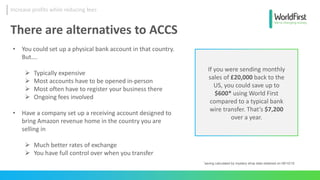

The document outlines how sellers on Amazon can increase profits by avoiding high currency exchange fees, which can be up to 3.75%. It suggests alternatives to Amazon's currency converter, such as using World First for better exchange rates and control over fund transfers. Additionally, it highlights the potential savings when transferring significant sales revenue back to the seller's home country.