This document discusses indemnity and guarantee contracts. It provides details on:

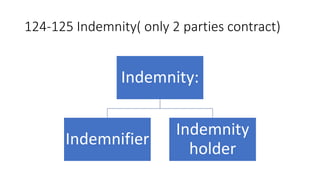

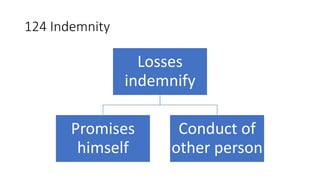

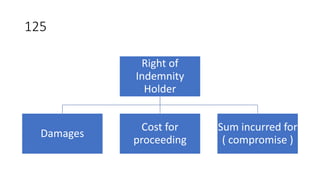

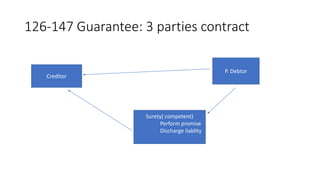

1) Indemnity contracts involve two parties - the indemnifier promises to compensate the indemnity holder for any losses or damages incurred. Guarantee contracts involve three parties - the creditor, principal debtor, and surety.

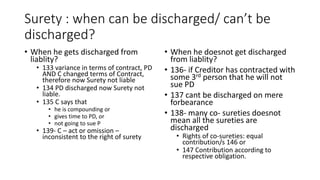

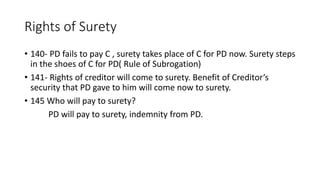

2) In a guarantee, the surety promises the creditor to discharge the liability of the principal debtor if they default. The principal debtor provides consideration to the surety by agreeing to reimburse them.

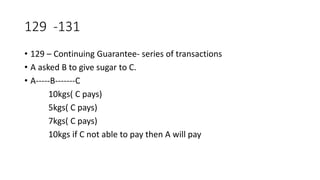

3) A continuing guarantee covers an ongoing or recurring series of transactions between the creditor and principal debtor. It remains in force until revoked by notice from the surety to the creditor.