- International trade has increased significantly in recent decades due to factors like globalization, regional economic blocs, and advances in transportation and communication technologies.

- When disputes arise in international contracts, it is often unclear which country's laws apply, which court has jurisdiction, or if access to favorable courts can be ensured.

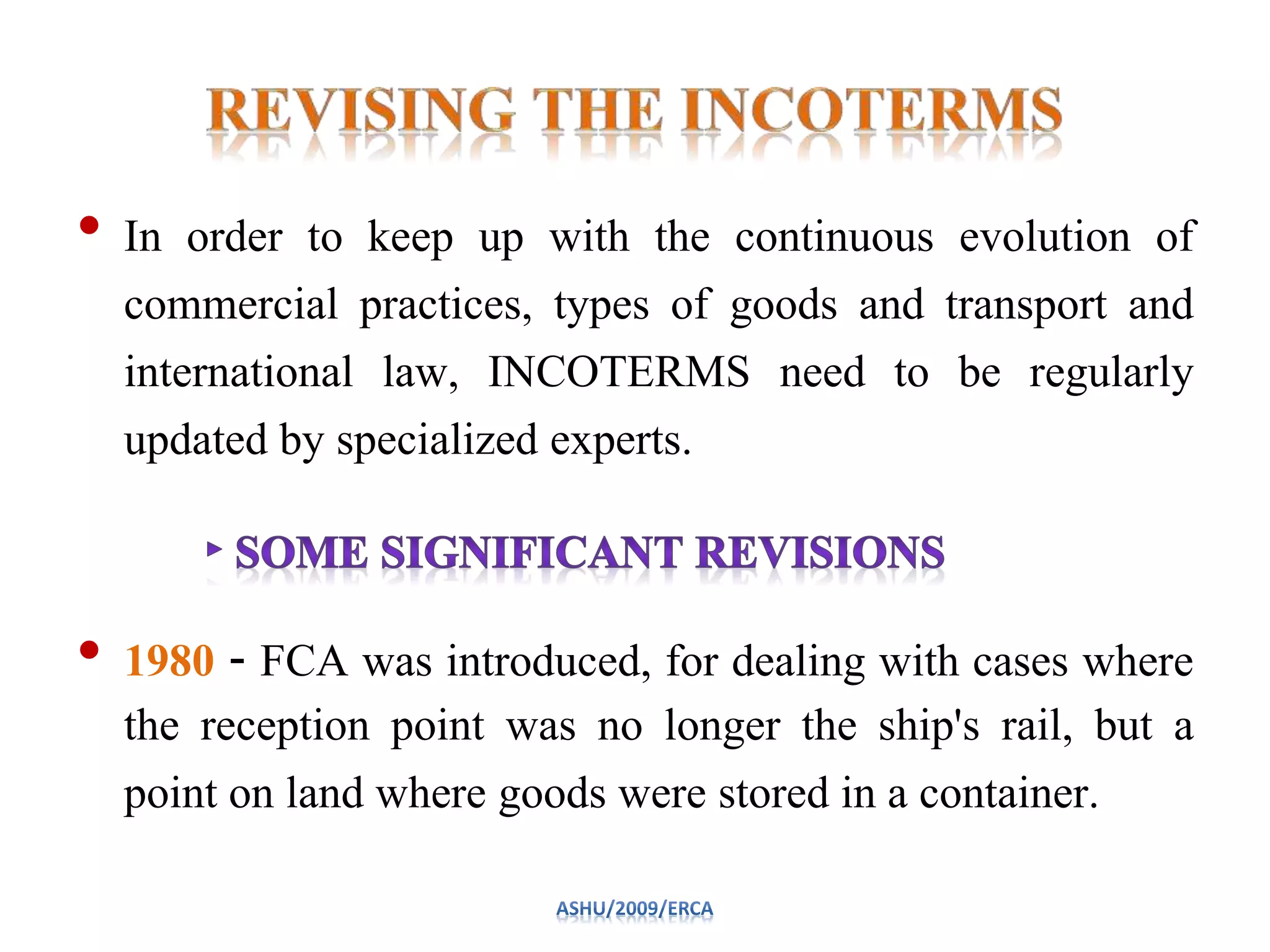

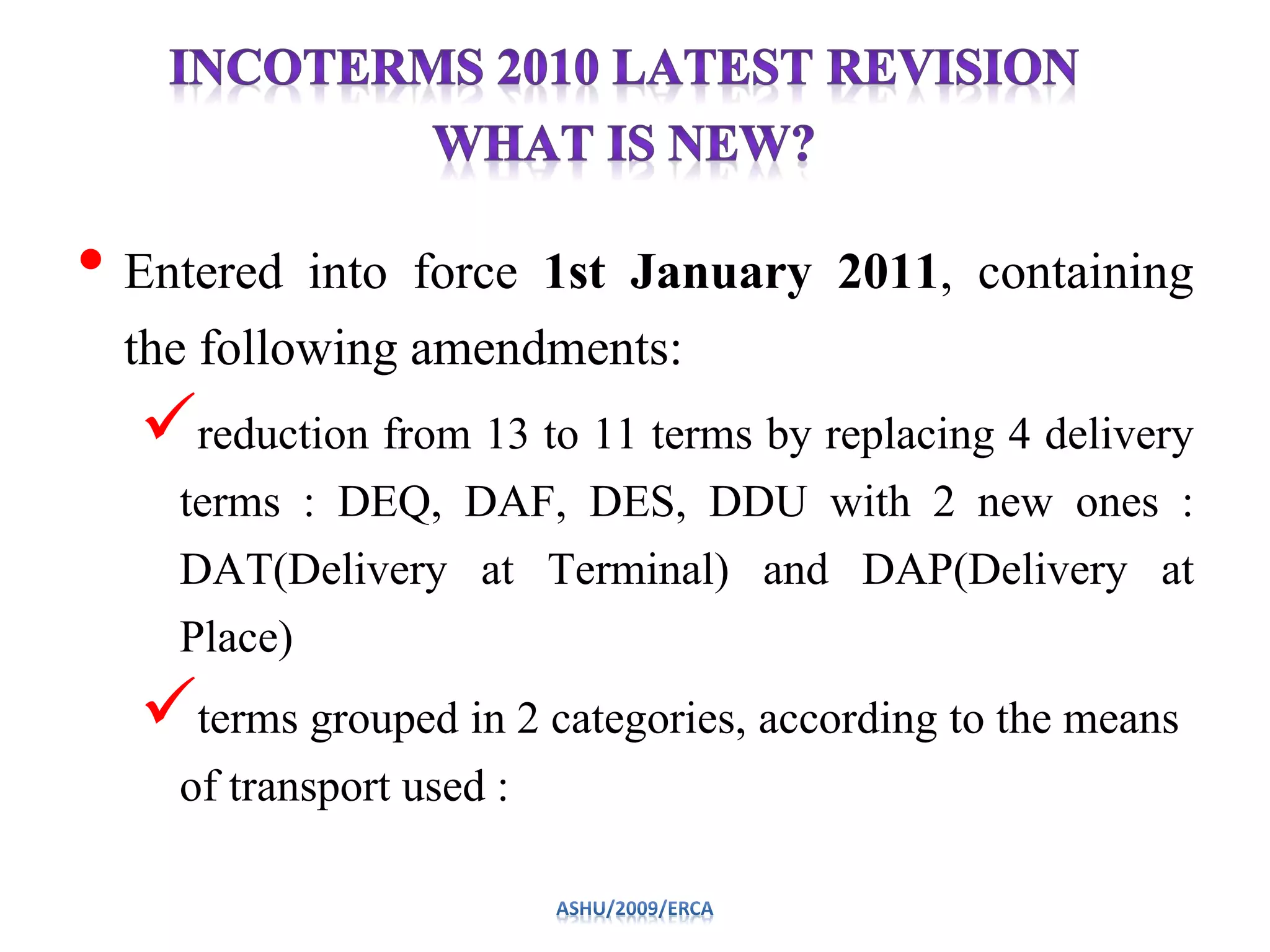

