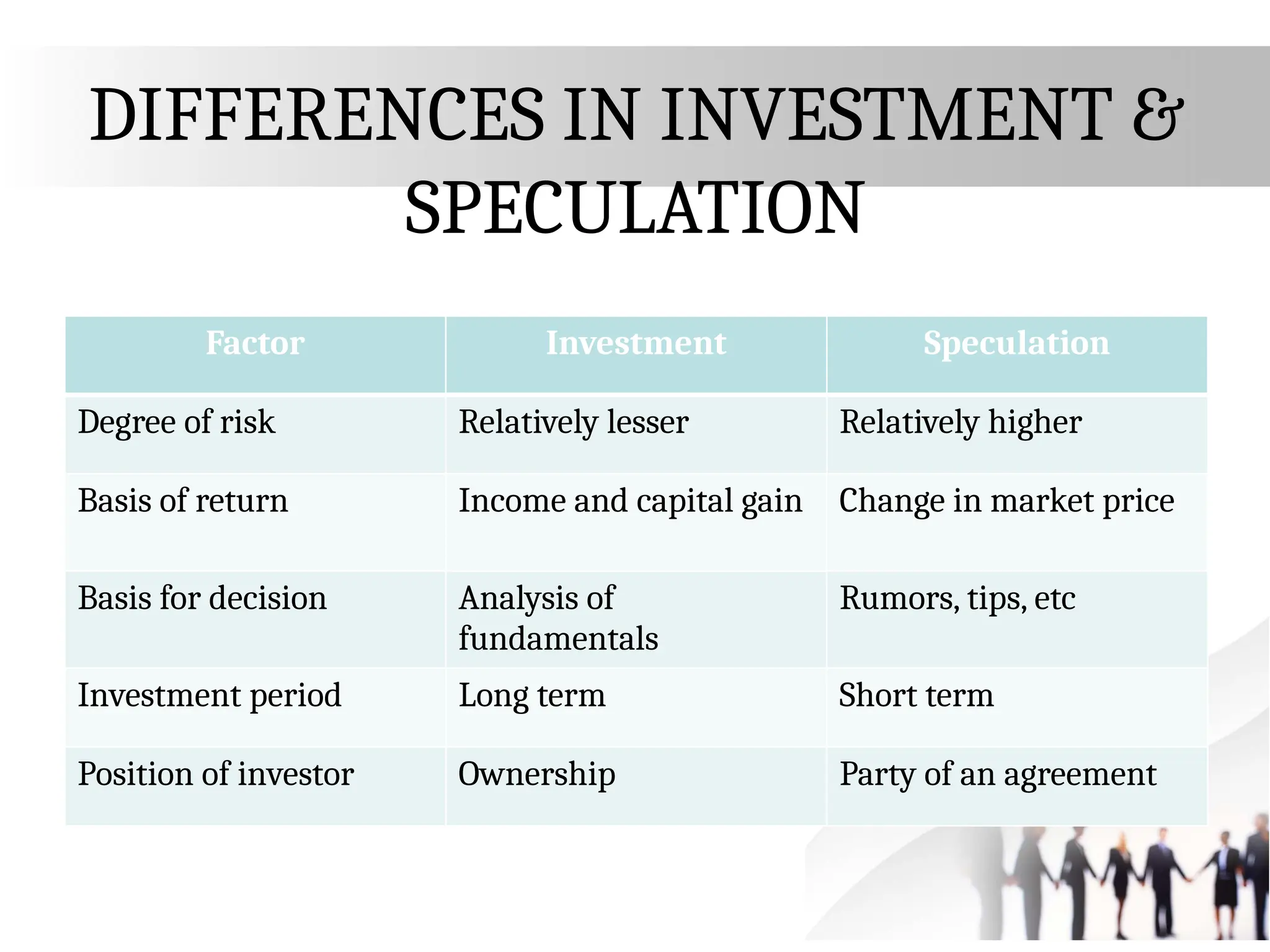

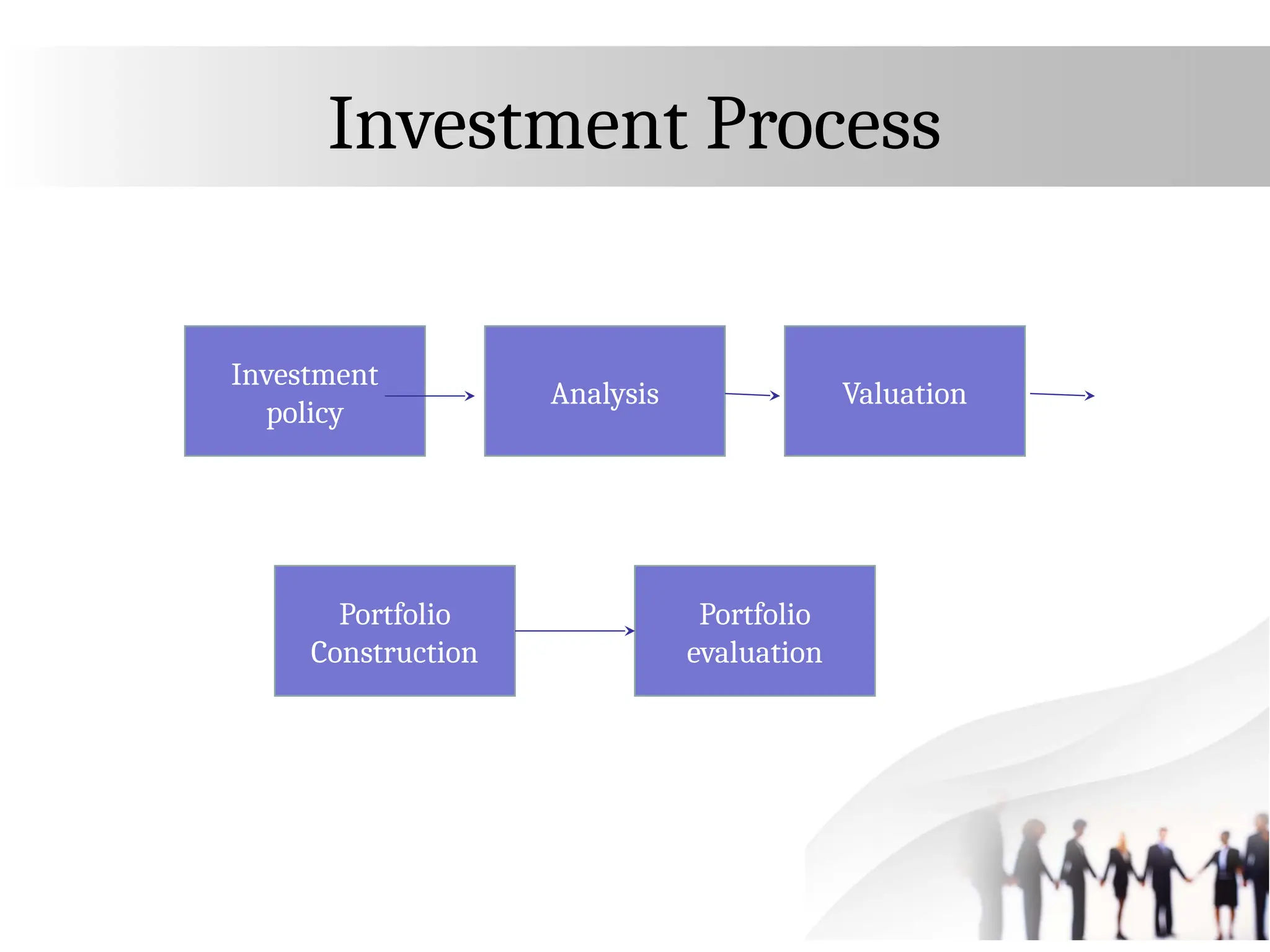

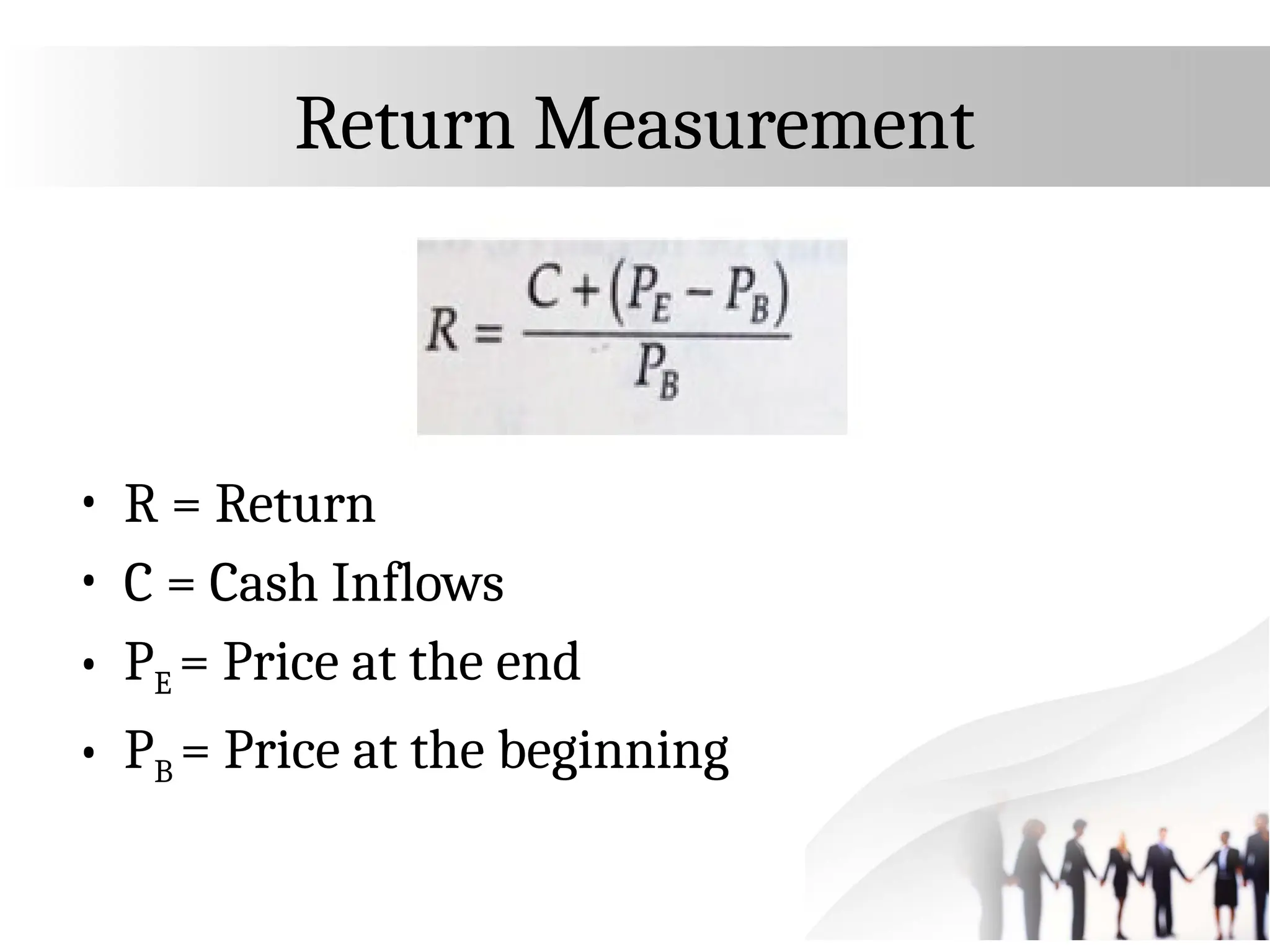

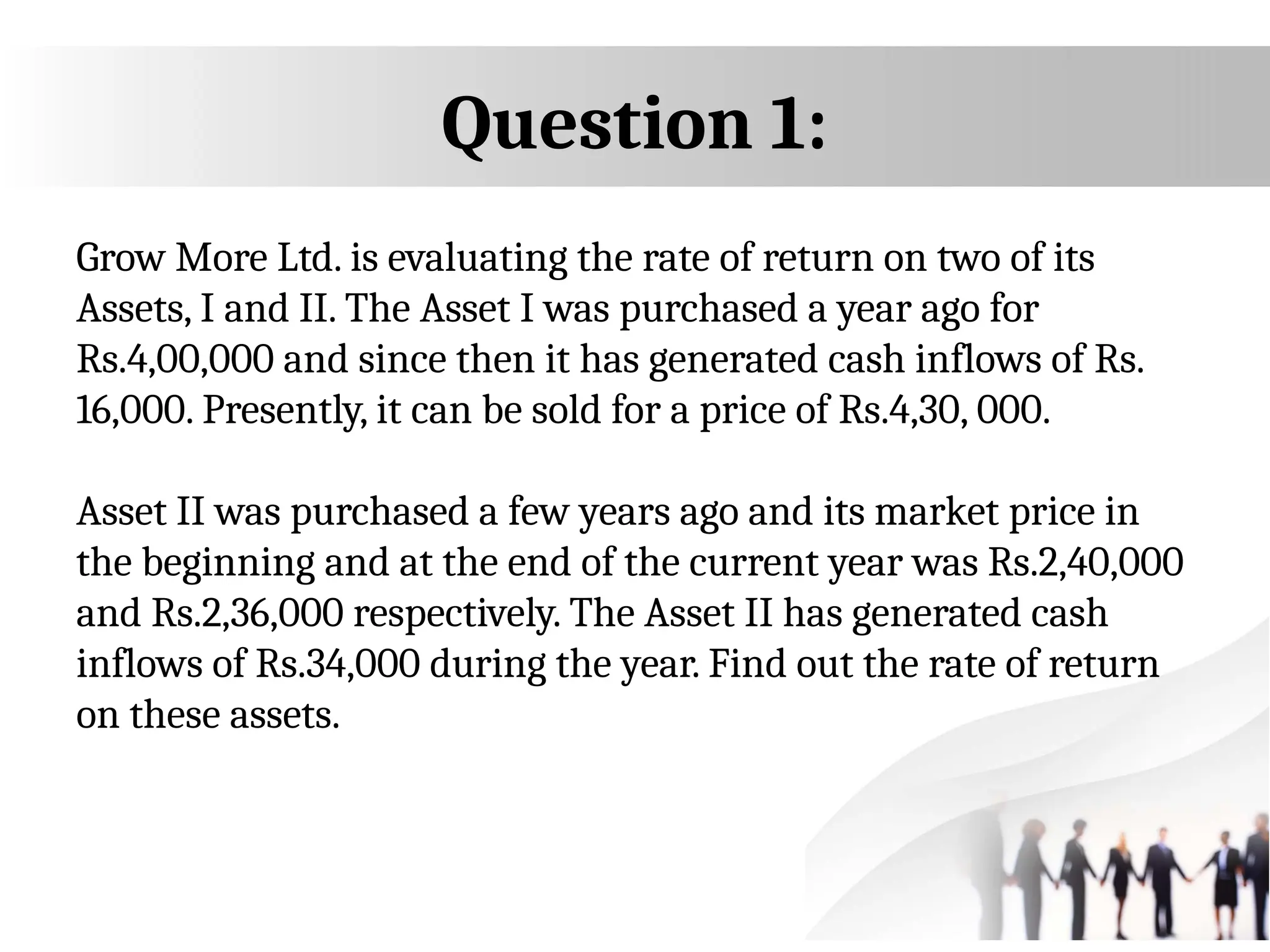

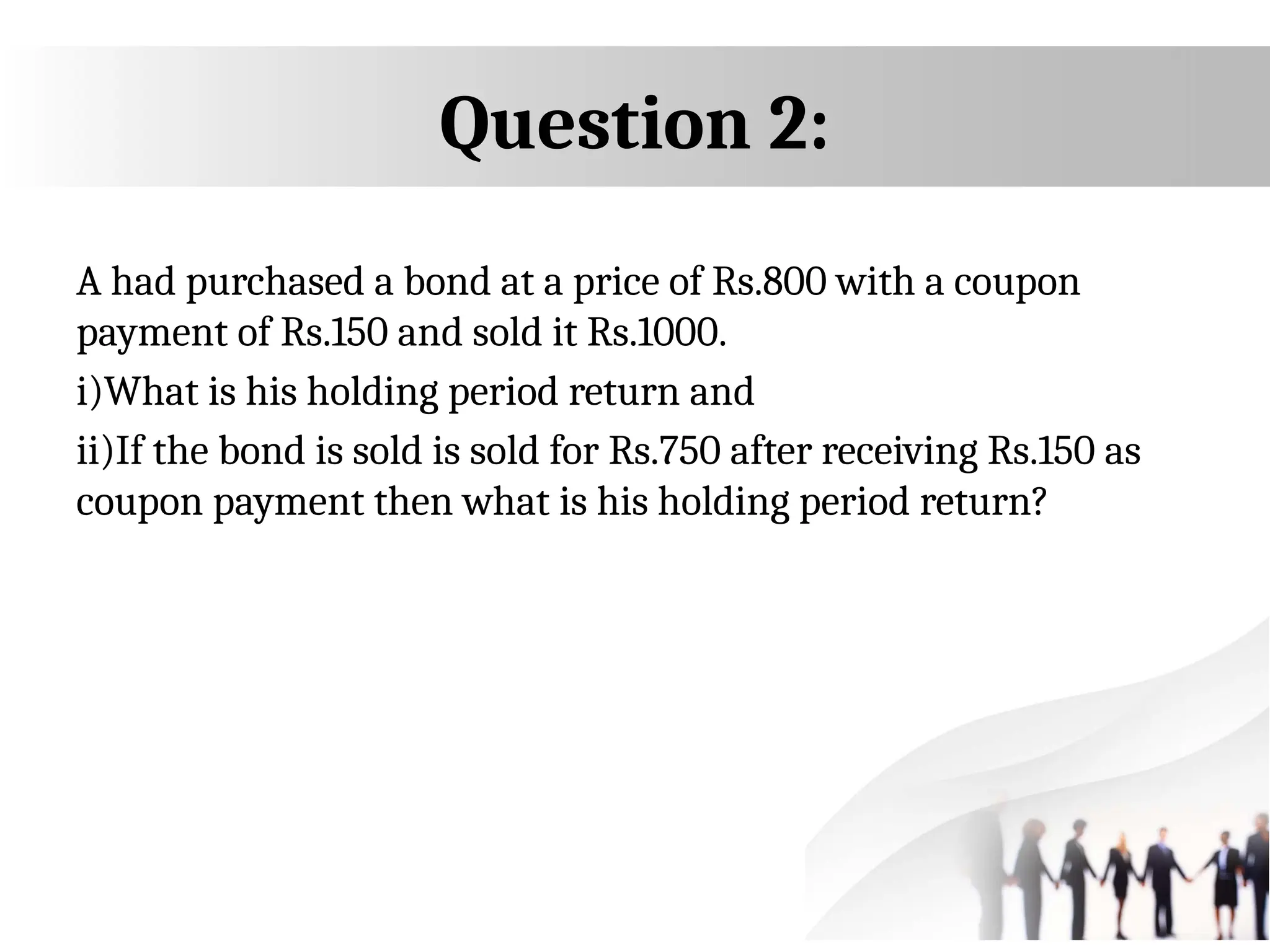

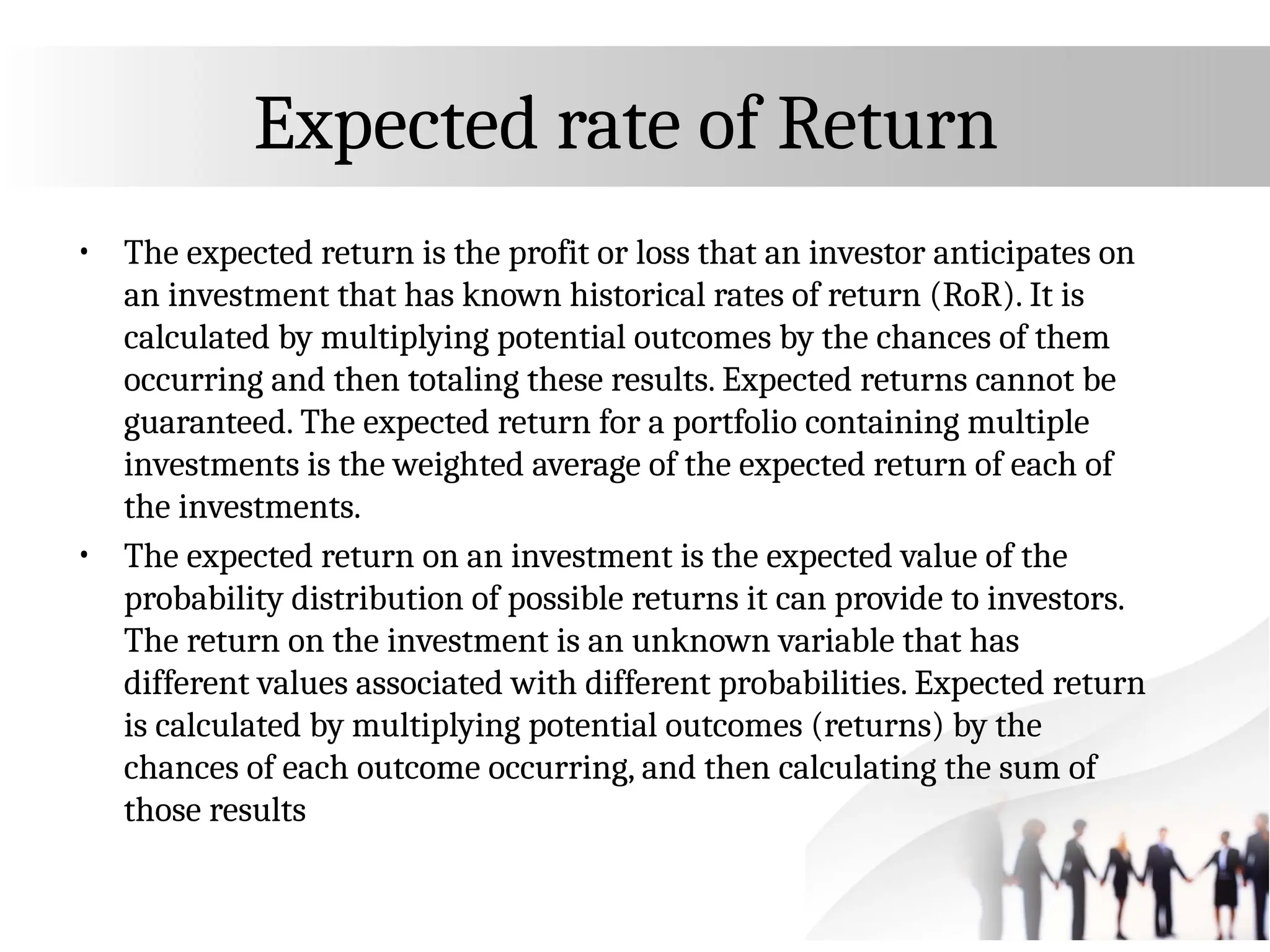

