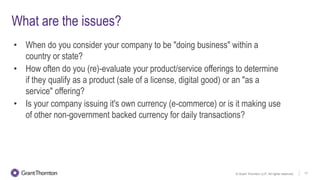

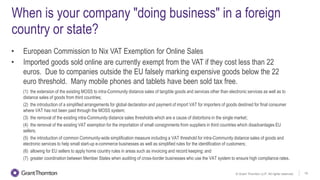

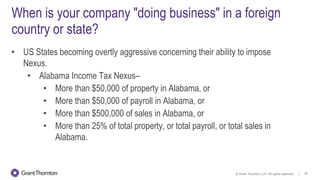

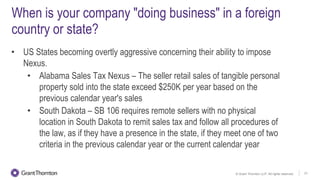

The document discusses the increasing regulatory complexity faced by technology companies, highlighting significant drivers of industry transformation and the implications of new domestic and international regulations. Key issues include data privacy, compliance with employment and tax laws, and the impacts of recent legal cases and corporate responses to evolving regulations. It also covers the importance of proactive measures companies can take to influence public policy and ensures proper classification of services for tax considerations.