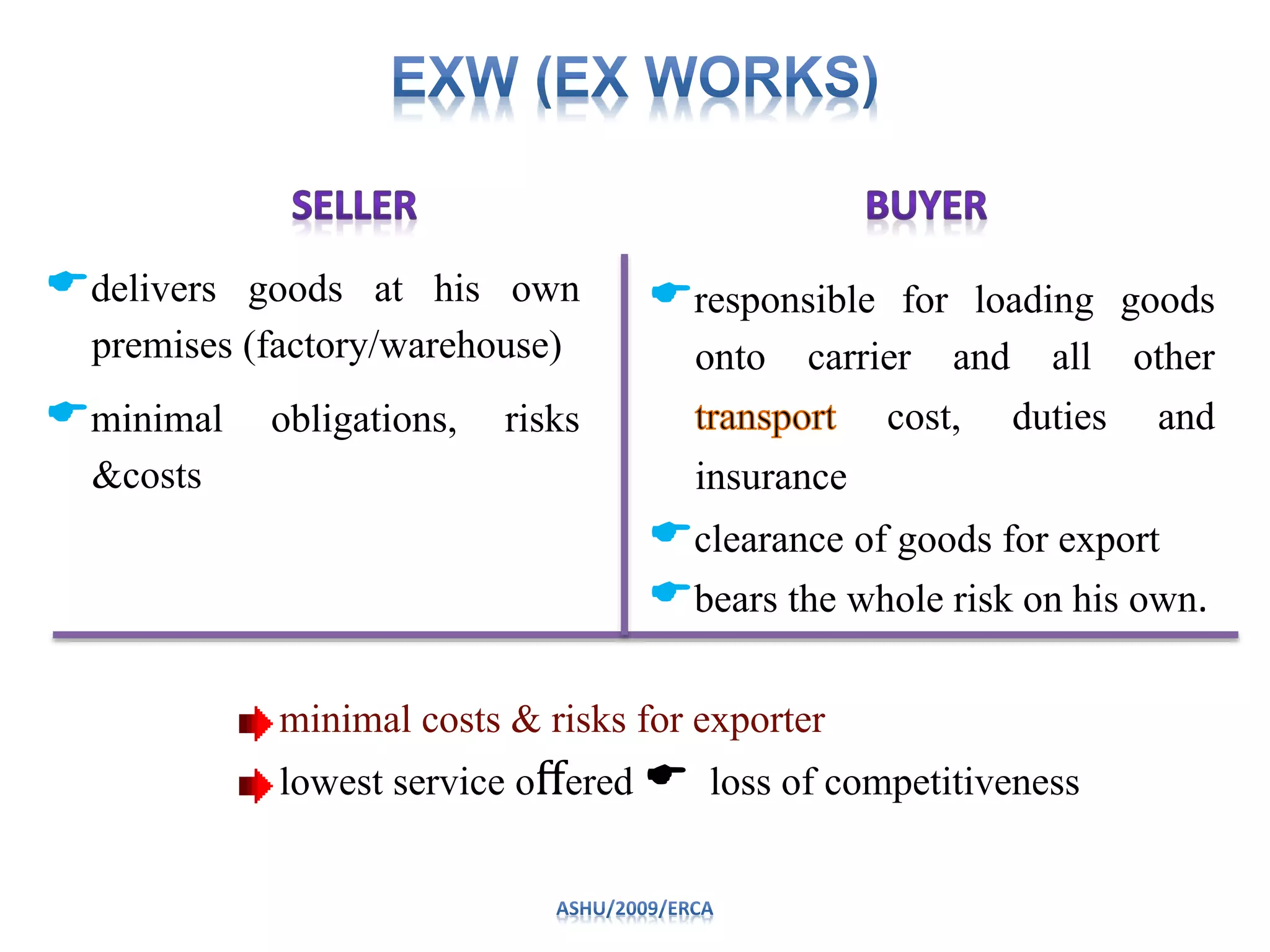

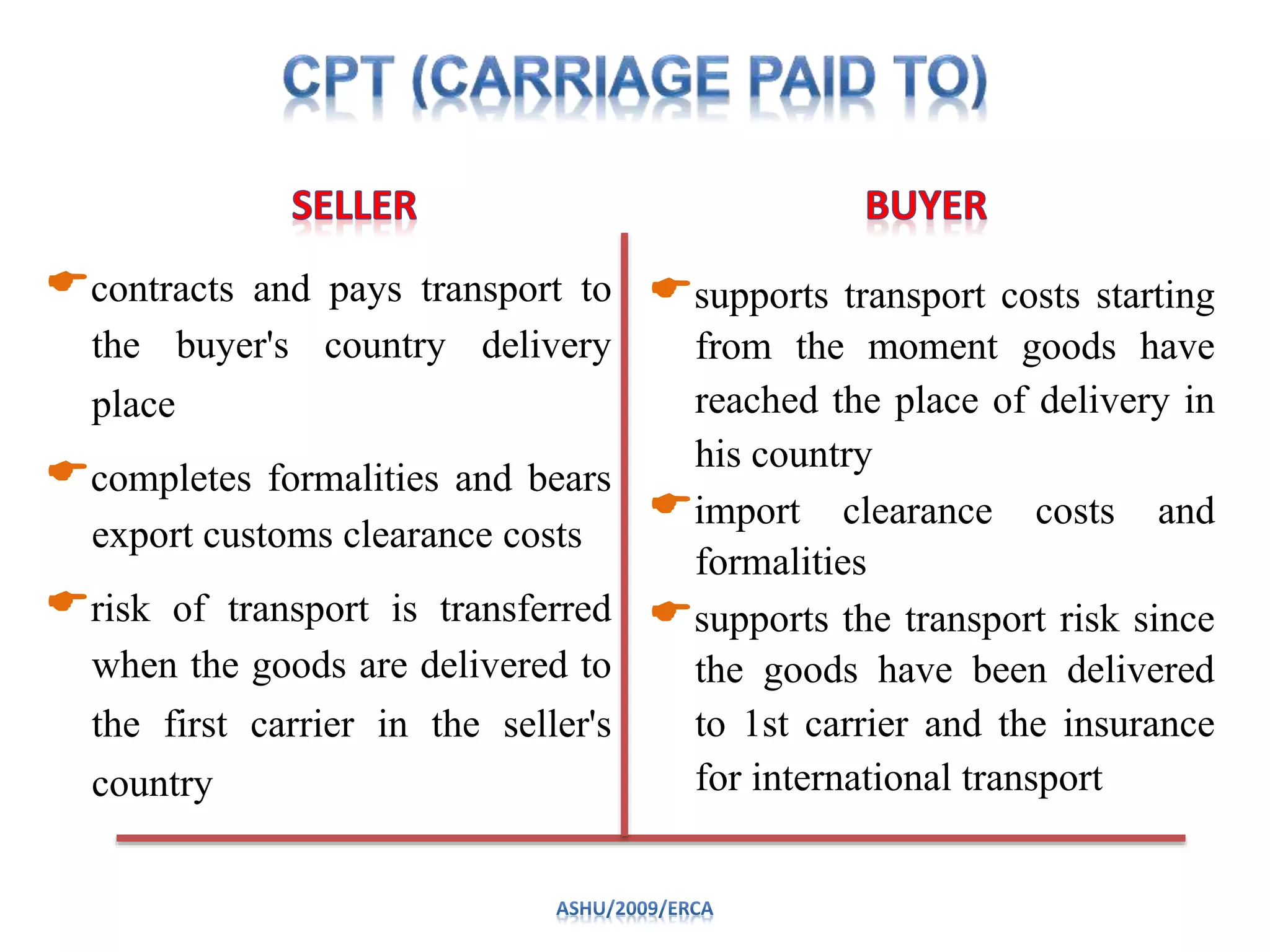

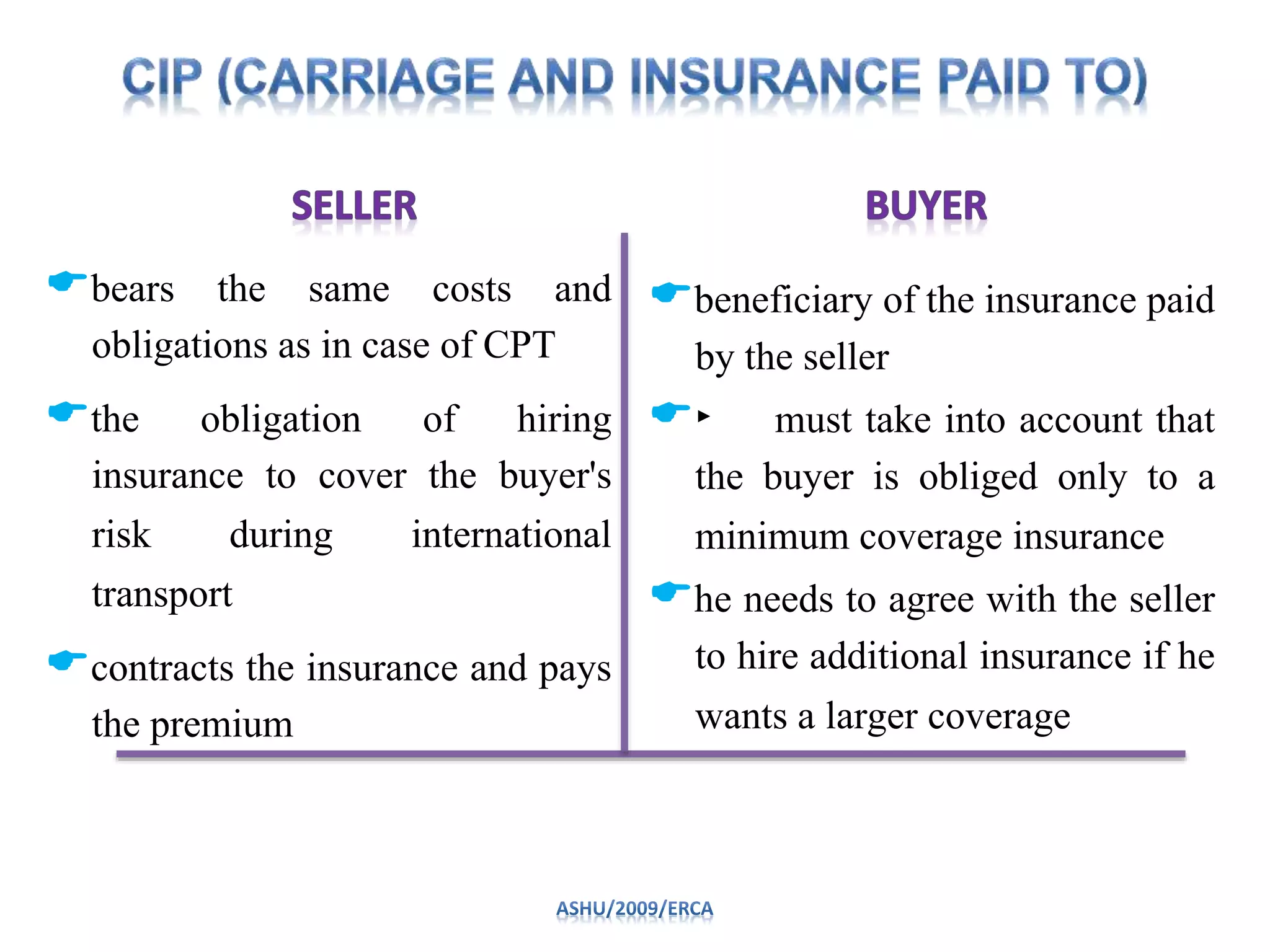