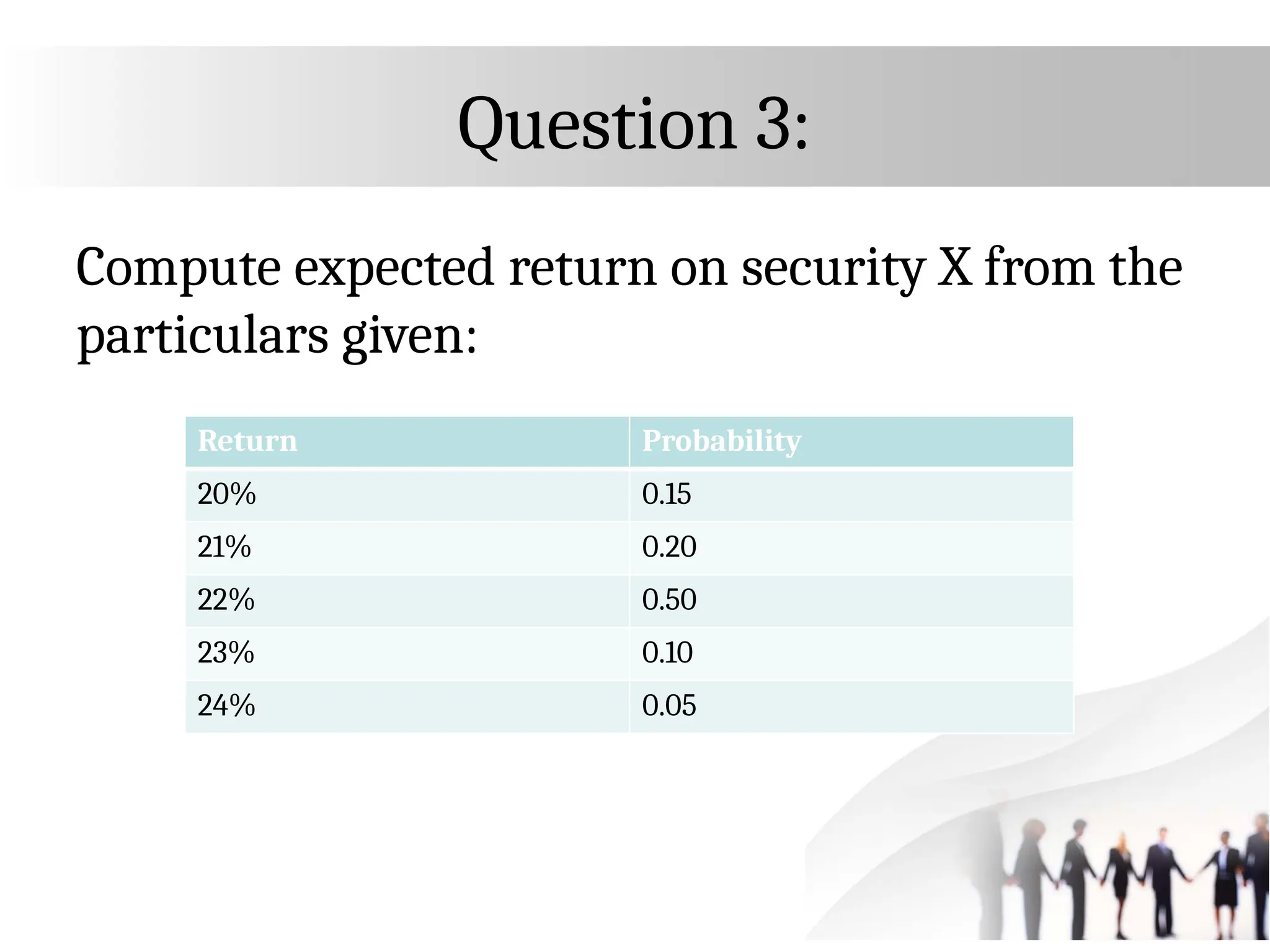

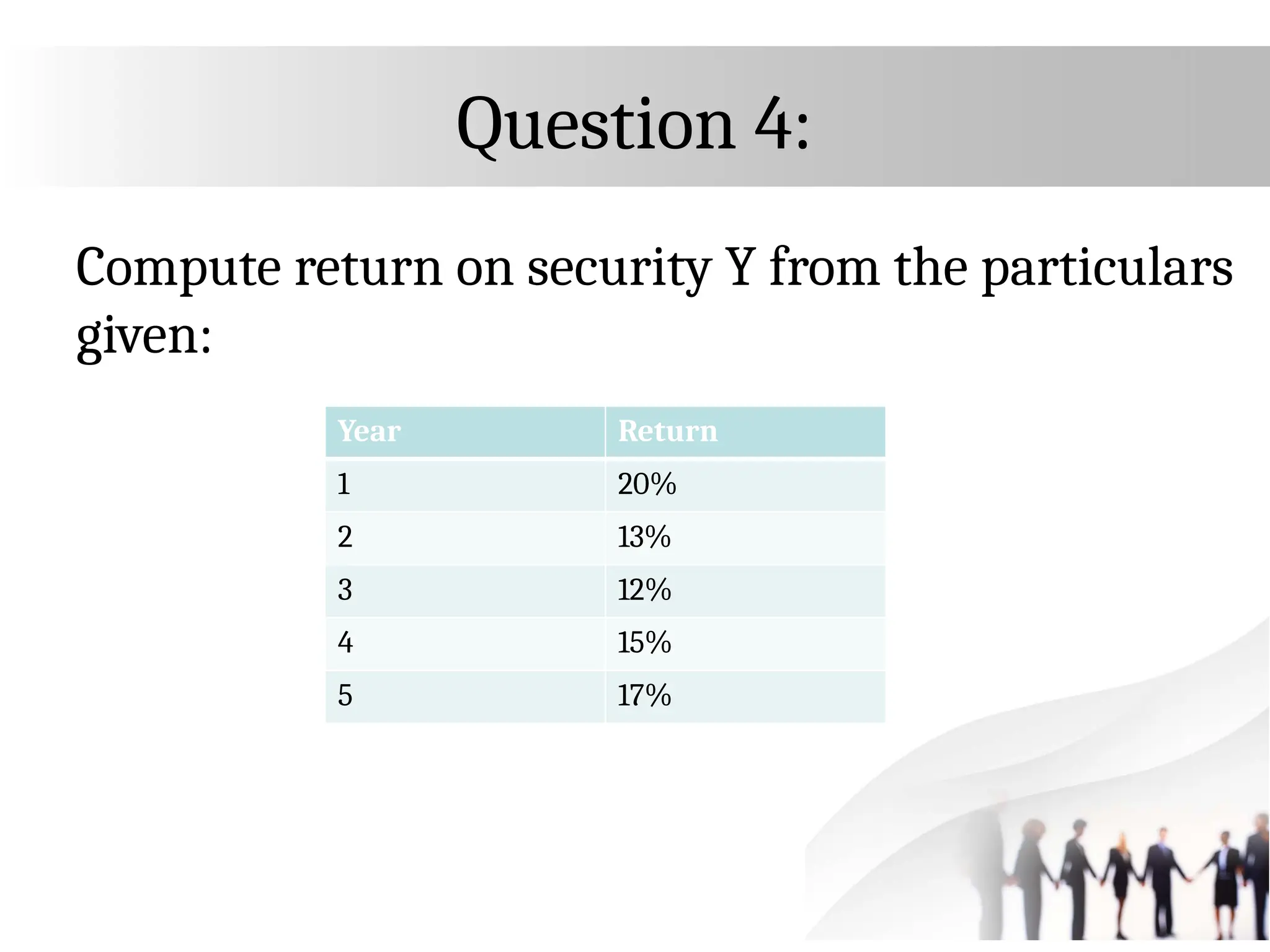

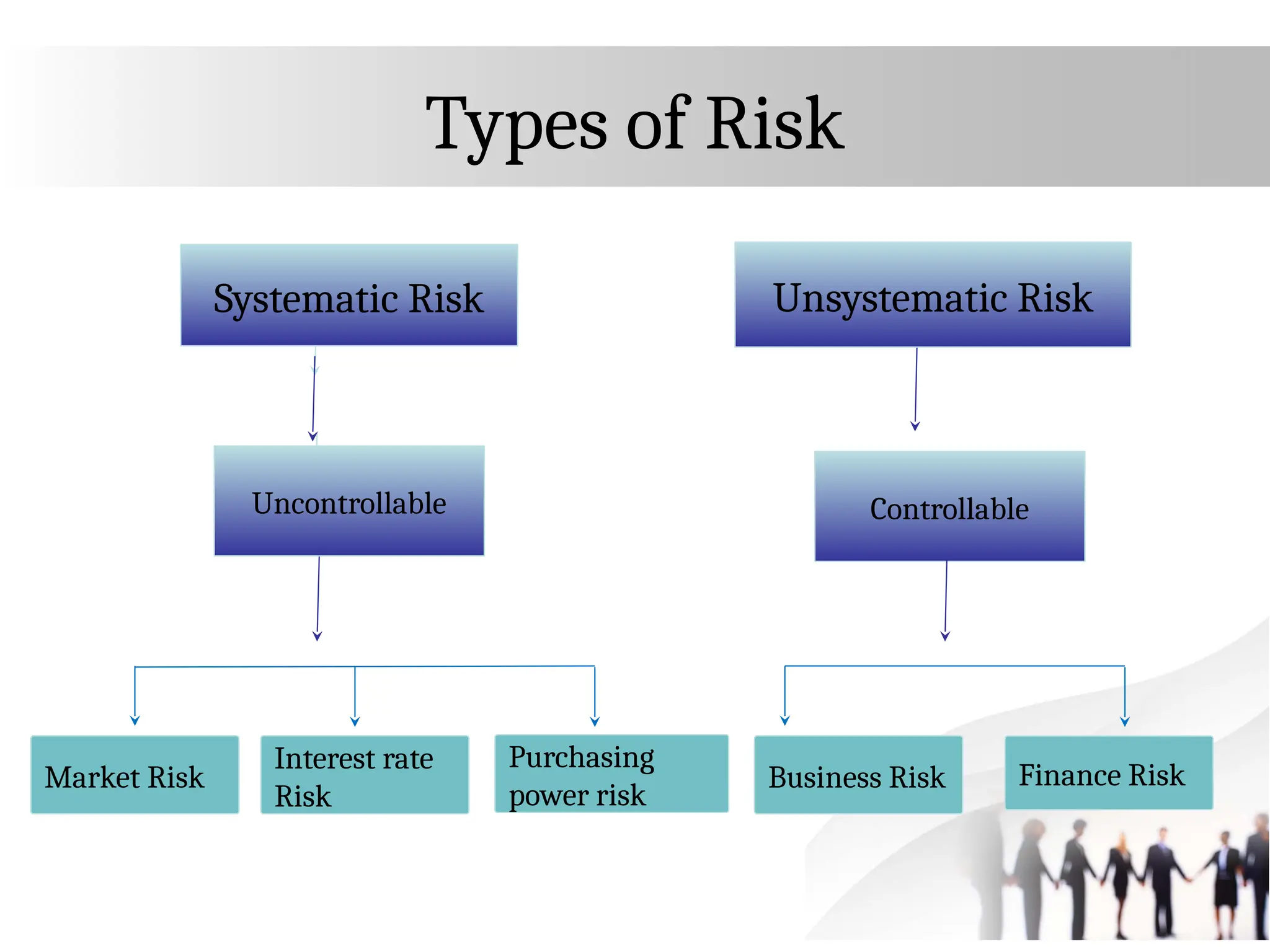

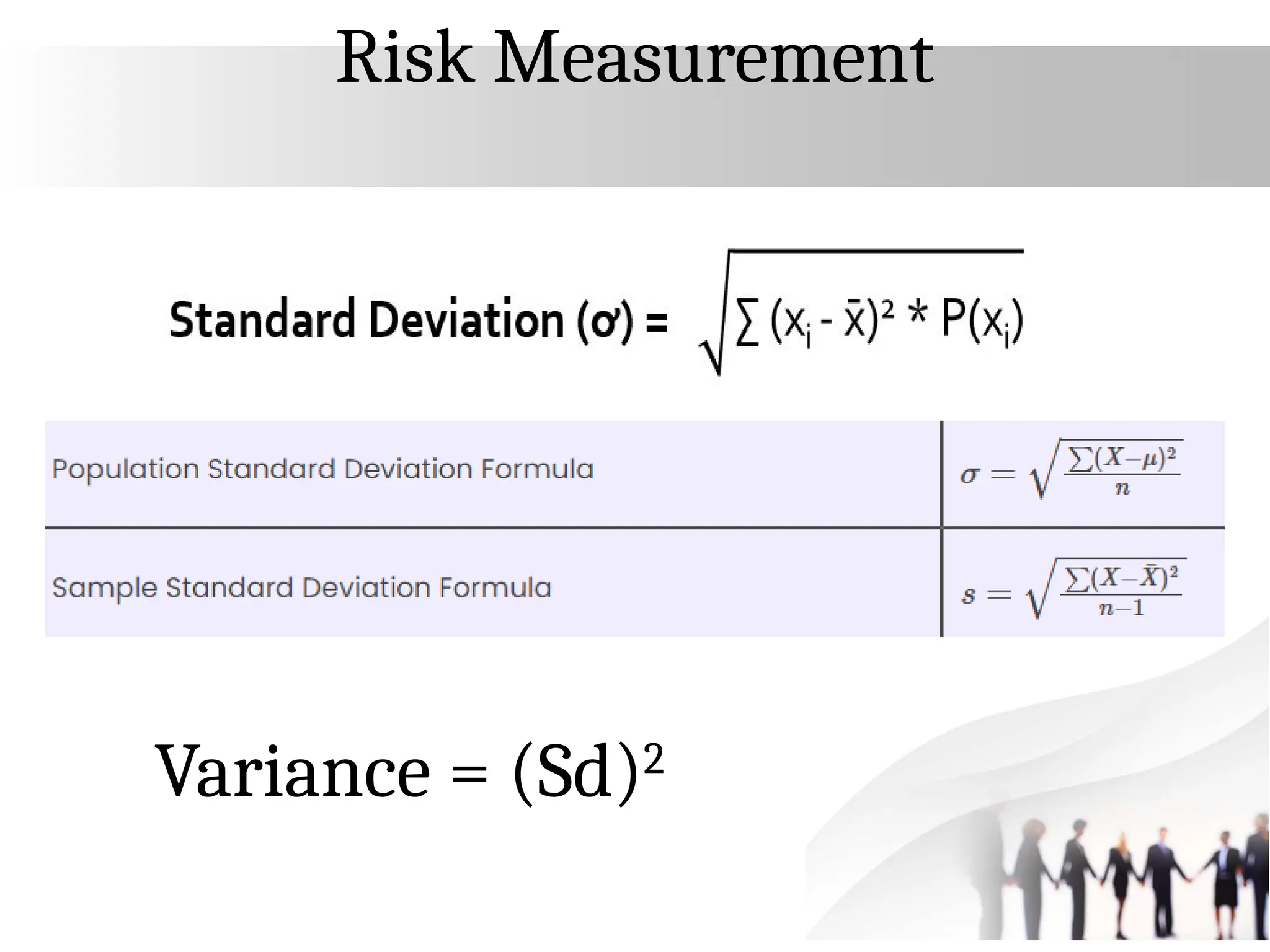

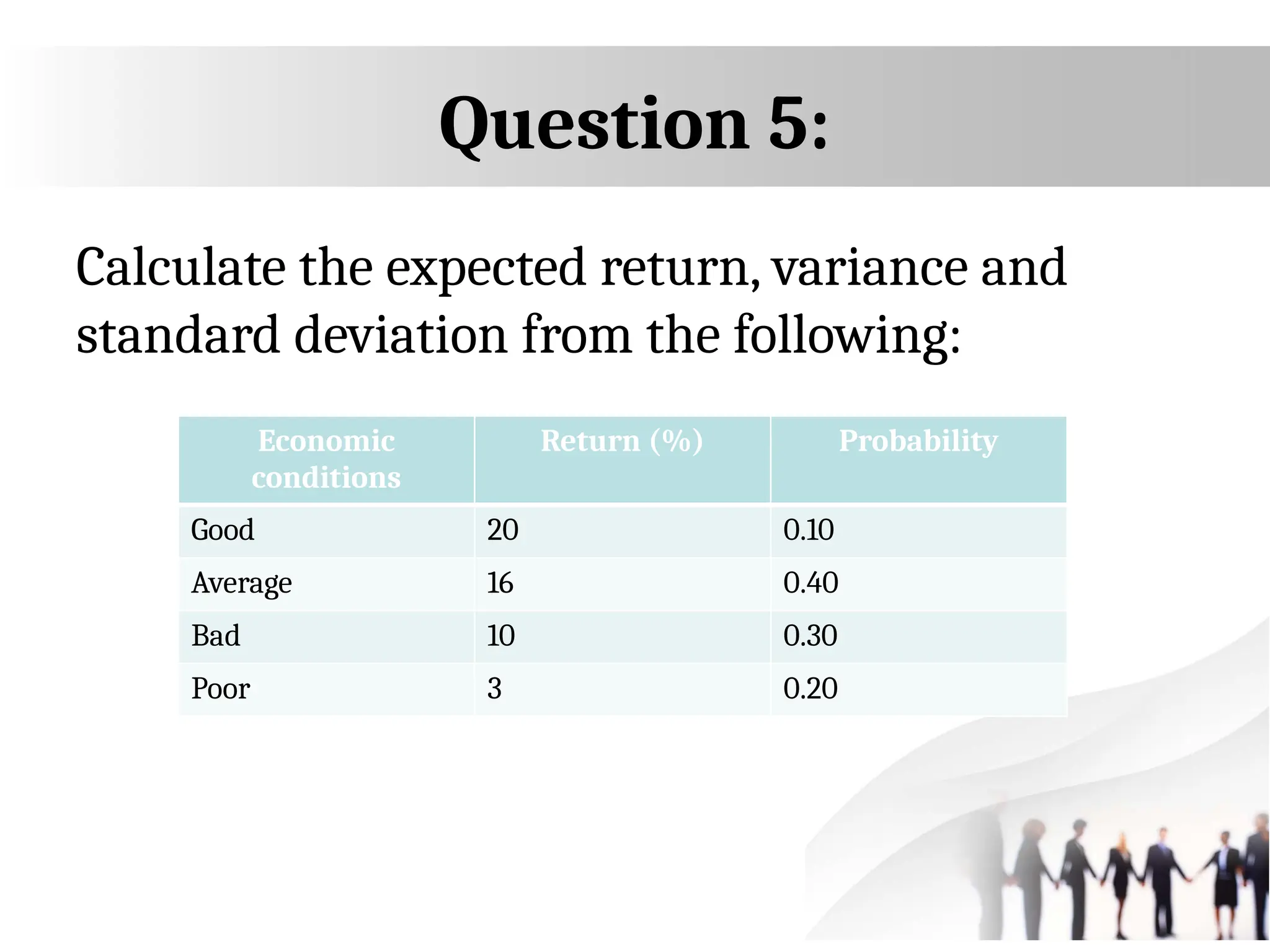

