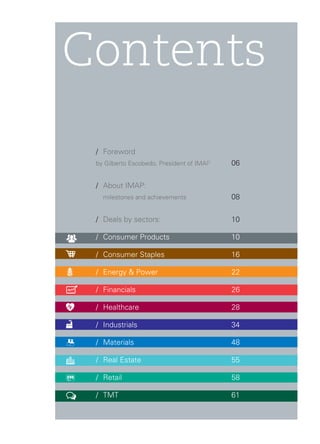

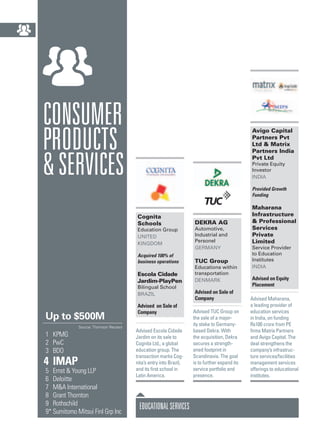

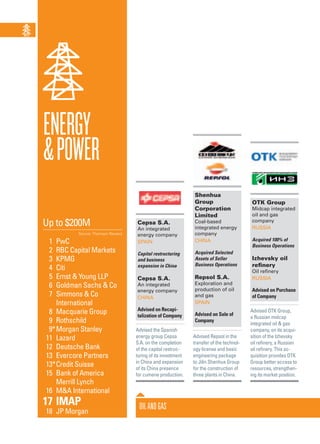

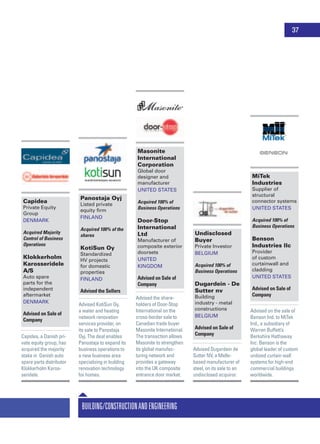

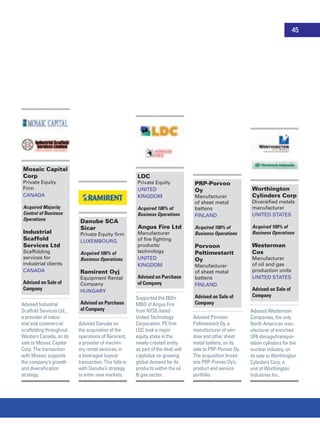

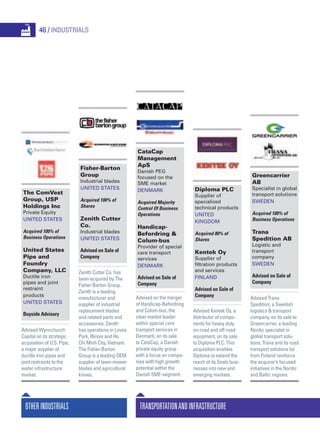

The document appears to be an annual report or brochure from IMAP, a global M&A advisory firm, summarizing their deals and performance from 2011-2014. It includes statistics showing IMAP ranked 4th globally in number of deals under $200 million. The brochure then highlights representative M&A transactions IMAP completed over that period sorted by industry sectors such as consumer products, education, energy, and others. Deals spanned multiple countries and involved sales, acquisitions, and growth funding.