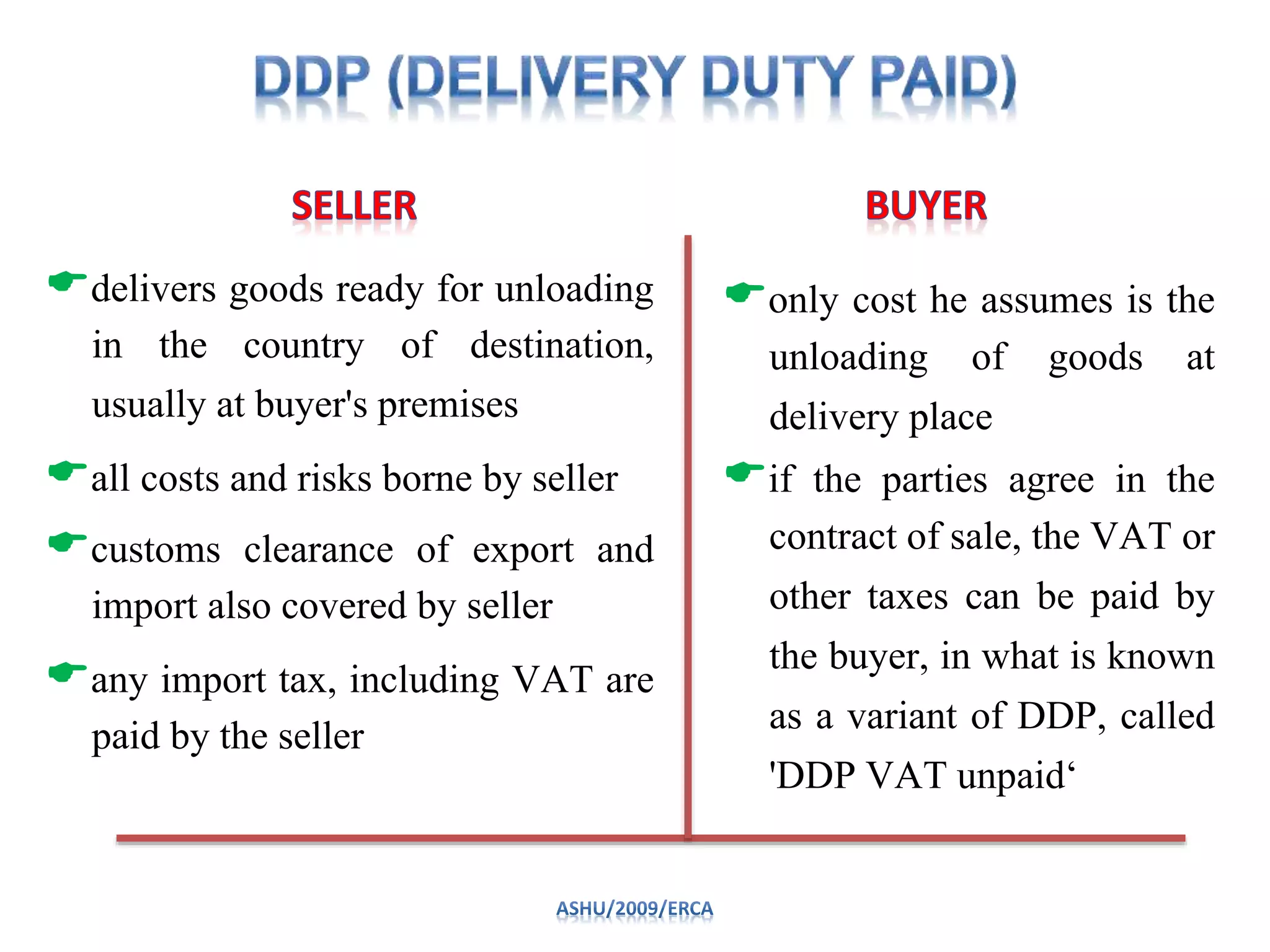

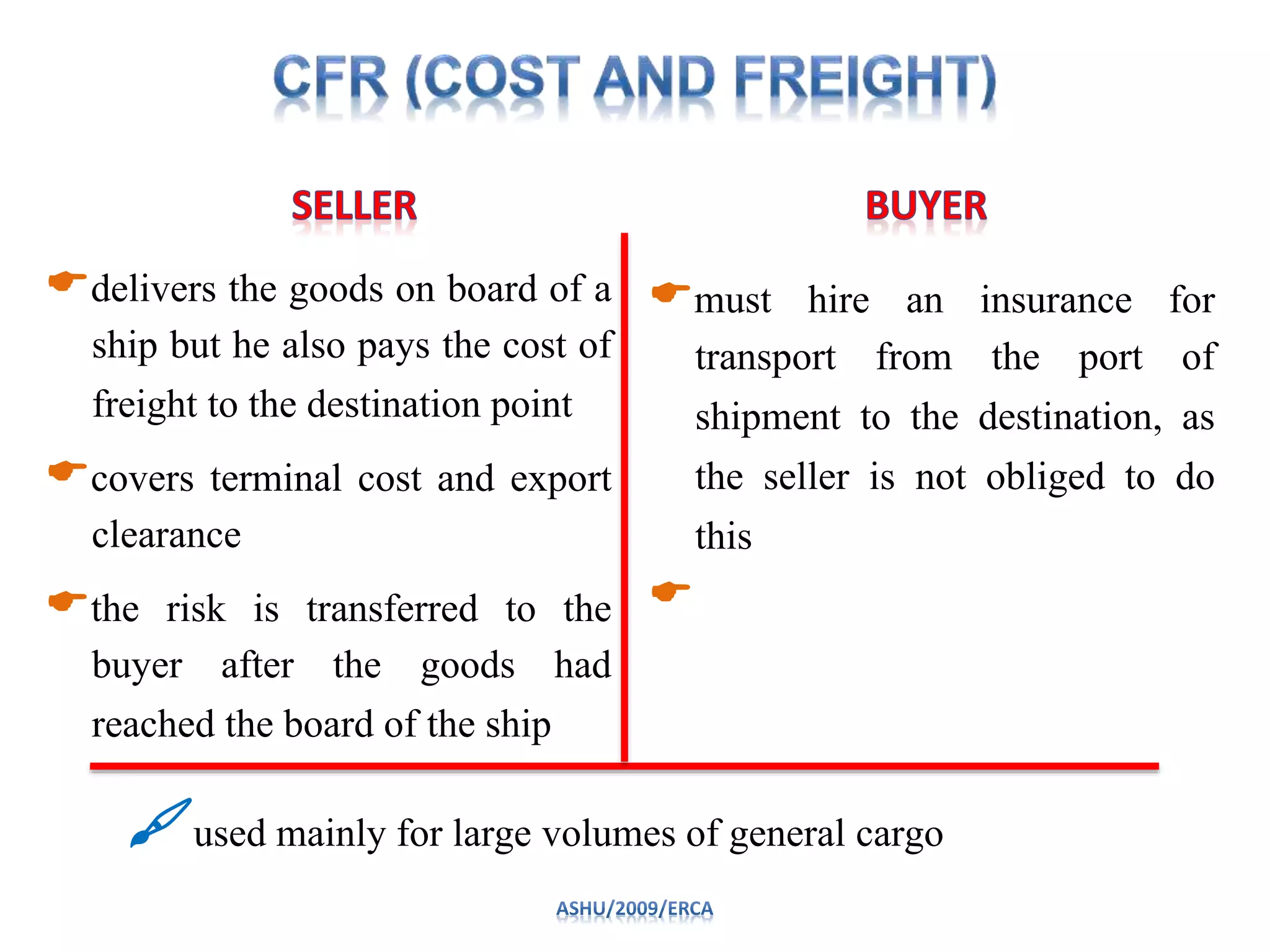