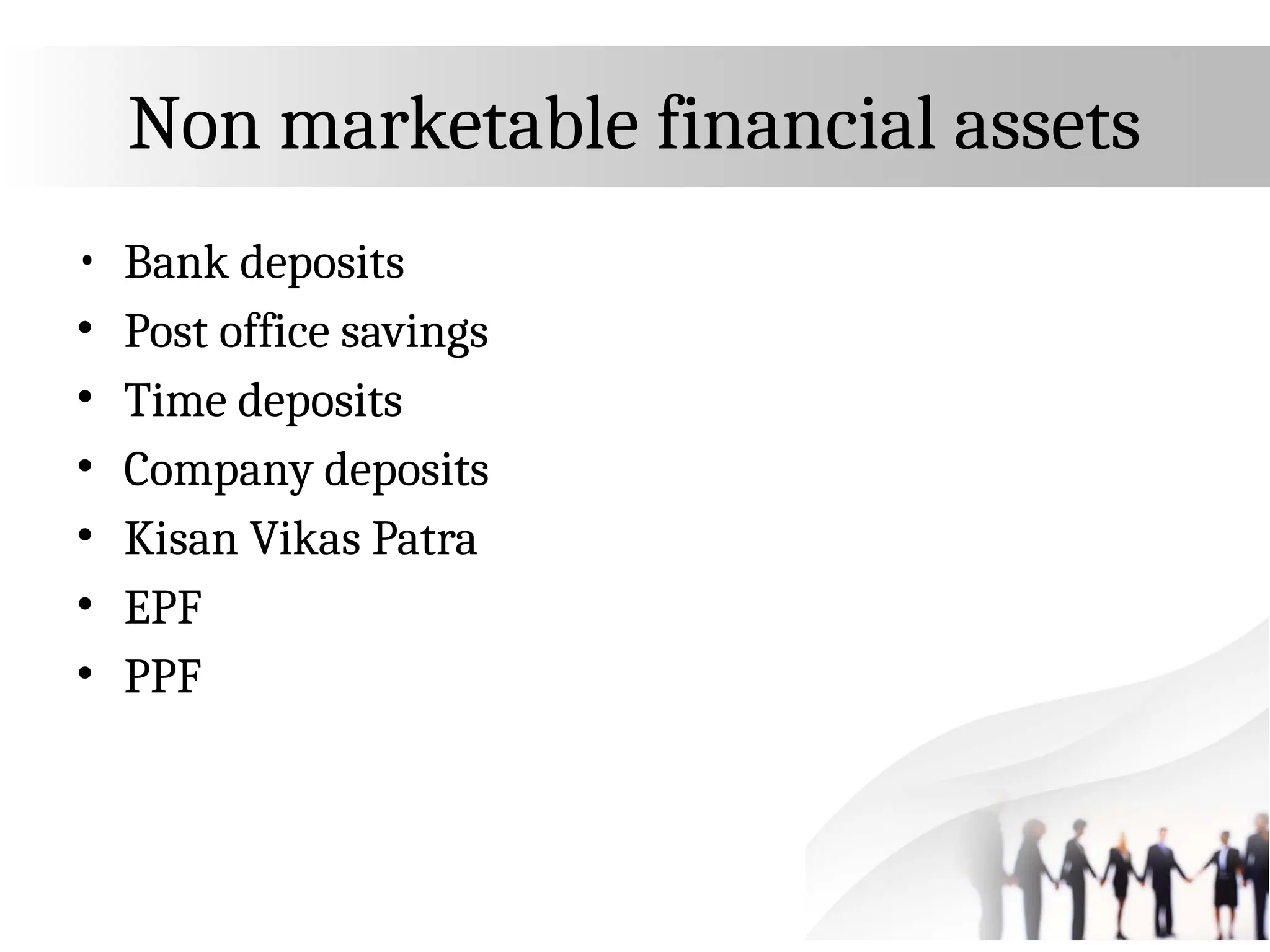

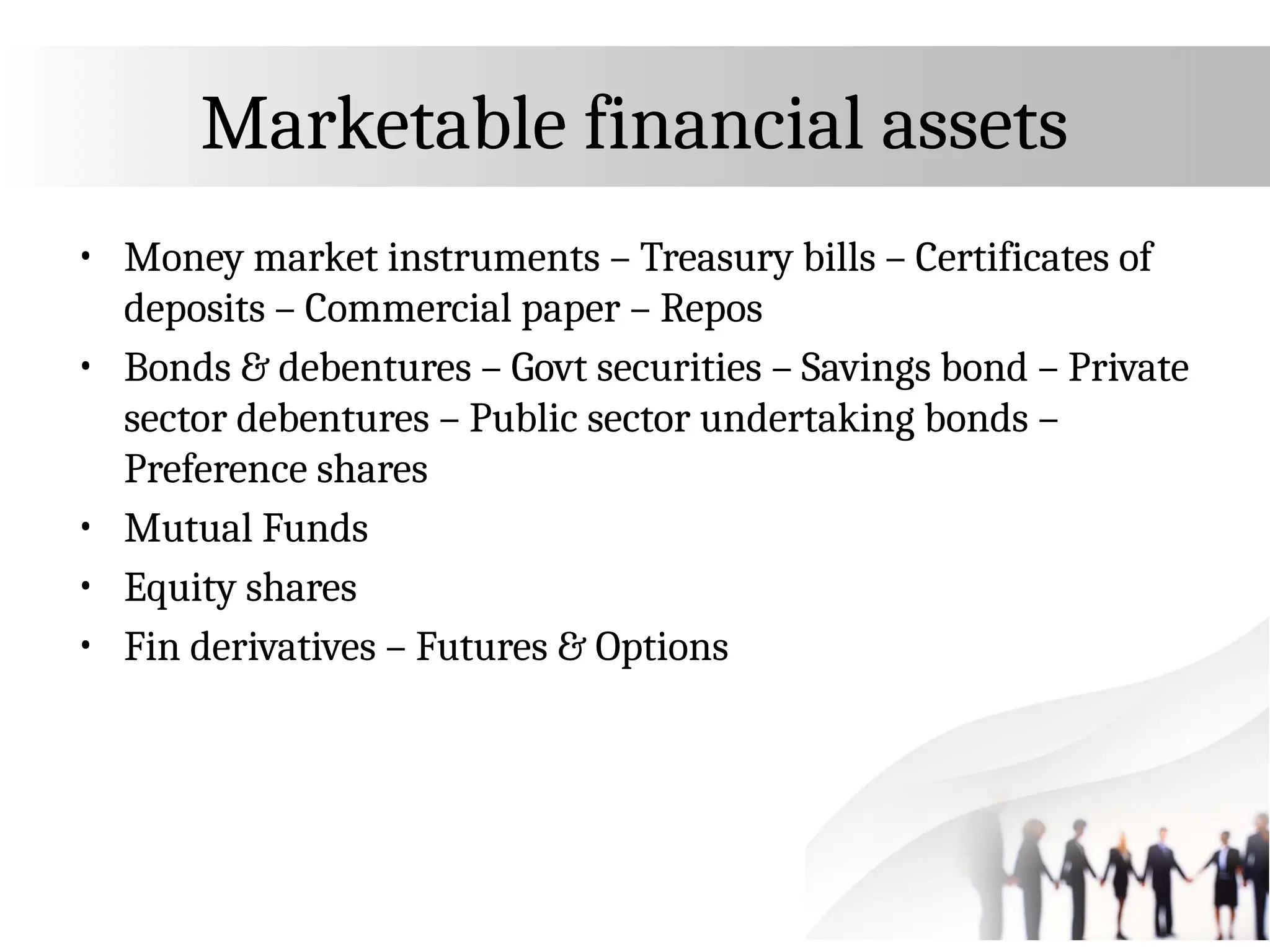

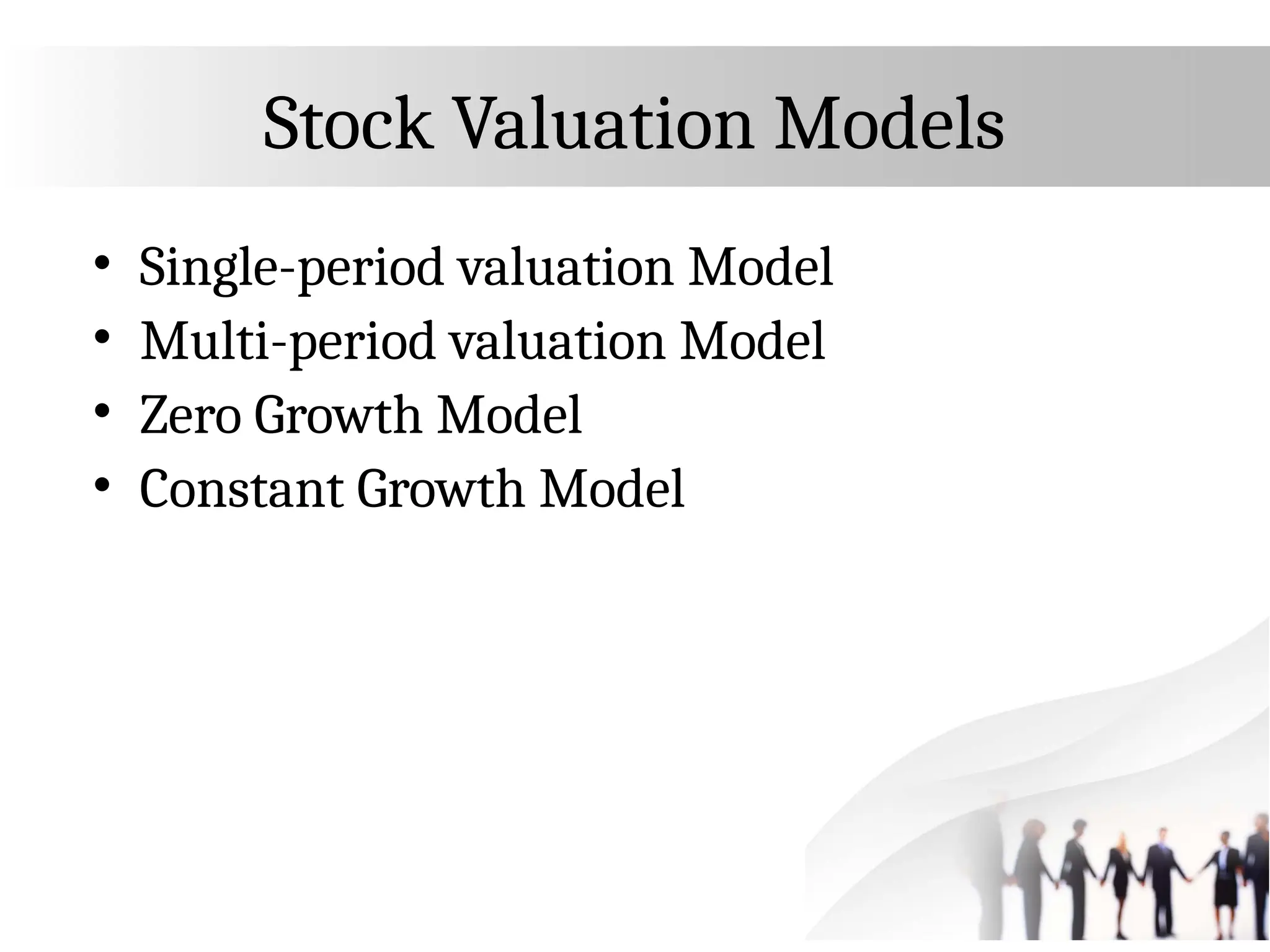

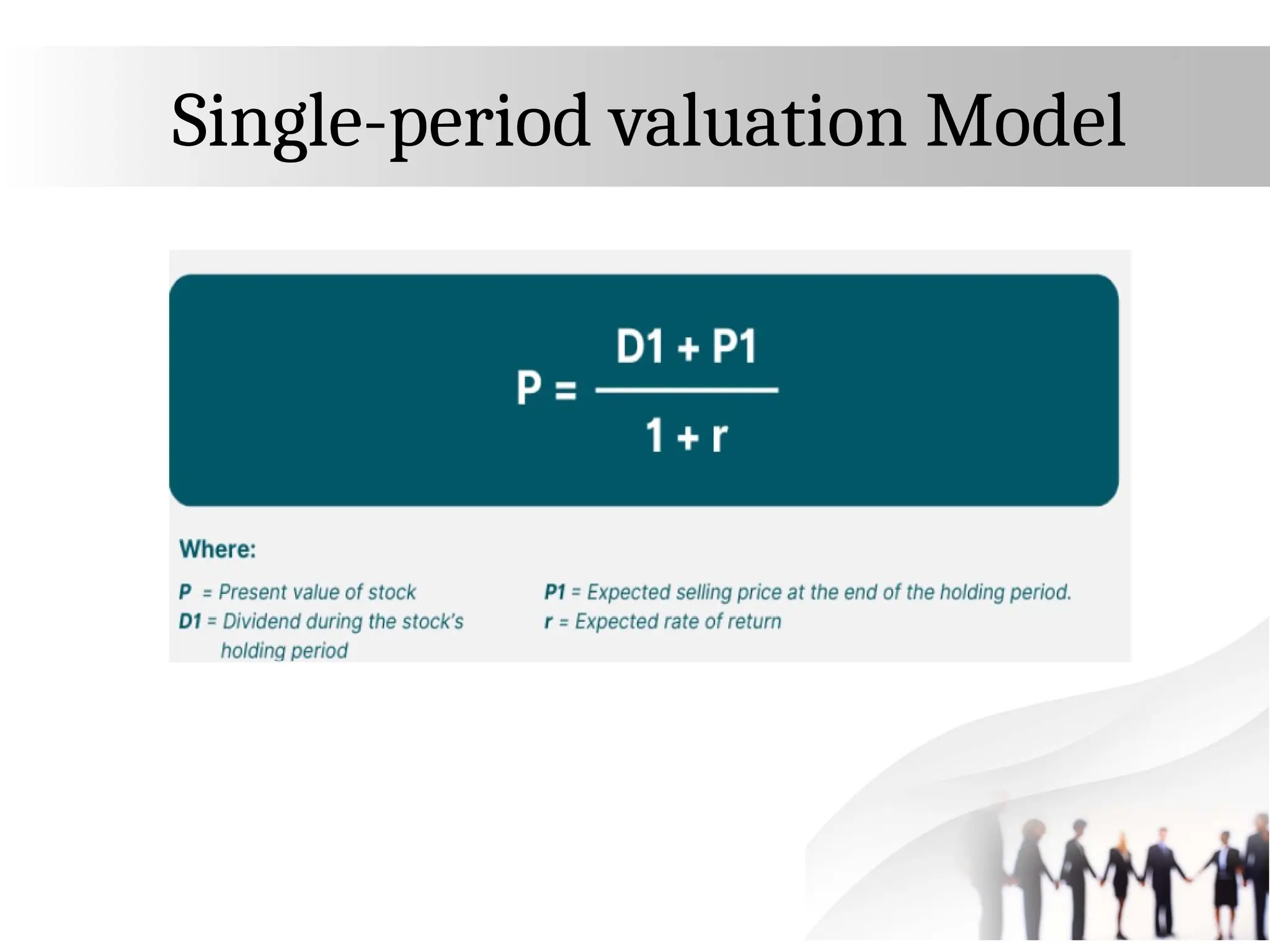

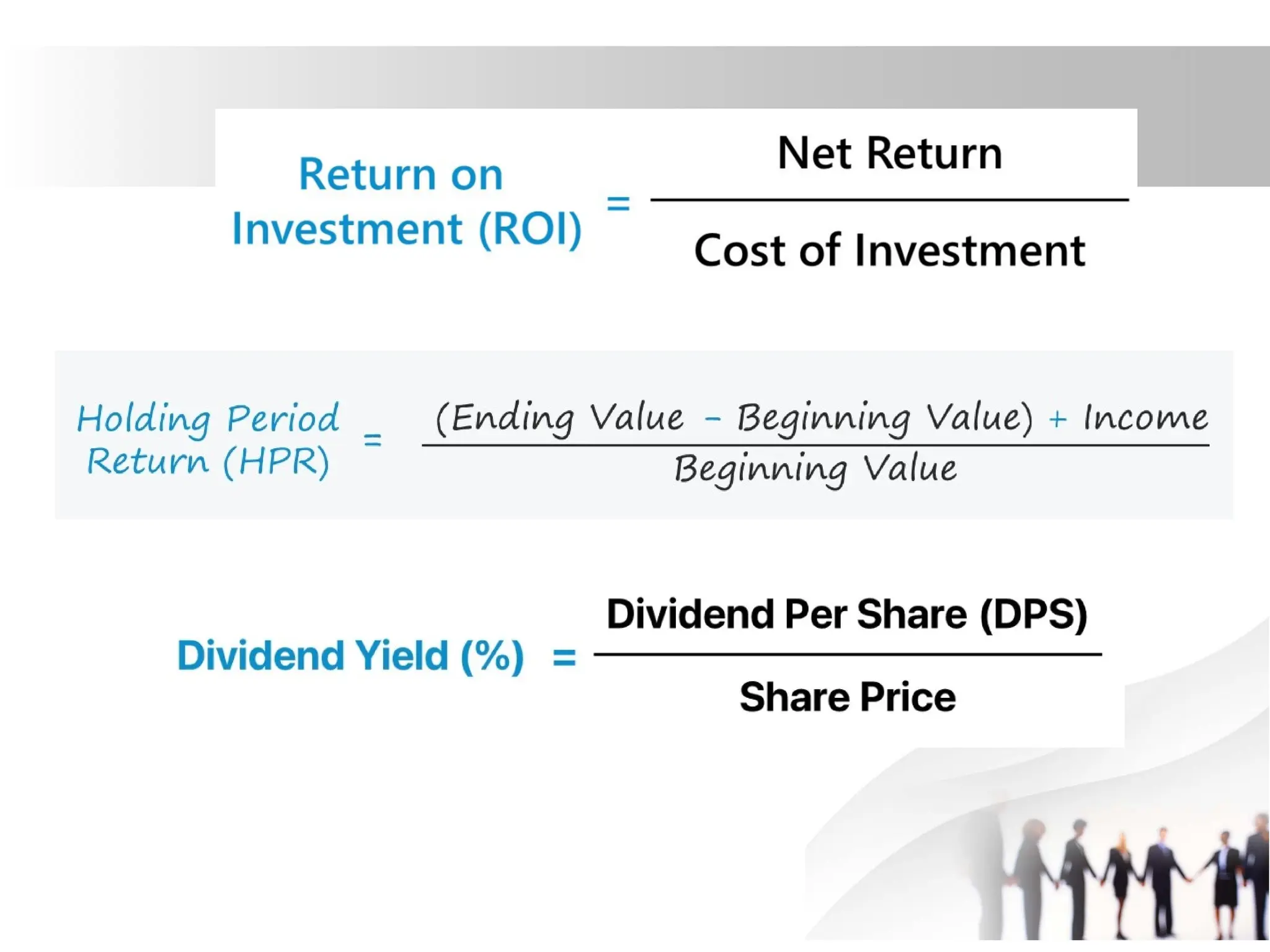

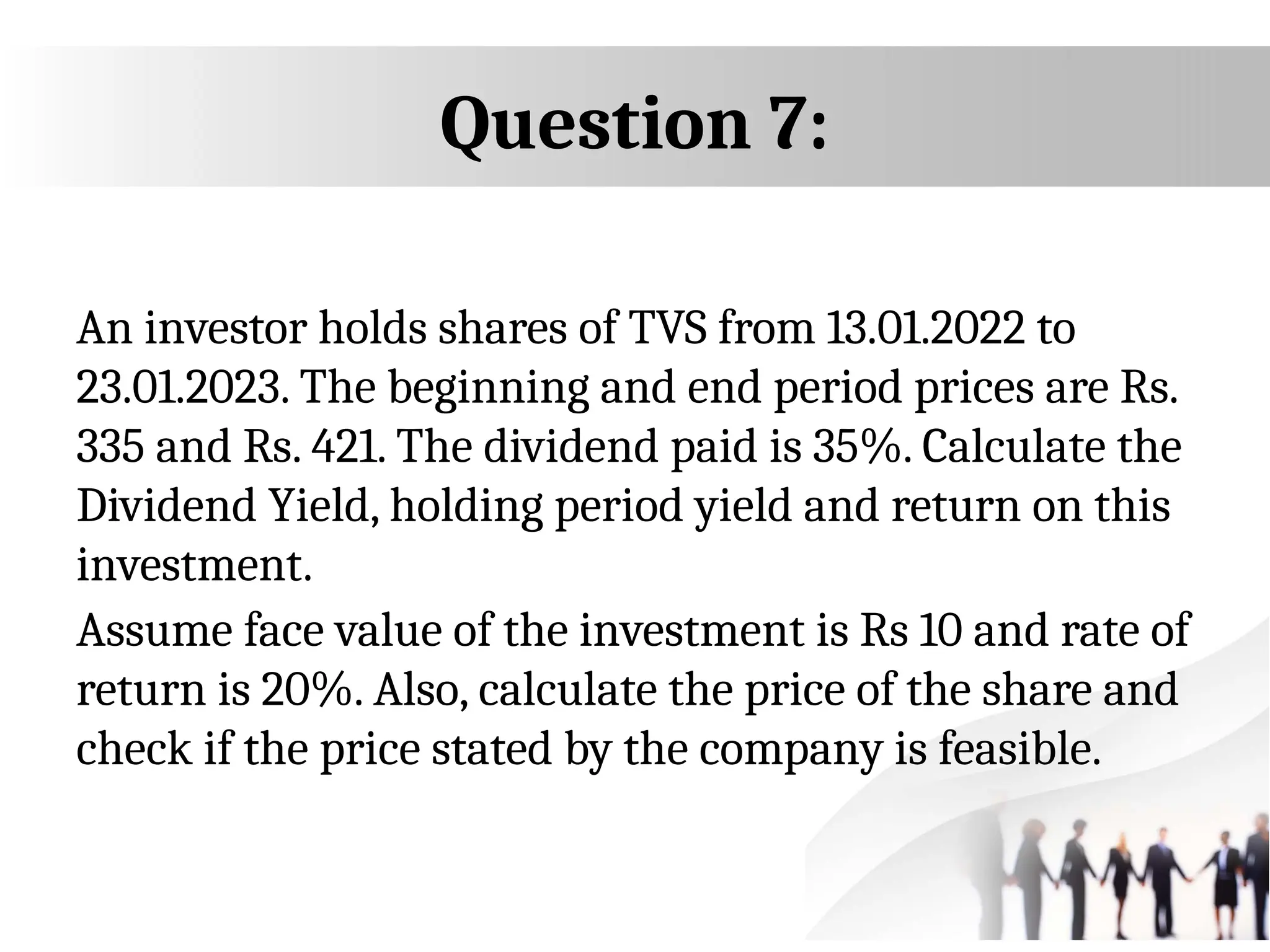

