek India2.741.72256.8312.19551.22<br />TATA TELESERVICES LIMITED faces severe competition from Reliance and Idea Cellular.<br />Though the sales of Reliance are much higher than TATA Teleservices but then also they are incurring heavy losses but on the other hand their total assets are much lower than that of reliance.<br />Ratio Analysis<br />Profitability RatioMar-07Mar-08Mar-09Mar-10Mar-11Operating Profit Ratio20.5423.7528.2722.2710.87Gross Profit Margin Ratio10.61-1.986.32-1.28-22.5Net Profit Margin Ratio-21.81-7.07-7.8-13.442.15<br />Gross profit ratio may be indicated to what extent the selling prices of goods per unit may be reduced without incurring losses on operations. It reflects efficiency with which a firm produces its products. As the gross profit is found by deducting cost of goods sold from net sales, higher the gross profit better it is. However, the gross profit earned should be sufficient to recover all operating expenses and to build up reserves after paying all fixed interest charges and dividends. Over the past two years, the gross profit of TATA TELESERVICES declined from 6.32 to -22.5. It can be because of over valuation of opening stock or under valuation of closing stock.](https://image.slidesharecdn.com/telecomindustryanalysis-111006142931-phpapp01/75/Tata-Teleservices-Industry-Analysis-1-2048.jpg)