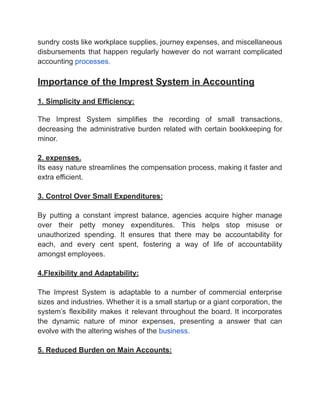

The imprest system in accounting, also known as the petty cash system, simplifies monetary management by allowing organizations to maintain a fixed cash balance for small expenditures. This system enhances efficiency, control, and accountability, reducing administrative burdens and preventing unauthorized spending. Overall, it serves as a strategic tool that fosters effective financial management across various business sizes and industries.