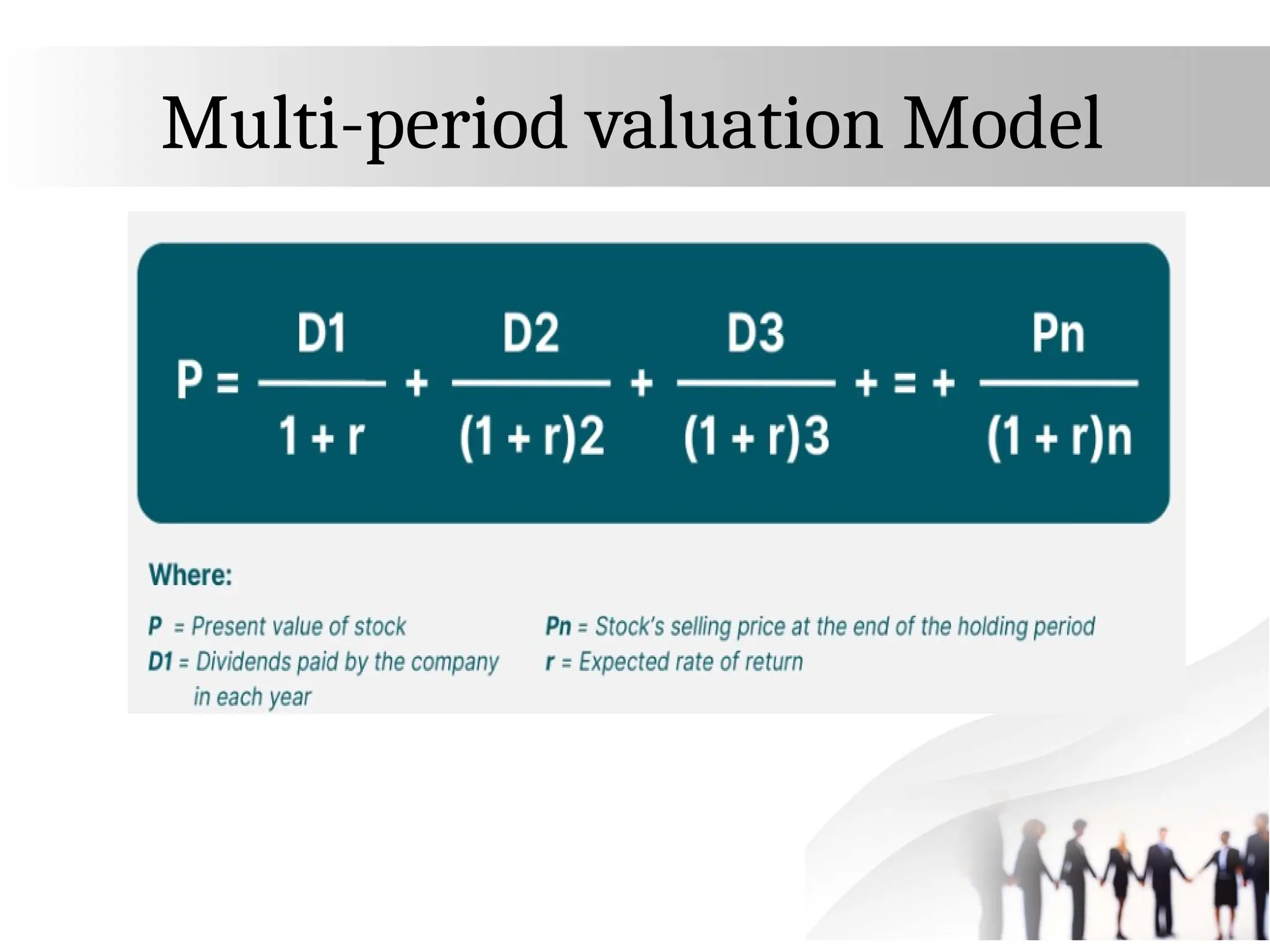

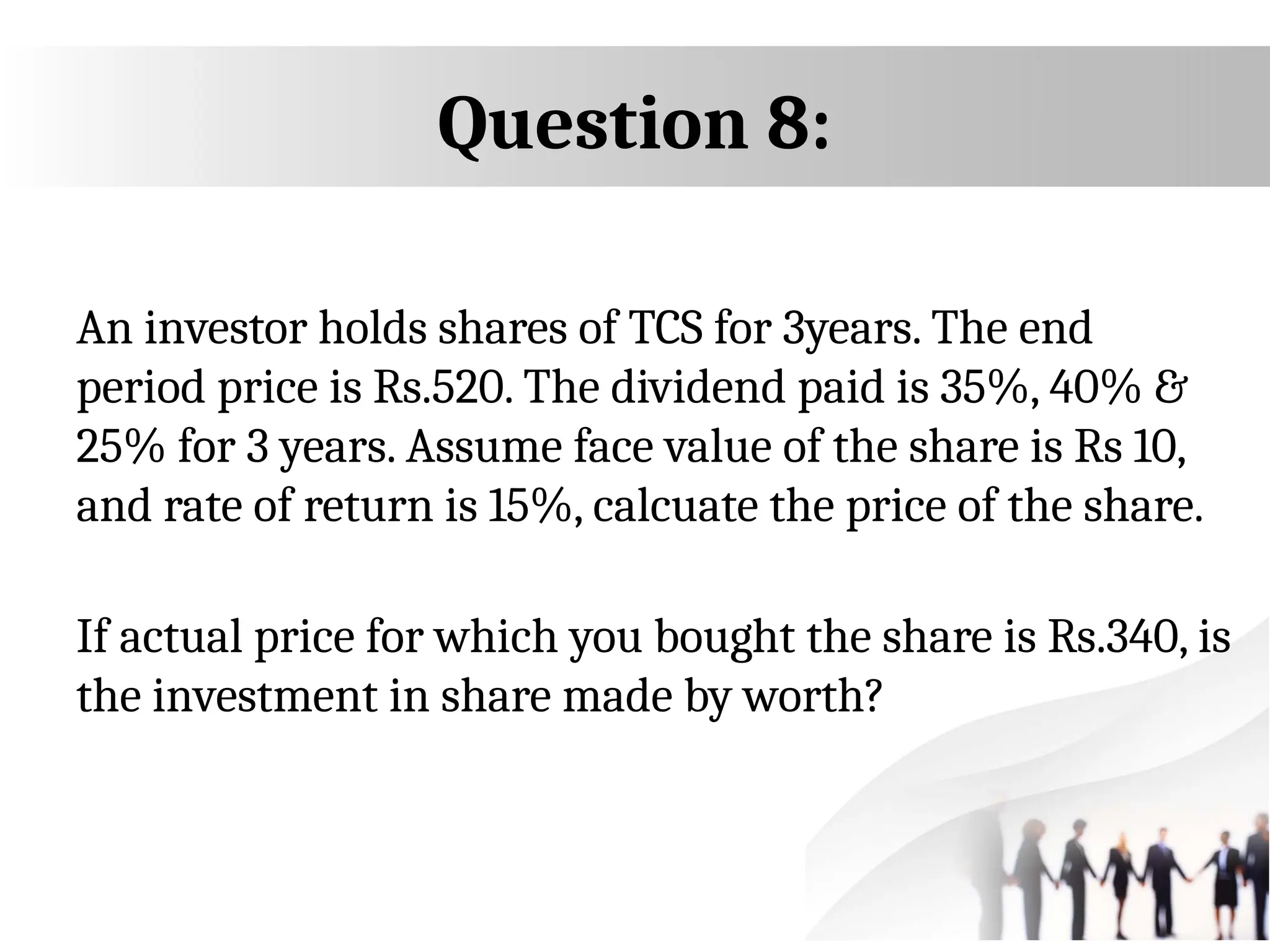

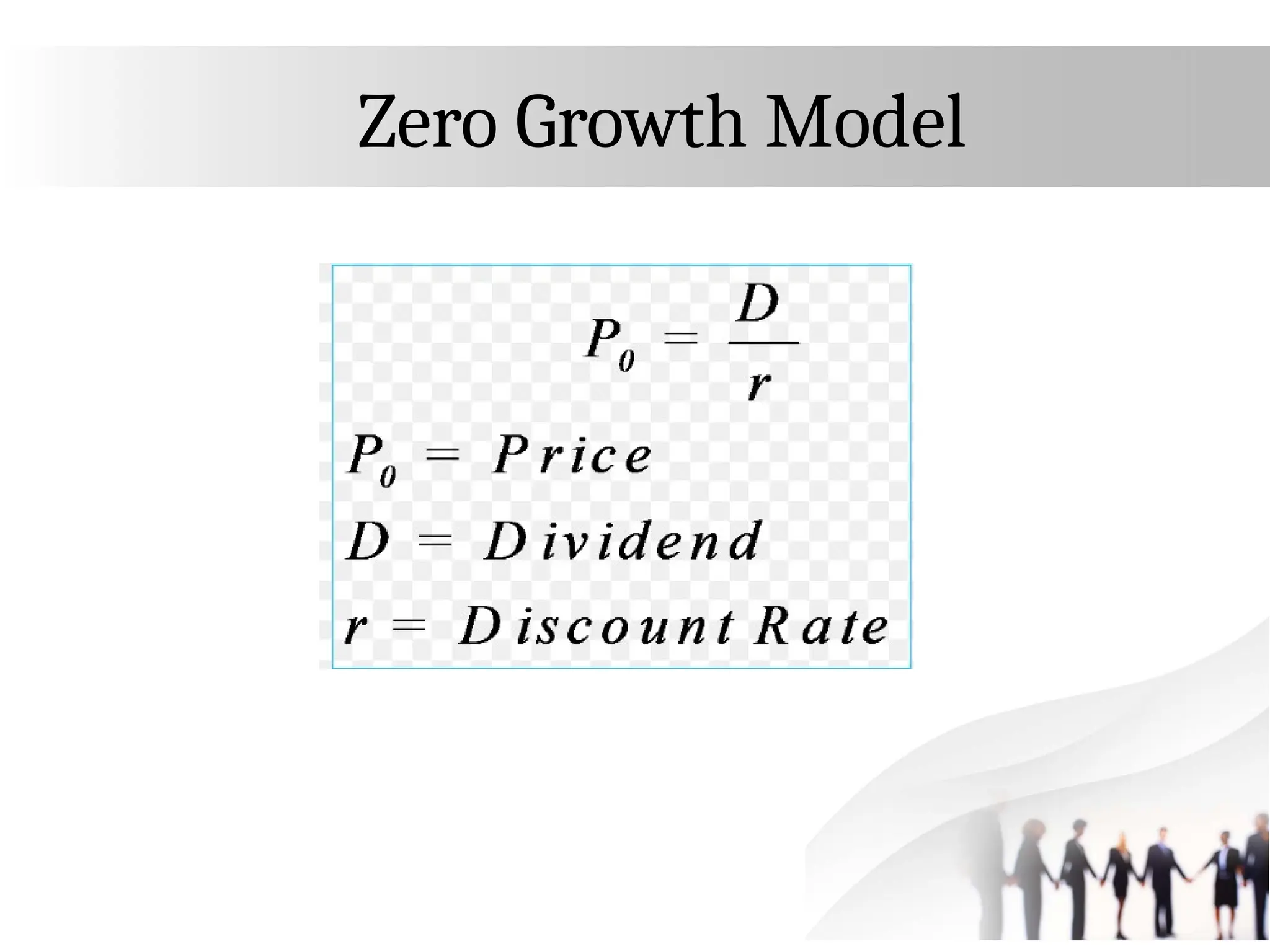

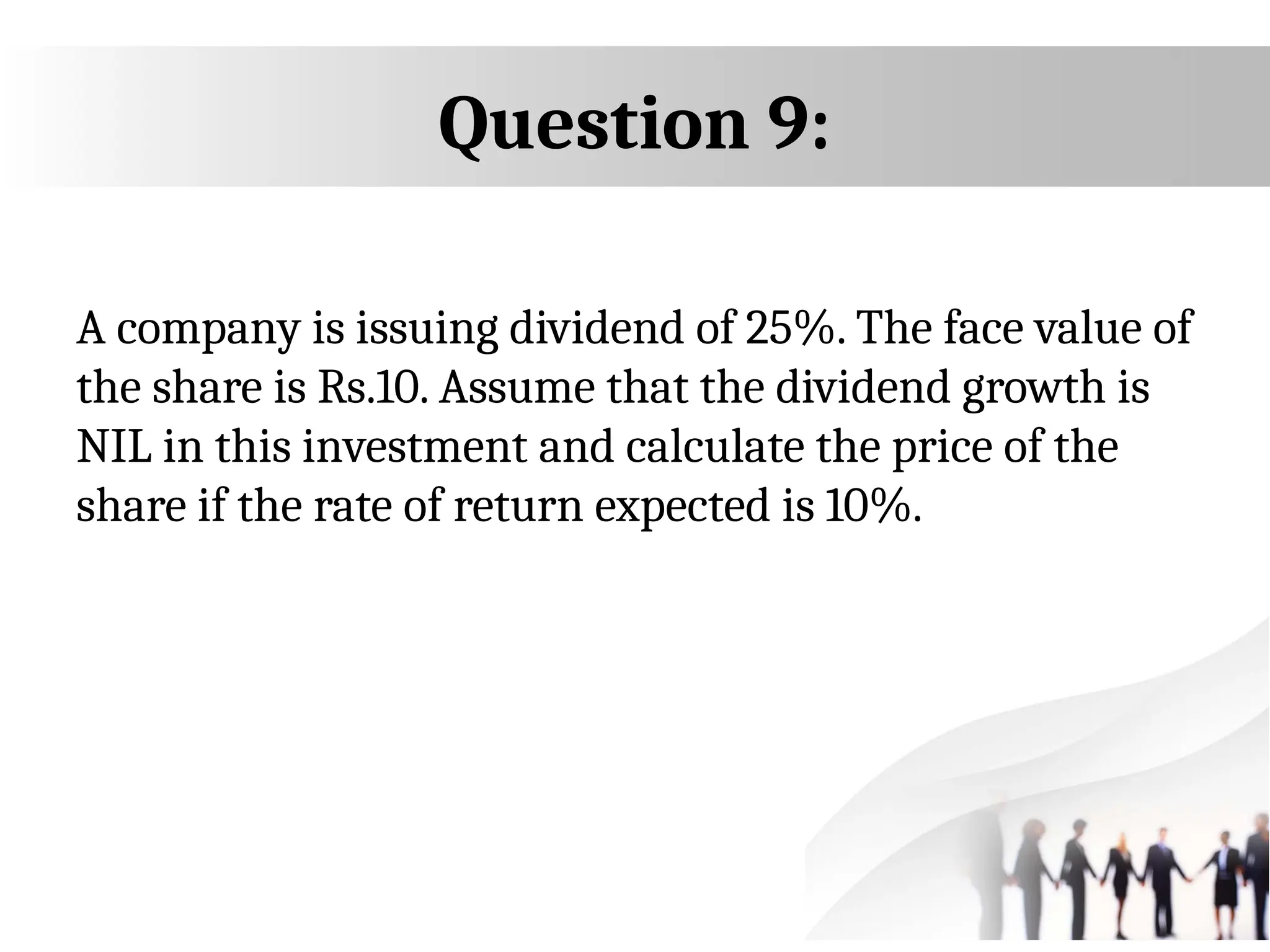

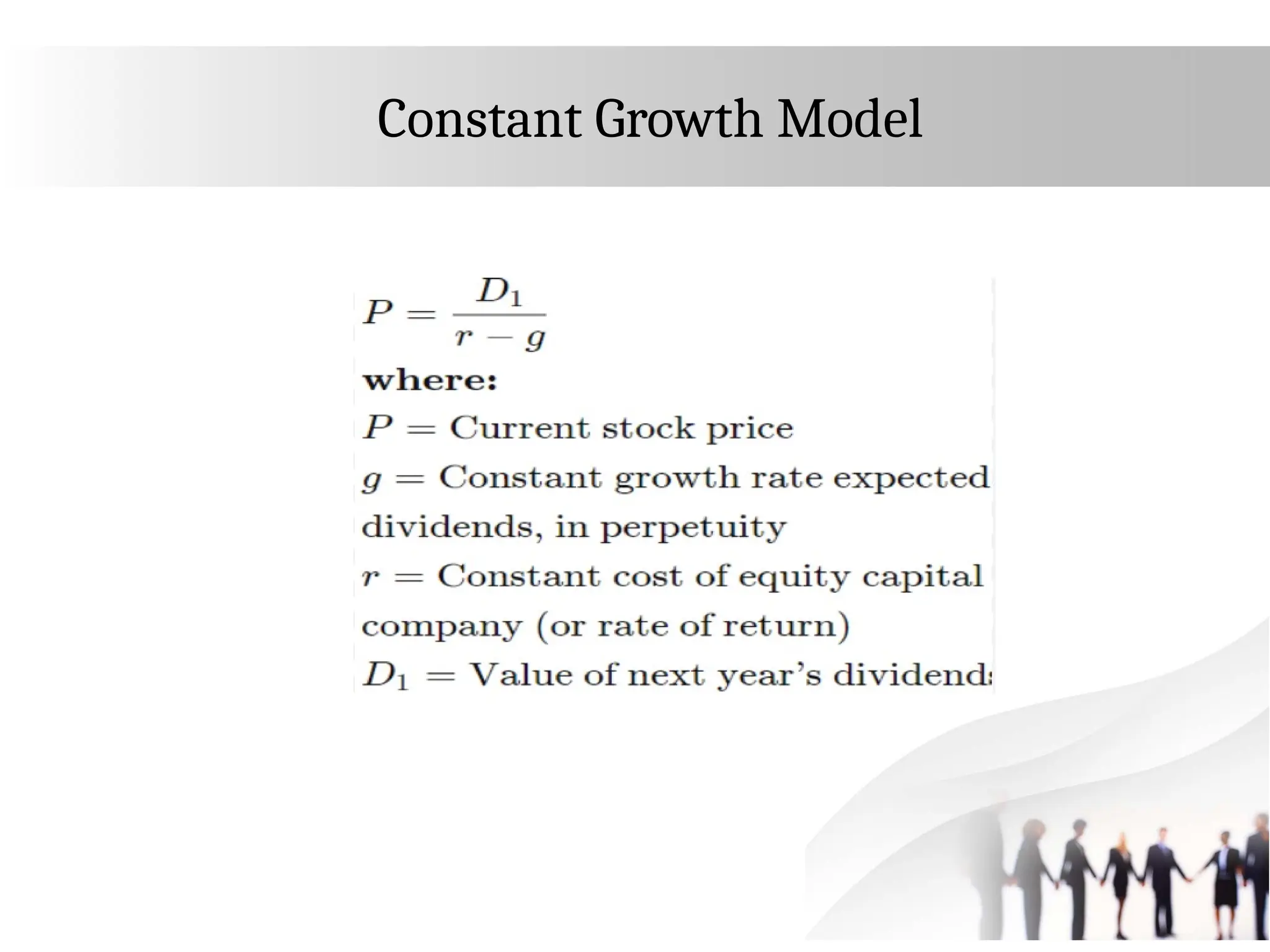

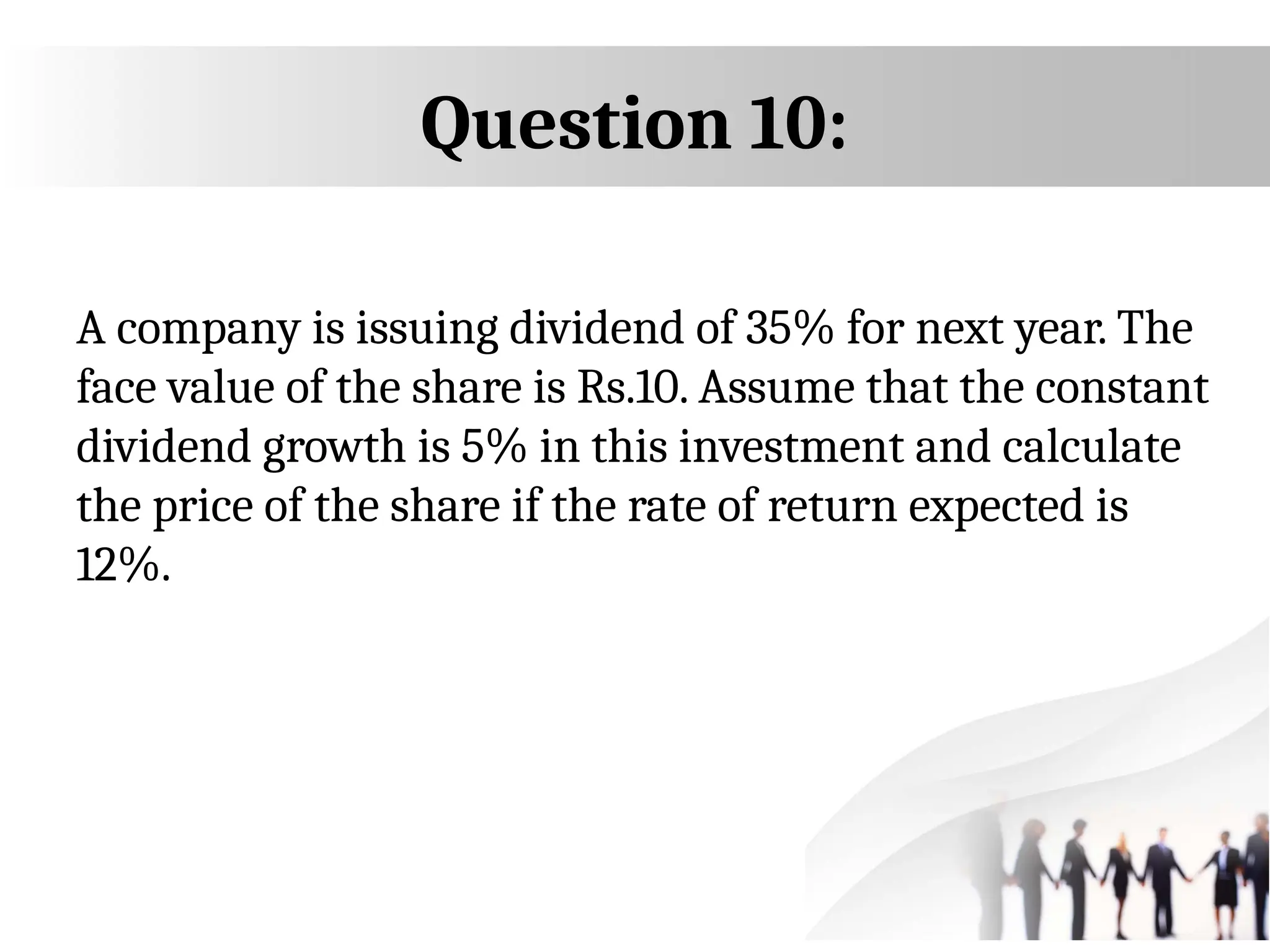

