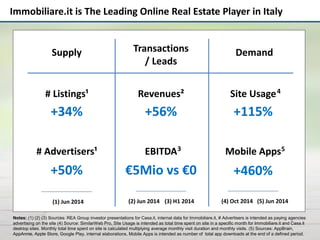

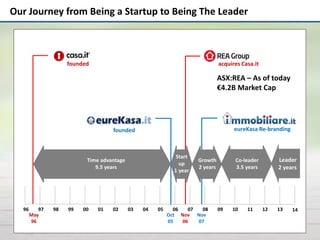

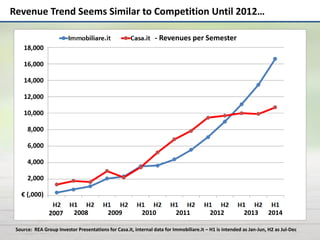

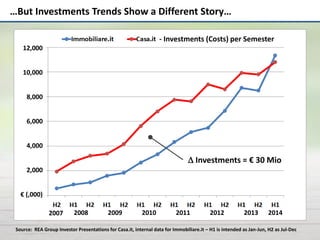

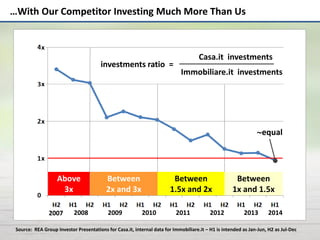

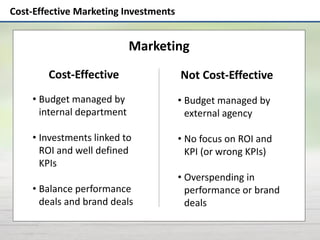

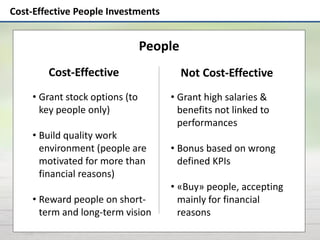

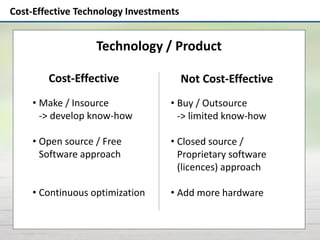

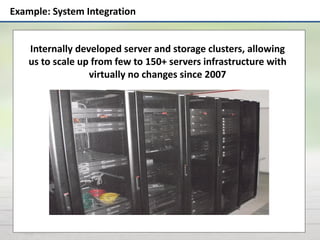

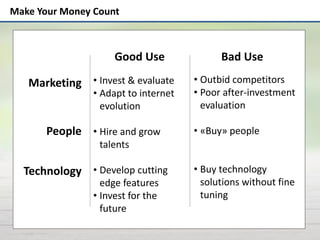

Immobiliare.it has established itself as the leading online real estate platform in Italy since its founding in 2005, demonstrating significant growth in user engagement and advertising revenue. Despite initial revenue trends resembling competitors until 2012, their marketing, technology, and human resources investments have been managed effectively to support long-term performance. The document outlines the company's strategic focus on cost-effective investments and internal developments to maintain competitive advantage.