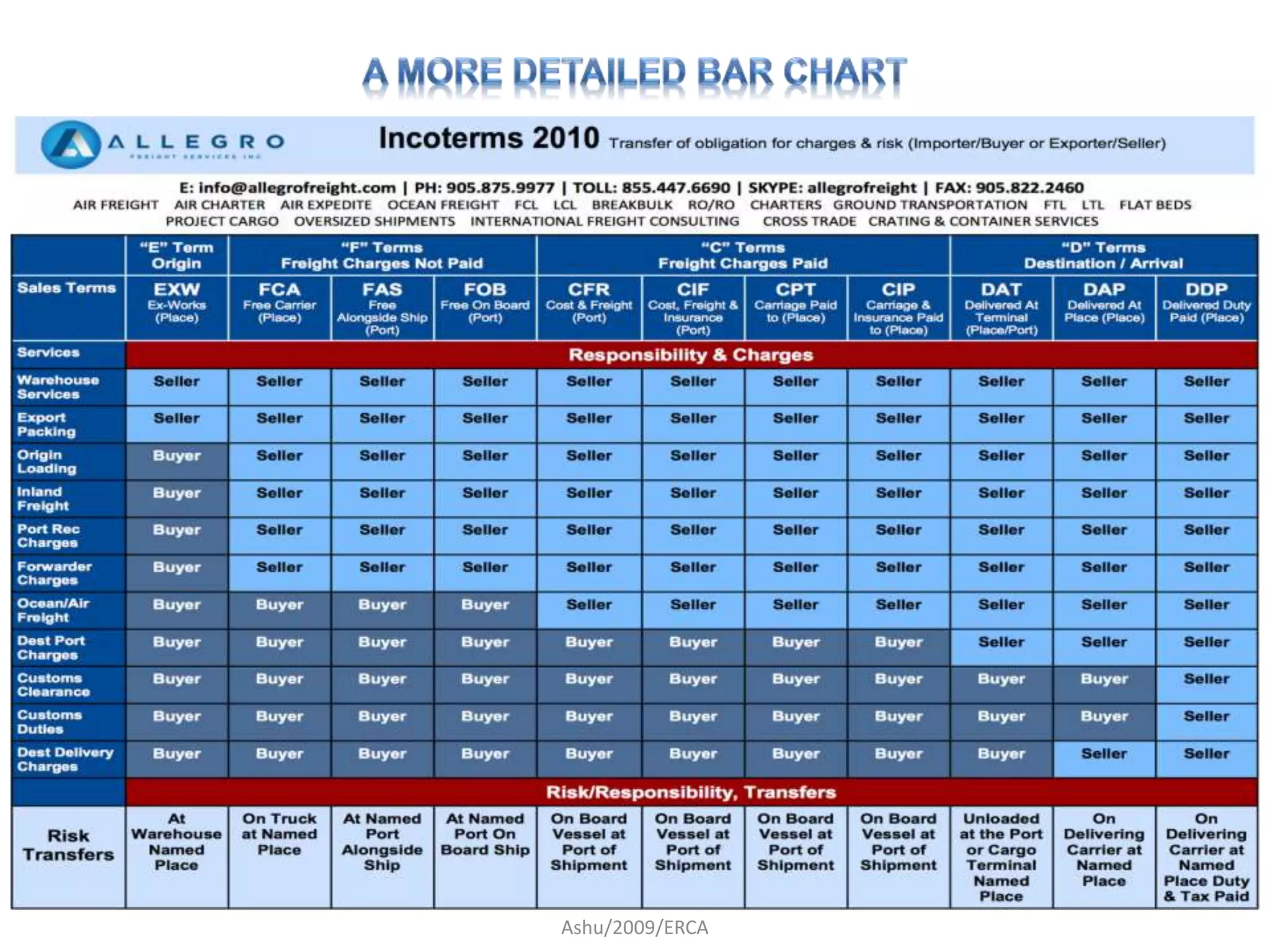

- Incoterms provide standardized trade terms that clarify the obligations and allocation of costs, risks, and responsibilities between buyers and sellers in international commercial transactions.