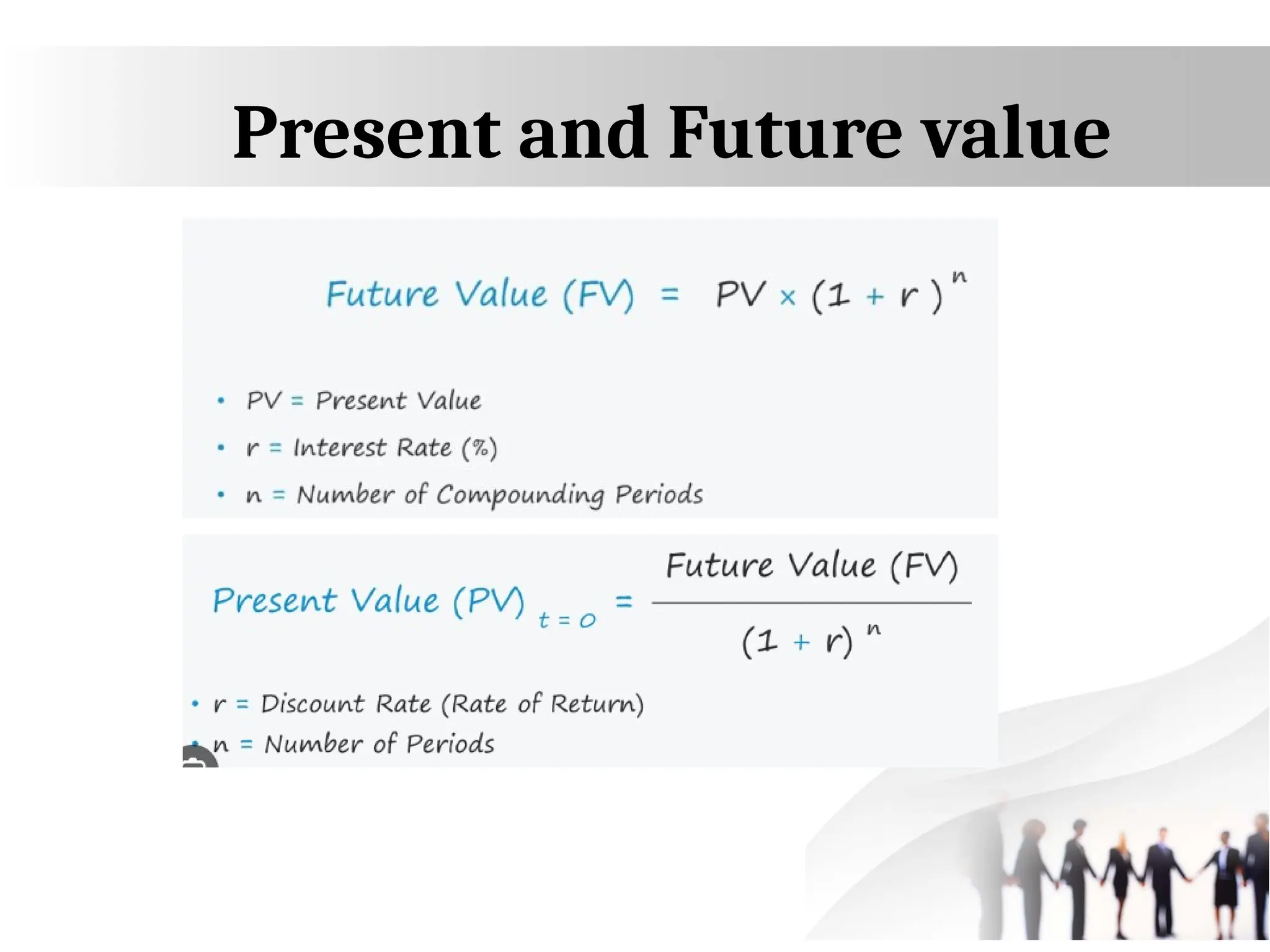

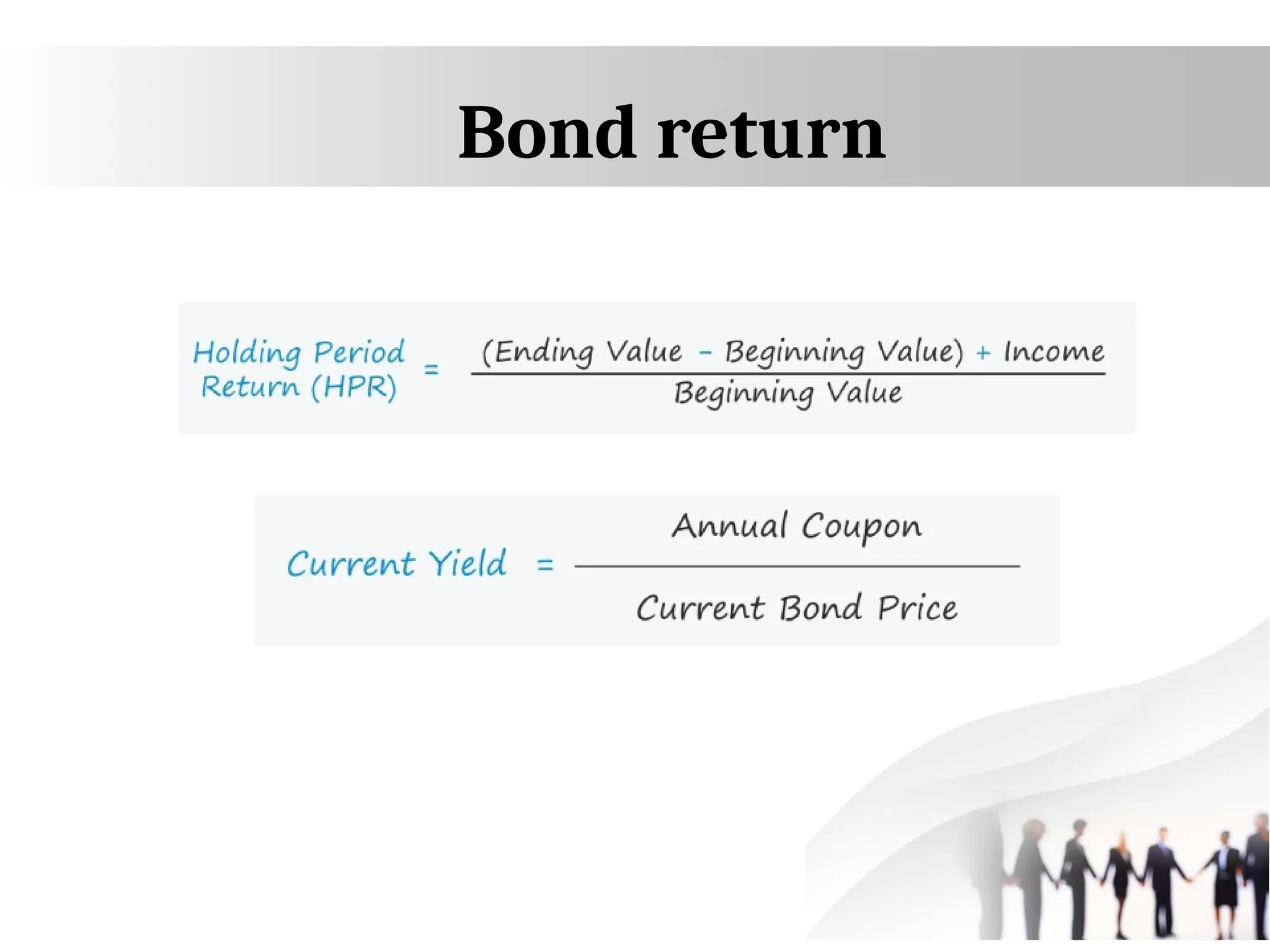

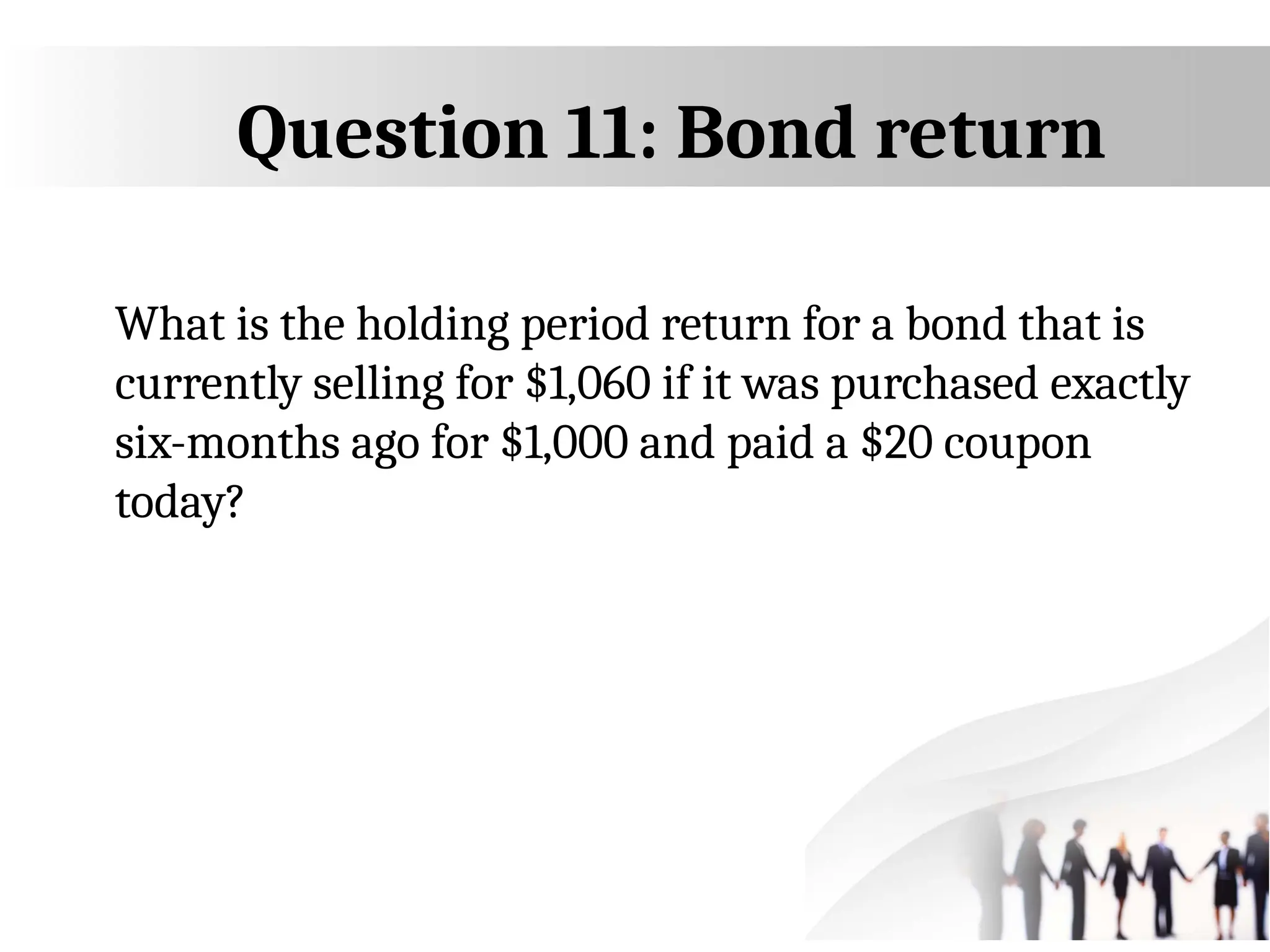

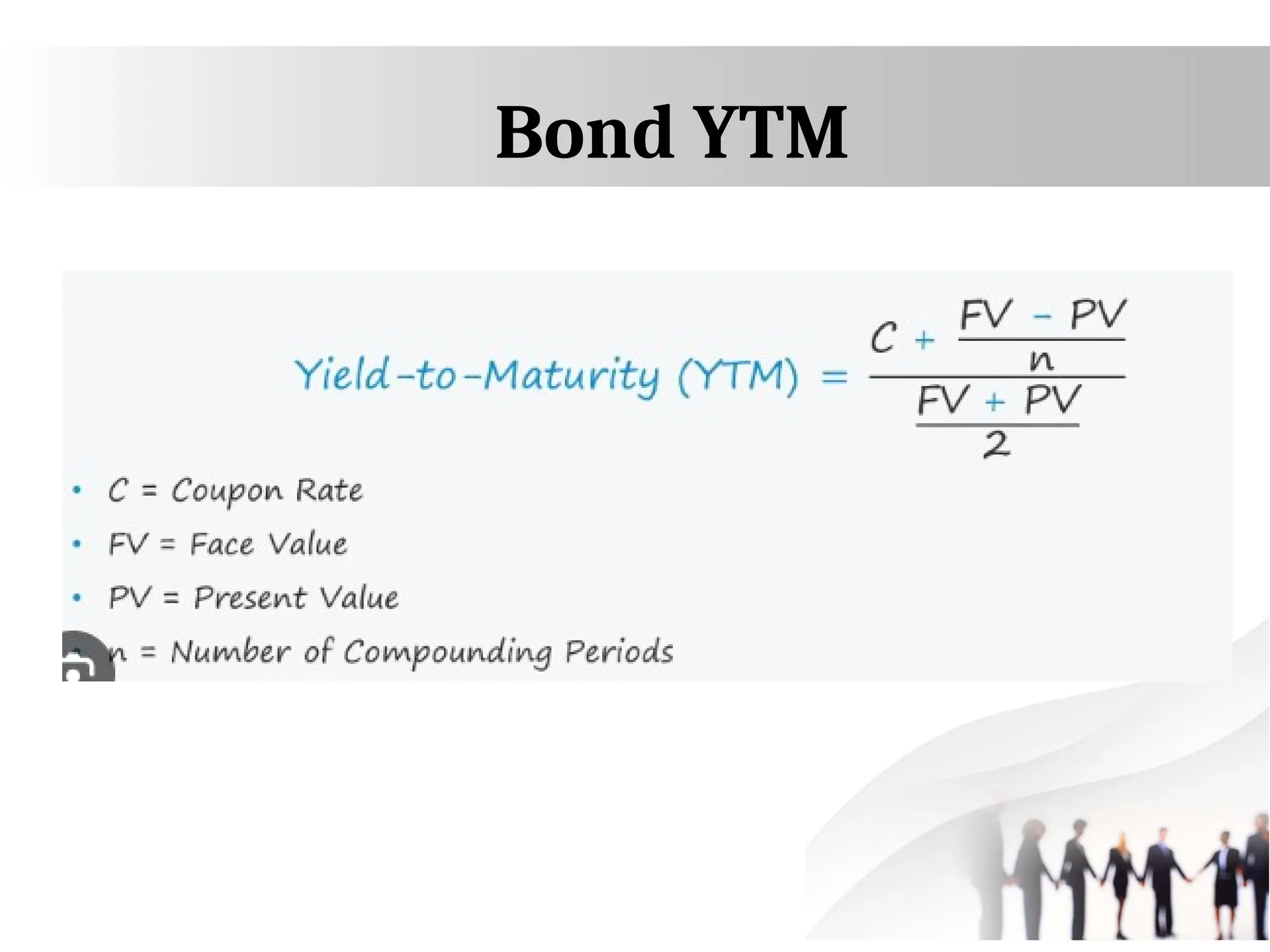

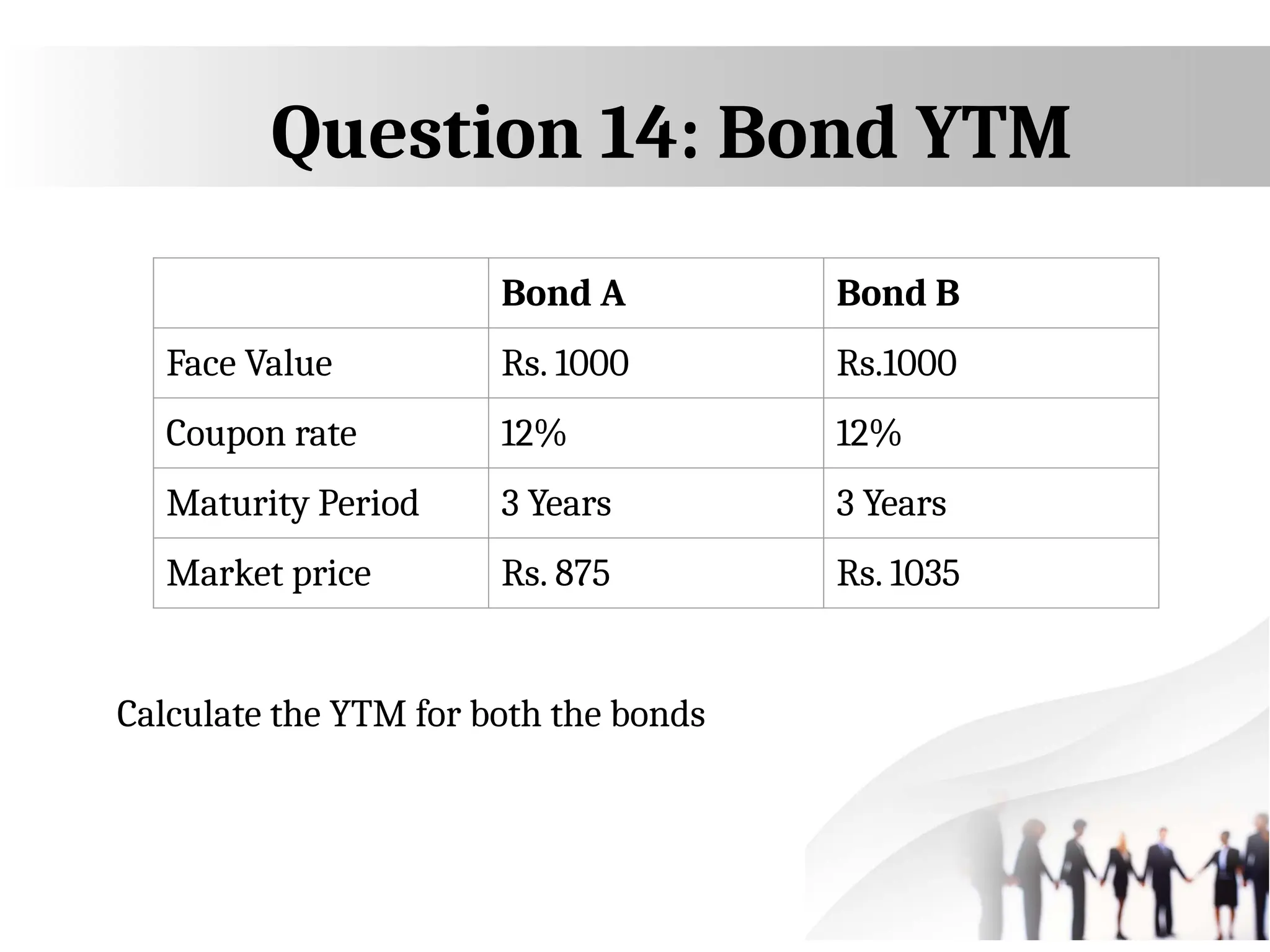

