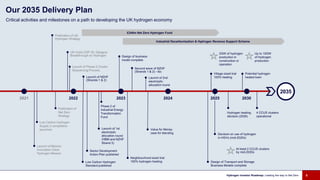

Low carbon hydrogen will play a key role in achieving the UK's net zero targets. The UK government is doubling its ambition for low carbon hydrogen production capacity to up to 10GW by 2030. It has introduced several new policies and funding mechanisms to support the development of a thriving hydrogen economy, including a Net Zero Hydrogen Fund, a hydrogen business model, and a Low Carbon Hydrogen Standard. Working with industry, the government aims to have up to 2GW of hydrogen production capacity operational or under construction by 2025 to help unlock over £9 billion in private investment by 2030.