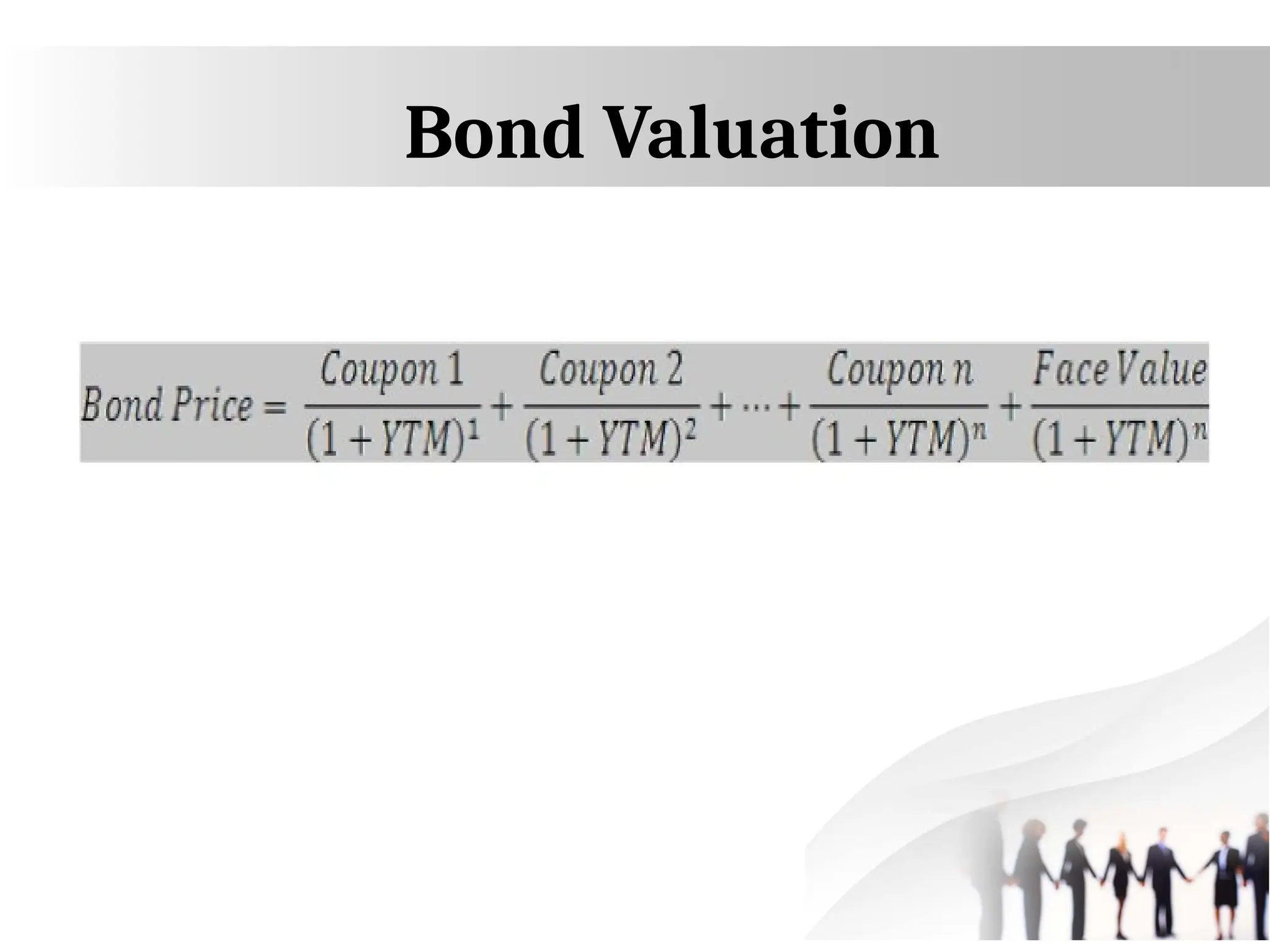

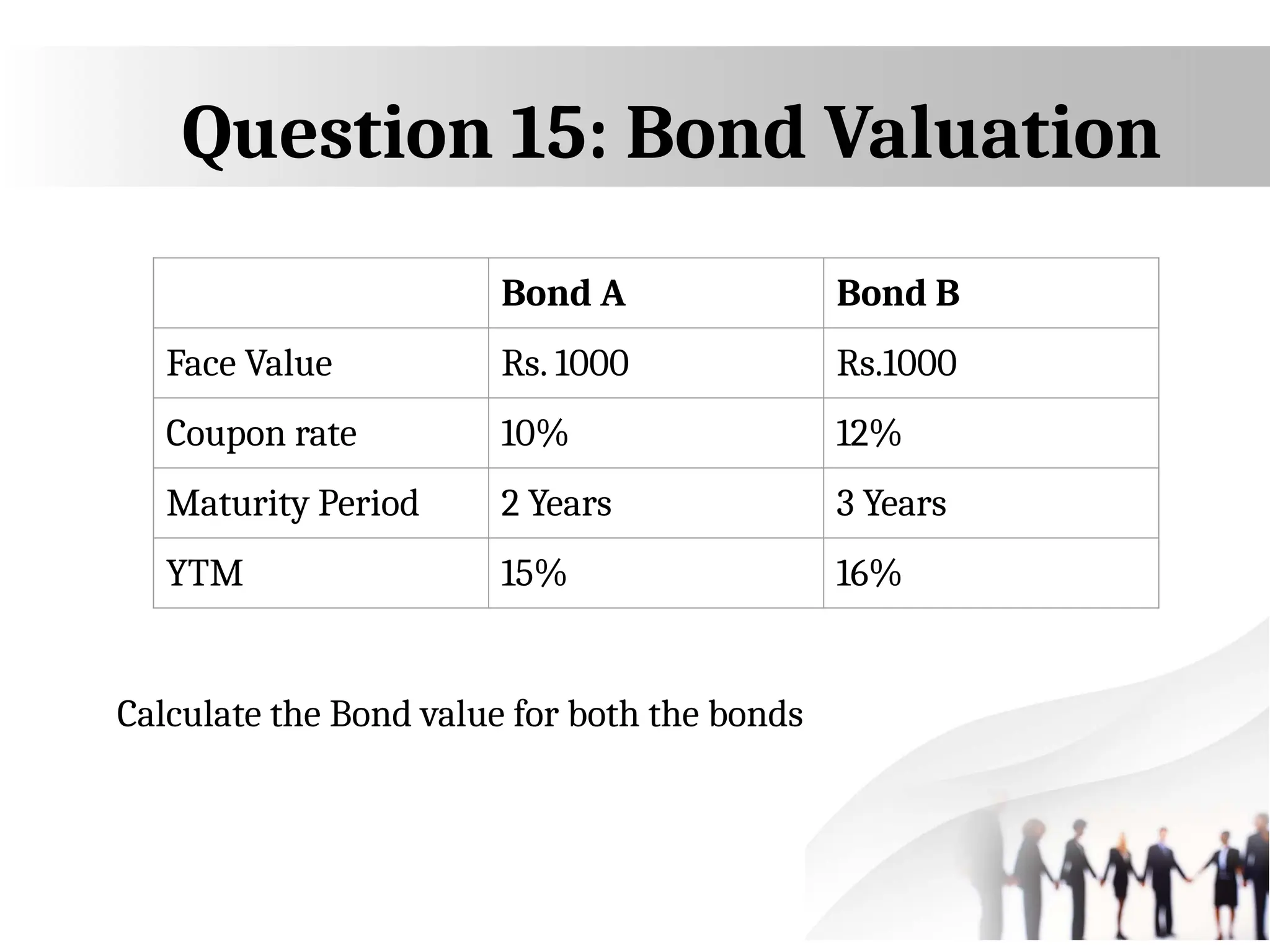

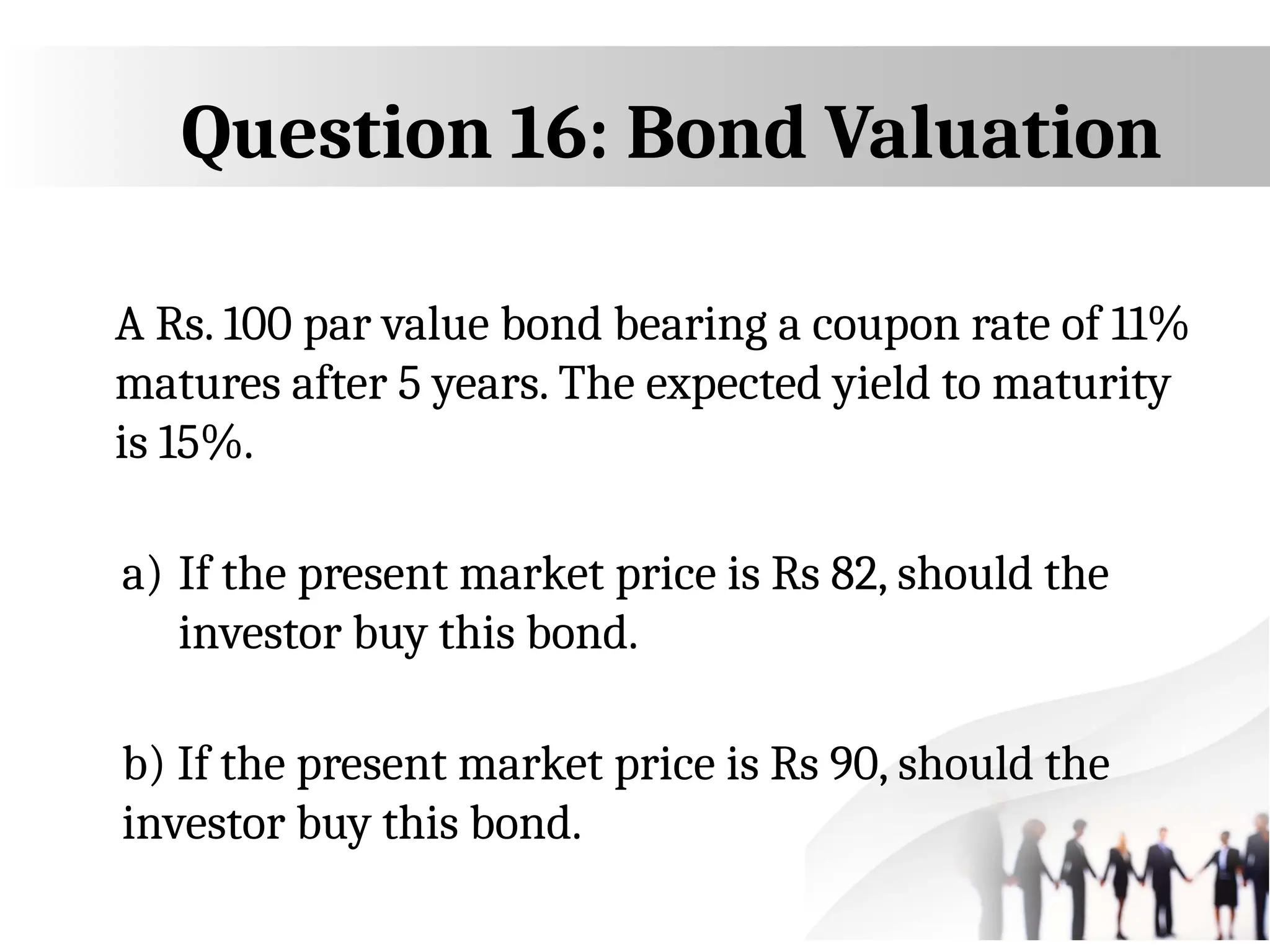

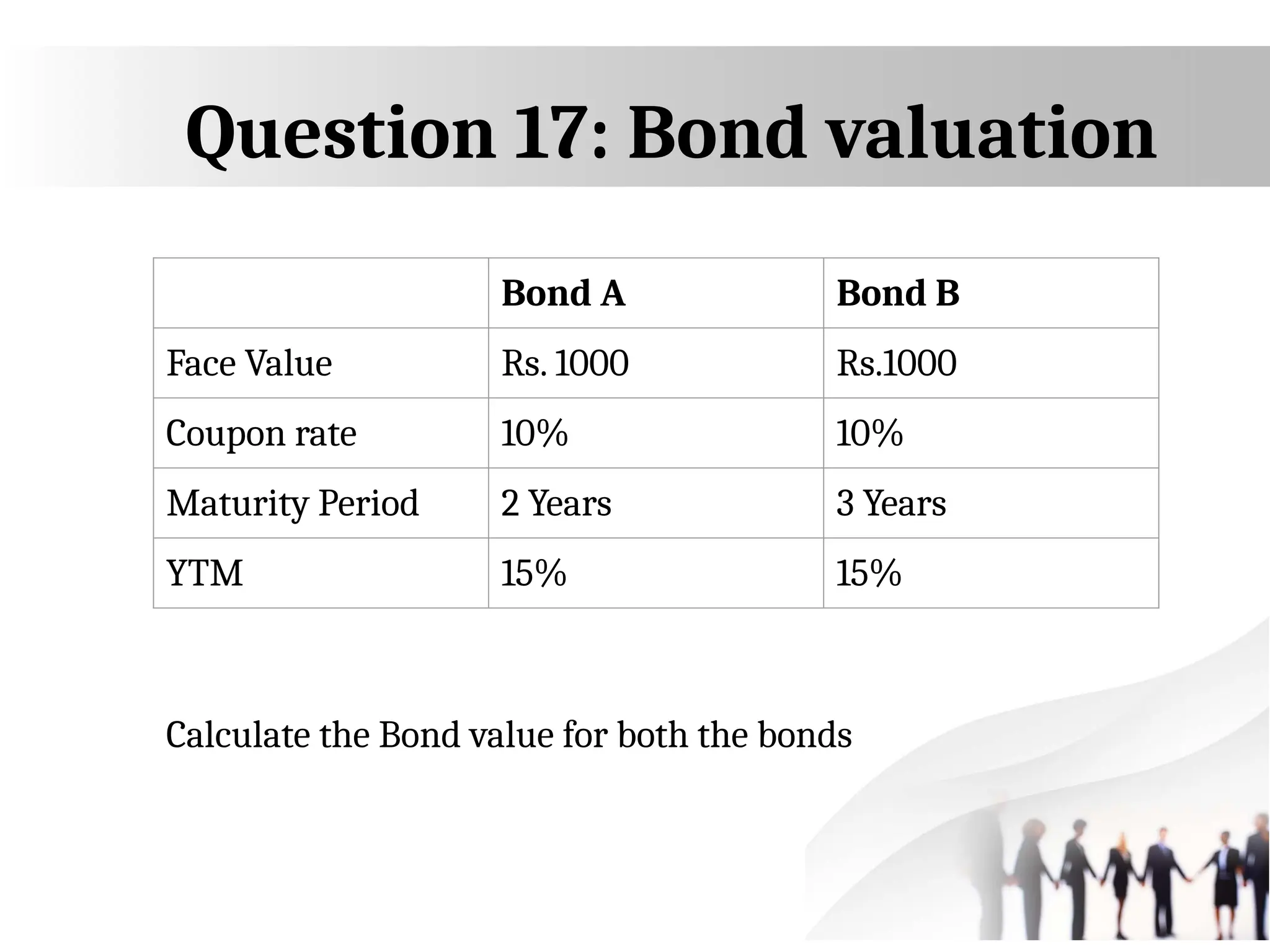

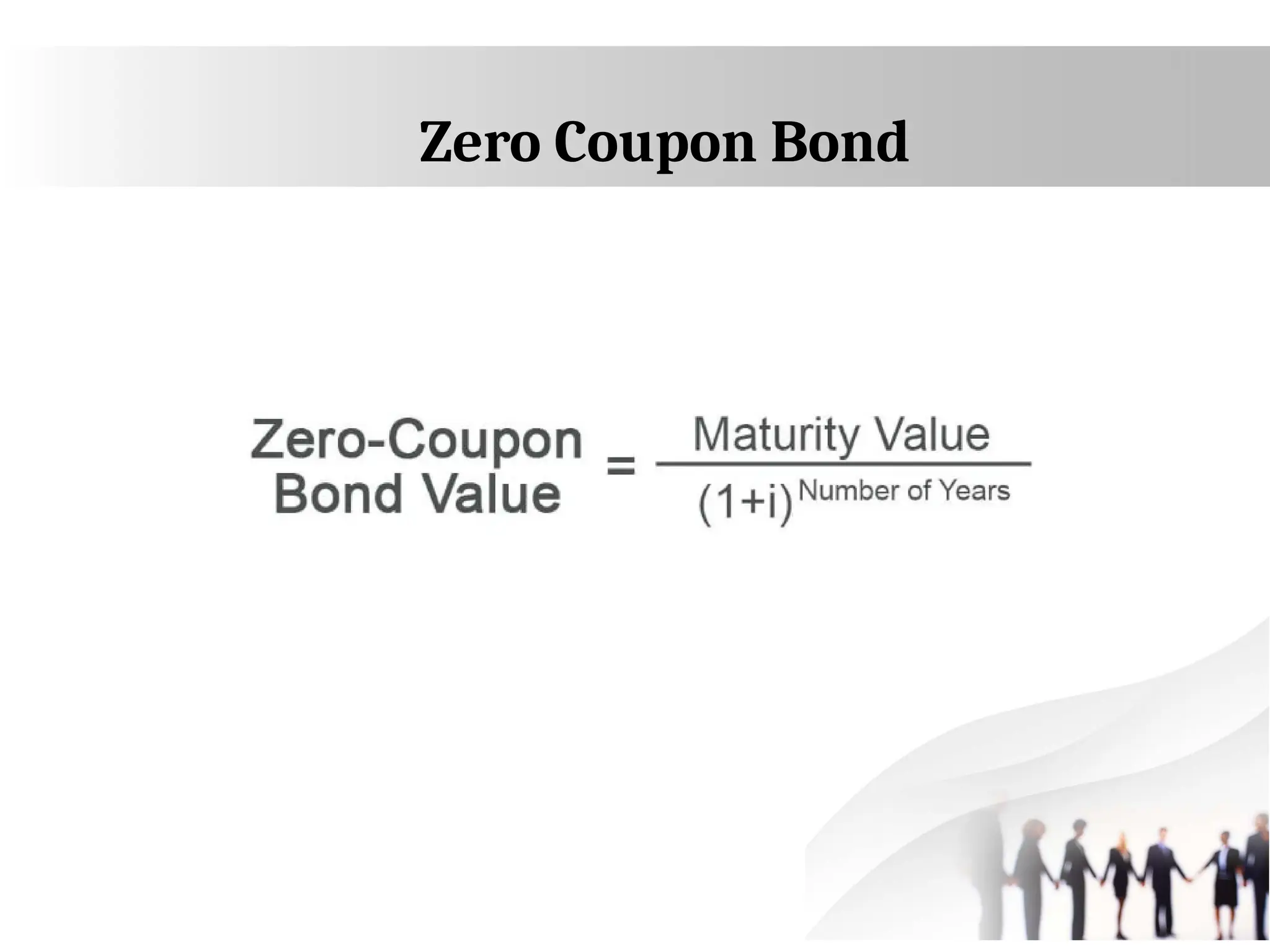

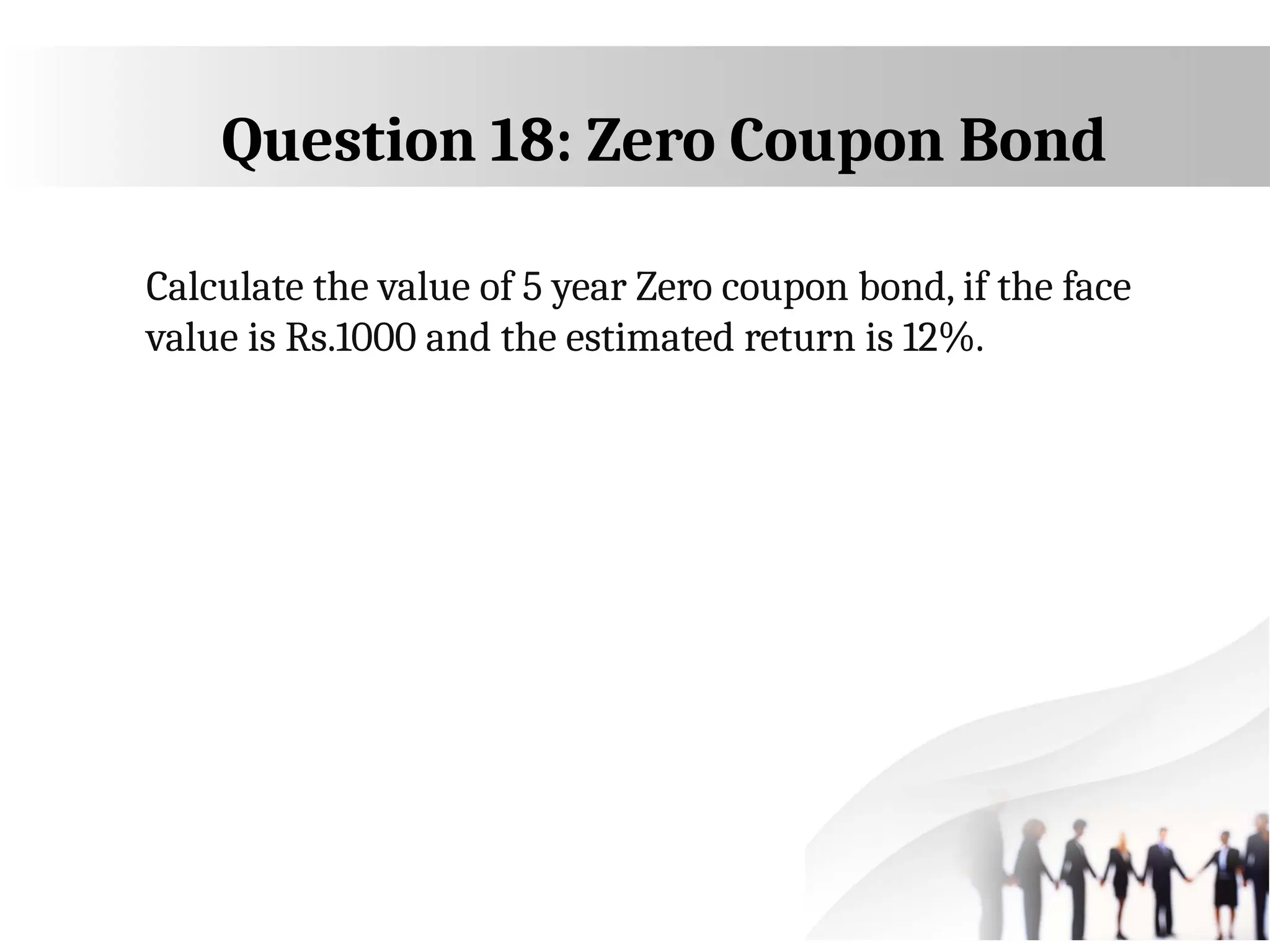

The document provides a comprehensive overview of investment analysis and portfolio management, detailing definitions, types of investments, and the investment process. It distinguishes between investment, speculation, and gambling, explains risk types, and discusses expected returns alongside various financial instruments and valuation models. Additionally, it contains questions and calculations related to expected returns, variance, bond valuations, and investment alternatives.